In April, the ADP employment in the United States increased by 192,000, beating expectations, while wage growth slowed down

美國 ADP 就業整體強勁,但工資增幅放緩,這對於期待薪資通脹降温的美聯儲來説是個好消息。幾乎所有行業的招聘都穩健,除了信息行業出現失業。ADP 數據發佈後,美股期貨盤前仍下跌,但跌幅收窄,美元指數明顯回落。

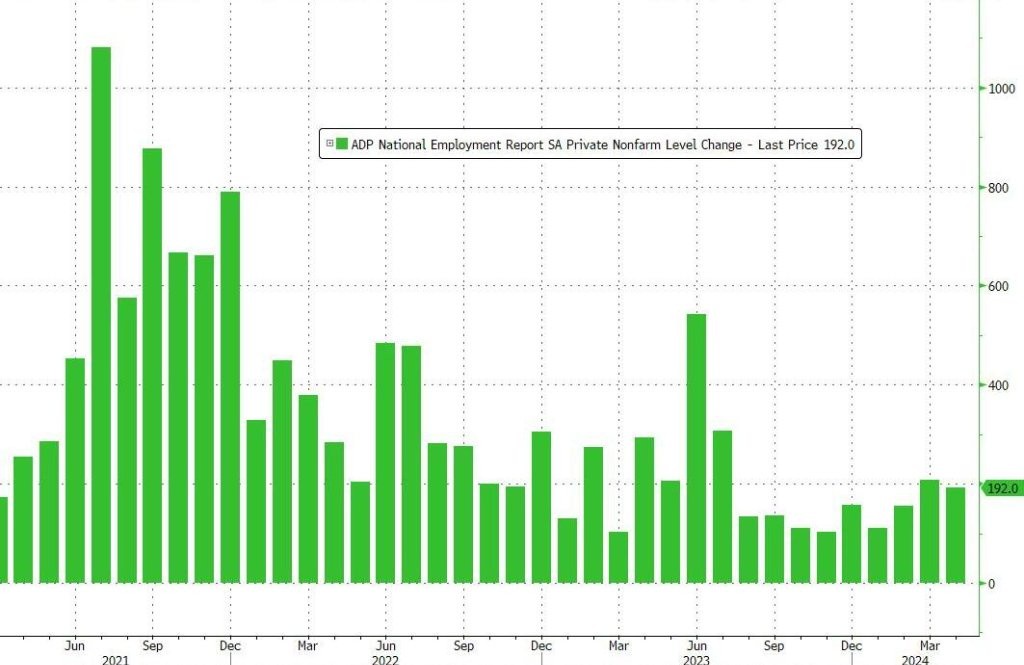

有 “小非農” 之稱的 ADP 就業數據 4 月超預期,3 月數據上修,表明美國勞動力市場仍然強勁穩健,不過市場高度關注的薪資增幅有所放緩。

5 月 1 日週三,美國 ADP 就業報告顯示,美國 4 月 ADP 就業人數增加 19.2 萬人,高於預期的 18 萬人,3 月前值從 18.4 萬人上修至 20.8 萬人。

