Revenue and net profit hit a new historical high, BOSIDENG presses the "acceleration key"

波司登 2023/24 財年營收 232.14 億元,同比增長 38.4%;淨利潤 31.2 億元,同比增長 44.7%。股價上漲 39.3%。公司持續實施 “聚焦主航道、聚焦主品牌” 戰略,收入年複合增長率達 17.5%。淨利潤增速連續 9 年超過營收增速。公司股價上漲,獲得 3.63 億港元資金淨流入。董事會建議派發末期股息 20 港仙,全年派息率約 81%。

選擇投資標的,有一個簡單的方法,就是看備選標的是否為行業內品類最優的公司。判斷依據也不復雜,即這家公司如果繼續發展下去,會越大越強,便可認為是投資的上佳之選。

在服裝領域,全球領先的羽絨服專家——波司登(03998)便屬於 “越大越強” 的範本。2018 年,波司登明確 “聚焦主航道、聚焦主品牌” 的戰略方向,開啓轉型升級新徵程,同時進入業績增長的 “強週期”。

2024 年 6 月 26 日,波司登發佈了一份超預期的 2023/24 財年業績公告。財報顯示,公司於期內實現營收 232.14 億元,同比增長 38.4%;實現淨利潤 31.2 億元,同比增長 44.7%。智通財經 APP 注意到,2018/19 至 2023/24 財年,波司登收入的年複合增長率達到 17.5%;體現公司 “大而強” 的淨利潤指標,增速表現更加突出,年複合增長率達到 25.4%。截至 2023/24 財年,波司登已連續 9 年,實現淨利潤增速超過營收增速。

基於良好的業績增長,波司登為投資者創造了豐厚的投資回報。2024 年,波司登股價一度上漲至 4.89 港元,年內最大漲幅達到 39.3%。智通財經 APP 數據顯示,截至 6 月 26 日近 60 個交易日,波司登獲得 3.63 億港元資金淨流入。6 月 27 日,受業績利好影響,波司登股價盤中上漲至 4.7 港元,較上一交易日最高上漲 8.54%。除了股價上漲,波司登還繼續保持穩健派息,董事會建議就每股普通股派發末期股息 20 港仙,對應全年派息率約 81%。

創新驅動品牌升級,夯實高質量增長底色

在智通財經 APP 看來,波司登盈利能力持續增強的根源,是公司表現是強大的戰略定力。公司自 2018 年以來堅定 “聚焦主航道、聚焦主品牌” 的戰略方向,明確波司登 “全球領先的羽絨服專家” 品牌定位,通過激活消費者心中 “羽絨服專家” 的認知,贏得時代主流消費者的認可。在經營策略上,波司登持續夯實 “品牌引領、產品升級、渠道升級、優質快反” 四項核心競爭力,夯實企業發展的韌性。

品牌建設方面,波司登融合品牌策略、創意視覺、公關體驗及數智內容等方式,通過貫徹品牌引領、品牌戰役發力、品銷兩旺的策略,從暢銷款(Top 款)推廣打造、熱銷店(Top 店)引流賦能為品牌戰略提供幫助,不斷加深消費者對品牌的認知度和美譽度,實現品牌引領感知以及品銷最大化目標。

根據國際五大品牌價值評估權威機構之一 Brand Finance 公佈的 “2023 年全球最具價值服飾品牌榜 50 強 (Brand Finance Apparel50 2023)”,波司登品牌再次入選,位列服飾品牌榜第 47 名。同時,波司登品牌亦再度上榜 Brand Finance“中國品牌價值 500 強” 榜單,排名較去年相比躍升 30 位,位居 145 位。世界品牌實驗室 (World Brand Lab) 發佈的 2023 年度《世界品牌 500 強》排行榜中,波司登排名 462 位,為中國服裝服飾領域唯一入選品牌。

