In the capital winter, innovative pharmaceutical companies start "shell-making" financing

In the cold winter of capital, innovative pharmaceutical companies have begun "shell-building" financing. KEYMED BIO's BD transaction has set an "alternative example" for Chinese innovative pharmaceutical companies, as they exhaust all possible financing feasibility, including returning to the primary market to seek opportunities. KEYMED BIO has granted two new drug rights, marking a return to the primary market. The stock prices of innovative drug companies have fallen, leading to severe discounts for listed innovative drug companies, causing them to lose financing capabilities in the secondary market. KEYMED BIO, through its collaboration with the capital institution OrbiMed, has used the "shell" company Belenos to prolong its life. KEYMED BIO is highly likely to grant overseas rights of the subsequent pipeline to the "shell" company Belenos

In a downturn in the capital market, all innovative pharmaceutical companies are having a hard time.

Today, the "disdain" of the Chinese capital market for the innovative pharmaceutical industry is reminiscent of American investors in the 1990s. This "disdain" is not because Chinese innovative pharmaceuticals are performing poorly, but rather due to investors' aversion to risk during an economic downturn.

Recently, KEYMED BIO-B set a "unique example" for Chinese innovative pharmaceutical companies in a BD transaction. As the difficulty of secondary market financing increases, innovative pharmaceutical companies are exhausting all feasible financing options, including returning to the primary market to seek opportunities - even if it means further devaluation of asset valuation. In the capital winter, "persevering" is more important than other options.

I. Returning to the Primary Market

KEYMED BIO-B granted equity rights to two new drugs, essentially an act of returning to the primary market.

IPO has always been seen as the best stage for innovative pharmaceutical companies, as after going public, innovative pharmaceutical companies have more diverse financing options, including rights issues, bond issuance, and even easier access to bank loans. However, in a market environment downturn, investors become more conservative, no longer believing in expectations, and placing more emphasis on performance, which is obviously detrimental to innovative pharmaceutical assets.

With the decline in the stock prices of innovative pharmaceutical companies, almost all listed innovative pharmaceutical companies will suffer severe discounts, leading to a loss of financing capabilities in the secondary market. If a company has completed large-scale financing before, it is fine, but if it missed the financing boom before, it will be passively trapped at this point.

Difficulty in obtaining large-scale financing is the objective environment, and the same goes for BD transactions.

KEYMED BIO-B's CM512 and CM536 are early-stage dual-antibody products, with even no disclosure in the financial reports, indicating high uncertainty in the pipeline. Therefore, the opportunities facing KEYMED BIO-B are limited: cooperation with large MNC companies may be a luxury, so when capital institutions extend an olive branch - although the down payment is not high, only $15 million - it is already a lifeline.

This transaction is more like KEYMED BIO-B's attempt to return to the primary market. Through two cutting-edge pipelines, using the newly created "shell" company Belenos, to build interests with the capital institution OrbiMed.

Looking ahead, KEYMED BIO-B is likely to continue to grant overseas rights of subsequent pipelines to the "shell" company Belenos, while OrbiMed will continue to provide funds to KEYMED BIO-B, which is a kind of disguised financing.

Taking money from the primary market is only the superficial value of KEYMED BIO-B's financing this time. On a deeper level, KEYMED BIO-B is jointly creating an alternative forward "IPO" with OrbiMed.

In the US stock market, there have been several cases of financing based on Chinese innovative pharmaceutical pipeline assets.

First, in December 2022, the US-listed company Summit reached an agreement with Kangfang Bio for a high price of $5 billion upfront payment and $50 billion total milestone payment, to acquire the exclusive rights of PD-1/VEGF dual-antibody AK112 in the US, Canada, Europe, and Japan. After acquiring part of the overseas rights of AK112, Summit's previously struggling stock price quickly rose, returning to the mainstream view of American investors On June 28th this year, another US company based on China's innovative drug pipeline went public. Alumis successfully raised $210 million from the market, with its core pipeline being an imported TYK2 inhibitor from Hisun Pharma, which is likely to become a blockbuster drug. At that time, Alumis only paid $60 million upfront and $120 million in milestone payments for the drug imported from Hisun Pharma.

Keymed Bio-B divests pipeline assets, while the capital institution OrbiMed provides the funding. Rebuilding an "IPO" in the US may be a beautiful dream with a certain probability. After all, the liquidity of innovative drug assets in the domestic capital market has almost dried up, while the liquidity in the US stock market is good. Instead of sticking to the shells of domestic listed companies, it is better to try to "move the tree."

