CHICMAX announces profit joy, with its brand Han Shu's GMV reaching 1.4 billion yuan in January and February.

CHICMAX has released a positive earnings report, expecting a revenue growth of approximately 49.5% to 57.0% in 2023, with a net profit increase of about 185.5% to 212.7%. Its brand Han Shu achieved a GMV of 1.4 billion yuan in January and February, becoming the "new king" of beauty on Douyin. Domestic beauty brands are on the rise, while sales of international beauty giants are declining. As a representative of domestic beauty brands, Han Shu has captured market share with its product strength and brand power.

Zhitong App learned that on March 1, 2024, CHICMAX (02145) released a positive earnings report. The announcement indicated that the estimated full-year revenue for 2023 is around RMB 4 to 4.2 billion, showing a year-on-year growth of about 49.5% to 57% compared to 2022. In 2023, the company's net profit attributable to shareholders is expected to be approximately RMB 420 million to RMB 460 million, a significant increase of about 185.5% to 212.7% compared to RMB 147 million in 2022.

In the just-concluded February, CHICMAX's domestic brand Han Shu once again delivered an outstanding performance.

According to the latest data from Chan Mama, in January and February 2024, Han Shu's GMV on ByteDance reached 1.4 billion yuan, once again topping the list of ByteDance's beauty brands. Specifically, Han Shu's GMV in January was 773 million yuan, and in February, it was 627 million yuan.

Foreign brands are cooling down, while domestic brands are heating up

Looking at the data from Chan Mama, domestic brands have taken multiple seats, breaking the dominance of foreign beauty brands. The rise of domestic beauty brands is unstoppable, and the Chinese beauty market is undergoing a major reshuffle.

Indeed, based on the recent earnings reports released by major beauty companies, international beauty giants are experiencing varying degrees of decline in sales. To maintain overall competitiveness, after the Lunar New Year, major international beauty companies have once again initiated a new round of price adjustment strategies and expressed their intention to continue implementing price increases to ensure profitability. These series of events reflect a shift in the plans of international beauty giants to "divide" the Chinese market.

However, compared to the cooling of foreign brands, domestic beauty brands are experiencing their heyday. Not only are emerging brands advancing rapidly, but established domestic brands are also making a strong comeback with powerful products and brand strength, gradually capturing market share from international beauty giants. In 2023, Han Shu not only became the "new king" of beauty on ByteDance but also was seen as a significant representative case of the rise of domestic beauty brands in the industry.

Super brands in the golden age

As a classic domestic beauty brand, Han Shu has a substantial user base and national recognition. In the complex era of new media, as an "old player" in the beauty market, Han Shu is reclaiming its dominance in its own way. This can be seen from the following data points: Firstly, Hanshu has truly achieved a major breakthrough in performance across all platforms, rightfully earning the title of a super brand. Looking at the annual data of ByteDance's beauty sector, Hanshu achieved a total GMV of 3.34 billion yuan in 2023, a year-on-year increase of 374.38%, ranking first among ByteDance's beauty brands. Breaking through the 3 billion level marks the beginning of a new era!

Not only ByteDance, according to publicly available data, in January 2024, Hanshu's Tmall flagship store GMV increased by 570% year-on-year, JD's self-operated GMV increased by 398% year-on-year, Vipshop's GMV increased by 135% year-on-year, and Pinduoduo's GMV increased by 218% year-on-year.

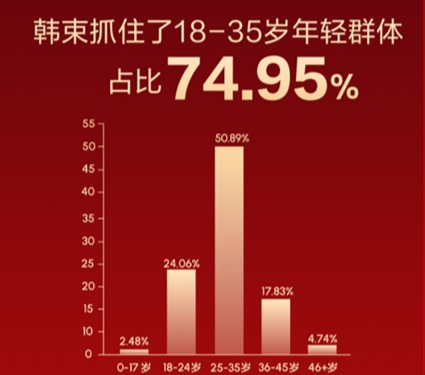

Secondly, Hanshu has captured China's most valuable consumer group, with ByteDance's channel having 74.95% of the 18-35 age group. The high conversion rate of this valuable consumer group provides a stable output for brand sales, continuously pushing the boundaries of brand growth.

Thirdly, by retaining customers with high-quality products, Hanshu has achieved an average repurchase rate of 20.99% within 30 days. This repurchase rate far exceeds the industry average. The reason behind this is that Hanshu realized early on that only high-quality, highly effective products can truly retain valuable consumers and achieve long-term compounding for the brand. CHICMAX's founder and CEO, Lv Yixiong, once said, "Good quality leads to high repurchase rates, which is the only way to outperform ByteDance's algorithm."

Therefore, over the 21-year period, Hanshu has continuously increased its investment in research, establishing a "production-education-research-medical" closed-loop system as the foundation for research innovation, leading the scientific anti-aging group and continuously exploring cutting-edge skincare technologies. Currently, in the field of effective skincare, Hanshu has independently developed the world's first anti-aging hexapeptide - Hexapeptide-9. As a proprietary patented technology independently developed by Hanshu, it has broken through foreign technological barriers, creating anti-aging ingredients exclusively for the Chinese people.

Thus, Hanshu has formed a research-supported efficacy, efficacy-supported product strength, marketing-focused amplification of product strength, research-production-sales closed-loop, winning high recognition from the market and consumers.

Building a "super aircraft carrier" to carry the "super brand"

Hanshu's success is a microcosm of the rise of domestic beauty brands. As the "super aircraft carrier" of the super brand Hanshu, CHICMAX integrates global research to serve Chinese brands, supports multiple brands through cycles, and serves as the backbone of domestic beauty brands.

As a leader in the domestic cosmetics industry empowered by research, CHICMAX has successfully completed a "triple jump in research." Currently, CHICMAX has established international dual research centers and built a multi-level research talent system of over 200 people, dedicated to leveraging global research to serve Chinese brands and utilizing global research talents for China's benefit. CHICMAX has made exclusive breakthroughs in basic research, such as the dual-bacterial fermentation ingredient Tiracle Pro, Hexapeptide-9, E-AGSE active grape seed extract, and Artemisia AN+ oil. These achievements have empowered brand development by translating scientific research into tangible results, providing strong support for product enhancement and brand elevation.

Moreover, as a company with a multi-brand matrix, CHICMAX has not only successfully applied the transformation experience of the Han Shu brand to other brands like One Leaf and Red Elephant, but also independently incubated several high-growth potential brands, such as the infant and child skincare brand newpage. By focusing on niche markets, professional efficacy, and product differentiation, CHICMAX is achieving breakthrough performance and gradually forming a new growth trajectory.

As a multi-brand company that has spanned a 21-year cycle, CHICMAX stands out as one of the few domestic beauty companies with successful cases in brand transformation and brand incubation. Riding the wave of the rise of domestic brands, CHICMAX is poised to become a "super aircraft carrier," providing the essential driving force for creating more super brands in the domestic beauty market and ensuring a smooth journey for future brand expansions.