Barclays: Just "talking the talk" is not enough, the Bank of Japan may raise interest rates in July

日本央行加息可能比想象中來得更快?

日元持續走軟、經濟復甦穩健、漲薪前景樂觀……日本央行加息可能比想象中來得更快?

巴克萊銀行於 3 月 29 日發佈研報稱,僅僅通過 “口頭” 影響市場對政策利率的定價對日央行來説 “相當具有挑戰性”,因此繼續預計日本央行將在七月加息至 0.25%、可能在 2025 年 4 月再次加息,並將對末端利率(最終利率水平)的預期上調至 0.5%。

在近期不會再次加息的市場普遍預期下,巴克萊此番預測顯得十分激進。

巴克萊稱,鑑於日元持續疲軟、油價走高和工資增長處於 “支持/不支持加息” 的臨界點,預計日央行加息路徑的風險偏向上行,如果前述情形強於預期,日央行還可能會提前第三次加息的時點。

日元持續疲軟 亟需政府幹預

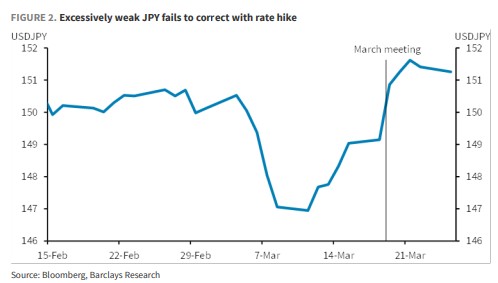

巴克萊表示,日元過度疲軟的態勢將持續成為日央行關注的焦點。自日央行在 3 月利率會議上宣佈加息以來,日元已持續貶值至 34 年低點。

華爾街見聞此前提及,美元兑日元一路飆升至 151 上方,距離上次日本直接干預匯市時的匯率水平(151.97)僅 “一步之遙”,另外,日本外匯最高主管也在一週內連續兩次口頭干預,加劇了日本當局採取匯市干預行動的風險。

3 月 22 日,日本財務大臣鈴木俊一也進行了口頭干預,警告稱當局正在 "以高度的緊迫感 "關注利率。

日本央行行長植田和男此前曾表示:

“如果匯率對日本央行的經濟活動和價格前景有重大影響,日本央行自然會考慮採取貨幣政策應對措施。有鑑於此,我們將考慮美日政策利率前景與美元兑日元之間的關係,以及美元兑日元與通脹之間的關係。”

巴克萊認為,如果美國方面沒有出現利率水平的大幅下調,日央行在不久的將來就會需要加息來修正日元的持續疲軟。

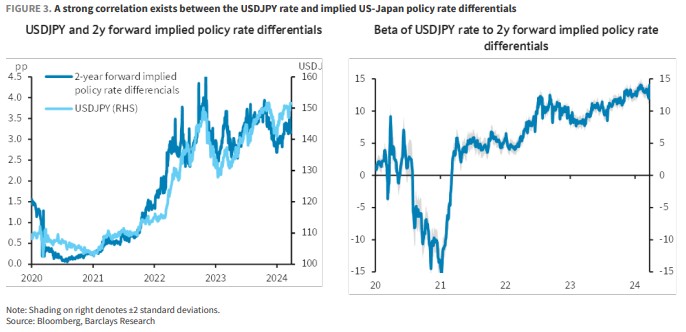

我們構建了一個美元兑日元利率對隱含利差敏感度的理論模型,顯示隱含利差每變動 0.1 個百分點,美元兑日元水平就會波動 1.4 日元。根據模型進行估算,可以發現:

- 假定美國政策利率的定價保持不變,如果市場對日本政策利率的定價從目前的約 0.5% 水平上升 0.5 個百分點,美元兑日元可能會從目前的即期匯率(截至 3 月 25 日為 151.3)下跌約 5%。