As more and more companies in the market understand this operation, "shell-building" financing may become a new way out for Chinese innovative drugs.

Survival is the key to winning in extreme markets. In the extreme market, the competition is no longer about who is more valuable, but about who can survive longer. Only by surviving can one have a chance to win.

In the mid-1990s, the US capital market's biotech bubble burst, leading to the first-ever pharmaceutical depression. 58% of Biotech companies did not have enough remaining funds to support operations for two years. The reason lies in the "loss of trust" caused by the ebb of capital. When investors lose their expectations, innovative drug assets lose their value.

Of course, the US innovative pharmaceutical industry did not collapse in that depression. Instead, with the realization of a group of excellent companies' expectations, investors began to have expectations for the innovative pharmaceutical industry again. The foundation of the FDA system today lies in the continuously growing innovative drug companies in the US.

When the capital market is in a downturn, the days of all innovative drug enterprises are tough. However, the more critical the situation, the more significant investment opportunities will emerge. For example, in the first US innovative drug bubble, Amgen, which was just emerging, was a direct victim, but it turned danger into an opportunity.

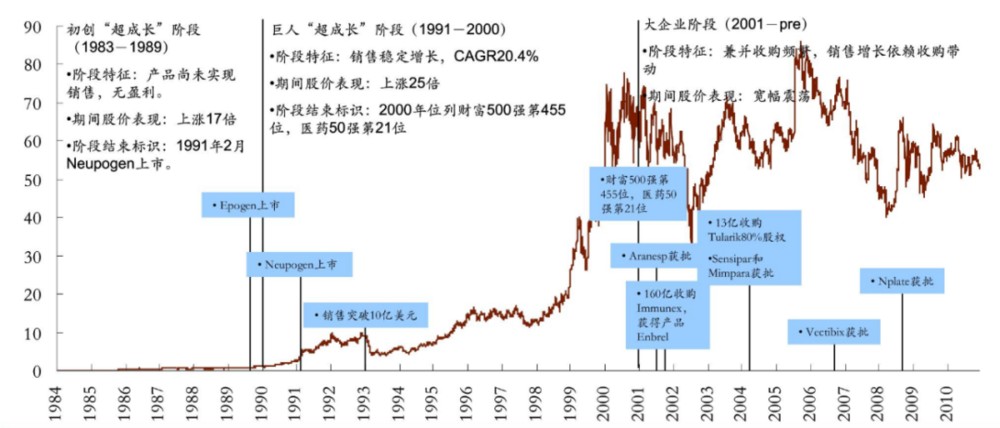

At that time, Amgen was still a typical small biotech company driven by innovation, with only two products, Epogen and Neupogen. Although the company's revenue continued to grow significantly, reaching over $1 billion in 1993, its stock price was halved in the following two years.

Despite the capital chill affecting Amgen's stock price, its performance was not affected. By 1999, Amgen's revenue had reached $3.4 billion, and a year later, it entered the global top 30 pharmaceutical companies. Among the many underestimated innovative drug companies, Amgen was the first to emerge from the trough. After investor confidence returned, Amgen's value was quickly recognized by the market, and by the end of 2020, Amgen's stock price had risen 25 times from the beginning of 1990.

Image: Amgen's stock price and history, Source: CICC In addition, under the cold winter of the capital market, Anjin saw an opportunity. Anjin subsequently embarked on a vigorous bottom-fishing style of mergers and acquisitions, conducting large-scale acquisitions almost every year at extremely low prices to harvest a large number of pipelines, covering multiple tracks such as immunology, oncology, diabetes, gene therapy, and more. It is with these M&A actions that Anjin completed its transformation from a biotech company to a multinational corporation.

Image: Anjin's overview of mergers and acquisitions, Source: JinDuan Research Institute

Currently, the Chinese capital market's "disdain" for the innovative pharmaceutical industry mirrors that of American investors at the time. This "disdain" is not because Chinese innovative pharmaceuticals are not performing well, but rather due to investors' aversion to risks during an economic downturn.

Tides rise and fall eventually. When investor confidence is restored, it is believed that the entire Chinese innovative pharmaceutical industry will once again become vibrant. In the next decade, the leading company in the Chinese innovative pharmaceutical industry will definitely be the one that can smell business opportunities in this cold winter and successfully seize them