AI-Driven Apple in the Replacement Cycle

蘋果最近推出了 AI 相關的 Apple Intelligence 計劃,將在 iPhone 16 系列開始植入 AI 大模型。這一計劃獲得了市場的認可,併成為蘋果股價上漲的催化劑。蘋果擁有付費能力強的用户羣體,對於大模型公司來説具有很大的吸引力。預計蘋果在 AI 應用端有較大的發展空間。

在英偉達拆股後再創新高的這段大漲裏,給英偉達供貨的公司們也創下歷史新高,例如代工環節的台積電、服務器部分的超威電腦和 DELL 戴爾,唯有 3 家能供 HBM 的海力士、三星、美光,以及架構端的 ARM。

這些公司在美股各家科技巨頭上調資本開支後,可以説是賺的盆滿缽滿,至少短期內的訂單不用愁,硬件端的軍備競賽繼續加速。但應用端層面發展的就不及硬件端那麼快,除了 ChatGPT 的商業化做的好之外,大多數 AI 應用的盈利能力還是偏弱的,還未出現一家能提供大量用户的應用端入口,而近期市場預期應用端能做好的是投入 AI 最晚的蘋果。

一、蘋果 ALL IN AI,博弈換機大週期

在兩週前,蘋果推出了 AI 相關的 Apple Intelligence 計劃,該技術指的是在 iPhone 16 系列開始,將在手機內植入 AI 大模型,一部分技術來源於蘋果自身研發,也就是原先的 SIRI,而另一部分技術需要合作伙伴來共同提供。

在宣佈 AI 計劃後,立刻吸引了 ChatGPT、谷歌的 Claude、Meta 的 Llama,以及 Perplexity 等大模型申請與蘋果合作,蘋果在兩日內漲超 10%,再創歷史新高。

大漲的主要原因是蘋果加快執行 AI 計劃,市場都很認可蘋果做好產品的能力,加上科技股都在大漲,AI 計劃成為催化劑。

另一點,雖然蘋果是全力投入 AI 最晚的科技巨頭,但蘋果擁有手機行業裏最高 APRU 的用户羣體,付費能力強的用户羣體恰好是大模型公司最需要的,所以蘋果在 AI 應用端付費上有不小的想象空間。根據預測,若蘋果在發佈會上的 AI 功能實裝到新機型上,有望對 iPhone 能達到 5-10% 的銷量拉動。

兩點疊加,以致於外資博弈蘋果在嵌入 AI 大模型後,能夠驅動更多消費者的換機需求,也有助於手機廠商提高定價,增厚利潤率。例如,帶有 AI 大模型的三星 S24 Ultra 價格從上一代的 1199 美元提高到 1299 美元,而後續也可以推出更多需要訂閲付費的 AI 功能。

小摩認為,在全球手機經歷出貨量連續 3 年下跌後,今年是全球出貨量重回增長的拐點,而在蘋果嵌入大模型後,明年全球出貨量將再增長 5%。

其中,小摩預計明年 AI 手機佔智能手機的份額將從今年的 13% 增長至 28%。預計今年蘋果將佔全球 AI 智能手機市場的 50% 以上,之後隨着 AI 手機的更廣泛普及,蘋果在 AI 手機的市場份額會有所下滑。

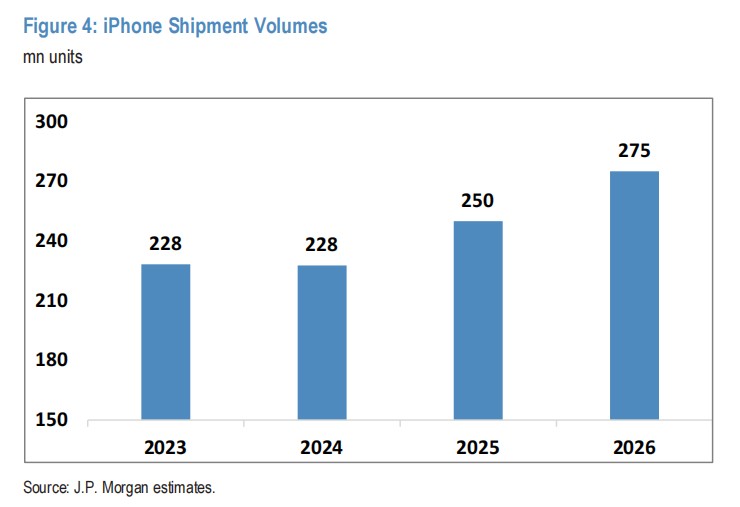

小摩預計蘋果在 25/26 年的出貨量將達到 2.5 億部/2.75 億部,而 23/24 年是 2.28 億部。小摩上調的原因是 AI 手機會拉動最大的中國市場和北美市場的銷量。

同時將 25/26 財年 EPS 提高至 8.1 美元和 9.69 美元,市場此前對 EPS 的預期是 7.26 美元和 7.64 美元,並上調蘋果的目標價至 245 美元,按明年盈利預測計算,對應約 29 倍 PE。

