Singapore Tech & Healthcare Stocks Recently Sought by Institutions

自 6 月 9 日 STI 高點以來,科技和醫療保健類股繼續領漲本地和全球股。科技股將產品和服務擴展到 20 年的能力一直是關鍵的行業驅動因素,醫療保健行業更受醫療用品和設備的生產商和分銷商的驅動。6 月 9 日至 8 月 21 日機構淨流入 (與市值成比例) 最高的五隻科技股,包括 UMS Holdings、AEM Holdings、Venture Corporat

- 自 6 月 9 日 STI 高點以來,科技和醫療保健類股繼續領漲本地和全球股。科技股將產品和服務擴展到下半年的能力一直是關鍵的行業驅動力,醫療保健行業更多地由醫療用品和設備的生產商和分銷商推動。

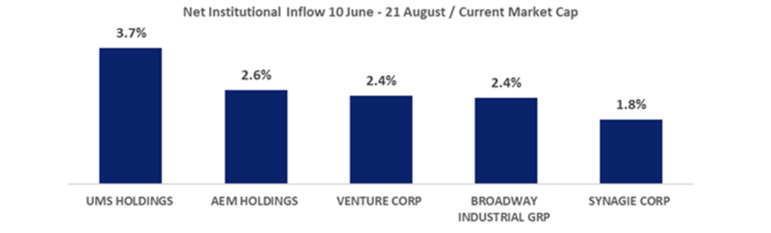

- 6 月 9 日至 8 月 21 日,機構淨流入 (與市值成比例) 最高的 5 只科技股包括 UMS Holdings、AEM Holdings、Venture Corporation、百老匯工業集團和 Synagie Corporation,這 5 只股票的總回報率平均為 29%。

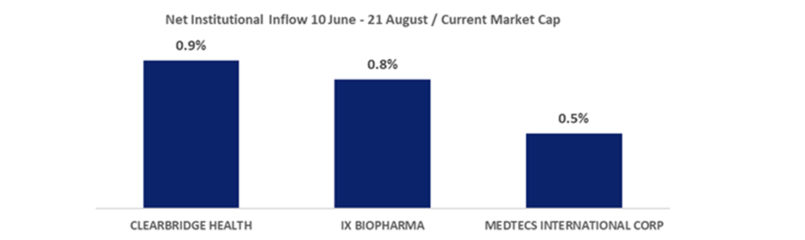

- 從 6 月 9 日至 8 月 21 日,機構淨流入 (與市值成比例) 最高的三支醫療股,包括 Clearbridge Health,iX Biopharma 和 Medtecs International Corporation,三人的總回報率中位數為 36%。

在全球範圍內,過去 11 周科技股和醫療保健類股繼續領漲股市。自 6 月 9 日海峽指數 (Straits Taines Index,簡稱 “STI”) 在 6 月 9 日創下 2839 點的高點後,總收益下降了 8.1%,富時東盟所有股票指數 (FTSE ASEAN All-Share Index) 下跌了 4.6%。這讓 iEdge SG All Healthcare Index 在 11 周內反彈了近 50%。風險投資公司 (Venture Corporation) 、AEM 控股公司 (AEM Holdings) 和吉寶 (Keppel DC REIT) 三人幾乎一致行動,平均回報率為 28%,超過 iEdge-Factset 全球互聯網指數和 iEdge-Factset 全球電子商務指數 (iEdge-Factset Global E-Commerce Index),兩者的漲幅接近 20%。

超越封鎖的行業需求

科技股繼續擴大產品和服務的能力是該行業的關鍵驅動力,而醫療保健行業的收益更多地是由醫療用品和設備的生產商和分銷商推動的。例如:

- 8 月 7 日,Venture Corporation 表示,其在 2QFY20 (截至 6 月 30 日) 的穩步復甦預計將持續到今年下半年,其研究與發展實驗室 “計劃隨後將一些新開發的產品發佈到 2021 年初開始生產”。

- 8 月 6 日,Riverstone 控股執行主席兼首席執行官 Wong Teek Son 援引馬來西亞橡膠手套製造商協會的預測,橡膠手套需求將強勁增長 11%,在 20201 年達到約 3300 億件,鑑於行業前景,它 “未來幾年的產能擴張計劃將有助於滿足世界各地對手套日益增長的需求”。

科技股獲得最高機構淨流入與 6 月 9 日以來市值比例

自 6 月 9 日 STI 高點 2,839 點形成以來,機構淨流入 (與當前市值成比例) 的最高機構淨流入 (與當前市值成比例) 的新加坡科技股包括 UMS Holdings、AEM Holdings、Venture Corporation、Broadway Industrial Group 和 Synagie Corporation。流入股票當前市值的相對規模説明如下:

如下表所示,這 5 只股票在 11 週期間的表現都相對強勁,只有 1 只股票百老匯工業集團產生了邊際下跌。

|

名稱 |

代碼 |

市值上限 (百萬新元) |

平均日營業額 (百萬新元) |

年初至今淨流入 (百萬新元) |

總回報 12 月 31 日-20 年 3 月 23 日 |

總回報 3 月 20 日 3 月 20 日至 6 月 9 日 |

總回報 6 月 9 日 20-20 年 8 月 21 日 |

淨資金流 6 月 20 日-20 年 8 月 21 日 |

年初至今總回報 |

|

UMS 控股 |

558 |

539 |

7.5 |

12.2 |

-45.1% |

59.3% |

16.5% |

20.1 |

1.8% |

|

AEM HOLDINGS |

AWX |

1112 |

21.2 |

54.7 |

-29.2% |

118.2% |

31.1% |

28.7 |

102.5% |

|

風險公司 |

V03 |

5,816 |

24.9 |

236.5 |

-22.7% |

28.2% |

29.2% |

140.9 |

27.9% |

|

百老匯工業 GRP |

B69 |

52 |

1.5 |

1.2 |

-50.4% |

69.7% |

-0.9% |

1.2 |

-16.5% |

|

SYNAGIE 公司 |

V2Y |

64 |

1.9 |

3.1 |

-35.7% |

49.4% |

69.4% |

1.1 |

62.8% |

來源: 新交所、彭博社、Refinitiv (數據截至 2020 年 8 月 21 日)

