Overseas warehouse benefits continue, but is there hidden concern for GigaCloud Tech, whose valuation has doubled?

大健云仓是一家从事大件出口 B2B 交易平台的公司,股价在纳斯达克指数猛涨的影响下创下新高。大健云仓主要有三大业务,包括自营平台、货架平台和平台外电商。公司的估值翻倍主要受到海外仓需求的推动。然而,公司的成色可能被估值过快增长所掩盖。

从去年 10 月 26 日到今年 3 月 1 日,纳斯达克指数从最低 12543.86 点涨至 16302.24 点,区间最大涨幅达到 29.96%,创下其历史记录。在指数猛涨的同时,大健云仓也借着这股东风在 3 月 4 日盘中达到 43.56 美元的股价新高。

但在接下来 2 个交易日,纳指出现回调,大健云仓股价同样小幅跳水,与大盘走势如出一辙。实际上,回看大健云仓去年 10 月底以来的走势,公司之所以能在短短 4 个多月实现估值翻倍,除了公司基本面外,外部牛市环境裹挟而来的东风同样不可或缺。也正因如此,在低基数高增长衬托下,公司原本的成色或许会过快的估值增长所掩盖。

“海外仓大年” 的低基数高增长

去年 9 月,TikTok 在美区正式上线 TikTok Shop,一场新的跨境电商盛宴由此开始。由于 TikTok Shop 美国小店仅支持海外仓本地发货,并严厉打击虚拟仓发货,“找个海外仓合作” 成了 TikTok 卖家们的刚需。也正是因此 “海外仓概念股” 来到市场聚光灯下,大健云仓便是其一。

据智通财经 APP 了解,大健云仓主要是从事大件出口 B2B 的交易平台,将发现、支付和物流工具的所有内容集成到一个平台中,然后为全球大件商品提供线上或线下综合跨境交易及交付服务。

分业务来看,大健云仓主要有三大业务,包括 GigaCloud 3P、GigaCloud 1P 以及平台外电商。1P 模式下,公司作为自营平台,通过采购商品并在自有平台 GigaCloud 或第三方平台上销售,参考京东自营;3P 模式下,公司则作为货架平台,为平台上的卖家和买家提供交易撮合服务,并收取服务费用,参考淘宝。

由于大健云仓涉及的大件产品在跨境运输与仓储方面,相较跨境电商此前主营的小商品成本更高,疫情前市场整体规模不大,市场参与者较少。但在疫情后,全球供应链紧张背景下,凭借 1P 模式,大健云仓的海外仓业务大增,并延续至 2023 年。

2023 年 Q3 财报显示,大健云仓当期总营收达到 1.78 亿美元,同比增长 39.2%;同期净利润则为 2420 万美元,同比大幅增长 3357.1%。

目前来看,此前市场低基数红利为公司带来的业绩增长明显。从运营数据来看,报告期内,GigaCloud Marketplace 平台 GMV 为 6.85 亿美元,同比增长 40.8%;活跃 3P 卖家数为 741 家,同比增长 43.3%;活跃买家数为 4602 家,同比增长 9.6%。与此同时,3P 卖家 GigaCloud Marketplace GMV 为 3.69 亿美元,同比增长 67.0%,3P 卖家 GigaCloud Marketplace 的 GMV 占 GigaCloud Marketplace 总 GMV 的 54.0%。

作为一家跨境电商平台,大健云仓的业绩始终受到海外仓的租赁成本与航运成本的影响。据智通财经 APP 了解,目前公司在美国、德国、英国、日本建有 31 个大型实体仓库,总面积超 700 万平方英尺。其中美国有 23 个大型仓库。

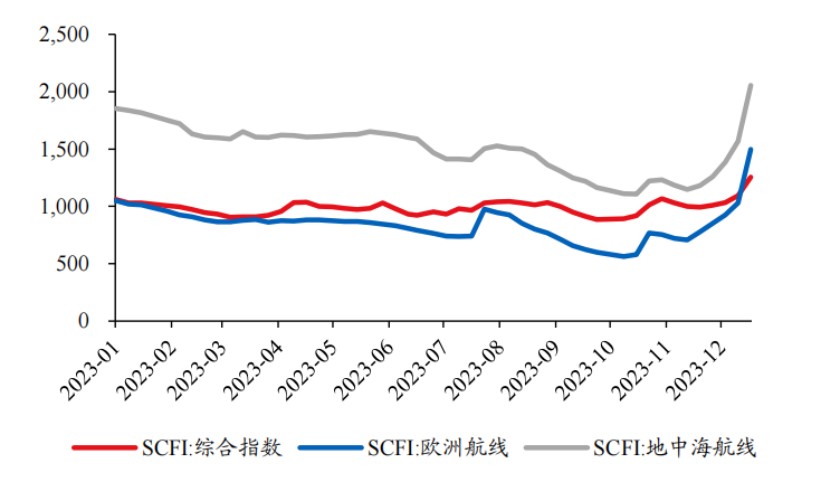

受红海危机影响,去年 12 月 18 日,HMM 和阳明海运宣布避过苏伊士运河,绕道南非好望角或在安全地点等待。至此,占全球运力约 82%(Alphaliner2023 年 12 月数据) 的前九名班轮公司均暂停红海通行。在此背景下,SCFI(上海出口集装箱运价指数) 去年 12 月 22 日收于 1255 点,周环比 +14.8%,其中欧线大涨 46%。

