When IPO meets performance-based listing, can FANGZHOU JIANKE, a poorly issued company, heal the wounds of a bleeding IPO?

方舟健客是一家線上慢性疾病管理平台,正處在招股階段。然而,該公司面臨內部股權穩定性存疑、公司入不敷出和無基石丐版發行等問題,投資者對其青睞尚未確定。方舟健客此次 IPO 公開發行比例僅佔全部股份的 1.78%,屬於低於 10% 的 “丐版” IPO。

今年 5 月以來,港股 IPO 市場捷報頻傳,公開認購超百倍成標配,認購人數也在顯著回升。從個股表現來看,其中優博控股以超 2500 倍的認購倍數暫定今年 “認購王”,老鋪黃金則以上市首日暴漲超 80% 成為近期港股 IPO 最火新股。

但也並非所有新股都有如此戰鬥力。智通財經 APP 觀察到,近日招股的 10 家新股公司亦不乏表現欠佳者,方舟健客 (06086) 便是其中之一。

三度遞表,終過聆訊,正處在招股階段的方舟健客離港交所只差一步之遙,但此時醫藥電商風口已過,方舟健客內部股權穩定性存疑,加之公司入不敷出和無基石丐版發行,這家線上慢性疾病管理平台能否斬獲投資者青睞還是一個未知數。

“無基石丐版發行” 意欲何為?

智通財經 APP 瞭解到,招股日期為 2024 年 6 月 28 日至 7 月 4 日,招股價區間在 7.6-8.36 港元,每手 500 股,上市日期預計在 7 月 9 日。全球發售方面,方舟健客此次發行比例約為 1.78%,發行市值區間在 101.86-112.05 億港元。本次無基石投資者參與。

根據捷利交易寶的新股孖展數據披露,截至 6 月 28 日港市收盤,方舟健客的孖展總額約 3796 萬港元。截至 7 月 2 日 9:04 分,方舟健客孖展總額約 0.49 億港元,認購倍數為 1.45 倍。其中,富途證券孖展金額為 0.38 億港元、盈立證券孖展金額為 335 萬港元,華盛證券認購 280 萬港元等。

一般而言,港股 IPO 新股發行 25% 是多數公司的選擇,低於 10% 則被稱為 “丐版” IPO,而方舟健客此次 IPO 公開發行比例僅佔全部股份的 1.78%。認購資金方面,若不回撥的情況下,按發行價中間價 7.98 港元計,全球發售的總募資額約為 1.90 億港元,其中國配約佔 1.71 億港元,公開發售僅佔 1899.24 萬港元。

僅發行不到 2% 的股份也要上市募資,足見方舟健客所面臨的壓力,其中內部股權穩定性情況是任何投資者都難以忽略的問題。

據智通財經 APP 瞭解,在方舟健客向港交所遞交招股書中的 “歷史、重組與公司架構” 內容中,方舟健客詳細闡述了其公司內部,剛剛經歷的一場創始人與後入局者之間激烈的內鬥。作為歷史創始人的蘇展因一起被隱瞞的且導致公司出現虧損的關聯交易被揭開,其與現公司控股股東謝方敏撕破了臉皮,不僅上演 “武力奪權” 的戲碼,雙方至今仍對簿公堂。

