I can't sell foldable screen phones in the county town

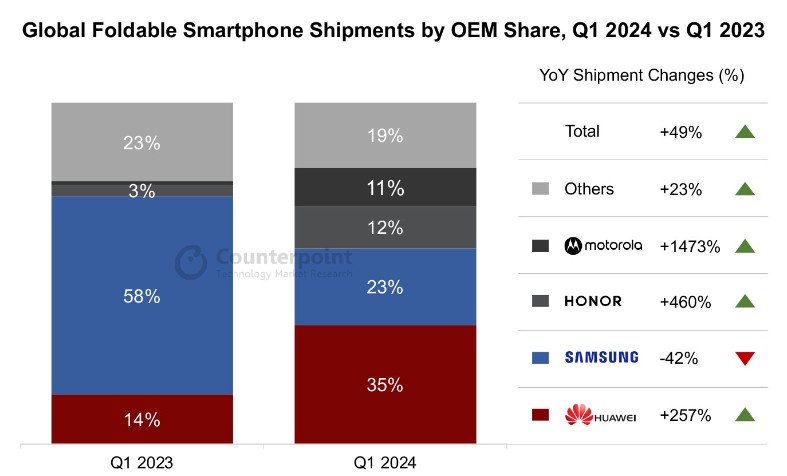

華為、榮耀和摩托羅拉等廠商的摺疊屏智能手機出貨量激增,推動了 2024 年第一季度全球可摺疊智能手機市場同比增長 49%,達到六個季度以來的最高增幅。華為憑藉強大的技術創新能力,出貨量暴漲 257%,超越三星成為全球市場份額最高的廠商。榮耀 Magic V2 成為西歐出貨量最大的可摺疊手機,摩托羅拉 Razr40 成為北美頂級機型。目前智能手機高端需求仍以摺疊屏手機為主,華為和三星即將發佈新款摺疊屏手機,預計將帶動行業訂單需求向上。

編輯 | 楊博丞

題圖 | IC Photo

日前,餘承東和董宇輝兩大頂流強強聯合,科技與文藝碰撞出的強烈火花讓當晚直播間在線觀看人數超 60 萬人,點贊量破億,銷售額衝至抖音帶貨總榜 TOP1。

接近兩個小時的專訪中,餘承東介紹華為突破大量手機和新能源汽車的技術。如在衞星通信領域,華為是業內首家完全隱藏天線的廠商。憑藉強大的技術創新能力,華為摺疊屏系列出貨量激增。

Counterpoint Research 數據顯示,依託大摺疊屏 Mate X5 以及小摺疊屏 Pocket2,2024 年 Q1 華為出貨量暴漲 257%,全球市場份額較去年同期提升 19%,超越三星,全球出貨量 TOP1。

不僅僅是華為,榮耀 Magic V2 成為西歐出貨量最大的可摺疊手機,摩托羅拉 Razr40 成為北美頂級機型,全球市場份額均有明顯提升。華為、榮耀、摩托羅拉等廠商出貨量的激增,讓 2024 年 Q1 全球可摺疊智能手機市場同比增長 49%,創下六個季度以來的最高增幅。

圖源:Counterpoint Research

供應鏈從業者表示,目前智能手機高端需求仍以摺疊屏手機為主,三星已率先發布全新 Galaxy Z 系列,包括 Galaxy Z Fold6 以及 Galaxy Z Flip6。今年 Q3,華為或將發佈 Nova 系列摺疊機以及三屏摺疊機,預期有望帶動行業訂單需求向上,整體動能略優於原有基本盤。

圍繞摺疊屏手機,廠商逐漸衍生出兩種不同的技術路徑。以榮耀為代表的廠商,主打輕薄路線。如 Magic V2 以 9.9mm 的機身厚度將摺疊屏手機厚度縮減至毫米時代,Magic V3 以 9.2mm 摺疊態機身厚度,刷新內折摺疊屏最薄紀錄。

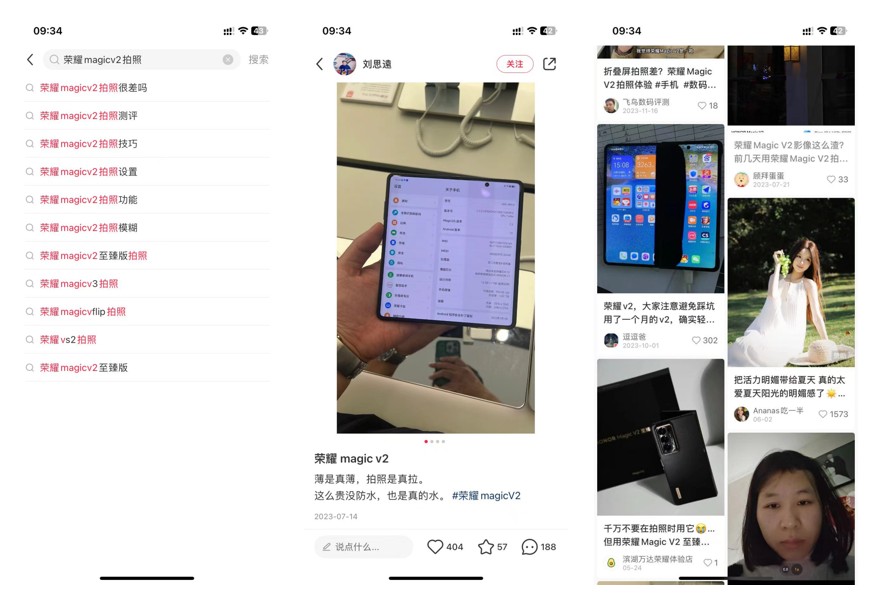

但榮耀過於追求輕薄的代價則是部分性能的欠佳。以榮耀 Magic V2 影像為例,在小紅書平台上,不僅衍生出 “榮耀 Magic V2 拍照很差嗎?”“榮耀 Magic V2 拍照模糊” 等相關搜索詞條,不少 Magic V2 用户稱其拍照模糊、拉胯。

