Walmart's sales continue to grow, with full-year performance expectations raised, becoming the top choice for more and more Americans | Financial Report Insights

沃尔玛 CEO 强调公司业绩增长非通货膨胀驱动,单位增长和市场份额提升为业绩增长主因。高收入消费者为主的市场份额增长和配送服务的依赖,促使沃尔玛推出更多折扣和新产品,以及计划翻新 900 多家店铺以吸引顾客。

沃尔玛的最新季度报告出炉,越来越多的消费者选择到沃尔玛购买日常必需品和寻找折扣商品,带动公司营收、利润双双超出市场预期。同时,沃尔玛也上调了全年的业绩预期。

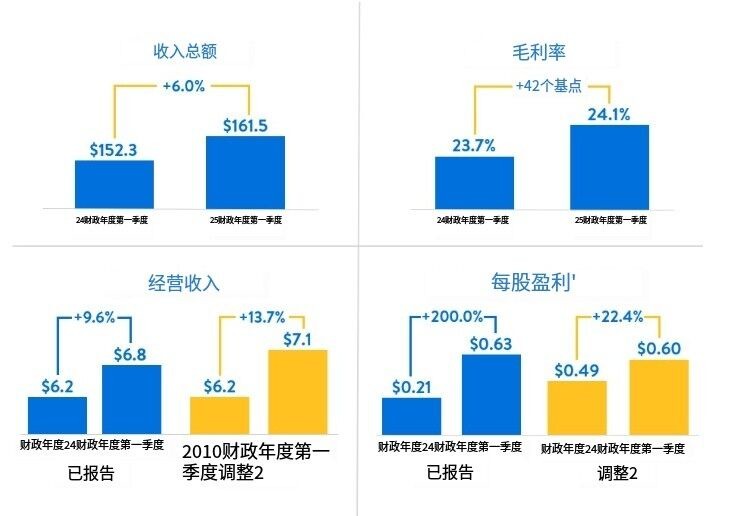

5 月 16 日周四,沃尔玛公布了 2025 财年 Q1 业绩(截至 4 月 26 日)。本季度,公司营收 1615.1 亿美元,同比增长 6%,超出市场预期的 1595.8 亿美元。这一增长主要得益于顾客交易次数的增加,而非每笔交易的平均金额上涨所致,因为更多人去沃尔玛买东西了。

此外,由于以沃尔玛美国为首的各细分市场的盈利改善,沃尔玛综合毛利率上升 42 个基点至 24.1%;公司调整后的每股收益为 60 美分,也高于分析师预期的 53 美分。

沃尔玛在美国的老店(开业超过一年的店)的销售额同比增长了 3.8%,超过了 3.17% 的预期。随着通货膨胀有所缓解,顾客单次购物的平均花费持平,未如预期的 1.32% 那样增长,但交易次数却比去年同期增加了 3.8%。其中,电子商务表现尤为突出,同比增长 22%。沃尔玛指出,高收入家庭是推动其销售增长的主要力量。

业绩指引方面,在这些积极因素的推动下,沃尔玛上调了全年的业绩预期,并现在预计全年的调整后每股收益将达到或略超之前预计的 2.23 美元到 2.37 美元,全年收入增长预期在 3% 至 4% 之间。分析师此前预计,沃尔玛全年的调整后每股收益和收入增长将接近上述预期的高端。

对此,沃尔玛的首席执行官 Doug McMillon 在与分析师的电话会议中表示:“公司近期的业绩增长并非由通货膨胀所驱动。单位销售的增加、交易量的增长以及市场份额的提升是推动业绩表现强劲的主要因素。公司正在推出更多折扣优惠,这些优惠正与越来越多寻求性价比的顾客产生共鸣。”

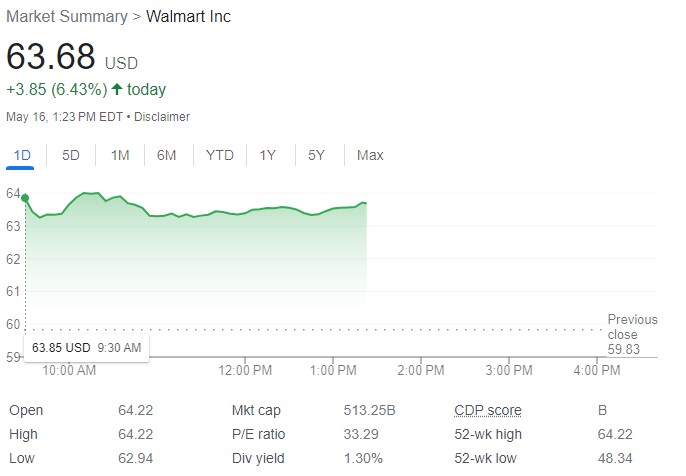

季报公布后,沃尔玛的股价盘中一度大涨 7.3%,为自 2022 年末以来的最大涨幅,推动公司股价创自上市以来的历史新高。截至周三收盘,沃尔玛的股价今年迄今为止已经上涨了 14%,超过了同期标普 500 指数 11% 的涨幅。

