Bank of America: If the Federal Reserve does not cut interest rates, the interest on the US government's debt will soar to $1.6 trillion

I'm PortAI, I can summarize articles.

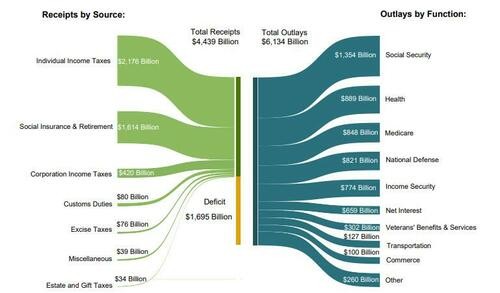

美银预计,到今年年底,利息支出将超过社保、卫生、医疗保险和国防支出,成为美国政府最大的支出项。

近日,美银首席投资官 Michael Hartnett 在其最新报告中表示,随着美国政府债务的增加,利息支出正迅速上升。

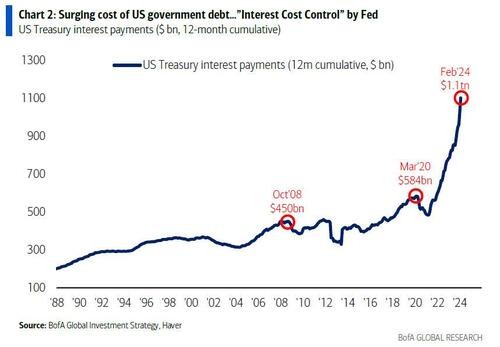

报告指出,美国政府在过去 12 个月对于债务的利息支付已达 1.1 万亿美元,此数额自新冠疫情以来已翻倍。Hartnett 预测,如果美联储在接下来的 12 个月不降息 150 个基点,按照当前趋势,美国政府的年度利息成本可能从 1.1 万亿美元上升到 1.6 万亿美元。

为了凸显利息支出的巨大规模,Hartnett 列举了 2023 财年的其他主要政府支出项目,例如社保 (1.354 万亿美元)、卫生 (8890 亿美元)、医疗保险 (8480 亿美元) 和国防 (8210 亿美元)。Hartnett 预计,如果美联储不降息,到今年年底,利息支出就将成为美国政府最大的支出项。

为了控制利息支出的飙升,Hartnett 认为美联储会采取降息措施。他将这种政策称为 “利息成本控制 (ICC)”。

除了债务问题,Hartnett 还简要提到了以下几点:

科技行业的监管趋严,例如美国司法部起诉苹果的反垄断诉讼、联邦贸易委员会起诉亚马逊的反垄断诉讼等等,以及欧盟针对科技巨头的调查和处罚。

美股科技七巨头,在过去一年中对标普 500 指数涨幅的贡献高达 60%。投资者青睐这些科技巨头拥有的竞争优势,但它们巨额的收入也使其成为监管部门的潜在目标。

过去一年美国科技行业的平均税率仅为 15%,远低于标普 500 指数其他公司的平均税率 (21%)。从历史上看,监管和利率上升往往是科技行业牛市和泡沫破灭的导火索。