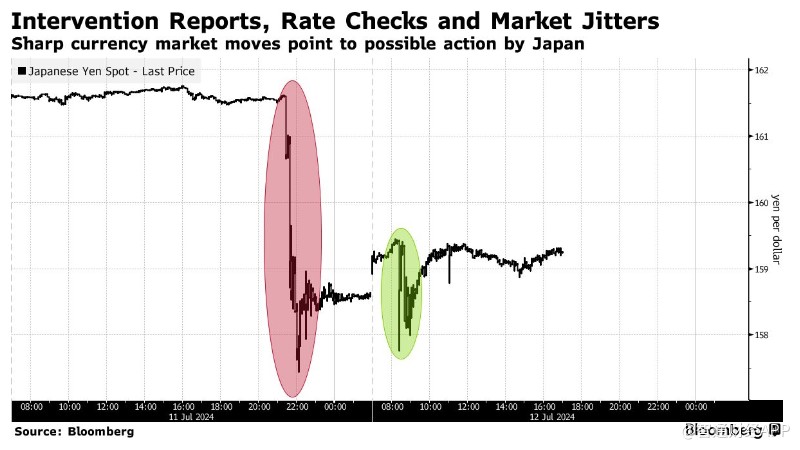

After the release of the US CPI data, the Japanese yen jumped against the US dollar. Japanese authorities may use $22 billion to intervene in the foreign exchange market

日本可能動用 220 億美元干預匯市以支撐日元,這是因為美國通脹數據降温,市場預期美聯儲將降息。週四的疑似干預將是日本自 2022 年以來首次在日元兑美元走強時採取行動,旨在讓投機者處於被動地位。日元兑美元匯率隔夜大幅波動,日元已累計貶值逾 11%。相比之前的預測,日本央行經常賬户可能減少 3.2 萬億日元,引發了干預猜測。日本政府可能會採取干預措施,但市場對此並沒有廣泛預期。

智通財經 APP 獲悉,根據 Bloomberg 對日本央行賬户的分析,在美國週四公佈通脹數據後不久,日本可能今年第三次進入外匯市場以支撐日元。干預的規模可能在 3.5 萬億日元(合 220 億美元)左右。

這表明,在數據顯示美國通脹普遍降温後,市場對美聯儲很快降息的預期不斷增強,日本貨幣當局試圖利用這一機會。

在自 2022 年 9 月以來為支撐日元而採取的行動中,週四的疑似干預將是首次在日元兑美元走強之際提振日元的行動,這是日本試圖讓投機者處於被動地位的戰略的新進展。

日本財務大臣鈴木俊一和日本外匯事務主管神田真人拒絕對外匯干預猜測發表評論。

日元隔夜大幅波動後,干預的猜測激增。東京市場週四晚間,在美國公佈低於預期的通脹數據後半個多小時,日元兑美元匯率從 161.58 日元兑 1 美元左右大幅升值至 157.44,漲幅略高於 4 日元,與此前大多數干預行動的幅度相似。

外匯市場走勢暗示日本可能採取行動

一些市場觀察人士已經警惕,如果美國物價高於預期,從而導致日元下跌,日本可能會採取干預措施。但如果日元開始走強,日本政府出手干預的可能性並沒有被廣泛預期。

東京匯市週五晚間,日元兑美元匯率約為 159.09。今年以來,日元已累計貶值逾 11%,成為主要貨幣中貶值幅度最大的貨幣。

對干預規模的估計基於央行賬户的變動。日本央行週五報告稱,由於政府財政因素,其經常賬户可能會在下一個工作日 (下週二) 減少 3.2 萬億日元。相比之下,在疑似干預之前,包括 Central Tanshi、Totan Research 和 Ueda Yagi Tanshi 在內的私人貨幣經紀公司平均預測增加 3330 億日元。

Totan Research 分析師 Yuichiro Takai 表示:“在美國公佈 CPI 數據後,日本政府很有可能抓住日元走強和美元走弱的機會進行干預,並且能夠以低於 5 月份約 4 萬億日元的規模提振日元。”

事實證明,將貨幣經紀商的估計與日本央行的經常賬户預測值進行比較,可以準確計算出自 2022 年 9 月以來干預措施的大致規模。

今年早些時候,在日元兑美元跌至 34 年低點後,日本政府在 4 月底和 5 月初的干預行動中花費了創紀錄的 9.8 萬億日元,以支撐日元。Bloomberg 當時估計,干預規模為 9.4 萬億日元。

日本政府一直在努力扭轉外匯市場的局勢。兩年多來,通脹率一直維持在日本央行 2% 的目標水平或以上,而日元是主要推動因素。隨着實際工資下降,在截至 3 月份的一年裏,消費者支出每個季度都在下降。

推動日元走軟的主要因素之一是美國和日本之間的利率差異,尤其是考慮通脹因素的長期債券收益率之間的差異。這表明,日本央行加息或美聯儲降息將有助於提振日元。

日本央行曾多次表示,其政策並非針對日元,並表示不願公開改變政策以支持日元。但日本央行行長植田和男表示,如果日元疲軟導致通脹前景發生變化,則可能會改變政策。

對於可能的干預對日本央行 7 月 31 日政策決定的影響,人們的看法並不一致。一些經濟學家表示,干預行動加大了加息的可能性,因為在日本政府做出反應之後,日本央行需要採取下一步行動。另一些人則認為,由於日元面臨的壓力有所緩解,加息的可能性更小。

官方月度干預數據將於 7 月 31 日公佈,屆時神田真人將在日本政府定期改組中卸任,由現任日本財務省國際局局長三村淳接任。