"Super Central Bank Week" is coming, the European Central Bank may cut interest rates in September, these central banks may "act on the news"

本周,欧洲央行等多个国家央行将召开议息会议。欧洲央行官员将评估通胀压力,降息可能性排除。欧洲央行将在 9 月份的会议上采取行动,并对美联储意图有更清晰认识。美国通胀放缓,人们猜测美联储将在 9 月降息。欧洲央行将考虑新数据,包括工业生产数据和通胀终值。欧洲央行官员将减少一名有投票权的成员。拉加德可能会在 9 月暗示下一次降息,但预计不会太明确。这次会议将受到投资者的密切关注。

智通财经 APP 获悉,本周,欧洲央行、埃及、南非、安哥拉等多个国家央行将召开议息会议。欧洲央行官员或将让投资者为再次降息做好准备,尽管正处于欧洲央行管委会有史以来最长的一次夏季决策间隙。由于决策者仍需时间以评估持续存在的通胀压力强度,周四的降息可能性实际上已被排除,交易员或将密切关注欧洲央行行长拉加德就 9 月 12 日议息会议前景提供的任何线索。

届时,欧洲央行将能看到往后两个月的消费者价格指数 (CPI) 数据,并掌握最新编制的预测。几位政策制定者表示,他们更倾向于在持有新预测的季度性会议上采取行动。

到那时,官员们也将对美联储的意图具有更清晰的认识。最新数据显示,美国通胀普遍放缓,降至 2021 年以来的最低水平,人们愈加猜测美联储也将寻求在 9 月降息。

在周四做出决定之前,欧洲央行管委会将看到的新数据包括:周一公布的 5 月工业生产数据,预计将呈现连续第二个月收缩,以及周三公布的 6 月通胀终值。

由于西班牙尚未任命新的央行行长以接替埃尔南德斯·德科斯 (Pablo Hernandez de Cos),欧洲央行官员本周将减少一名有投票权的成员,de Cos 的任期一个多月前刚刚结束,将不再连任。

除有关借贷成本走势的问题外,拉加德还可能被问及法国的情况。在提前选举产生悬浮议会后,金融市场对法国财政前景的担忧加剧。

Bloomberg Economics 欧元区高级经济学家大卫·鲍威尔称,“欧洲央行 7 月 18 日的会议将受到投资者的密切关注,以调整对下一次降息时间的预期,尽管本月几乎肯定将维持利率不变。拉加德可能会在 9 月暗示下一次降息,但预计不会太明确。”

拉加德的新闻发布会或将引起更深的共鸣。同样,如果欧洲央行官员出席美联储 8 月底在怀俄明州杰克逊霍尔举行的年度会议,也将引起额外关注。

今年欧洲央行两次利率决议之间相隔 8 周,是管委会自 2020 年疫情最严重的时期以来间隔最长的夏季暂停期。在历史上的大部分时间,该行几乎每月召开一次会议,直到 2015 年才在会议间隙引入更长的间隔期。

在全球其他国家及地区,美国零售销售或出现下滑、英国和加拿大或面临通胀减速,此外印尼、埃及和南非的利率会议也将成为亮点。将于周二发布的国际货币基金组织的最新全球经济预测,将引起投资者的关注。

美国和加拿大

周一,美联储主席鲍威尔将在华盛顿经济俱乐部 (Economic Club of Washington) 接受采访,此前数据显示出通胀放缓的可喜信号。投资者将密切关注蛛丝马迹,即美联储官员是否对价格压力持续放缓具有充足信心从而进行降息。

鲍威尔的活动开启了美联储其他高层官员为期一周的活动,其中包括美联储理事库格勒和沃勒,以及纽约联储银行行长威廉姆斯。

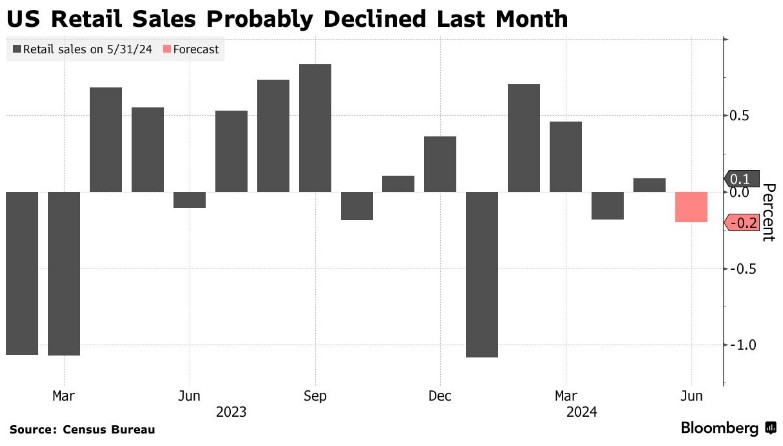

零售销售是美国经济数据日历上的亮点。经济学家预计,6 月销售额将下降,部分原因是网络攻击扰乱了汽车经销商,以及加油站收入下降。

不包括汽车、汽油、食品服务和建筑材料在内的控制组销售预计将放缓。这是一项用于计算国内生产总值 (GDP) 的指标,说明了精打细算的消费者限制可自由支配购买的程度。

