In the crazy first quarter of AI, these stocks are more bullish than NVIDIA

AISP 一季度大漲 311%,超越所有 AI 股。

全球股市一季度在科技股的推動下表現強勁,其中,納斯達克指數大漲 9.11%,標普 500 指數大漲 10.16%。

在科技股中,AI 股漲幅最驚人,美股半導體 ETF(SMH)漲幅達 28.5%,是漲幅最大的 ETF 之一。

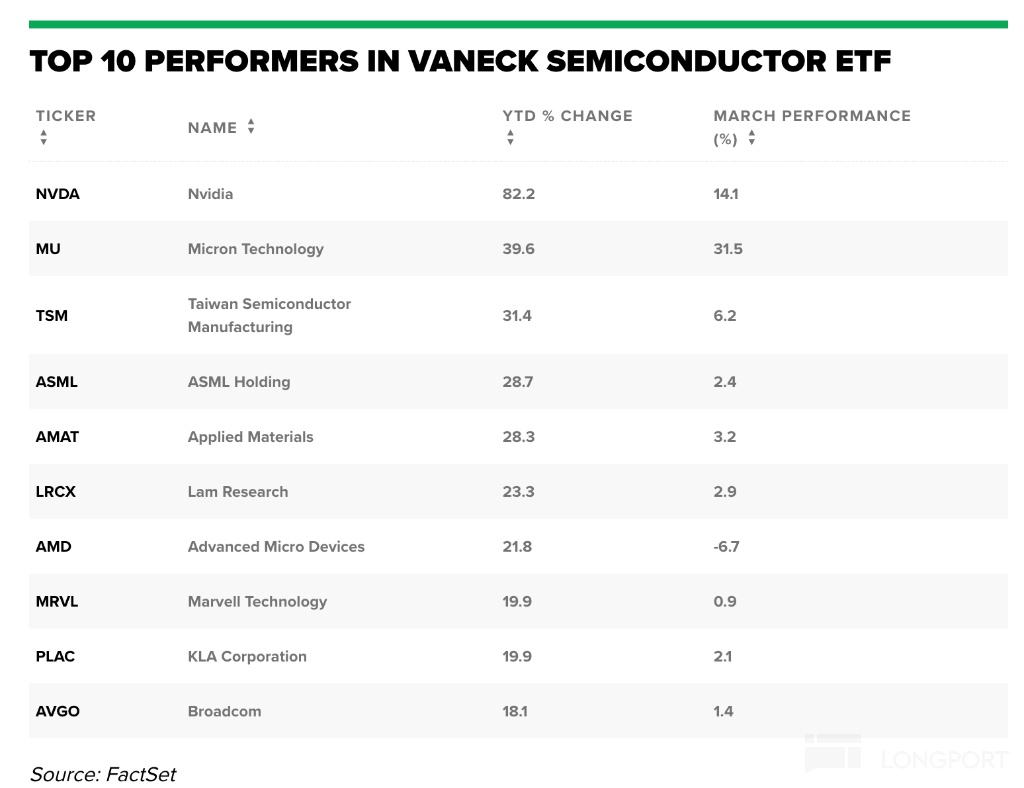

在這隻半導體 ETF 中,英偉達漲幅最大達 82%,市值增長近萬億美元,MU 漲 39.6%,TSM 漲 31.4%,ASML 漲 28.7%。。。

但 AI 股不只有這些,其中最知名的就是美股 AI 新貴 SMCI,由於 AI 服務器需求火爆,業績大好,股價在一季度就大漲 253.8%(2023 年則大漲 246%):

而同樣受益於 AI 服務器的鴻海精密(HNHPF)近一個月大漲 50%:

除了這些大市值公司,一些小 AI 公司漲幅也是非常驚人。其中,Airship AI(AISP),一季度大漲 311%,超越所有 AI 股,不過該股市值非常小,僅 1.8 億美元。

Airship AI 是一個人工智能驅動的視頻、傳感器和數據管理監控平台,通過在事件發生之前提供預測分析併為決策者提供有意義的情報,為公共部門和商業客户提高公共安全和運營效率。

英偉達持倉股 SoundHound AI(SOUN)則在一季度大漲 177.8%(區間最高漲 385%),主要原因是英偉達在年初公佈了其 F13 持倉股,包含了 SoundHound AI,該公司主要從事智能語音相關業務,和英偉達有一定的合作關係。

AI 後市如何看?

一、英偉達將影響整個 AI 行業

AI 後市主要看英偉達,實際上,整個美股,都要看英偉達。

目前市場普遍看好英偉達,主要理由有:

1)業績增長快,收入有望繼續翻倍

據分析師,預測英偉達 2024 年(即 2025 財年,截止 2025 年 1 月的財年)數據中心業務營收或可達到 969 億美元,同比增長 104%;

預測英偉達 2025 年(即 2026 財年)數據中心業務營收 1203 億美元,同比增長 24%。

2)英偉達競爭護城河短期內無人能及

英偉達產品技術以及人工智能大模型技術或還有大幅度提升的空間。

具體而言:英偉達今年 2 季度和 4 季度還將上市 H200 和 B200 的新產品,另外新的大模型技術和應用還在不斷更新,例如 Sora 等現在也只能生成 60 秒鐘的內容,產品還有升級空間,對算力的需求將更大。

二、AI 的市場需求巨大,且將繼續火爆

統計下游八家主要雲服務巨頭 2024 年的資本開支計劃,預計或可達到 1610 億美元,同比增長 25%,在 AI 上投入很大。

不過,儘管半導體行業整體表現強勁,但並非所有半導體公司都因 AI 而上漲,英特爾一季度則跌 7.3%。半導體公司出現分化,請注意風險。