New Stock Preview | Wuzhou Energy's Hong Kong IPO: High proportion of industrial and commercial users, improved profitability "on the way"

Wuzhou Energy is an established urban gas company that has been operating in Henan for over 20 years. Recently, it has submitted a prospectus and plans to raise funds by listing on the Hong Kong Stock Exchange. The company holds a franchise operating area in Xuchang City, selling natural gas to end users through distribution channels. According to the prospectus, Wuzhou Energy's operating income is expected to increase year by year from 2021 to 2023, but may decline in 2023. This listing and fundraising may be aimed at advancing the development of the urban gas industry and improving profitability in the context of the "dual carbon" goals

The continuous advancement of the "dual carbon" goals means that controlling carbon emissions and adjusting energy structure will become the focus of China's development in the next decade or even decades. Against this backdrop, policies have placed new requirements on the development of various industries, including the urban gas industry.

However, in recent years, Hong Kong-listed urban gas companies have been passively facing the risk of declining operating performance, while the industry's overall valuation has irrationally continued to decline, as if entering a long "winter". But as time enters 2024, with the combination of a low base from previous periods, cost reductions, and multiple catalysts such as residential gas price increases, the industry as a whole has entered a period of recovery.

Therefore, the recent urban gas IPO market has become active again. Recently, Wuzhou Energy, a urban gas company from Xuchang, Henan, submitted its prospectus to the Hong Kong Stock Exchange. As a well-established urban gas company operating in Henan for over 20 years, what is the significance behind its decision to go public for financing at this time?

Endorsement by Industrial and Commercial Users, Profitability is Recovering

According to the Securities Times, Wuzhou Energy was established in 2001, located in Xuchang City, Henan Province, and has three franchise operating areas in Xuchang City: Changge Franchise Area, Xuchang Franchise Area, and Yanling Franchise Area. This early on determined the core business of Wuzhou Energy: selling pipeline natural gas to end users through urban pipeline networks based on franchise rights.

It is understood that Wuzhou Energy operates urban pipeline networks in its operating areas, with no less than 1500 kilometers of secondary high-pressure, medium-pressure, and low-pressure pipelines. It has the exclusive rights to sell and distribute pipeline natural gas in the franchise areas and to build urban pipeline networks for a period of 30 years, with expiration dates in May 2036, September 2041, and March 2042 respectively. According to Frost & Sullivan data, in 2023, based on the sales volume of pipeline natural gas to end users under the exclusive franchise rights, Wuzhou Energy is the largest natural gas distributor in Xuchang City.

The prospectus shows that in the past years 2021-2023, Wuzhou Energy's operating income was 0.948 billion, 1.266 billion, and 1.217 billion yuan respectively. After achieving a significant growth in 2022, its revenue actually decreased in 2023. The corresponding net profits attributable to shareholders for the same period were 62.168 million, 111.6 million, and 111.1 million yuan, with profits fluctuating slightly with revenue.

Further breakdown reveals that selling pipeline natural gas to end users is undoubtedly the core of Wuzhou Energy's main business, contributing to about 70% of total revenue in the past two years, while the remaining 20% is from the long-distance pipeline business. The remaining other businesses mainly include providing construction and installation services, as well as selling compressed natural gas.

From the business structure of Wuzhou Energy, it is not difficult to see that its business model is generally similar to that of other regional city gas companies, with the main profit model being to earn the price difference through gas sales, and the business model is relatively simple. In terms of the structure of end users, Wuzhou Energy mainly relies on the "blessing" of industrial users in the operating area, with revenue contributed by residential end users accounting for only about 7% of the business segment.

From the business structure of Wuzhou Energy, it is not difficult to see that its business model is generally similar to that of other regional city gas companies, with the main profit model being to earn the price difference through gas sales, and the business model is relatively simple. In terms of the structure of end users, Wuzhou Energy mainly relies on the "blessing" of industrial users in the operating area, with revenue contributed by residential end users accounting for only about 7% of the business segment.

From 2021 to 2023, the revenue from selling pipeline natural gas to industrial end users by Wuzhou Energy was approximately RMB 523 million, RMB 814 million, and RMB 786 million respectively, accounting for about 88.2%, 90.1%, and 89.2% of the total revenue from selling pipeline natural gas to end users. The reason why Wuzhou Energy was able to take a "big step" in 2022 was mainly due to the addition of industrial end users engaged in non-ferrous metal smelting and pressing, steelmaking, and steel ring production in the Changge franchise area, which increased its gas sales volume. Additionally, there was also a factor of rising selling prices due to increased procurement costs. In 2023, the fluctuation in performance was mainly due to a decrease in consumption by industrial end users engaged in non-ferrous metal smelting, pressing, and pharmaceutical industries in the Changge franchise area.

