"Stock God" buying again? Berkshire Hathaway launches a new round of yen bonds, leading to a rise in Japanese stocks with the five major trading companies following suit

媒體報道稱,伯克希爾計劃發行自日本央行加息以來的首批日元債券,巴菲特此舉引發市場猜測,其可能正在考慮繼續增加在日本的投資。

“股神” 巴菲特或再發日元債,成為日本央行加息後首家在日本市場發行日元債券的大型非金融海外發行人,有人猜測這位傳奇投資大佬可能會向日股投入更多資金。

當地時間 4 月 9 日,媒體援引知情人士消息稱,伯克希爾哈撒韋計劃在全球市場發行日元債券,該公司已聘請銀行安排日元債券發行工作,根據市場情況,這筆交易可能會在不久的將來達成。巴菲特此舉引發市場猜測,其可能正在考慮繼續增加在日本的投資。

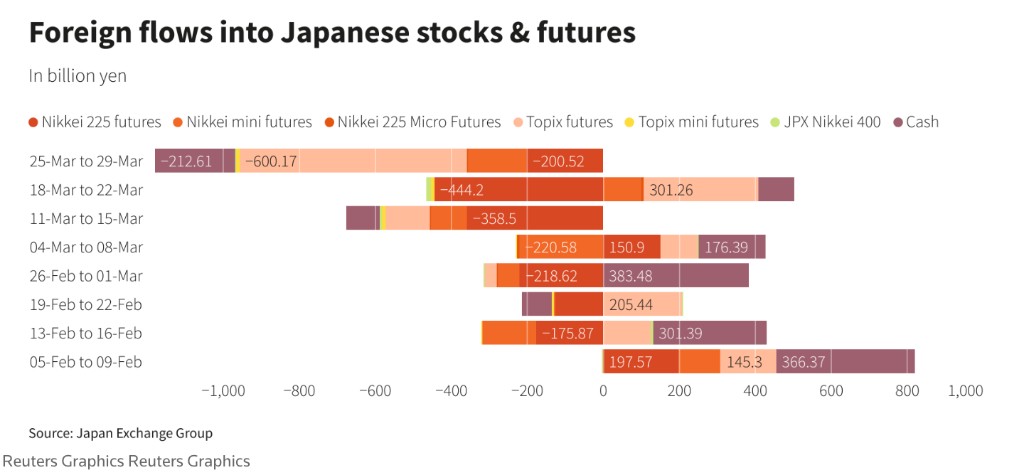

值得注意的是,外資 3 月底淨賣出日本股票現貨和期貨的規模創六個月新高。據日本交易所集團的數據,外國投資者在截至 3 月 29 日的一週淨賣出了 1.18 萬億日元(78 億美元)的股票現貨和期貨,刷新去年 9 月最後一週以來的最高水平。