电商业务表现强劲

沃尔玛强调了其在全球电子商务领域的强劲表现,并指出:“在全球所有市场中,电子商务的渗透率都有所提高,这主要得益于店铺履行的自提和配送服务以及市场平台的推动。”

在经济压力下,消费者趋向于购买必需品而非奢侈品,影响了零售市场的整体动态。随着高收入消费者对配送服务的依赖日益增加,对于沃尔玛来说,配送业务正变得越来越重要。公司表示,这类消费者更倾向于使用配送服务,因此沃尔玛正在改进其在多个方面(如订单的可用性)的配送效率和质量,以吸引和保持这一消费群体。

沃尔玛的首席财务官 John David Rainey 在周四接受采访时表示:“我们看到顾客转向沃尔玛。这些高收入家庭是沃尔玛市场份额增长的主要力量。”

Rainey 提到,沃尔玛正在努力削减其电子商务业务的成本,同时增加配送订单的数量,配送订单的增长率超过了自提订单。过去 12 个月内,沃尔玛完成了大约 44 亿个同日或次日配送的订单,其中大约 44% 的订单在四小时内送达客户。相比之下,亚马逊公司上个月表示,2023 年通过其 Prime 会员服务实现了超过 40 亿件商品的同日或次日送达。

Rainey 强调,虽然沃尔玛过去主要以提供价值(价格实惠)而闻名,但现在公司不仅关注价值,还强调产品质量和购物便利性。而且,随着高收入消费者寻找交易或寻找更划算的商品,沃尔玛通过推出更多折扣、新产品以及翻新商店的决策而受益。公司表示,今年有望翻新 900 多家商店。

相较之下,低收入消费者在沃尔玛的购买模式显示出稳定性,他们主要购买食品和其他必需品,而非一般商品。与此同时,低收入消费者在沃尔玛的购买模式与高收入消费者相似,他们在杂货和其他必需品上的支出超过了普通商品。 Rainey 指出:“消费者的钱包仍然紧张”,并注意到顾客们将更多的工资用于食品和美容等必需品上,而在利润率较高的普通商品上的支出则有所减少。

在经济压力下的高收入消费者也开始寻找优惠。当前,消费者更倾向于购买基本生活必需品(如食品和家庭用品)而非可选择的大宗商品(如家具和电子产品)。这种消费模式的改变已经对其他零售商如家得宝(Home Depot)和塔吉特(Target Corp.)等产生了负面影响,因为它们的销售很大程度上依赖于非必需品的消费。

与此同时,沃尔玛的杂货业务继续推动公司增长,而日用百货业务却表现滞后。在零售行业中,杂货通常被视为基本需求,即使在经济放缓时期也能保持相对稳定的销售。最近的报告显示,由于对通货膨胀和就业市场的担忧,消费者情绪在五月初跌至六个月低点。这种消极情绪可能会影响消费者的购买决策,导致零售销售在四月份停滞不前。

尽管如此,4 月份的一项潜在通货膨胀指标首次在数月内降温,这对希望今年开始降息的美联储官员来说是一个好兆头。

沃尔玛的高层预计,在不久的将来,食品和其他消费品的价格将出现个位数的通胀,而普通商品的价格则将出现中个位数的通缩。这意味着食品等必需品的价格可能会轻微上涨,但如服装、家电等非必需品的价格可能会下降。

沃尔玛的高管们还指出,他们看到通过了其在线市场增加一般商品销售的机会。因为,在线市场允许第三方卖家在沃尔玛的平台上销售商品,这不仅可以增加产品种类,还能提升沃尔玛网站的访问量和销售额。

Evercore 分析师 Greg Melich 在周四的报告中写道,美国中低收入消费者的不确定消费模式仍然是一个挑战。他提到:“鉴于沃尔玛核心消费者群体的持续市场焦虑,该股票似乎很可能从今天的结果和稳健的指导中受益,这可以为市场提供一些缓解。” 沃尔玛通过其广泛的产品线和价格优势,持续满足不同收入水平消费者的需求,同时公司也在积极应对市场变化,以保持其在零售行业的领先地位。