European stocks fell, while the three major US stock index futures strengthened collectively. Companies under Trump's name surged more than 70% in pre-market trading, and Bitcoin rose by 5%

2/10 年期收益率曲線陡峭程度創 1 月以來最高,30 年期收益率自 1 月 6 日以來首次高於 2 年期。

週一美股盤前,“特朗普交易” 繼續上演!特朗普旗下公司特朗普媒體科技集團大漲逾 70%。美股三大期指普遍上漲,科技股多數走強。

美債收益率曲線趨陡,2/10 年期收益率曲線陡峭程度創 1 月以來最高,30 年期收益率自 1 月 6 日以來首次高於 2 年期。

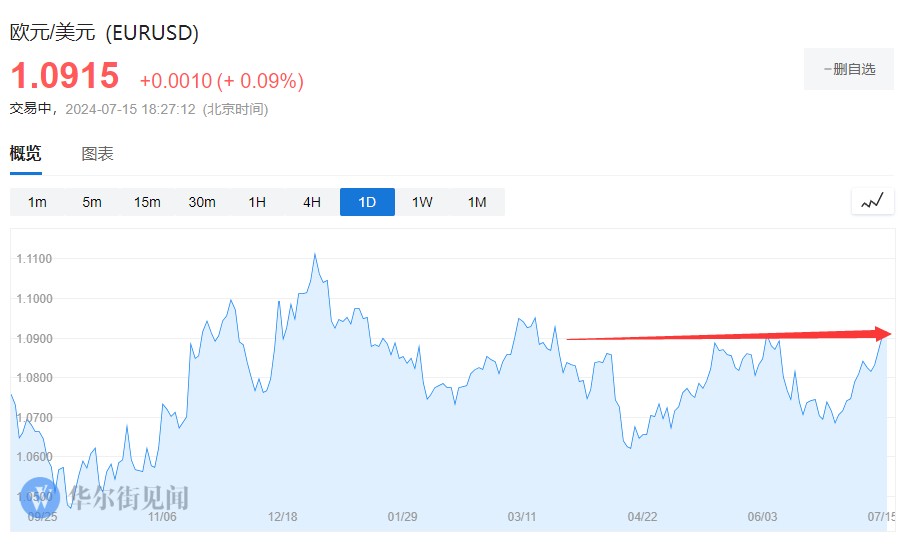

歐洲央行利率決議前,歐股普跌。比特幣大漲 5%,美元、黃金、油價持穩,歐元小幅走高,新興市場貨幣集體走跌。

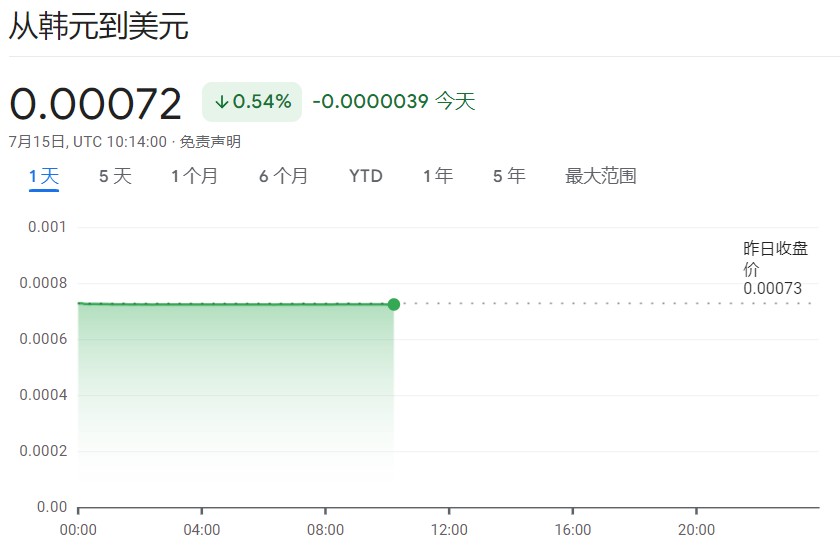

隨着特朗普勝選預期升温,新興市場貨幣普遍承壓。韓元領跌亞洲貨幣,印尼盾和泰銖結束八天連漲,馬來西亞林吉特從 1 月高點回落。墨西哥比索下跌 0.8%,南非蘭特下跌 0.6%。

