The market continues to be "Risk On"! The Fed's lack of hindrance to rate cut expectations, tech giants driving US stocks to new highs

Federal Reserve Chairman Powell's speech failed to stop traders from betting on a rate cut by the Fed this year, as market funds continue to chase risks, driving the U.S. stock market to new highs. Tech giants Apple, Microsoft, and Nvidia saw their stock prices rise, with the S&P 500 index breaking through 5600 points for the first time. In addition, Powell stated that the Fed does not need inflation to be below 2% to cut rates, but the labor market has clearly cooled. It is expected that the Fed will cut rates twice in 2024, with the first cut possibly in September. Gold and silver mining stocks rose, while bank stocks performed poorly. Google's parent company Alphabet has shelved its plan to acquire HubSpot Inc

Zhitong Finance APP noticed that the stock prices of global tech giants such as Apple (AAPL.US), Microsoft (MSFT.US), and NVIDIA (NVDA.US) collectively rose, pushing the US stock market to historic highs. Federal Reserve Chairman Powell's speech in Congress did not deter traders from betting on a rate cut by the Fed this year.

The market funds continue to show a fervent "Risk On" trend, driving the S&P 500 index to break through 5600 points for the first time in history. A new round of bidding for large-cap tech stocks, along with Powell's relatively dovish remarks, has led to the longest rally in US stock indices since November last year. NVIDIA (NVDA.US) rose by over 2.5%, Apple's stock price continued to rise, and the company plans to increase the shipment volume of the new iPhone by 10% after a turbulent 2023. Following a strong $39 billion 10-year Treasury bond sale, US bonds remained fairly stable. Swap trading expects the Fed to cut rates twice in 2024, with a higher likelihood of the first rate cut in September.

As Wall Street prepares for CPI, Powell stated that the Fed does not need inflation to be below 2% to cut rates, while adding that officials have more work to do. He noted that the labor market has cooled "quite noticeably." Powell pointed out that there is still "a long way to go" in reducing the balance sheet and stated that commercial real estate does not threaten financial stability.

Krishna Guha from Evercore said, "The key to his testimony is that the Fed's assessment of risk balance is changing, and if supported and sustained by future data, the Fed is likely to cut rates in September."

The S&P 500 index rose by 1%, marking the seventh consecutive day of gains and the 37th new high this year. Gold and silver mining stocks rose on expectations of Fed easing monetary policy. Bank stocks performed poorly. According to sources, Google's parent company Alphabet (GOOGL.US) has shelved plans to acquire HubSpot Inc.

The yield on the US 10-year Treasury bond fell by 2 basis points to 4.28%. Huw Pill, Chief Economist at the Bank of England, said that the timing of a rate cut remains a "hanging question," prompting traders to reduce bets on a rate cut in August. Oil prices rose due to increased demand for gasoline and aviation fuel during the US holiday.

Mark Hackett from Nationwide said, "Despite a lot of data released this week, including Fed Chairman Powell's testimony, CPI/PPI reports, and the start of earnings season, the market remains unusually calm The so-called core CPI, which excludes food and energy costs and is considered a better measure of underlying inflation, is expected to rise by 0.2% for the second consecutive month in June. This will be the smallest increase in two months since August—this increase is more acceptable to Federal Reserve officials.

Economist Anna Wong said, "The CPI report for June looks like another 'very good' report, which should boost the FOMC's confidence in the inflation trajectory." "This should set the stage for the Fed to start cutting rates in September."

A survey conducted by 22V Research shows that 55% of investors expect the market's reaction to Thursday's CPI to be "Risk On," 16% of investors believe it will be "Risk Off," and 29% of investors think it will be "Mixed/Can be ignored."

Dennis DeBusschere of 22V said, "The market generally has an optimistic view on inflation," adding that the survey also shows that investors believe "CPI is on a downward trajectory favorable to the Fed (rate cut)."

Meanwhile, some trading desks suggest that investors should prepare for possible calmness in the market in the near term.

Stuart Kaiser, head of equity trading strategy at Citi Group, said that the options market is betting that the S&P 500 index will move in a certain direction by 0.8% after Thursday's consumer price report, depending on the price of straddle options that day.