外資認為 2023-2024 年蘋果在中國區的下滑,主要是因為華為自制芯片的重新迴歸,而從明年開始,全球智能手機市場的份額將取決於各家在高端 AI 手機上的進展。外資認為基於蘋果在應用端的優勢,明年華為份額將下滑,三星份額持平,而蘋果的市場份額重回增長。

這裏值得一提的是,蘋果做好產品的能力毋庸置疑,但應用能否順利落地,這中間可能會與監管方產生些爭議,可能會階段性的影響股價,即例如 FSD 能否順利推出一樣。

假設蘋果在中國區提供的 AI 大模型與海外版不一樣,加上華為也有可能推出自家的 AI 大模型手機,那中國區的銷量表現可能沒那麼樂觀。因為此前就傳出蘋果的國行版本可能與百度進行合作,或是與國內其他大模型商合作,若真像傳聞這樣,那蘋果在中國區的大模型競爭力會受到影響。

另外,蘋果表示由於的監管問題,暫時無法在歐洲市場推出 AI 功能。並且蘋果在發佈會上提到,融入 AI 後的 Siri 新功能要到明年才會出現,而這些功能最初僅限提供美式英語版本,其他地區的用户都被排除在外。

除了監管問題,全球智能手機的出貨量走出週期拐點,重回慢增長是行業共識,而這輪基於新技術拉動的換機週期,哪家廠商的應用體驗做的更好是關鍵。

二、為了 AI,暫時放棄了 Vision pro

在換機週期的邏輯下,蘋果股價創出歷史新高,但從估值上看,遠期市盈率為 30 倍 PE,在上一輪制裁華為拉動的換機週期時,遠期市盈率最高去到 33 倍 PE 左右。

由於上述提到的,AI 落地監管和競爭激烈的問題仍在,蘋果未來增長的確定性是不及其他科技股的,以致於蘋果在股價創新高後,市場對 210-220 元的價位分歧並不小。當然,蘋果的回購金額是大幅領先於其他科技股的,至少提供了個不小的安全墊。

市場上也有觀點對 AI 拉動蘋果換機週期是不認可的。以 macOS 桌面版的 ChatGPT 為例,這也是一種蘋果和 OpenAI 的合作,但實際上對於 Mac 的出貨量毫無幫助。

重點在於合作後推出的 AI 服務,能否具備獨特的競爭優勢?

例如,與蘋果合作的大模型廠商,必須是與蘋果是獨家合作,否則只是通過接入大模型的方式合作,那其他手機廠商也可以效仿,但似乎也很難要求 OpenAI 只和蘋果一家合作。更有可能的合作方式是,蘋果設計好應用,實際推理靠合作方的大模型和算力。

值得注意的是,蘋果推出 AI 計劃的同時,也調整了 Vision Pro 頭顯設備的產品策略。

目前 Vision Pro 已發售近半年時間,雖然一開始的測評體驗挺震撼,但後續對於更多用户來説,Vision Pro 仍然是一個非常貴的產品。在剛發售時,國內大約要 5-6 萬人民幣才能買到,而近期國內版本快發售了,定價大約要 2.5-3 萬元左右。

即使 Vision Pro 自帶的空間體驗不錯,但出現了與目前 AI 發展同樣的問題,就是應用端沒有出現一個殺手級的應用程序,再加上原先定價就非常高,即使之後價格大幅削減,也難吸引更多消費者買。

基於用户使用率不佳,今年 Vision pro 的出貨量從原先的 70-80 萬台減少至 40-45 萬台。

並且,蘋果計劃推出定價更低的頭顯設備,預計代號名為 Apple Vision,未來售價預計從 2500 美元降低至 1500-2000 美元。有可能會取消 EyeSight 顯示屏,取消從外部顯示用户眼睛的功能,並且可能使用配置更低的芯片,降低頭顯內與現實結合的視覺效果。

蘋果計劃在向用户普及低價版本後,再繼續發展高端的 Vision Pro,預計新一代的 Vision Pro 要等到 2026 年。不過,若低價版本是降低用户體驗換來的,那即使最低售價來到 1500 美元,售價仍然較 Meta 的頭顯設備貴了 3 倍左右。

三、結語

所以,即使頭顯設備硬件端體驗不錯,但應用端無法帶來與之匹配的生態系統,那最後在高定價之下還是白搭。

在科技巨頭都為 AI 保持鉅額投入的環境下,未來蘋果在 AI 上的投入肯定不會小,而蘋果在今年就已經放棄了維持多年的造車計劃,剛推出的 Vision Pro 又令市場失望,之後能否在一遍加碼 AI 投資的同時,繼續養着短期內難以實現回報的 AR/VR 設備?

基於這些擔憂,目前市場認為當下 30 倍 PE 估值是合理的,至於再往上看到近幾年最貴的 33 倍 PE,就要看大模型融入手機的速度如何了,畢竟其他手機廠商也在做同樣的事情。