"Commodity leader" Goldman Sachs: "Supply shortage" in copper and aluminum, "safe-haven value" in gold

高盛表示,铜和铝将在二季度开始出现供应缺口,预计年底铜将涨至 10000 美元/吨,铝将涨至 2600 美元/吨。在欧美央行货币政策转向、地缘政治因素的作用下,黄金在年底将升至 2300 美元/盎司。

今年以来各类大宗商品价格开启 “狂飙” 模式,黄金、铜、铝等金属表现尤为亮眼,“大宗商品旗手” 高盛高呼,今年铜、铝、黄金还将继续攀升。

3 月 28 日,高盛分析师 Nicholas Snowdon 和 Lavinia Forcellese 在报告中指出,到年底,铜将涨至每吨 10000 美元,铝将涨至每吨 2600 美元,黄金料为每盎司 2300 美元:

铜将在二季度出现 25 万吨供应缺口,2024 年下半年铜将出现 45 万吨供应缺口,到年底铜将涨至每吨 10000 美元;

与铜类似,铝也将在二季度进入供应短缺的阶段,年底铝将涨至每吨 2600 美元;

在欧美央行货币政策转向、地缘政治因素等多重因素作用下,黄金有望延续 2024 年初的上涨势头,黄金在年底前升至每盎司 2300 美元。

需求复苏与供应受限 铜价或破新高

3 月份以来全球铜价持续走高,3 月 16 日,国际铜价(LME 铜)一度上破至 9000 美元/吨关口;截至当前,国际铜价依然超过 8700 美元/吨。

高盛认为,铜市场正处于一个重要的季节性拐点,自去年 12 月底以来,精炼铜市场出现了明显的季节性过剩阶段,目前这一阶段即将结束,在第二季度,库存水平将逐步走低:

我们注意到,在过去两周,中国的铜库存达到 45 万吨后开始回落。我们预计在第二季度将转入去库存周期,本季度全球将出现 25 万吨的供应缺口,下半年供应缺口将达到约 45 万吨。

高盛分析指出,在中国需求强劲、供应持续受限的情况下,铜市场将逐步转向供应短缺格局,持续供应短缺将支撑铜价,预计 2024 年底铜将涨至每吨 10000 美元:

预计 2024 年第二季度铜市场将出现 25 万吨供应缺口,下半年缺口将扩大到 45 万吨。一方面,中国需求强劲复苏,第一季度铜需求预计同比增长 12%,其中 1-2 月终端需求同比增长 9%,可再生能源(太阳能需求上涨 80%,风电需求上涨 69%)和电网投资强劲,带动铜需求大幅改善。

另一方面,铜矿供应持续受到干扰,中国铜原料联合谈判小组倡议联合减产,建议减产幅度 5-10%,这意味着减产规模可能达到 10 万吨,将对铜供应形成直接冲击。

二季度开始供应偏紧 支撑铝价上涨

高盛指出,与铜类似,全球铝市场也将从第二季度开始转入持续的供应短缺阶段,今年全球铝市场将出现 724 万吨供需缺口的预期,这一趋势将支撑伦交所铝价今年年底达 2600 美元/吨,在此背景下当前铝市场的三个动态值得关注:

首先,今年迄今为止,中国铝市场的走势最为强劲。我们预计,中国一季度铝需求或同比增长 11%,与铜市场类似,主要受到太阳能和电网投资的强力支撑。在产能限制下,中国国内铝供应趋于平稳,推动了原铝进口的强劲增长。与 2023 年的 140 万吨相比,目前主要进口量年化达到 270 万吨,这表明中国市场对全球铝市场的影响力正在增强。

其次,我们注意到越来越多的证据表明,除德国外,欧洲现货铝需求出现回暖。南欧和东欧大多数下游领域的去库存已经结束,订单量正在增强。这已经反映在欧洲铝升水价格上,升水从 12 月的低点已经上涨了近 40%。