从财报中也可以看出海运成本波动对公司收入成本的影响。2023 年第三季度,大健云仓收入成本为 1.29 亿美元,同比上年同期增长了 22.7%。

虽然目前公司利益相关最大的中美航线未受红海危机影响,回望 2020-2021 年,当时受疫情影响,国际船业公司联合哄抬价格,叠加美国港口卡车司机罢工等事件,较严重地影响了中国跨境出口的航线运输,以致海运成本的大幅走高。2021 年公司毛利率、净利率同比分别下跌 6.54 和 5.64 个百分点,影响了公司整体盈利能力。

中间商生意还能干多久?

由于跨境电商的火爆,市场有观点认为海外仓企业能够比肩生物医药行业的 CXO,成为跨境电商们的 “卖水人”。毕竟从数据统计来看,有 4 成的跨境电商企业的仓储物流成本占营业收入的 20-40%,而有 2 成以上的企业占比在 40-60%。

之所以电商卖家的收入成本偏高,在于其从选品、找工厂、打样、生产到品控环节需要半年以上的时间,时间成本较高;海运的环节同样时间成本较高,产品从国内发货到产品上架平均需要 60 天;专业做大件海外仓业务的公司较少且报价较高;产品存在滞销的风险;小批量产品尾程运费较高。

而大健云仓的 “供应链前置模式” 可以由工厂先制造产品并将现货运输至海外,再直接对终端用户进行销售。简言之,该模式能够帮助跨境卖家抛开起订量、资金投入等供应链上的约束,进行轻资产模式运营。

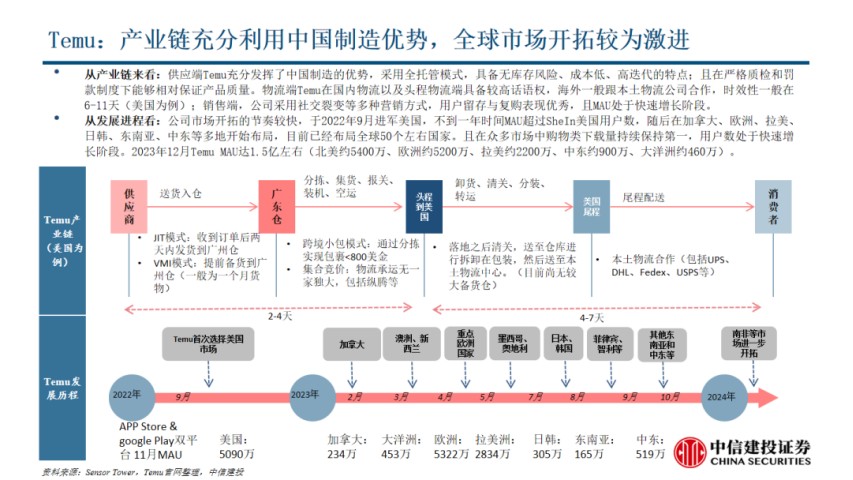

但站在卖家角度,物流及仓储成本是其利润增长的最大阻碍,成本控制同样是刚需。大健云仓的服务费需求其实还是要求卖家牺牲利润率换取交易便利性,本质上与 Temu 的 “全托管” 模式类似,但在便利性上却不如全托管模式便利。

除了全托管模式的竞争外,独立站模式同样也是大健云仓未来的重要竞争对手。

据智通财经 APP 了解,独立站是指企业自主搭建并运营的网站或应用程序,通过自有域名或第三方平台进行销售,具备相当大的经营灵活性,易于收集、分析用户数据以运营私域流量,也可以更好地展示品牌形象和产品特色,提高用户粘性和转化率。根据艾媒咨询数据,2021 年中国企业在海外建立的独立站数量已达 20 万个,呈现持续快速增长趋势。

两相比较之下,全托管模式的重点在于以价换量,独立站则具备高自由度的优势。而大健云仓所实行的供应链前置模式受到现货库存风险的限制,主要适用于小额批发或零售,但又无法像独立站那样完全抛开中间商平台环节。

简言之,作为中间商,大健云仓的供应链前置模式在性价比方面并比不上上述两种模式,未来成长空间存在可见天花板。另一方面,由于估值跟随纳指上涨过快,大健云仓估值显然已经偏高,在此时间点任何利空都或许可能会触发市场止盈情绪,因此存在一定追高风险。