除了股東內訌以外,還有一個問題在於方舟健客此次 IPO 或屬於一次基於對賭協議的 “被迫 IPO”。

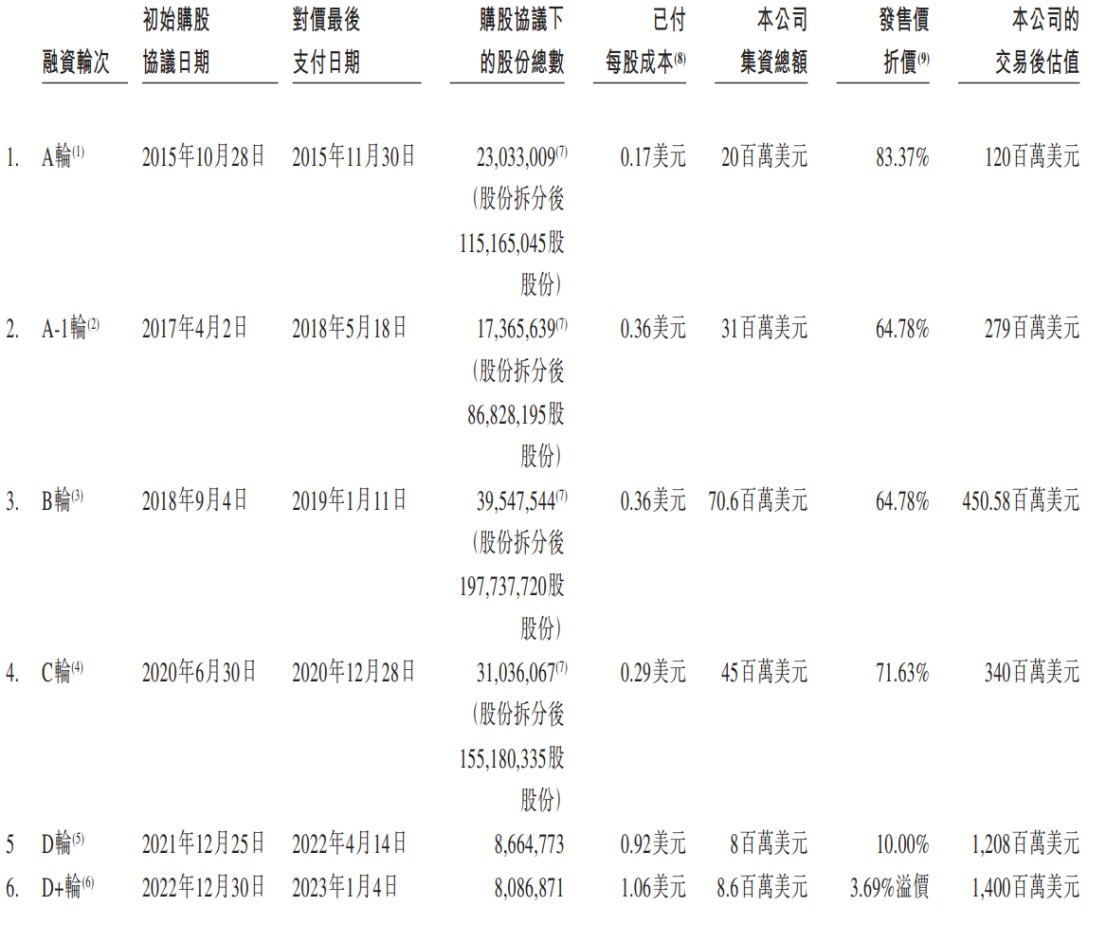

公司 IPO 前總共完成 6 輪融資,最後 D+ 輪融資完成於 2023 年 1 月 4 日,公司估值 14 億美元,約合 109.31 億港元,每股成本 1.06 美元,約合 8.27 元港元,較發售價溢價 3.69%,IPO 前投資者禁售期 6 個月。