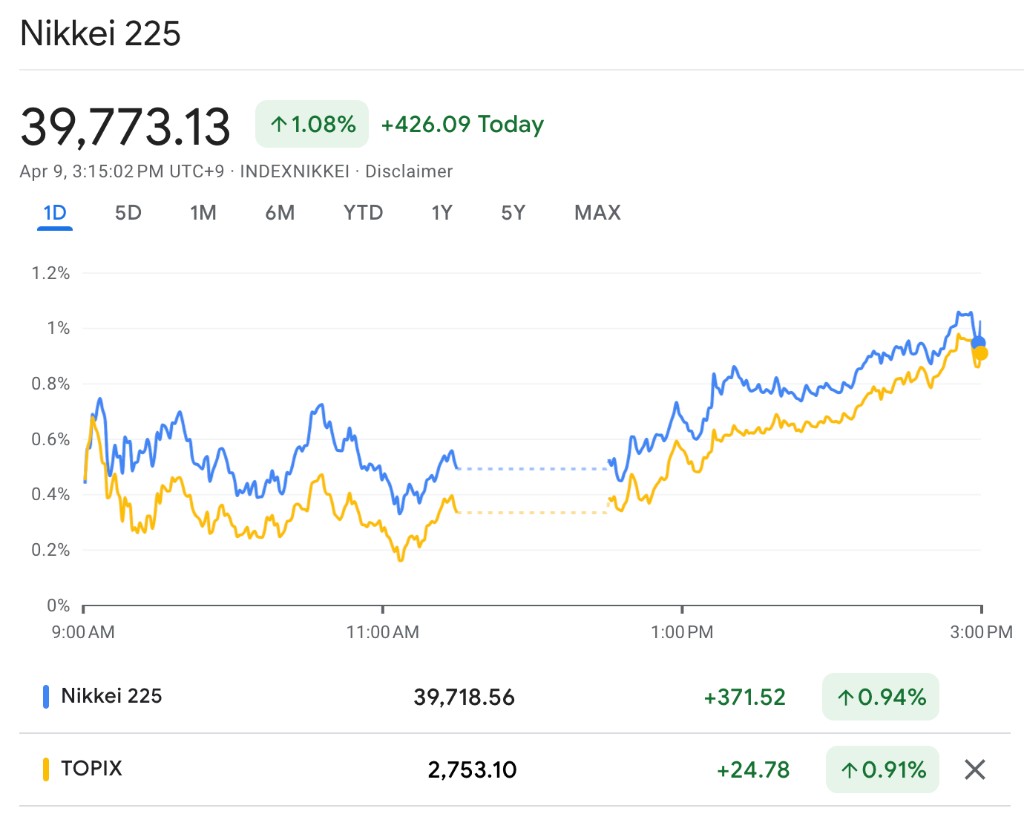

伯克希爾即將發行日債的消息一出,巴菲特青睞的日本五大商社(伊藤忠商事、丸紅、三菱、三井和住友)股價應聲上漲,拉高日股,日經 225 指數收漲 1.08% 報 39773.13 點,連漲 2 日,三菱商事、三井物產漲超 3%。

日本央行在 3 月宣佈最新利率決議,將基準利率從-0.1% 上調至 0-0.1%,為 2007 年以來首次加息,長達 8 年的負利率時代宣告終結。伯克希爾哈撒韋也將成為日本央行取消負利率政策後,首家在日本市場發行日元債券的大型非金融海外債券發行人。

媒體分析指出,有跡象表明日本央行行長植田和男不會急於再次加息,在這種背景下,日元債券的信用利差 (即相對於無風險基準的額外收益率) 已經收窄至 2022 年 9 月以來的最低水平。投資者現在對企業債券要求的信用利差約為 52 個基點,低於一年前的 67 個基點。

巴菲特持續加碼日本市場

近兩年,巴菲特在日本市場相當活躍。自 2019 年發行首隻日元債券以來,伯克希爾就是日元債券最大的海外發行商之一,在其過去 40 次債券發行中 32 次選擇了日元。截至去年 9 月份,伯克希爾發行的日元債券約為 76 億美元。

除連續發債外,2020 年 8 月,伯克希爾首次宣佈被動持有日本 “五大商社” 5% 的股份,之後又於去年 6 月透露已將其持股比例增至 8.5% 以上,在今年 2 月發佈的股東信中巴菲特透露伯克希爾持有這 5 家公司約 9% 的股份。

巴菲特在股東信中稱,多元化業務、高股息、高自由現金流、審慎增發新股是其青睞五大商社的重要原因:

伊藤忠商事、丸紅、三菱、三井和住友這五家公司都遵循着股東友好的策略,自從我們開始收購日股以來,這五家公司都以具有吸引力的價格減少了流通股的數量。

五家公司都只將大約 1/3 的收益用於分紅,留存的鉅額資金既用於建立其眾多業務,也在較小程度上用於回購股票。與伯克希爾一樣,這五家公司也不願發行股票。

此外,無法預測主要貨幣的市場價格,因此伯克希爾用 1.3 萬億日元的債券收益為其在日本的大部分頭寸提供了資金。

關於將持有多久,巴菲特在股東信中表示,將繼續長期持有五大商社股份,他此前透露伯克希爾計劃持有這些投資 10 到 20 年。

五大商社是巴菲特近年來最成功的投資之一,自 2020 年伯克希爾收購這五隻股票以來,平均漲幅超過一倍。日本股市一路高歌猛進,基準指數日經 225 指數超越 1989 年的歷史前值 38957.44 點,創出歷史新高。

目前伯克希爾對這 5 家公司的投資成本共計 1.6 萬億日元,5 家公司的年末市值為 2.9 萬億日元。隨着近年來日元匯率走低,伯克希爾的年終未實現美元收益為 61%,達 80 億美元。