However, the performance of Wuzhou Energy is naturally also affected by international gas prices. In terms of costs, from 2021 to 2023, the total cost of pipeline natural gas sold by the company was approximately RMB 723 million, RMB 990 million, and RMB 934 million respectively, accounting for about 89.5%, 92.9%, and 91.0% of the total sales cost each year. The cost of gas source is undoubtedly the company's largest expenditure item.

In 2023, the fall in international gas prices lowered the gas source costs of city gas enterprises. In addition, the gradual increase in residential gas prices is also continuously restoring the profitability of city gas enterprises, and the operational stability of city gas enterprises will also be guaranteed.

According to a report by Shenwan Hongyuan, in 2024, with international gas prices continuing to operate at low levels (U.S. gas prices continue to operate below $2/mmBtu), the economic advantages of imported sea gas continue to be prominent. The latest spot LNG price imported in April is running at around $9/mmBtu, highlighting cost advantages. With the alleviation of procurement cost pressure for city gas with diverse gas sources, it is expected that breakthroughs will be made in the "industrial coal-to-gas" conversion that was previously hindered by high prices, and the improvement in the gas sales structure for industrial and commercial use with high gross margins will be promoted. Therefore, Wuzhou Energy, which has a relatively high proportion of industrial and commercial users this year, may further restore its profit space.

Fierce Market Competition, Franchise Rights May Be Difficult to Guarantee "Worry-Free"

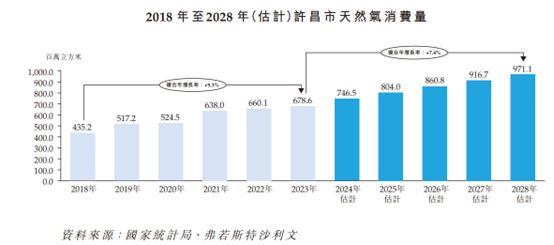

For Wuzhou Energy, which has been deeply cultivating in Henan Province and mainly focuses on gas sales, having a 30-year franchise right is undoubtedly its "magic weapon" for maintaining stable operations for 20 years. Frost & Sullivan reports that in the future, the natural gas consumption in Xuchang City is expected to continue to increase and reach 971 million cubic meters by 2028, with a compound annual growth rate of 7.4% from 2023 onwards.

However, the expected expansion of market demand does not necessarily mean that Wuzhou Energy can stably "earn money lying down" in regional operations. In June 2022, the General Office of the State Council issued the "Implementation Plan for Aging Renewal and Transformation of Urban Gas Pipelines (2022-2025)", which proposed to strengthen market governance and supervision, support industry mergers and reorganizations in the gas and other sectors, ensure the completion of aging renewal and transformation tasks, and promote the scale and professional development of the gas market. Against the backdrop of the ongoing acceleration of national urban gas market integration, "standing still" does not seem to be a good choice.

As the energy industry is a typical industry with economies of scale, as the degree of marketization in the industry gradually increases and industry concentration continues to rise, market competition intensifies. Currently, national gas companies such as Kunlun Gas, Ganghua Gas, Huarun Gas, and Xin'ao Gas account for more than 50% of the national market share in terms of gas sales volume. Moreover, these large cross-regional gas companies are continuously acquiring small gas companies using their resources and cost advantages to compete for new markets.

In this process, regional gas companies usually find themselves at a disadvantage when competing for new markets with these large companies, and they also need to avoid being acquired by these large companies. In addition, since the beginning of this year, the domestic "one city, one enterprise" policy has been accelerating, and the overall trend of urban gas scale development may be one of the important reasons why Wuzhou Energy actively seeks independent listing on the Hong Kong Stock Exchange.

Therefore, Wuzhou Energy undoubtedly needs more funds to achieve its own scale growth. If it can successfully list on the Hong Kong Stock Exchange, it plans to expand its natural gas sales and distribution business through strategic investments, build new natural gas pipelines with a total length of no less than 80.0 kilometers in franchise operation areas in the next two years to expand market coverage, connect more city pipeline networks with long-distance pipelines in the next two years, upgrade facilities to improve operational efficiency and safety, and use operating funds and other general corporate purposes.

On the other hand, from the perspective of the "dual carbon" policy orientation, as coal exits at a high proportion, natural gas plays an important substitute role. In the journey to achieve carbon neutrality in China, natural gas will play an important bridging and balancing role, promoting China to achieve its strategic goal of carbon reduction while meeting market supply requirements. However, although natural gas is a type of clean energy, it still falls within the category of fossil energy, with no "immediate concerns" at present, but the "long-term concerns" of being replaced by renewable new energy still exist.

As of now, the majority of urban gas companies in the industry have begun to layout and develop integration with multiple energy sources, and this type of growth space will also become a key factor in determining the intrinsic value of gas companies in the future. This not only conforms to the development trend of the times, but also opens up new growth space for urban gas companies through the integration of multiple energy sources, further enhancing their growth potential.

Therefore, after achieving scale growth, structural transformation of regional urban gas companies like Wuzhou Energy is imperative. This may be the next important issue related to "growth choices" that the company will have to consider after going public