隨着品牌力持續提升,波司登的消費羣體穩定擴容。2023/24 財年,波司登品牌在天貓及京東平台,新增粉絲超 1100 萬,新增會員超 400 萬。截止 2024 年 3 月 31 日,波司登品牌在天貓及京東平台共計粉絲約 4500 萬,會員約 1800 萬。同時,波司登品牌在抖音平台共計粉絲超 900 萬人,新增粉絲超 100 萬。

需要注意的是,“以產品深度支撐品牌高度” 是波司登實現品牌引領,粉絲羣體快速增長的底層邏輯。2023/24 財年,波司登共申報專利 545 項,為羽絨服專家提供了專利技術、背書支撐。截至 2024 年 3 月 31 日,公司已累計全部專利 971 項(含發明、實用新型及外觀專利)。對產品研發的高度重視,使得波司登得以在夯實羽絨服功能性的基礎上,根據消費變化趨勢,不斷優化產品研發、設計,為市場提供富有 “高值感” 的創新產品。

2023 年,波司登在春夏季節推出防曬服等功能性品類產品,成功拓展增量業務。在輕薄羽絨服賽道,波司登聯合中國、意大利設計團隊,攻克了不同材質的拼接和復古與現代元素結合的難題。波司登用羽絨跨界拼接 6 大時尚單品,全系列羽絨服採用國際認證的 700+ 填充量鵝絨,生產出比傳統羽絨服更多樣、更輕暖、更時尚的專業產品,開啓羽絨服跨季節、多場景時尚穿搭自由的新格局。

隨着户外運動熱潮興起,功能性羽絨服的穿着場景不斷拓寬。波司登根據市場需求變化推出了 “會呼吸” 的衝鋒衣鵝絨服。據悉,衝鋒衣鵝絨服採用科技防護面料,三合一可拆卸設計讓波司登羽絨服,與衝鋒衣產生連接,進一步拓展使用場景。

創新產品加持之下,羽絨服業務對業績增長的牽引力不斷增強。2023/24 財年,波司登品牌羽絨服業務實現收入約 195.2 億元,佔總收入的 84.1%,同比上升 43.8%,其中,波司登主品牌實現收入 167.8 億元,同比增長 42.7%,收入規模均為歷史最高。中端品牌雪中飛,實現收入約 20.2 億元,同比高速增長 65.3%。貼牌加工業務收入同比上升 16.4%,達到 26.7 億元,創歷史新高。

渠道、供應鏈升級,經營效率再攀高峰

智通財經 APP 注意到,除了產品在銷售端不斷攀登高峰,“提質增效” 也是體現在波司登財報中的關鍵詞。

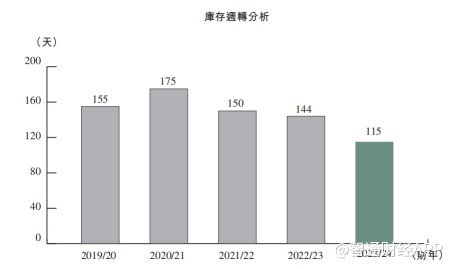

財報顯示,2023/24 財年,波司登的應收賬款週轉天數為 19 天,同比下降 4 天。同期,公司庫存週轉天數為 115 天,較去年同期下降 29 天。其中,庫存週轉天數的下降主要得益於波司登持續維持較低首次訂單比例的同時,一方面持續使用拉式補貨、小單快返的調節機制,另一方面有效推進全渠道商品一體化運營管理。

2023/24 財年,波司登持續從柔性快反模式向 Top 款敏捷極速供應模式突破,持續實現 Top 款補貨可得率高達 99%,真正實現急市場之所急,讓暢銷款不缺貨、讓滯銷款不生產;在最大化助力銷售目標的實現的同時,驅動商品大價值鏈協同,實現柔性、敏捷響應的流程重構與能力培育,併成為波司登核心競爭力之一。

2023 年 “雙 11”,波司登品牌取得了天貓平台女裝第一、男裝第二,天貓官旗單店(男裝 + 女裝)第一,京東和唯品會服飾排名第一,抖音官旗全週期品牌女裝單店第一的好成績。其背後,勢必有 “優質快反” 能力的功績。