投資者擔心,特朗普如果當選將提高關税,這可能會加劇通脹壓力,並使美聯儲有更多理由維持限制性貨幣政策。

歐元區 5 月工業產出好於預期,表明歐洲經濟持穩恢復,歐元兑美元漲 0.1% 至 1.0920,創 3 月 21 日以來最高水平。

【以下行情為 16:30 更新】

截止發稿,標普 500 指數期貨上漲 0.35%,道指期貨漲 0.37%,納指期貨漲 0.4%。

歐股集體走跌,歐洲斯托克 50 指數跌 0.34%,德國 DAX 30 指數跌 0.29%,法國 CAC 40 指數跌 0.47%,英國、意大利、西班牙股市均小幅下挫。

美股盤前,特朗普媒體科技集團大漲逾 70%。

據民生宏觀分析,特朗普遇刺後,無論總統還是國會選舉,共和黨的勝率都明顯升高。

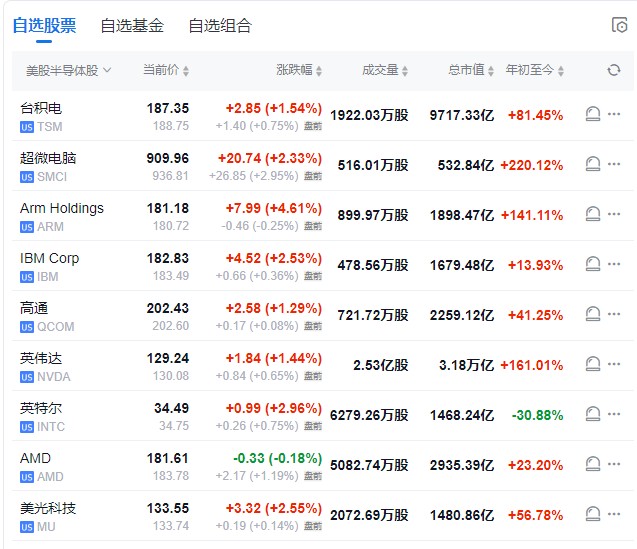

科技股多數上漲,蘋果漲逾 1%,此前摩根士丹利將蘋果評為首選股,目標價從 216 美元上調至 273 美元。超微電腦漲近 3%,AMD 漲超 1%。

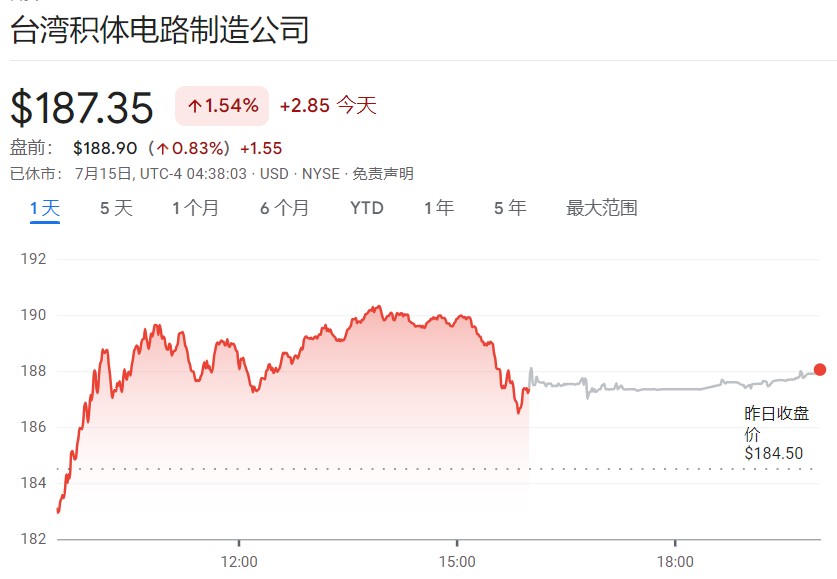

英偉達、台積電均漲近 1%,報道稱,英偉達對台積電的訂單增加了 25%,同時 GB200 顯卡的銷售預估增加了 50%,從 40000 個上升到 60000 個。