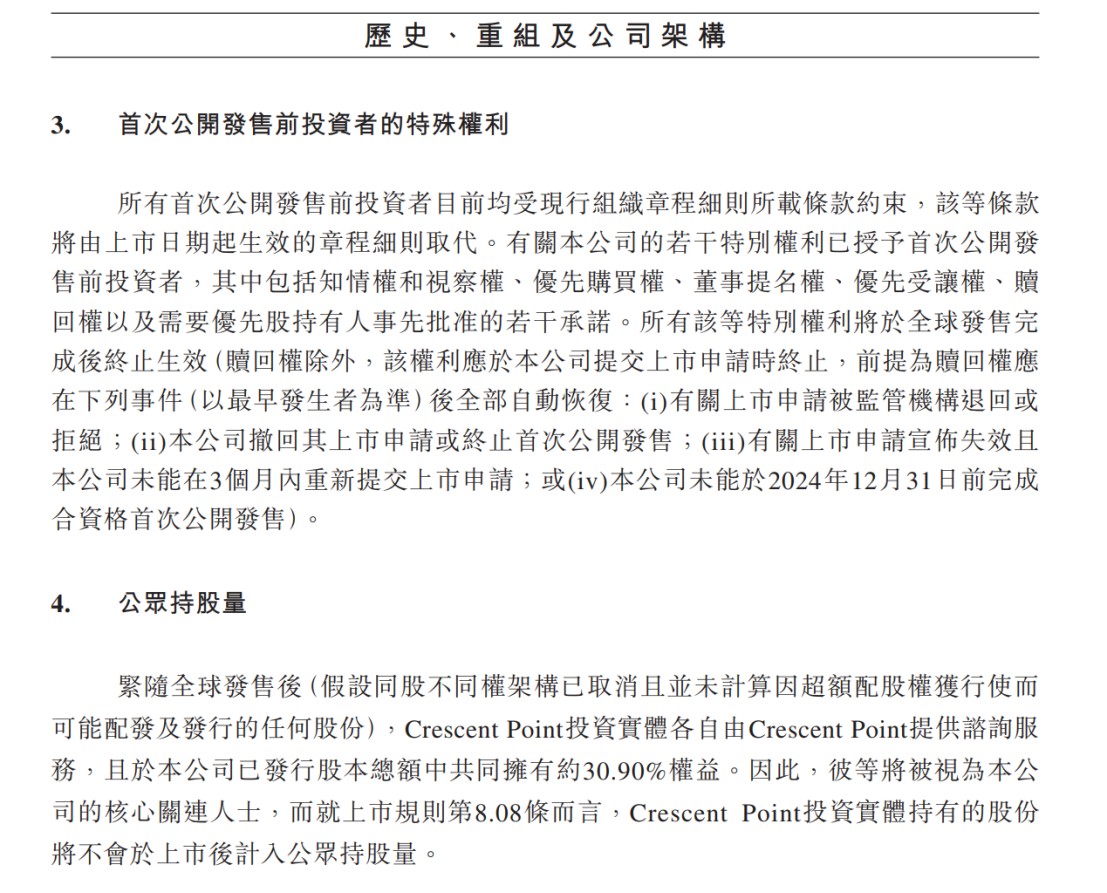

根據招股書,在吸收大量戰略投資的同時,方舟健客還授予其若干特殊權利,其中包括知情權和視察權、優先購買權、董事提名權、優先受讓權、贖回權以及需要優先股持有人事先批准的若干承諾。不過根據招股書描述,上述所列特殊權利目前已得以終止。

另外,根據對賭協議,方舟健客必須在今年年末前完成 IPO:若公司 IPO 申請被監管機構退回或拒絕、公司撤回 IPO 申請、申請失效且未能在 3 個月內重新提交申請,或公司未能在 2024 年末前完成 IPO,則贖回權自動回覆效力。

除了上市對賭外,方舟健客還需要保證一個叫做 Crescent Point 工具的外部投資者持股比例不低於 30%。

根據招股書,Crescent Point 工具方與謝方敏及周峯簽署了一份表決代理契據,根據這份契據,方舟健客必須保證 Crescent Point 工具在公司的持股比例達到 30% 及以上。否則,其將收回授予謝方敏及周峯的表決代理權。

招股書顯示,Crescent Point 工具包括 Crescent Trident Singapore Pte. Ltd.、Asia-Pac E-Commerce Opportunities Pte. Ltd.、CP Pharmatech Singapore Pte. Ltd.及 Tech-Med Investments (S) Pte. Ltd.四家股東,參與公司 A 輪-C 輪四輪融資。目前其累計持有公司 32.63% 的股份,持股比例僅次於公司控股股東的 38.3%。