而顯然,日央行如果僅僅是通過 “嘴炮”,是不能帶來如此大規模的定價變動的。

- 如果美國政策利率定價上調 0.5 個百分點,在日本方面沒有變化的情況下,美元兑日元可能會進一步攀升 5%。

同時,模型顯示敏感度正在穩步上升——表明市場對美日兩個經濟體貨幣政策的關注度越來越高。

多因素助推通脹走高 放大加息可能性

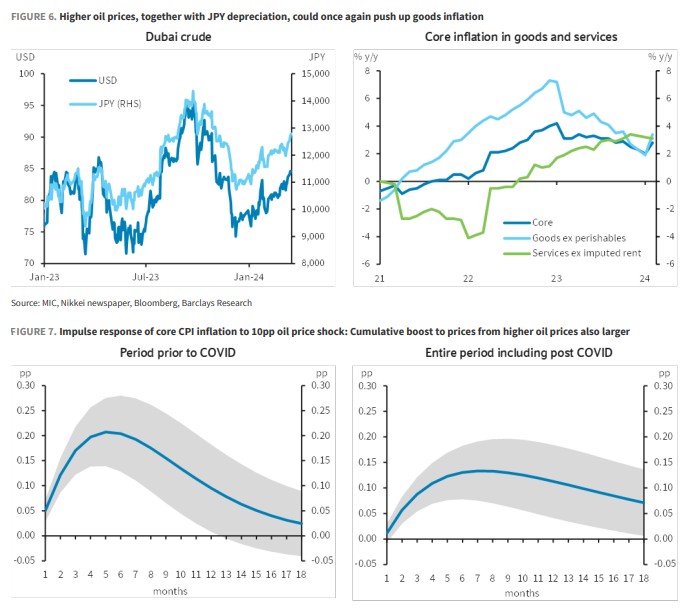

巴克萊表示,由於近期日元貶值和油價走高,商品通脹上行的可能性正在增加。

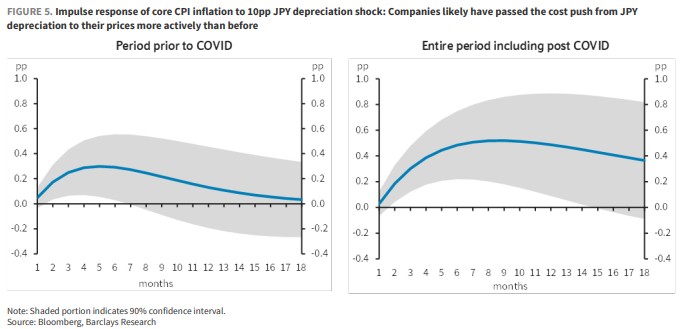

報告顯示,美元兑日元匯率對核心 CPI 的影響在新冠疫情後變得更顯著,意味着日本企業疫情後更積極地將日元貶值的成本轉嫁到了產品價格上。

在新冠疫情之前,10% 的日元貶值對核心 CPI 通脹的影響在 5 個月後達到約 0.3% 的峯值,在 6 個月後統計意義上的影響消失。

然而,在新冠疫情之後,這種影響在八個月後達到峯值,約為 0.5%,並且在統計意義上的顯著影響持續了一年多。

其次,最近有所上漲的油價,對於通脹走高的助推力也越來越大。

據上述模型,估算迪拜原油價格(以美元計)上漲 10% 對核心 CPI 通脹的影響路徑。結果顯示,自新冠疫情以來,累積影響已經上升。

更具體地説,雖然峯值影響從新冠疫情之前的 0.2% 下降到疫情後的 0.13%,但統計顯著性週期從 12 個月大幅延長到 18 個月左右,導致後者的累積影響達到原先的約 1.2 倍,這又進一步放大了日元貶值的風險。

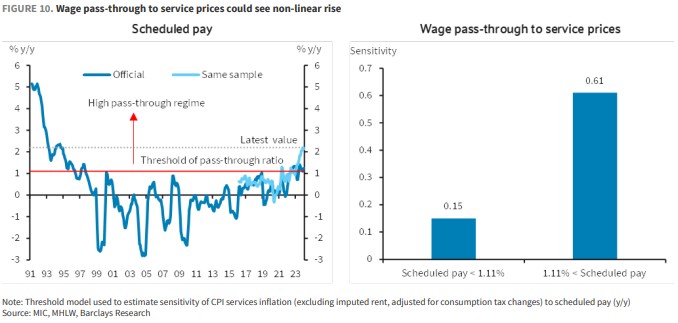

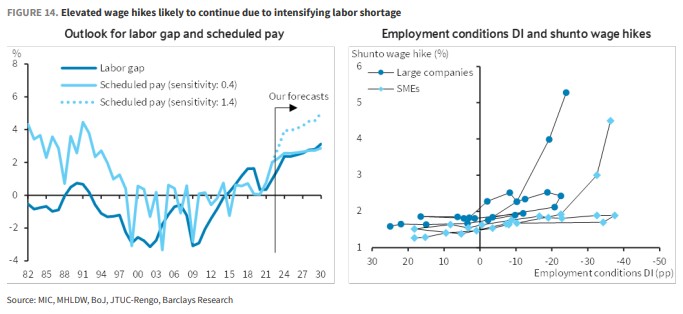

此外,在日央行長期關注的工資/通脹循環方面,巴克萊預計今年的最終工資增幅將達到 4.6%,並還有上行可能,當整體名義工資漲幅超過 1.11% 的臨界點,服務通脹將會出現非線性上升(上升幅度會更大)。

預計從 4 月到 7 月左右,工資將按計劃上調。隨着成本推動型通脹也呈放緩趨勢,我們認為實際工資增長轉為正值的可能性越來越大。

名義工資在截至 2024 年 1 月的過去半年中呈現 2% 的穩健增長,再加上今年工資的大幅上漲,預計實際工資在 6 月前後小幅回升的可能性增大,已經穩定在 3% 左右的服務通脹可能會進一步上升。

最後,報告還提到了另一個評估經濟活動和通脹的重點:產出缺口。

目前,日央行預估的產出缺口仍略微處於負值,即因需求疲弱而導致限制產能。巴克萊預計,如果實際工資增長從年中開始轉正,那麼消費有望復甦,產出缺口有望在年中同步轉為正值。

儘管將該指標作為工資和通脹壓力的先行指標的有效性仍受質疑,但報告認為屆時應關注央行在這方面的溝通,或將增加通脹上行的可能。

7 月加息後 再次加息的空間有限

報告同樣表示,一旦利率上調至 0.25%,進一步加息的障礙可能會大大增加,因為這將首次對經濟產生明顯影響,需要考慮可能帶來的政治影響。

因此,巴克萊預計,日央行在 7 月加息後將保持較長時間的觀望態度,不過 2024 年的下議院大選和 11 月的美國大選會構成風險因素。

總體而言,巴克萊基於對經濟活動、價格和金融狀況的考量,預測偏向於提前加息。

如果日元持續過度疲軟,且通脹因前述因素而繼續強於預期,巴克萊認為日央行在 7 月會議上加息後,可能會在 10 月或明年 1 月的議息會議上再次考慮加息。

我們認為,基於今年通脹和盈利增長下降的前景,2025 財年的工資漲幅可能會小於 2024 財年(今年 4 月 1 日至明年 3 月 1 日)。

儘管如此,日本似乎已經到了第二個劉易斯拐點(勞動力由過剩向短缺的轉折點),勞動力短缺問題日益突出,這已經導致日本企業的漲薪心態發生了重大變化。因此,即使 2025 財年的工資漲幅小於 2024 財年,我們仍認為其漲幅可能大於 2023 財年,並連續第三年保持高位。