不僅如此,波司登對渠道的升級也體現了公司對提質增效的進取之心。線下渠道方面,波司登持續穩健改善現有渠道結構、佈局、質量以及終端形象。一方面通過聚焦 “單店經營提質增效”,以門店經營為中心,、以顧客價值為原點的業務流程變革,帶動門店經營能力和運營效率的提升;另一方面通過進一步夯實渠道結構、佈局、質量以及終端形象,更加精細化管理和運營渠道建設,同時通過 “Top 門店”、“Top 店長” 等項目實施落地,實現了渠道端資源的有效匹配。

2023/24 財年,波司登全方位升級打造 Top 店,針對甄選出來的標杆門店進行系統性、體系化運營和管理,並通過搭建超 250 個項目,覆蓋約 500 個銷售網點,聚焦資源精準投放,實現 Top 店快速有效增長,為未來渠道的迭代升級塑造經營標杆。

根據財報,2023/24 財年,波司登品牌門店數量同比去年減少 186 家,品牌收入卻同比大幅增長 42.7%,印證了精細化運營的成果,將資源投放在合理有效的地方着實帶動了業績持續上行。

業績增長動能充沛,機構看好長線發展

智通財經 APP 注意到,波司登業績按下 “加速鍵”,引發了市場對公司的廣泛關注,多家機構發佈研報看好波司登長遠發展前景。

中金公司在研報中表示,波司登 2023/24 財年業績,高於該行預期,主要因出色的收入表現。公司計劃在做強羽絨服核心主業的同時,開展 “時尚功能科技” 服飾核心品類的創新延伸,同時進一步坐實單店經營提質增效。中金維持波司登 “跑贏行業” 評級,考慮公司良好的銷售表現,上調 FY25/26 年 EPS 預測 9%/9% 至 0.34/0.38 元,目標價上調 11% 至 5.63 港元。

浙商證券指出,3 月波司登推出新一代專業防曬衣,以突出的專業性能(UPF100+、高於國標 66% 涼感、透氣效果提升 35%+)打造差異化,並推出與 Christelle Kocher(香奈兒旗下高級手工坊藝術總監)的聯名產品、與時尚芭莎合作打造 SHOWROOM、與北京電影節合作大秀助力話題度提升,在產品系列上除已有的驕陽系列 2024 年新增都市輕户外系列擴大覆蓋生活場景,產品系列擴張為新財年防曬服業務延續高增打下堅實基礎。

考慮 2024/25 財年防曬服、輕薄羽的積極增長計劃及冬羽絨的穩健增長,浙商證券上調波司登盈利預測,預計 2024/25、2025/26、2026/27/財年公司收入 263/297/334 億元,同比 +13%/13%/13%,歸母淨利 35.1/39.8/45.0 億元,同比 +14%/+13%/+13%,對應 PE12.8/11.3/10.0X,目前估值仍具備明顯性價比,過去連續三財年分紅率超過 80%,低估值、穩增長、高分紅屬性凸顯,維持 “買入” 評級。

國盛證券維持波司登 “買入” 評級。國盛證券認為,波司登始終堅持產品與渠道創新,過去品牌升級卓有成效,近年來積極擴充品類、尋求中長期增長,預計 FY2025~2027 淨利潤為 35.7/41/47.2 億元。該行估計 FY2025 品牌羽絨服業務在品類擴張、產品推新的帶動下有望穩健增長 10%~20%/貼牌加工業務預計增長 10%~20%,綜合來看該行估計 FY2025 公司收入預計增長 15% 左右/淨利潤增速有望快於收入,維持高質量增長趨勢。

正所謂 “數字是最好的試金石”,波司登作為羽絨服市場的領軍企業,核心財務指標的持續增長顯然向外界展露了穩定性和成長性兼具的底色。從公司的清晰有效戰略佈局中,亦可窺視出,波司登未來保持業務增長的確定性頗高,值得投資者長期關注。