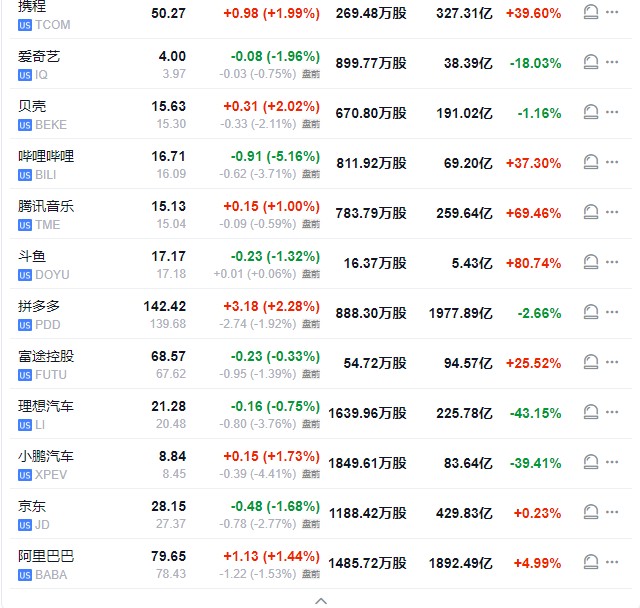

中概股多數下跌,百度跌超 3%,蔚來跌近 3%,小鵬汽車跌超 4%,嗶哩嗶哩跌近 4%。

區塊鏈概念股普漲,Marathon Digital 漲近 7%,Coinbase Global 漲超 6%。

美債收益率曲線趨陡。10 年期美債收益率日內上行 2 個基點至 4.204%,此前一度上行 5 個基點,導致 2/10 年期收益率曲線陡峭程度為 1 月以來最高。

30 年期美債收益率上行 4 個基點,日內超過 2 年期美債收益率,為 1 月 6 日以來首次,後者自 5 月初以來持續下行。

華爾街發現,美國大選過程中,特朗普佔優時,美債收益率曲線將變得更加陡峭。因為市場認為特朗普若上台,將意味着美國通脹的回升以及政府財政赤字的擴大,並導致長期利率攀升。

虛擬貨幣普漲,比特幣 24 小時漲幅超 5%,以太坊 24 小時漲幅超 5%,狗狗幣 24 小時漲幅近 5%。

美元漲幅縮窄至持平。

現貨黃金持穩,日內跌 0.1%。

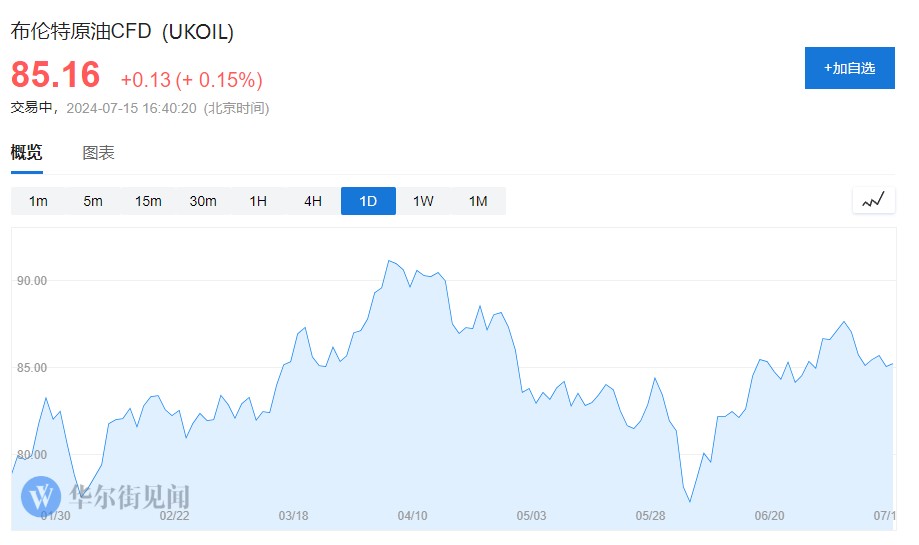

日內油價變動也不大,布油小幅上漲 0.15%。

更新中.....