Analysis of New Stocks in the US Stock Market | A 38% Reduction in Xuhang Holdings' Marketing Team Due to the Loss of Small and Medium-sized Clients Leading to a Slowdown in Performance, What Signal Does It Send?

旭航控股赴美上市遇冷,IPO 募資額下調。2023 年收入下滑 13.1%,淨利潤下滑 20.5%。中小客户流失成業績失速關鍵。

旭航控股 (SUNH.US) 赴美上市或遇冷,其 IPO 募資額下調。

早在 2023 年 3 月 31 日旭航控股向 SEC 提交首次公開募股 (IPO) 申請時,擬融資至多 9200 萬美元;此後市場消息報道旭航控股將以 4-6 美元的價格發行 375 萬股普通股,至多募集 2250 萬美元資金。

但在最新版的招股書中,旭航控股募資額有明顯下調。7 月 1 日,旭航控股第四次向 SEC 提交了 F-1/A 文件。據該文件顯示,旭航將在此次 IPO 中發行 250 萬股普通股,發行價格為 4-5 美元,至多募集 1250 萬美元資金。

旭航控股是以內容驅動的營銷服務提供商,截至 2023 年 12 月 31 日時,其新媒體賬户資源包括了 524 個自營賬户和 180 個合作賬户,總共覆蓋了大約 1 億的互聯網用户。

但從業績來看,旭航控股 2023 年發展的並不理想。據招股書顯示,2023 年時,旭航控股的收入為 4.15 億人民幣,同比下滑 13.1%,期內淨利潤為 5546.5 萬元,同比下滑 20.5%,呈現收入、淨利潤雙降。

若對旭航控股的招股書進行深入剖析,或許便能理解旭航控股為何下調募資額。

中小客户流失成業績失速關鍵

成立於 2014 年的旭航以傳統的數字化廣告起家,即通過公司的數字廣告渠道發佈客户的產品或服務廣告,而該等渠道主要由嵌入旭航 SDK 的應用程序組成。

至 2017 年時,為滿足營銷人員在新媒體領域對社交、娛樂和時尚營銷內容日益增長的需求,旭航推出了新媒體綜合內容營銷服務,並開發了兩種商業模式,S2B 模式和 S2P 模式。

具體而言,S2B 模式為根據客户需求制定營銷計劃、製作營銷內容併發布,同時組織相關的線上和線下活動。而 S2P 模式指的是公司通過編輯和製作來自授權的電視劇、電影和綜藝節目的短視頻,並在短視頻平台上投放,從而為大型互聯網媒體平台提供在線流量服務。

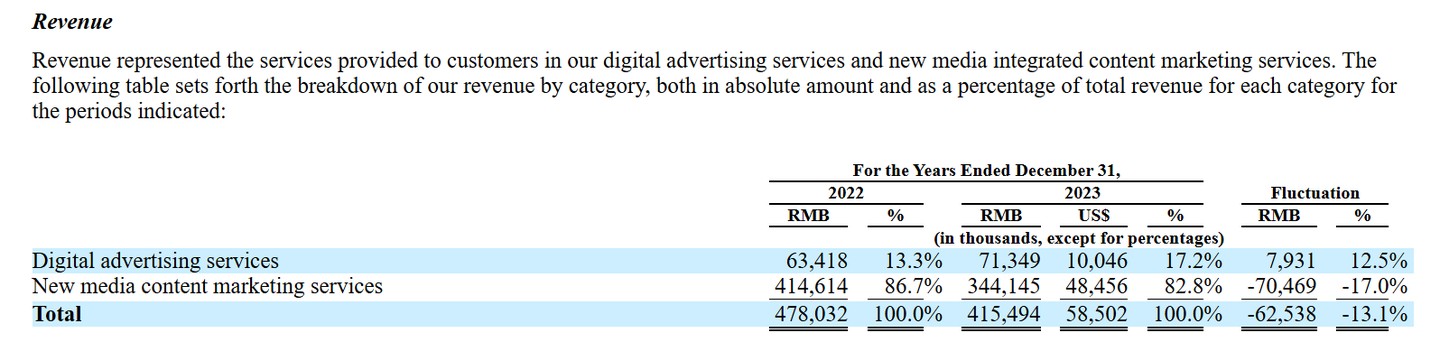

截至目前,旭航控股的主要業務便是數字化廣告以及新媒體綜合內容營銷服務。據招股書顯示,2020-2023 年,旭航控股數字廣告服務的收入佔比分別為 53.6%、22.6%、13.3%、17.2%,佔比整體呈現明顯的下降趨勢,而新媒體內容營銷服務的收入佔比從 2020 年的 46.4% 快速上升至 2022 年的 86.7%,這充分説明了旭航控股抓住了新媒體趨勢。

