Will the thriving NVIDIA become the next Amazon AWS in its heyday?

英偉達和亞馬遜的雲服務部門 AWS 有着驚人的共同之處。英偉達的營收以三位數速度增長,預計本季度的營收將達到 240 億美元,同比增長 234%。儘管雲計算市場競爭加劇,英偉達仍有其他業務,但規模較小。

智通財經 APP 獲悉,在美國科技類博客 TechCrunch 專欄作家 Ron Miller 和 Alex Wilhelm 看來,英偉達 (NVDA.US) 和亞馬遜 (AMZN.US) 的雲服務部門 AWS 有着驚人的共同之處。

首先,它們的核心業務誕生於一次幸運的意外。對於 AWS 來説,它意識到可以對外出售包括存儲、計算在內的內部服務。對於英偉達來説,為遊戲而設計的 GPU 也非常適合處理人工智能工作負載。

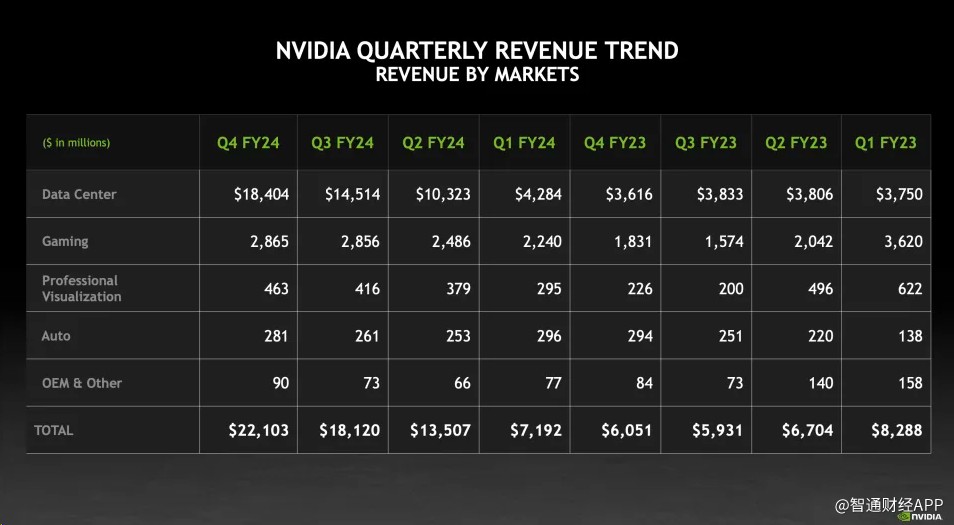

這最終在最近幾個季度為英偉達帶來營收的爆炸式增長。英偉達的營收一直在以三位數的速度增長,從 2024 財年第一季度的 71 億美元增長到 2024 財年第四季度的 221 億美元。這是一個相當驚人的發展軌跡,儘管其中絕大部分增長來自該公司的數據中心業務。

雖然亞馬遜從未經歷過如此迅猛的增長,但 AWS 一直是這家電子商務巨頭的主要營收來源。多年來,AWS 已經成長為一項利潤豐厚的業務,目前的運營價值接近 1000 億美元,即使脱離亞馬遜也將是一家非常成功的公司。然而,隨着微軟和谷歌加入競爭,雲計算市場形成了 “三足鼎立” 的格局。

英偉達也可能面臨同樣的問題,即其他芯片製造商最終也將開始獲得有意義的市場份額。如果 GPU 市場的競爭開始加劇,英偉達確實還有其他業務,但這些業務的營收規模要小得多,增長速度也比 GPU 數據中心業務慢得多。

短期財務前景

英偉達預計本季度 (2025 財年第一季度) 的營收將達到 240 億美元,同比增長 234%。

這根本不是我們在成熟的上市公司中經常看到的數字。鑑於該公司最近幾個季度的營收大幅增長,預計其增長率將下降。數據顯示,在 2024 財年,英偉達第四季度營收環比增長 22%,而 2025 財年第一季度營收環比增長將更為温和,為 8.6%。英偉達未來還會出現其他增長放緩的情況。

