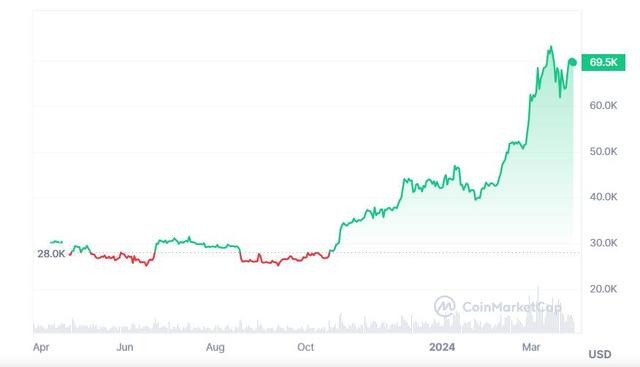

PCE inflation cools down, causing the US dollar to fall in response, but still maintains a monthly cumulative increase for the year. Bitcoin soared over 60% in the first quarter

美元指數在 PCE 通脹數據降温後轉跌。比特幣一季度漲幅超過 60%。

本週五是復活節前的耶穌受難日,歐美股市、債市休市,芝商所(CME)和洲際交易所(ICE)旗下的原油、貴金屬、外匯、股指、美債期貨全天暫停交易。

在交易清淡的週五假日,匯市主要貨幣的波動相對較小。最為突出的是,美聯儲青睞的通脹指標——美國 2 月核心 PCE 物價指數如市場所料降温,數據公佈後,美元指數迅速由漲轉跌。

週五公佈的 2 月核心 PCE 物價指數同比和環比增速均較 1 月放緩增長,同比增速 2.8% 為 2021 年 3 月以來最低,環比增速 0.3%,低於 1 月上修後的一年來最高增速 0.5%。在本月稍早公佈的 2 月 CPI 和 PPI 均超預期增長後,核心 PCE 降温會令美聯儲鬆一口氣。有分析指出,PCE 數據或強化交易員對美聯儲的降息押注。

此後美聯儲主席鮑威爾表示 2 月核心 PCE“基本符合預期”,重申美聯儲不急於降息,稱聯儲希望看到更多 “向好” 的通脹數據增強信心,重申預計通脹將繼續在 “顛簸的道路” 下降。華爾街人士評論稱,目前得到的整體訊息沒有太大變化,2 月通脹數據符合美聯儲預期,也符合更多數據出爐後美聯儲會同意行動的看法。美聯儲現在所處的模式是,只要得到更多的信心,再獲得幾個月的數據,他們就仍然願意今年年中降息。

美元指數轉跌之際,週五非美貨幣普遍刷新日高,歐元脱離一個多月來低位,日元擺脱跌向週四下逼 152.00 這一 1990 年來低谷的危險。雖然美元指數跌離週四所創的 2 月中以來高位,但本週和本月的漲勢不改,保持着進入 2024 年以來每月累漲的勢頭。比特幣的反彈僅持續了週四一日,盤中跌回 7 萬美元下方。

瑞士央行本月意外降息引爆了全球央行進入降息賽跑的預期。有分析認為,美元這波漲勢主要受到發達市場貨幣、如瑞士法郎和日元拋售的推動。即便在各國央行開始降息時,美國的實際收益率仍有可能保持相對較高的水平,因為美聯儲傾向於比目前市場預期更為謹慎。

PCE 後非美貨幣刷新日高 歐元脱離一個多月高位

追蹤美元兑歐元等六種主要貨幣一籃子匯價的 ICE 美元指數(DXY)在亞市盤初轉漲後,直到歐股盤前都保持漲勢,歐股盤前漲破 104.60,向週四漲破 104.70 刷新的 2 月 15 日以來高位靠近,日內漲逾 0.1%,歐股早盤短線轉跌,美國公佈 PCE 物價指數後迅速轉跌,從數據公佈前的接近 104.60 迅速跌至下逼 104.40 刷新日低,日內跌逾 0.1%,後逐步抹平多數跌幅。

非美貨幣中,美國 PCE 公佈後,日元漲幅迅速擴大,美元兑日元曾跌破 151.20 刷新日低,日內跌逾 0.1%;歐元兑美元迅速漲破 1.0800 刷新日高,日內漲近 0.2%,脱離歐市盤初跌破 1.0770 而連續兩日所創的 2 月 20 日以來低位;英鎊兑美元漲幅擴大,曾漲破 1.2640 刷新日高,日內漲近 0.2%,未繼續逼近上週五跌破 1.2580 所創的 2 月 20 日以來低位。

但在往常美股交易時段,日元、歐元和英鎊都逐步回吐漲幅,到往常美股收盤時,歐元和英鎊日內微漲,美元兑日元日內微跌,處於 151.30 上方,未逼近週四上測 152.00 所創的 1990 年中以來高位。

離岸人民幣(CNH)兑美元在亞市早盤轉跌後曾刷新日低至 7.2643,後很快轉漲並保持漲勢,美國 PCE 公佈後漲幅擴大,往常美股早盤時段曾漲至 7.2536 刷新日高,較日低漲 103 點,未繼續跌向週一跌破 7.28 所創的 2023 年 11 月 13 日以來盤中低位。

比特幣盤中跌破 7 萬美元 3 月仍漲超 10%

比特幣(BTC)在亞市早盤曾漲破 7.1 萬美元刷新日高,後很快跌破 7.1 萬美元,往常美股早盤時段,幣價跌穿 7 萬美元后曾跌破 6.92 萬美元、部分平台跌至 6.91 萬美元下方刷新日低,較日高回落約 2000 美元、跌近 3%,未能繼續逼近週三轉跌前突破 7.16 萬美元所創的 3 月 14 日以來高位。

CoinMarketCap 數據顯示,到往常美股收盤時,比特幣(BTC)現貨交易價處於 6.96 萬美元上方,最近 24 小時跌超 1%,最近七日漲超 9%,3 月漲超 12%,今年初以來的一季度內累漲超 60%。