Bought Nvidia and made a full pot, becoming the third largest holding stock of the Norwegian Wealth Fund

2024 年以来,英伟达继续大涨 91.8%,持有市值或达 260 亿美元。

众所周知,全球最大的财富基金 -- 挪威主权财富基金,其在股票投资上,非常成功。

2023 年股票收益 21.3%,整体收益 16.1%

挪威主权财富基金 2023 年投资报酬率达到 16.1%,一反 2022 年的巨额亏损,基金总值达到接近 15.8 万亿挪威克朗(约 1.55 万亿美元)。该资金来源主要是挪威国有石油和天然气公司的营收。

成立以来的资产增长:

挪威主权财富基金可以说是满仓投资,在其资产组合当中,约 71% 是股票,投资的公司多达 8859 家,遍布全球,相当于世界所有上市公司的 1.5%。这部分投资 2023 年报酬率达到 21.3%。

其次是固定收益资产,占比 27.1%:

2024 年前三个月,资产增长 10%

2024 年至今,15.8 万亿挪威克朗已经上涨至 17.4 万亿挪威克朗(约 1.62 万亿美元),3 个多月收益率达 10%(最新实时数据):

目前,挪威主权财富基金大部分资金,都是投资收益得来的:

一边躺在油田上富得流油,一边把石油赚的钱,在投资市场里再放大翻倍。

挪威全国人口仅仅 540 多万,按照目前 1.62 万亿美元计算,人均占有财富 30 万美元(约 216 万人民币),挪威人民可真的是幸福。

幸福来自于对比,不幸也来自于对比,作为全世界石油储备最大的国家 -- 委内瑞拉,2014 年之后就不再公布经济数据了,还一度成为难民数最多的国家,同样坐在油田上,结果天差地别。

押宝科技股,贡献最大的是英伟达

近两年,美股科技股的大幅上涨,2023 年纳斯达克 100 指数大涨 53.8%、2024 年至今涨 8.6%,获益最丰厚的是挪威主权财富基金。

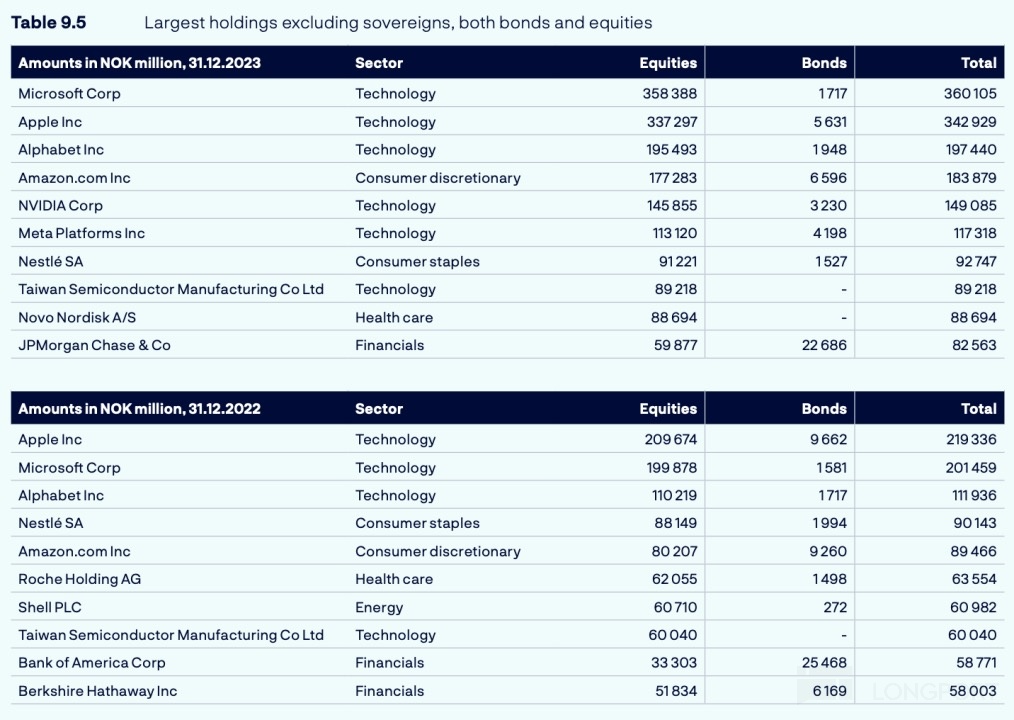

2022 年、2023 年其前十股票投资名单如下:

名单上可以看到,2022 年英伟达还未出现在前十名单中,2023 年已经是其第五大持仓股。

其前五持仓为:

微软:330 亿美元

苹果:310 亿美元

谷歌:160 亿美元

亚马逊:140 亿美元

英伟达:120 亿美元

进入 2024 年,英伟达继续大涨 91.8%:

如果没有减持,那么英伟达成为了挪威主权财富基金的第三大持仓股(超过亚马逊和谷歌,仅次于微软和苹果),价值超过 2800 亿挪威克朗(约 260 亿美元)。

挪威主权财富基金大部分资金投资于股市,又重点在于科技股,告诉大家,科技才是财富增长最快的途径。