從以上角度來看,方舟健客的此次無基石的丐版 IPO 與其説為了融資,不如説是為了 “應付對賭協議”。

現金流吃緊,基本面難撐發展

雖然號稱 “中國最大的在線慢病管理平台”,但方舟健客的基本面表現並不足以撐起這個稱呼。

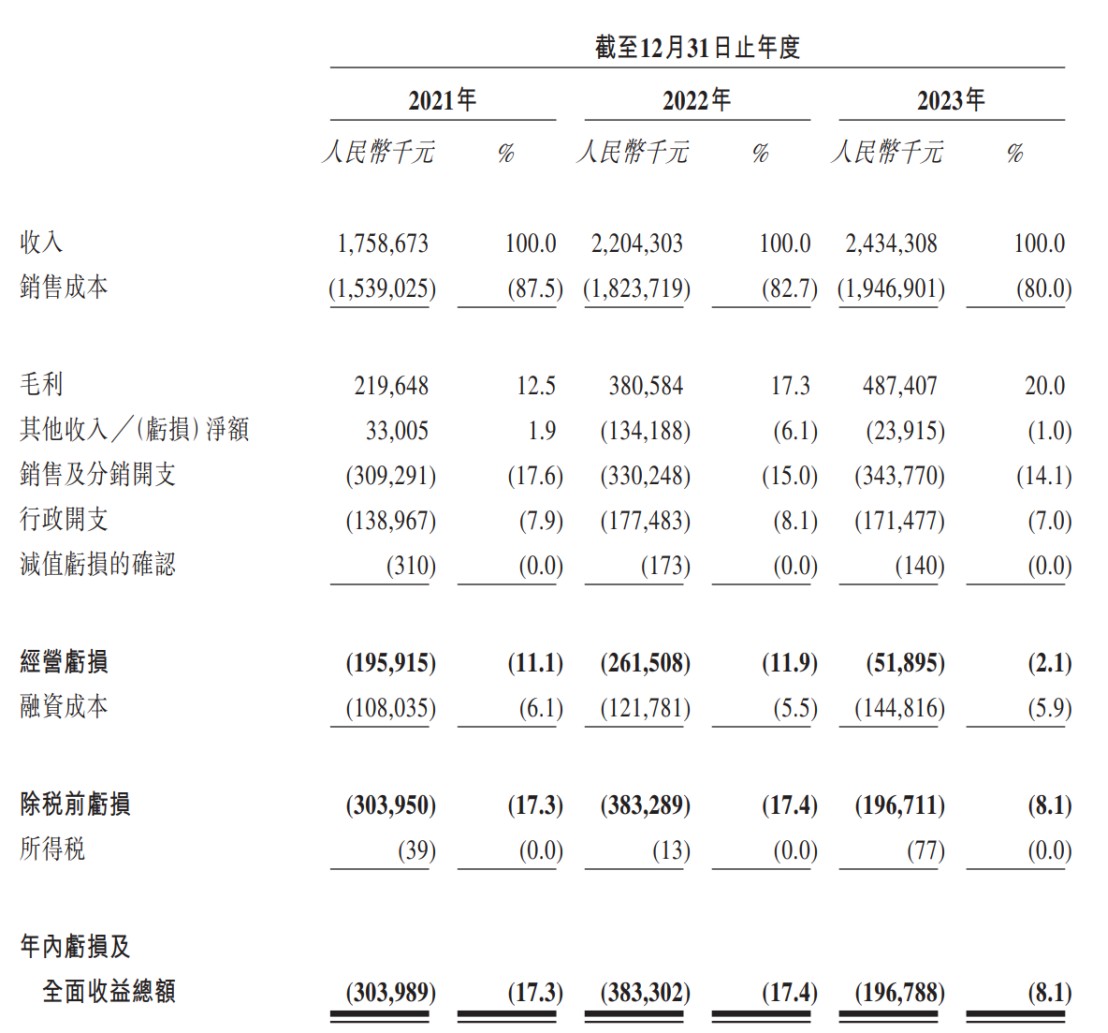

招股書數據顯示,方舟健客在 2021 年至 2023 年的收入分別為 17.59 億元、22.04 億元和 24.34 億元。儘管營收逐年有所增長,但淨利潤卻持續虧損,分別淨虧損 3.04 億元、3.83 億元和 1.97 億元,三年累計虧損近 9 億。

拆解其實際營收結構,2021 年至 2023 年,方舟健客的線上零售藥店服務營收佔比分別達到 57.5%、56.8% 和 53.3%。而來自定製化內容及營銷服務的營收佔比僅分別為 1.6%、2.7% 和 3.6%。也就是説,其核心收入來源的本質還是線上賣藥。

由於在上述賽道,方舟健客的競爭對手不乏阿里健康、京東健康、叮噹快藥、藥師幫及圓心科技等垂類醫藥互聯網公司,且其收入與行業頭部企業差距巨大,因而在業務端需要大量的成本進行市場開拓。招股書顯示,報告期內,方舟健客的銷售成本分別為 15.39 億元、18.24 億元和 19.47 億元,佔當期收入的比例分別高達 87.5%、82.7% 和 80%。

此外,方舟健客還要為公司高管支付逐年高漲的薪酬。2021 年至 2023 年,謝方敏的薪酬是分別是 258.3 萬元、456.8 萬元、669.5 萬元,而周峯的薪酬則分別為 177.3 萬元、262.6 萬元、415.3 萬元。