例如,分析師預計英偉達本財年的營收將達到 1105 億美元,較上年同期增長 81%。這遠低於該公司 2024 財年 126% 的增長率。

不過,至少在接下來的幾個季度裏,英偉達的年營收有望繼續突破 1000 億美元大關,對於一家上年同期總營收僅為 71.9 億美元的公司來説,這一數字令人印象深刻。

簡而言之,儘管今年令人瞠目結目的營收增長數據將放緩,但英偉達未來仍將有巨大的增長空間。

英偉達勢不可擋?

在未來幾年裏,即使來自 AMD、英特爾和其他芯片製造商的競爭開始加劇,但英偉達仍將是人工智能熱潮的最大贏家。就像 AWS 一樣,英偉達最終也將面臨更激烈的競爭,但該公司目前佔據如此多的市場份額,它可以承受放棄一些市場。

僅從 GPU 芯片層面 (不包括主板或其他相關產品) 來看,IDC 的數據顯示英偉達牢牢控制着這一市場:其市場份額高達 97.7%。

不過,追蹤 GPU 市場的研究公司 Jon Peddie Research 的數據顯示,雖然英偉達仍佔據主導地位,但 AMD 的市場份額正在不斷增長,從 2022 年第四季度的 12% 上升至 2023 年第四季度的 19%。

Jon Peddie Research 分析師 C . Robert Dow 表示,其中一些波動與新產品推出的時間有關。Dow 表示:“由於市場週期 (新顯卡推出的時間) 和庫存水平的變化,AMD 的市場份額可能會小幅增加,但英偉達多年來一直處於主導地位,而且這種情況將繼續下去。”

跟蹤芯片市場的 IDC 分析師 Shane Rau 也預計,儘管趨勢發生了變化,但英偉達的主導地位仍將持續下去。“有趨勢,也有反趨勢,英偉達參與的市場規模很大,而且還在不斷擴大,增長將持續下去,至少在未來五年內是這樣。”

部分原因是英偉達銷售的不僅僅是芯片。他表示:“他們會向你出售一台超級計算機上的主板、系統、軟件、服務和時間。這些市場都是巨大且不斷增長的,而英偉達與所有這些市場都息息相關。”

但並非所有人都認為英偉達的增長不可阻擋。雲計算資深顧問和作家 David Linthicum 表示,客户並不總是需要 GPU,公司開始意識到這一點。他表示:“他們説他們需要 GPU。我看了看,做了一些粗略的數學計算,他們不需要它們。CPU 完全沒問題。”

隨着這種情況的發生,他認為英偉達將開始放緩,其市場主導地位將會被削弱。Linthicum 表示,“我認為,在接下來的幾年裏,我們將看到英偉達變成一個更弱的玩家。我們將看到這一點,因為有太多的替代品正在生產。”

Rau 表示,隨着企業使用英偉達產品擴展人工智能用例,其他供應商也將受益。“我認為,未來你會看到不斷增長的市場將為英偉達創造有利條件。但也會有其他公司緊隨其後,尤其會從人工智能中受益。”

也有可能一些顛覆性的力量會發揮作用,這將是一個積極的結果,以防止一家公司變得過於主導。“你幾乎希望顛覆會發生,因為這是市場和資本主義最好的運作方式,對吧?有人搶先一步,其他供應商緊隨其後,市場不斷增長。一些老牌企業最終會被顛覆,” Rau 表示。

事實上,我們已經開始在亞馬遜看到這種情況,微軟通過與 OpenAI 的合作取得了進展,而亞馬遜被迫在人工智能領域追趕對手。英偉達目前牢牢地佔據着主導地位,賺得盆滿缽滿。Miller 和 Wilhelm 警告稱,這並不意味着英偉達會一帆風順,該公司未來可能會面臨更大競爭壓力。