百老匯工業集團和 Synagie 公司報告了 20 年 HFY20 年的扭虧為盈

8 月 6 日,百老匯工業集團公佈其 1HFY20 (截至 6 月 30 日) 的税後淨利潤為 68 萬新元,而 1HFY19 的税後淨虧損為 78 萬新元。儘管 COVID-19 大流行的影響,但仍代表了集團財務業績的重大轉機 (點擊這裏更多)。這主要是由於產品結構向價值較高的企業服務器類 (或近線) 產品轉變的平均銷售價格較高,近線產品的成交量同比增長 50%,達到總銷售量的 40% 以上。

8 月 13 日,Synagie Corporation 報告其 1HFY20 (截至 6 月 30 日) 的利潤增加了 780 萬新元,從 1HFY19 的虧損 3.7 萬新元到 1HFY20 的利潤為 4100 萬新元。主要是由於電子商務活動的增加,COVID-19 情況和留在家裏的措施。注意本集團於 2020 年 8 月 5 日宣佈擬處置其電子商務業務,其中包括其電子商務推動者和物流業務 (包括技術和業務解決方案),以獲取更多詳情這裏。出售該業務的總代價為 61,70 萬新元,並將出售給包括本集團創辦人在內的投資者組成的財團。該公司指出,1HFY20 電子商務收入激增主要是由於自大流行開始以來,COVID-19 相關產品需求的一次性增長,Synagie 指出,預計電子商務收入將在未來幾個月內正常化。擬議的處置將使本集團能夠向股東返還資本,並專注於其保險科技業務。

自 6 月 9 日以來最高機構淨流入的醫療機構股與市值比例

新加坡醫療保健股是自 6 月 9 日至 8 月 21 日形成的 STI 高點 2,839 以來機構淨流入 (與當前市值成比例) 最高的股票之一,包括 Clearbridge Health,IX Biopharma 和 Medtecs International Corp。注: Asiamedic 和 Cordlife Group 也在五隻佔流入額比例最高的醫療保健股中亮相,然而,在截至 8 月 21 日的 2020 年,這兩隻股票的平均日營業額都低於 100 萬新元。

流入股票當前市值的相對規模説明如下:

如下表所示,在 11 週期間,三隻醫療保健股的表現相對強勁,總回報率中位數為 35.6%。

|

名稱 |

代碼 |

市值上限 (百萬新元) |

平均日營業額 (百萬新元) |

年初至今淨流入 (百萬新元) |

總回報 12 月 31 日-20 年 3 月 23 日 |

總回報 3 月 20 日 3 月 20 日至 6 月 9 日 |

總回報 6 月 9 日 20-20 年 8 月 21 日 |

淨資金流 6 月 20 日-20 年 8 月 21 日 |

年初至今總回報 |

|

項目完結,系統自動填充內容 |

1H3 |

110 |

3 |

-1.3 |

-26.8% |

75.2% |

2.3% |

1.00 |

31.2% |

|

IX 生物製藥 |

42C |

198 |

2 |

-0.3 |

-35.6% |

79.3% |

17.3% |

1.57 |

35.6% |

|

醫學國際公司 |

546 |

1,016 |

19 |

-2.3 |

83.8% |

245.6% |

687.2% |

4.68 |

4900.0% |

來源: 新交所、彭博社、Refinitiv (數據截至 2020 年 8 月 21 日)

8 月 11 日,Medtecs International Corporation 報告税後淨利潤從 1HFY19 (截至 6 月 30 日) 的 386,000 美元增加到 1HFY20 的 38,893,000 美元,原因是更高的銷售額、更高的毛利率和外匯收益。有關該股今年對 iEdge SG 全醫療保健指數影響的更多詳情,請點擊這裏。

Clearbridge Health 報告在 20 年上半年出現了轉機

8 月 14 日,凱利上市的 Clearbridge Health 公佈其 1HFY20 (截至 6 月 30 日) 財務業績出現明顯轉機,淨利潤為 377 萬新元,而 1HFY19 的淨虧損為 77 萬新元(更多詳情請點擊這裏)。在 1HFY20,本集團的收入從 1HFY19 的 685 萬新元大幅增長 213.1% 至 2446 萬新元,因為本集團利用其區域醫療保健網絡和分銷平台,利用該地區的醫療和醫療保健機會,通過其醫療中心和診所業務部門和分銷網絡的存在。該集團醫療中心和診所業務部門的收入從 1HFY19 的 81 萬新元增長 601.7% 至 1269 萬新元,主要受醫療用品銷售、菲律賓 COVID-19 檢測相關服務的提供以及 COVID-19 抗體檢測試劑盒的分銷。

Catalist 上市的 iX Biopharma 預計本週將公佈 FY20 業績。iX Biopharma 是一家專業製藥和保健品公司,最近宣佈以每股 0.23 新元的價格配售 44,491,299 股新普通股,以每股認購股票 0.23 新元配售,以支持集團未來的增長 - 相關的臨時股東大會定於 9 月 4 日舉行。隨着配售的宣佈,管理層指出,隨着 iX Biopharma 從專注於研究和開發的轉變,該公司打算加強其資產負債表,以使其能夠在不同市場上進行多個產品的商業化。該公司今年還就產品和市場發展發佈了多個公告 - 點擊這裏更多。