WSB is buzzing about it | Target price of $298, RBC reiterates a Buy rating on Tesla.

Adobe 營收和利潤均超預期,但指引遜於預期,盤前大跌超 11%。

AI 芯片股歇一歇,權重股就起飛。

英偉達、台積電、AMD、SMCI 隔夜均下跌,而微軟、谷歌、蘋果隔夜都上漲,其中微軟大漲 2.44% 再創新高,市值 3.16 萬億美元,市盈率 38.4 倍,盤前繼續漲近 0.6%。

值得一提的是,今日是今年首個期權到期日——四巫日(Quadruple witching days),美股最大熱門英偉達期權交易情況預計將成為關注的重點之一。( “四巫日” 是美股每季度一次的金融衍生品集中到期日,發生在每年三、六、九、十二月的第三個星期五,當日股指期貨、股指期權、個股期貨與個股期權同時到期),當日最後一個交易小時被稱為 “四巫小時”(Quadruple Witching Hour),在此期間投資者急於平倉,往往導致交易量急劇增加,市場波動幅度加劇。因此,“四巫日” 通常伴隨股票和衍生品價格的短期大幅波動。

英偉達、台積電、AMD 等熱度靠前;

特斯拉熱度第三,隔夜繼續大跌 4.1%,三個交易日跌近 10%,目前盤前漲 1.3%,特斯拉下跌和部分大行下調目標價有關。

但也有看多的投行,加拿大皇家銀行資本市場 (RBC Capital Markets) 的分析師湯姆·納拉揚仍然對其長期前景持樂觀態度。他表示,特斯拉目前正處於兩波浪潮之間,Model 3 和 Model Y 基本上已飽和,正等待其售價預計低於 3 萬美元的平價車型帶來的下一波重大推動,預計這款新車將於明年下半年投產。RBC 重申特斯拉評級為 “買入”,目標價 298 美元。納拉揚的估值模型中,只有 10% 是基於特斯拉的核心汽車業務,剩下的則依賴於特斯拉的自動駕駛和能源存儲業務。

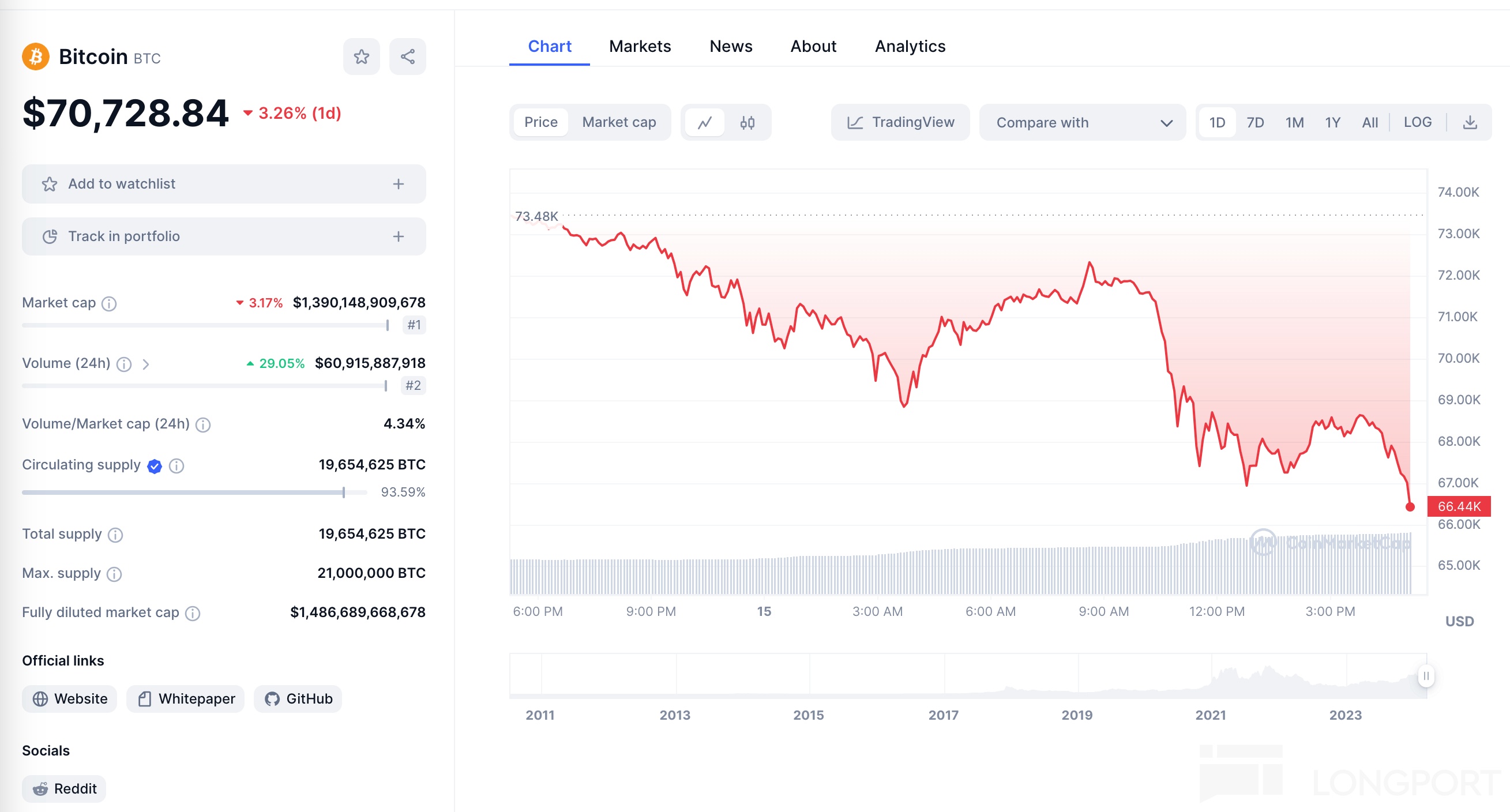

區塊鏈概念股 MSTR 熱度第六,隔夜跌 5%,盤前現跌超 7%,原因是 BTC 在小幅回落:

Adobe 熱度榜第七,營收和利潤均超預期,但業績指引遜於預期,盤前大跌超 11%。此前, OpenAI 在上個月宣佈推出文生視頻工具 Sora,Adobe 面臨的挑戰加劇,Sora 的出現意味着視頻生成門檻大幅降低,已有的視頻製作工具可能被顛覆,自 Sora 推出以來,Adobe 股價短期暴跌超 11%;

英偉達持倉股 SOUN 熱度第十,隔夜高開低走,盤中振幅高達 31%,或預示着第二波上漲告一段落;

醫療美容股 ULTA 熱度 11,業績不及預期,全年利潤下滑,Ulta Beauty 表示,美容行業的競爭越來越激烈;

波音熱度第 12,安全問題 “吹哨人” 的去世,安全問題依然被市場關注。

數據來源:apewisdom,過去 24 小時最熱議股票

注:

Reddit 上的 Wall Street Bets 頻道(簡稱 WSB)小組創建於 2012 年,這個投資社區目前吸引了 1400 多萬名用户,是討論美股的散户聚集地,這個頻道討論的股票往往是當下最熱門的股票,由於頻道影響力大,可能會帶動股價變動。

風險提示:

WSB 熱議股由於被散户追捧或者捨棄,特別對於小公司而言(如 2021 年的遊戲驛站 GME 和 AMC),波動會比較大,請注意風險。