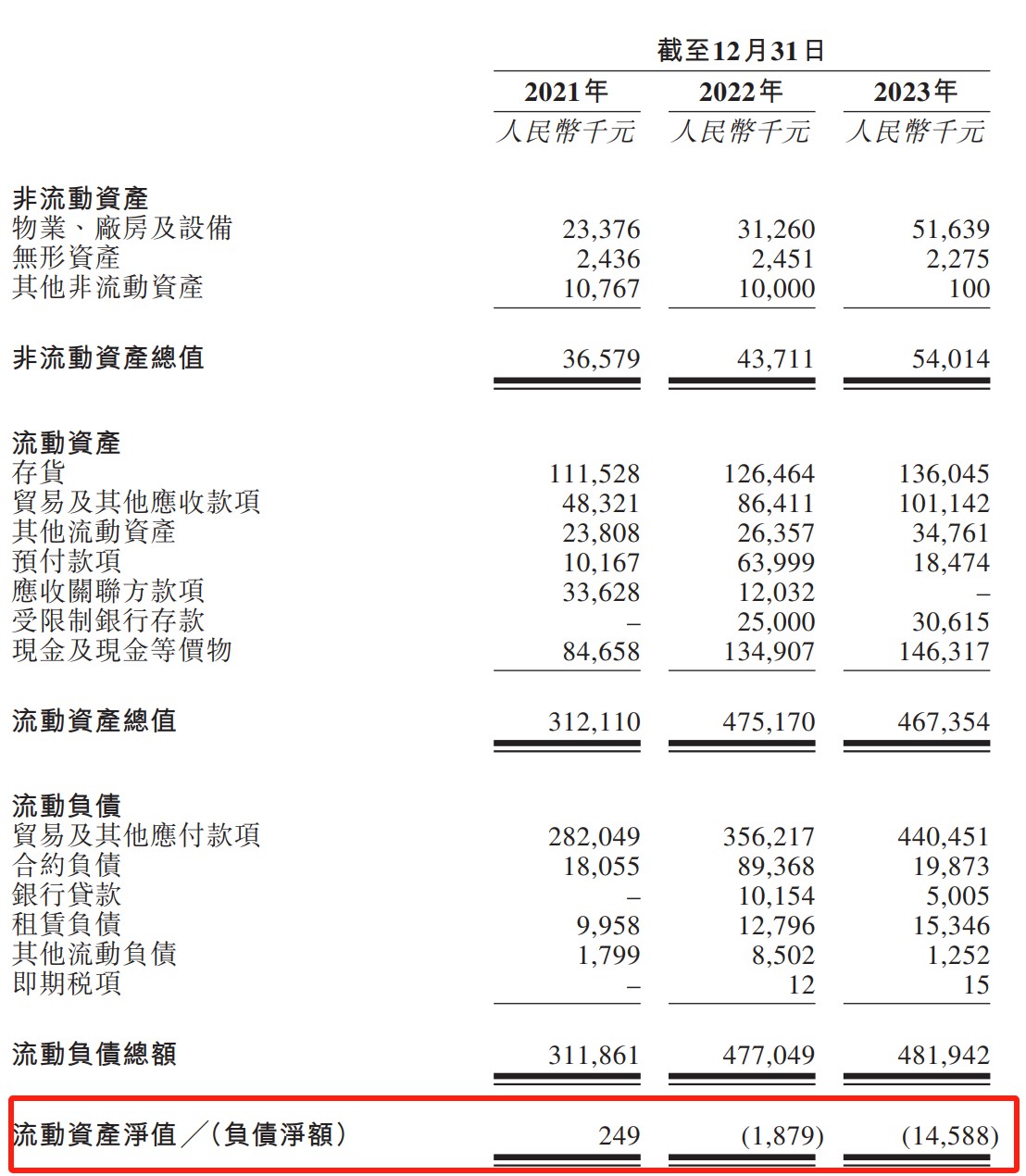

雖然高管薪酬節節高,但實際上方舟健客的資金情況算不上良好。從負債來看,在預付賬款減少以及應付賬款逐年增長的情況下,公司流動負債淨額從 2022 年的 187.9 萬元大幅增至 2023 年的 1458.8 萬元。

從現金流情況來看,2021 年、2022 年方舟健客的經營獲得所得現金淨額分別是-2.04 億元和-0.5 億元,而 2023 年經過調整之後,現金淨額由負轉正,約為 2228.2 萬元。而由負轉正的原因或許與其在報告期內大量佔用渠道資金有關。

此外,在招股説明書中方舟健客還明確説明其此前投資收取的所得款項淨額已動用 95.9%。也就是説,現金流吃緊已成為影響其日常運營的實際問題。