周二零售数据公布后的第二天,预计政府将公布 6 月新屋建设数据,从 4 年来的最慢速度略有增长。建筑商受益于转售市场库存减少,尽管需求仍受到高借贷成本的抑制。

同样在周三,美联储将公布 6 月工业生产报告,以及有关美联储 12 个地区经济状况的褐皮书。

与此同时,在加拿大,6 月通胀数据对于指导加拿大央行将于 7 月 24 日做出的利率决定至关重要,尤其是在 5 月出人意料地加速加息后。央行还将公布第二季度消费者和企业调查数据,此外还将获得 5 月零售销售数据和 6 月的初步估计。

亚洲

分析师、投资者和政策制定者正仔细研究最新的季度增长数据和一系列月度数据,中国经济将成为亚洲首要议题。在亚洲其他地区,印尼央行预计将在周三维持利率不变,新西兰将在同一天公布最新的通胀数据,新加坡也将公布出口数据。

马来西亚、日本和印度也将在本周公布贸易数据。吉隆坡将在本周末公布其 GDP 数据。

周四公布的澳大利亚就业增长数据预计将显示新增就业岗位数量减半。

周五公布的数据可能显示,日本 6 月全国物价涨幅料将升至 2.7%,这一结果可能会加剧人们的预期,即日本央行将在本月晚些时候的会议上考虑在削减债券购买的同时进行加息。

欧洲,中东,非洲

在公布的数据中,英国将吸引最多关注。周三公布的最新消费价格数据可能显示,6 月英国服务业通胀连续第五个月放缓,降至 5.6%,仍远高于政策制定者设定的 2% 的目标。该国最新的工资数据将于周四公布,截至 5 月的季度数据显示,常规工资增长率预计将在 20 个月来首次降至 6% 以下。

周三还将举行国王演讲,首相凯尔·斯塔默将利用这一演讲展示新政府为刺激英国经济增长所做的努力。

与此同时,定于周五公布的 6 月零售销售数据可能下滑,同日,英国财政大臣里夫斯 (Rachel Reeves) 将发布上任以来的首次公共财政数据。

本周的数据是英国央行 8 月 1 日决定之前的最后一次重要数据发布,届时官员们将判断是否进行自疫情开始以来的首次降息。

非洲大陆方面,尼日利亚周一公布的数据显示,受奈拉 (尼日利亚货币) 更加稳定的推动,该国 6 月通胀保持在 34% 附近。分析人士预计,从本月开始,部分出于高基数效应,经济增速或开始放缓。

此外,预计将有三次央行利率会议召开。预计埃及周四将把利率维持在 27.25%,尽管通货膨胀率已降至 17 个月低点。印度央行可能会在未来至少几个月里继续保持货币政策紧缩,以进一步遏制该国的生活成本危机。

同日,南非决策者预计也将连续第七次维持利率不变,以控制通胀并限制在最新水平 5.2%。南非央行行长肯亚戈 (Lesetja Kganyago) 曾多次表示,在通胀率稳定在 4.5% 之前,官员们不会降息。央行倾向于将预期与目标通胀挂钩。

考虑到持续的通胀和汇率压力,安哥拉政策制定者周五将连续第三次上调基准利率,当前数值为 19.5%。

拉丁美洲

拉丁美洲的四个主要经济体将公布 5 月的经济活动数据,这是衡量 GDP 的关键指标。由于对经济增长和通胀的持续担忧,央行正密切关注这一指标。

巴西和秘鲁的政策制定者最近暂停了宽松周期,两国将于周一公布经济数据。最近几周,巴西总统卢拉 (Luiz Inacio Lula da Silva) 再次批评借贷成本高企,认为这将对该国构成威胁,而秘鲁两年多来最快的经济增速也促使央行连续第二次决定维持利率不变。

哥伦比亚将于周四公布经济数据,该国第一季经济增速低于预期,促使总统佩特罗 (Gustavo Petro) 呼吁加快降息步伐,但决策者在 6 月底并未理会。

阿根廷将在周四下午紧随其后。由于总统哈维尔·米莱 (Javier Milei) 严厉的削减支出措施打压了消费和经济活动,这个南美第二大经济体在今年年初陷入衰退,经济较 2023 年第四季度萎缩 2.6%。