Pre-market trading in US stocks | FFIE doubled pre-market at one point! Li Auto fell 5% after earnings

法拉第未來盤前一度大漲 104%,現漲 70% 左右,該股上週累計漲幅超 2100%。CRKN 一度大漲 72%,現漲 34%;AMC 電影院線、遊戲驛站 GME 漲近 2%。理想績後跌超 5%,億航智能漲超 7%,Wix.com 漲 7%。

美股要聞

1、法拉第未來美股盤前一度大漲 104%,現漲 70% 左右,該股上週累計漲幅超 2100%。

2、理想汽車第一季度營收 256 億元人民幣,同比增長 36%,預估 255.8 億元人民幣;第一季度歸屬股東的調整後淨利潤 12.8 億元人民幣;第一季度調整後每 ADS 收益 1.21 元人民幣,上年同期 1.44 元人民幣。

理想汽車預計第二季度營收 299 億元人民幣至 314 億元人民幣,市場預估 386.3 億元人民幣;預計第二季度交付量 105000 至 110000 輛,市場預估 130692 輛。

3、蘋果官方直營渠道加入 “價格戰”?天貓蘋果旗艦店推出限時優惠,5 月 20 日晚 8 點至 5 月 28 日,iPhone15 系列開始降價促銷,其中,最新款 iPhone15ProMax 可優惠 2050 元。

4、據彭博,空客從沙特航空公司贏得 105 架窄體客機的訂單。

5、億航智能一季度總收入為 6170 萬元,同比增長 178.0%,經營虧損為 6580 萬元,同比縮窄 13.1%,2024 年第一季度,公司經營現金流轉正,這是連續第二個季度實現正向經營現金流。

6、搜狐第一季度營收 1.39 億美元,同比下降 14%;預計第二季度在線遊戲收入將從 1.33 億美元增長至 1.43 億美元。

7、據彭博,WeWork 在持續進行的戰略重組中取得進展。

盤前異動

美股盤前,三大股指期貨上漲,恐慌指數下跌。

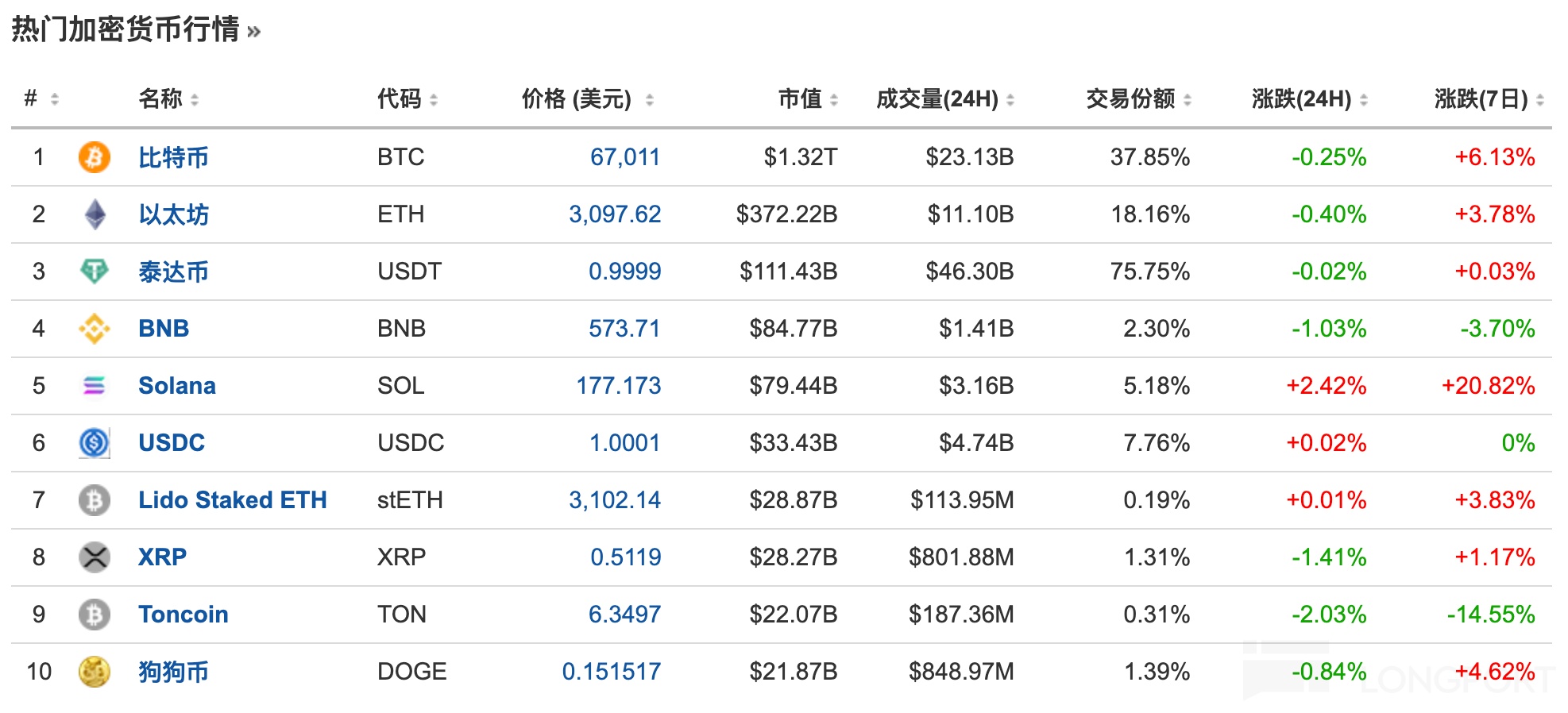

比特幣現報 67011 美元,24 小時之內微跌;以太坊現報 3097 美元,24 小時跌 0.4%。

Meme 股繼續狂飆,加密貨幣概念股上漲,科技股、中概股漲跌不一。

CRKN 一度大漲 72%,現漲 34%;AMC 電影院線、遊戲驛站 GME 漲近 2%。

Microstrategy、Coinbase 漲近 2%,Marathon Digital 漲近 1%。

英偉達漲超 1%,AMD、特斯拉、Meta、亞馬遜、微軟上漲,蘋果跌近 1%。

理想績後跌超 5%,嗶哩嗶哩跌超 2%,阿里、百度跌 1%,京東微跌,網易微漲,拼多多、蔚來漲超 1%,小鵬漲超 4%。

個股方面,億航智能漲超 7%,Q2 營收指引大增。

Wix.com 漲 7%,Q1 業績超預期。

策略回顧

1、“美股總龍頭” 英偉達即將發財報,市場關注這三點

一是利潤率走勢,二是 Blackwell 架構芯片產能爬坡情況,三是 GB200 和上一代芯片換代之際,需求增速會否放緩?

2、AI 佈局逐步加速,Snowflake 股價 “跳前深蹲”?

Snowflake 將於當地時間週三公佈最新季度業績,分析師預計,即將發佈的每股收益將同比增長 13.3%;預計營收為 7.8695 億美元,同比增長 26.2%。

3、飆漲 100% 後,美光的 “好日子” 將繼續

“我們認為,潛在的收益率問題是,在一個關鍵供應商處,其 1-alpha HBM3e 的堆疊高度綁定延遲,這將使 MU 和 Hynix 在 B100/B200/GB200 平台上獲得 HBM3e 的份額,從而推動從目前的增加路徑約 5% 上升到 2025 年的約 25%。”