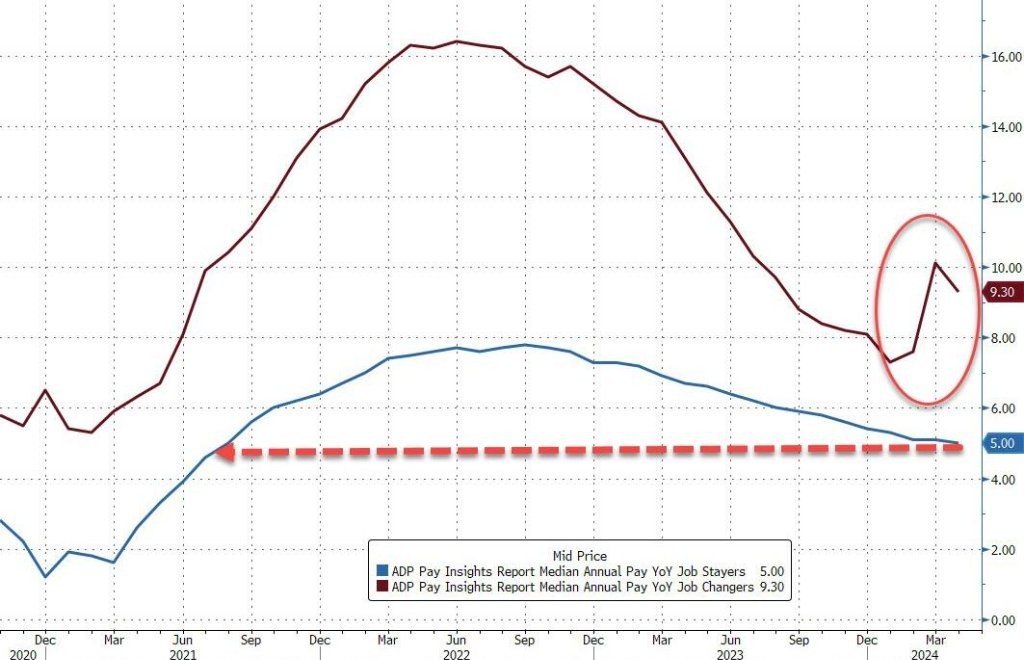

ADP 的工資數據顯示,無論是跳槽者還是留在本公司的員工,他們的工資增長均在放緩,不過前者仍然處於較高水平。具體來説,4 月跳槽者工資同比增幅為 9.3%,較 3 月增幅收窄,但是仍明顯高於幾個月前的低谷;而留在本公司的員工工資較一年前增長了 5%,這是 2021 年以來的最低增幅。

ADP 的工資增幅放緩,這對於期待薪資通脹降温的美聯儲來説是個好消息。當前已有其他許多跡象表明,美國通脹比許多經濟學家和政策制定者們的預期更加具有粘性。例如昨天公佈的數據顯示,美國第一季度勞動力成本加速上升,創一年來最大升幅。美聯儲青睞的勞動力成本指數超預期升温,顯示美國就業市場熱度不減。

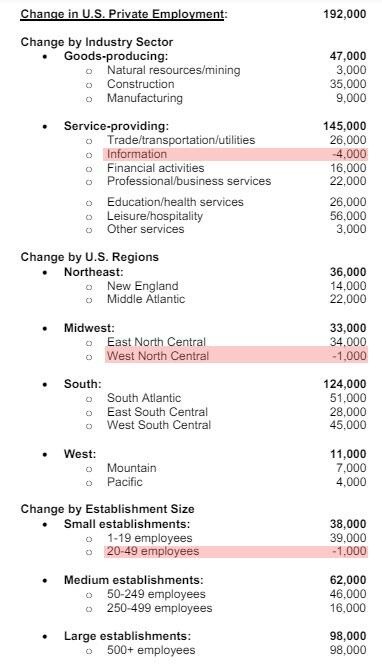

分行業來看,休閒和酒店業的就業增長最為強勁,增加了 5.6 萬人,建築業增加了 3.5 萬人。其它出現顯著增長的行業包括:貿易、運輸和公用事業,以及教育和醫療服務行業,這兩類均有 2.6 萬人的增幅;專業和商業服務增加了 2.2 萬人;金融活動增加了 1.6 萬人。不過,信息行業的就業有所減少,減少幅度為 4000 人。

從僱主規模來看,擁有 500 名或以上員工的公司在招聘人數方面增幅最大,達到 9.8 萬人。

ADP 首席經濟學家 Nela Richardson 表示:

4 月份的招聘包括的行業範圍很廣。只有信息行業——電信、媒體和信息技術表現疲軟,出現失業,薪資增幅為 2021 年 8 月以來的最低。

財經金融博客 Zerohedge 點評稱,美國 4 月 ADP 就業數據依然強勁,在這種勞動力市場的情況下,美聯儲能否維持今年某個時候降息的幻想呢?

ADP 數據發佈後,美股期貨盤前仍下跌,但跌幅有所收窄,美元指數出現明顯的回落,黃金大體呈震盪走高態勢。

ADP 數據發佈的時間比更受市場密切關注的美國非農就業報告早兩天。近幾個月來,ADP 的數字一直低於非農報告的數字,已有連續八個月如此,儘管 3 月份時二者的數字相當接近:美國勞工統計局報告稱,3 月非農私人就業部分的人數增加了 23.2 萬人,而 ADP 數據是增加了 20.8 萬人。

對於本週五將公佈的非農報告,市場預計 4 月份非農就業人數將增長 20.4 萬人,低於 3 月份的 30.3 萬人。