從業績來看,2020 至 2023 年,旭航控股的收入分別為 3.51 億人民幣、4.71 億、4.78 億、4.15 億元,同期的淨利潤分別為 4471.9 萬、6924.6 萬、6981 萬、5546.5 萬。業績的變化趨勢與新媒體內容營銷服務的收入佔比呈現了明顯的正相關性,即旭航控股的收入增長由新媒體內容營銷服務所帶動。

數據顯示,2020 至 2022 年,旭航數字廣告服務的收入分別為 1.88 億人民幣、1.06 億、6341.8 萬元,呈現快速的下降趨勢,這是公司戰略轉向新媒體內容營銷服務所致。而同期新媒體內容營銷服務的收入分別為 1.63 億、3.65 億、4.14 億元,該業務收入的快速增長得益於旭航於 2021 收購了杭州星空互聯網文化傳播有限公司,協同整合該業務後實現了持續成長,這也使得 2022 年公司整體的毛利率提升至了 36.8%,而 2020、2021 年均為 30%。

但進入 2023 年,旭航的持續成長戛然而止,該報告期內其收入下滑 13.1% 至 4.15 億元,這主要是因為新媒體內容營銷服務由於中小型客户數量減少導致該業務收入下滑 17%,即使數字廣告業務因新增兩名客户而錄得收入同比增長 12.5% 也難以抵擋總收入的下滑。

雖然旭航 2023 年的毛利率保持穩定,依舊維持在了 36% 的水平,且運營費用隨業務規模有所縮減,但在收入下滑的拖累下,期內淨利潤仍下降 20.5% 至 5546.5 萬元。

從上述的梳理中不難總結出旭航控股的發展脈絡,其抓住了新媒體的時代趨勢,通過外延併購標的整合新媒體內容營銷服務從而實現了持續的快速成長。但由於中小型客户佔比不少,宏觀經濟的持續低迷令中小企業經營承壓,從而導致了旭航控股中小型客户的流失而影響了公司的業務發展,這也是收入下滑毛利率卻能維持穩定的原因,因為流失的中小型客户毛利相對較低。

市場競爭持續加劇,客户結構失衡暴露潛在風險

從行業角度看,由於專業的整合營銷服務提供商通常會起草專門的營銷和傳播計劃,並利用直接或間接的媒體來幫助品牌或公司創造並保持積極的形象以及與目標受眾的牢固關係,因此,越來越多的品牌或公司傾向於獲得專業的整合營銷服務,以建立積極的社會聲譽和推廣產品和服務,這也使得中國整合營銷市場實現了持續成長。

根據 Frost & Sullivan 報告顯示,中國整合營銷行業的市場規模已從 2019 年的約人民幣 9716 億元增加到 2023 年的約人民幣 15381 億元,複合年增長率約為 12.2%,預計 2028 年將進一步增至約人民幣 24712 億元,複合年增長率約 9.9%。

而在整合營銷中,數字營銷扮演着至關重要的角色,佔據了最大的市場規模,2023 年的佔比高達約 82.5%。且與其他類型的綜合營銷服務相比,數字營銷增長勢頭最為迅速。其市場規模在 2019 年至 2023 年間以約 18.0% 的驚人複合年增長率增長,預計到 2028 年,數字營銷的市場規模將達到約 21500 億元人民幣,2023 年至 2028 年間的複合年增長率約為 11.1%。