第三,本周巴尔的摩大桥坍塌事件对美国铝市场来说是一个重要事件,超过 10% 的铝进口要通过该港口。去库存化的供应链很可能会被迫提前囤积更多库存,特别是考虑到美国终端需求趋势正在改善。我们注意到,美国中西部地区的铝升水已经出现上涨反应,支撑了一些现货交易的增加。

黄金创历史新高后仍将延续强势

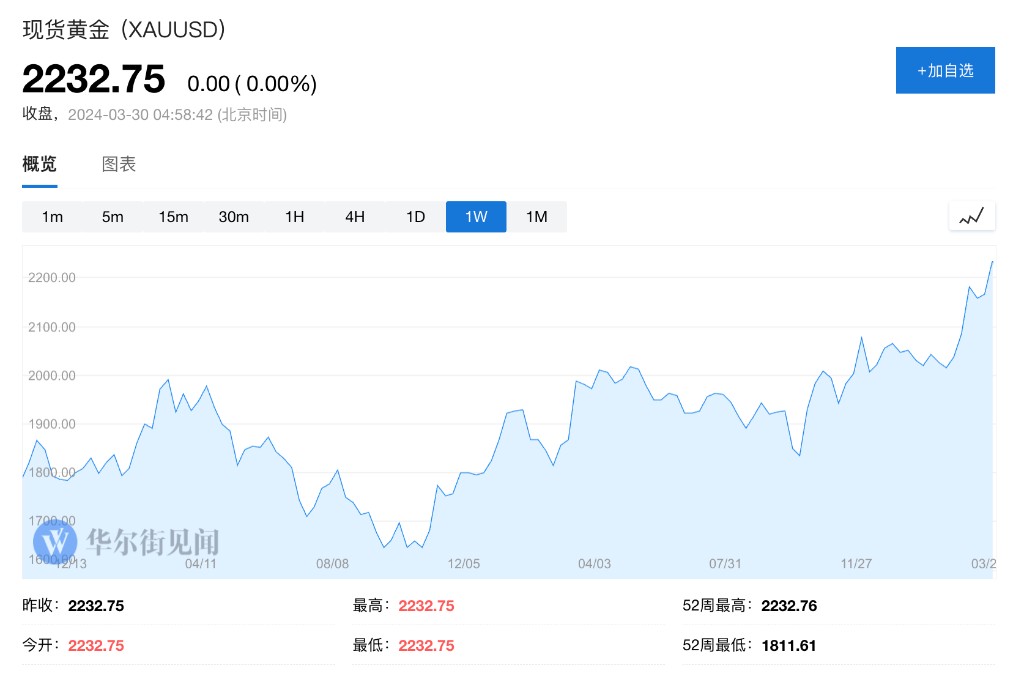

在强劲的美联储降息预期与避险需求的共同推动下,金价 3 月频繁触及历史新高,并创下 3 年来的最佳单月表现。

数据显示,3 月 28 日夜盘,COMEX 黄金期货涨 1.9%,报 2254.8 美元/盎司,三月涨幅达到 9%,刷新 2020 年 7 月以来的单月最大涨幅。值得关注的是,盘中金价一度触及 2256.9 美元的纪录高位。

高盛预计,美联储货币政策转向、ETF 等金融需求回暖、地缘政治风险及中国对实物的需求等因素,将推动黄金价格在 2024 年末升至每盎司 2300 美元:

我们的经济学家预计美联储将在今年 6 月开始降息,并在 2024 年降息三次。这将结束此前实物买盘和卖盘对黄金价格影响相互抵消的局面,转向更加一致的看涨效应。

过去几年,尽管地缘政治风险事件频发,但由于实际利率较高,黄金 ETF 持仓并未出现明显增长。但历史数据显示,美联储转向宽松后,ETF 买盘往往会显著回升,降息预期将提振机构投资者对黄金 ETF 的配置需求。

地缘政治冲突犹在,使得黄金作为避险资产的需求依然强劲。此外,随着美国大选的临近,政治不确定性可能进一步提振避险情绪,增加黄金配置吸引力。