Mark Haefele of UBS Global Wealth Management said that due to US political uncertainty, Fed Chair's remarks, and the start of the second-quarter earnings season, market volatility may increase in the coming days and weeks.

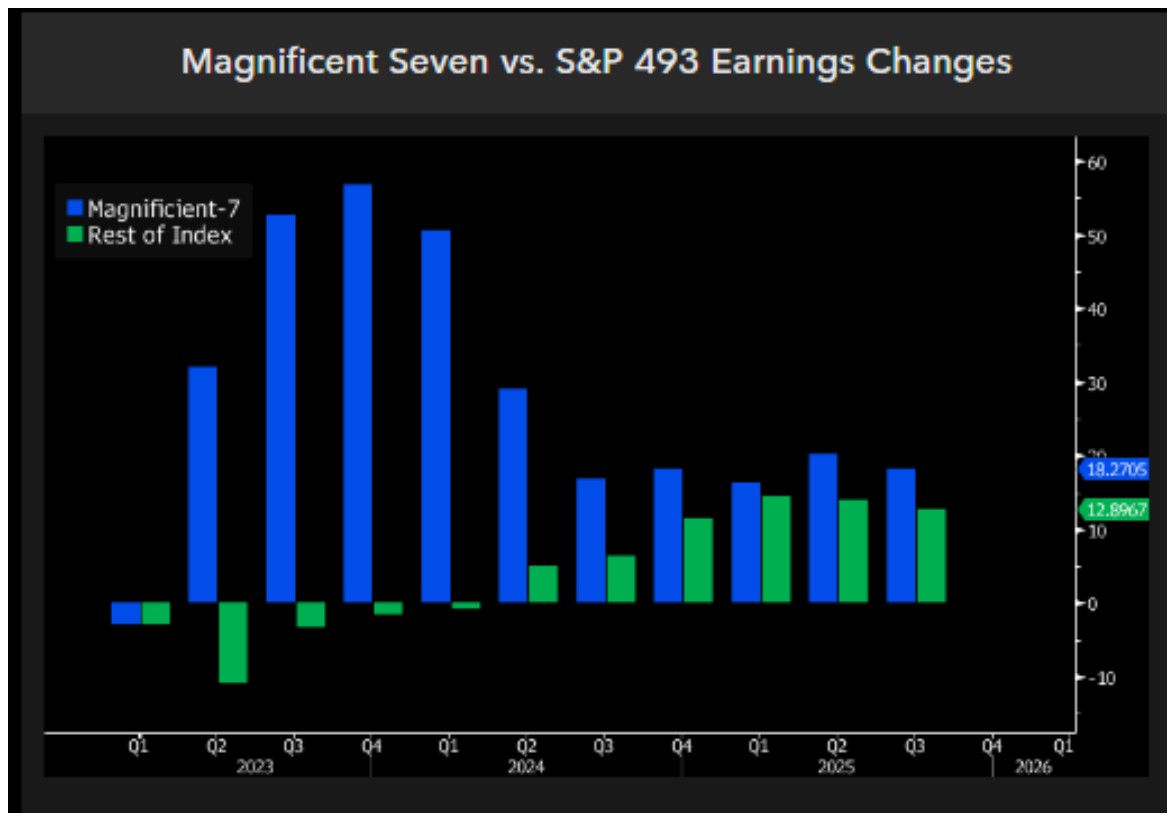

Industry research strategists led by Gina Martin Adams stated that since 2022, the earnings of S&P 500 index component companies may no longer be concentrated solely in technology. The success of this quarter depends on all factors other than the large tech giants that have been driving the stock market to record highs.

They noted, "While forecasts for the 'Big Tech Seven Sisters' remain strong, their earnings are expected to slow in the second quarter—meanwhile, other component stocks in the S&P 500 index may finally achieve year-over-year growth for the first time in at least five quarters."

Strategists summarized that the 'Seven Sisters' may have reached their peak, while the rest of the S&P 500 index components may achieve profit expansion for the first time in at least six quarters.