由此可見,整合營銷市場增長主要由數字營銷所推動,而短視頻營銷、社交媒體營銷、廣告庫存購買和 KOL 營銷已成為了數字營銷的主要方式。旭航控股抓住了數字營銷的新趨勢,其在多個媒體平台上擁有數量超 700 個的多元化自媒體賬户,覆蓋約 1 億粉絲,其中抖音粉絲約 4088 萬,百度百家號粉絲約 3477 萬,快手粉絲約 1223 萬,微信公眾約 461 萬,以及來自其他互聯網媒體和電子商務平台的約 733 萬粉絲,包括頭條號、大魚號、嗶哩嗶哩、企鵝號等。

憑藉覆蓋多元化自媒體平台從而實現觸達大規模粉絲的旭航控股,將從數字營銷行業的持續發展中獲益。但投資者應該清楚的認識到,旭航控股未來經營中所面臨的潛在挑戰亦不在少數。

首先,營銷市場的發展具有明顯的週期性,與宏觀經濟的波動高度相關,會直接影響行業中市場玩家的經營表現。以 2023 年的旭航控股為例,造成其業績下滑的關鍵原因便是新媒體綜合內容營銷服務在疲軟的宏觀經濟下導致客户流失,若經濟未能企穩,企業便有持續縮減營銷開支的可能,這或會導致旭航控股的經營受到影響。

其次,旭航控股客户結構或不夠穩健。與中小型客户相比,大客户具有高穩定性以及高支付能力,是廣告服務提供商最樂意服務的客户類型。若大客户佔比較高,那麼廣告服務提供商的業績和盈利能力也會相對穩健。而在廣告行業因疫情影響消除而明顯復甦的 2023 年中,旭航控股的中小型客户卻出現了流失而導致業績下滑,這與 2023 年中國互聯網廣告市場同比增長 12.66% 至 5732 億元人民幣的趨勢相背道而馳,這或説明旭航控股的中小型企業客户佔比相對較高,這會讓公司的業務經營在面對宏觀經濟的波動時顯得更加 “脆弱”。

此外,旭航控股的營銷團隊大幅縮減。據招股書顯示,2022 年以及 2023 年中,旭航控股的營銷人員分別為 1002 名、618 名,即 2023 年的營銷人員大幅縮減 38%,這並不是一個好信號。

一般而言,銷售及營銷人員的增減是企業業務擴張與收縮的先行指標,企業業務擴張時,會加大營銷團隊的建設,當營銷團隊大幅縮減時,説明企業對自身未來的發展已由樂觀向保守轉變。而這或許與公司中小客户佔比較高有直接關係,縮減團隊服務於中大型客户或許是旭航控股應對風險的方式之一。

同時,來自媒體渠道的潛在風險也值得投資者重點關注。短視頻平台的用户應該能發現,因違法平台相關規則而被封禁、限流的賬户其實不在少數,這就需要旭航控股的內容團隊有較高的風控意識以保證賬户安全。雖然旭航控股覆蓋多元化平台,且自媒體賬户超 700 個以分散來自渠道的風險,但從已有的案例來看,其實大量的粉絲或集中於部分頭部賬户,因此若頭部賬户出現問題,或會影響公司經營。未來,短視頻渠道流量成本或有走高的可能,這亦值得投資者關注。

另外,行業競爭或存在加劇可能。整合營銷行業市場份額主要集中在頭部的少數玩家手中,據 Frost & Sullivan 的統計,2020 年時,前五大玩家佔據了 50% 以上的份額,而至 2023 年時,前五大玩家的市場份額已上升至了 62.1%。

顯然,市場份額持續向頭部玩家集中,這勢必會造成中小玩家的劇烈 “廝殺”。且隨着短視頻平台的持續火熱,越來越多玩家湧入該賽道中,若未來市場競爭加劇,或會有出現價格戰的可能,從而影響企業的盈利水平。

綜合來看,旭航控股抓住了新媒體趨勢,通過收購標的協同整合實現了持續成長,但由於中小型客户佔比相對偏高導致抗風險能力相對較弱從而於 2023 年出現業績下滑,公司也大幅縮減了營銷團隊釋放了保守信號。未來,行業的持續成長將讓旭航從中獲益,但公司也將直面客户結構不穩健、小客户出清、媒體渠道風險以及競爭持續加劇等多個潛在挑戰。