圖源:小紅書

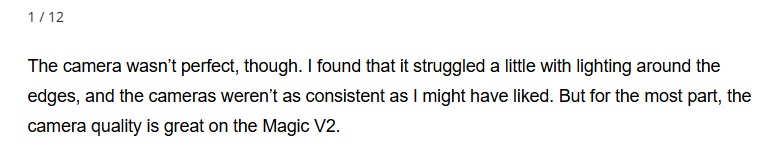

在海外市場,測評博主 Christian de Looper 稱,榮耀 Magic V2 雖在大多數情況下相機質量較好,但不僅邊緣照明表現欠佳,且無法達到相機拍照水平。

圖源:BGR

IDC 中國高級分析師郭天翔指出,“輕薄” 已成為影響消費者選擇摺疊屏手機的首要因素。但若是一味追求 “輕薄” 而造成可靠性下降,將會直接影響消費者未來長期的選擇。

基於此,以小米、OV 為代表的廠商更加追求影像,而非輕薄。以 vivo X Fold3 為例,京東平台關於該機型中差評數量雖在 180+,但很少有用户吐槽該機型的影像。

圖源:京東

當前廠商兩種技術路線看似有所差異,但本質均是向現實妥協的 “折中方案”。摺疊屏手機對廠商技術創新能力要求極高,需廠商投入高額研發費用,且能接受長期帶來的虧損。榮耀 CEO 趙明稱,榮耀在摺疊屏領域歷史累計虧損已達到二三十億元。

可當摺疊屏手機價格無法下探,歷經 5 年時間發展的摺疊屏手機,在國內縣城市場滲透到底如何?下沉市場又能否為摺疊屏手機貢獻更多增量?

帶着這些問題,DoNews 實地走訪安徽省阜陽市和河南省周口市的多個縣級市和鄉鎮,試圖還原摺疊屏手機在下沉市場的真實面。

一、摺疊屏手機膜和殼,三年賣出十個

2024 年全國高考塵埃落定,廠商為抓住大一準新生購機帶來的市場機遇,紛紛推出以舊換新、憑準考證購機立減 XX 元等促銷活動,這對廠商線下門店客流量的確有所拉動。

圖源:DoNews

在這波學生購機潮中,廠商線下門店以及合作的迪信通、運營商門店,普遍存在這樣一個現象:即學生和學生家長在聽完門店店員介紹摺疊屏手機的配置、重量、拍照、AI 等優勢後,雖會對門店樣機進行試玩體驗,但當聽到店員報價摺疊屏手機動輒六七千元,甚至過萬的價格後,普遍會選擇去看大直板手機。

門店店員對這種情況早已司空見慣,往往不會浪費太多時間在摺疊屏手機上,還是會重點給學生和學生家長推薦傳統直板手機。且願意和學生家長討價還價,進而促成交易。

甚至有學生家長在聽完店員的介紹後,更是發出一連串的 “抱怨”。來自安徽省臨泉縣的消費者胡強告訴 DoNews,前兩天和自家孩子看完 OPPO Find N3 系列,12GB+512GB 配置即使用准考證購機也要 8000 多元,但如此昂貴的價格卻沒有高性價比。

一是店員説這款手機重量僅有 245g,但 245g 和 300g,放到口袋中以及日常使用時,很難體會到重量差異。且自己感覺這種摺疊屏手機除展開後比大直板手機屏幕要大,其他和傳統直板手機沒有太大差異。

二是店員説這款手機拍照有多麼厲害,但自己使用三四千元的 OPPO 其他機型拍照也還可以。買手機重點是不卡頓能多用幾年,無需追求那些 “華而不實” 的東西。

三是按照 OPPO Find N3 這個售價,可給自家孩子購買兩三千元兼具性能和拍照的大直板手機、配置中上等的筆記本電腦以及平板,這就相當於買一部手機的錢能買三件產品。雖然自家在當地做生意並不差錢,但老百姓過日子還是要把錢花在刀刃上。

胡強的話實則也是廠商需要思考的問題。一方面,廠商卷 “輕薄” 將摺疊屏手機重量愈做愈輕,這雖能提高客户體驗,但幾十克的重量差異,消費者真能感知出來嗎?同理,當廠商圍繞大直板手機不斷提高配置和影像時,摺疊屏手機和大直板手機影像真正差異在哪?終端消費者能否感知?

另一方面,不管是廠商基於穩定市場份額、清庫存選擇降價,還是京東、天貓為爭奪 3C 產品市場份額選擇降價補貼,再或是線下渠道為搶奪客户、完成銷售 KPI,給顧客低於廠商官方真實的成交價,這讓大直板手機的價格持續下探。

且大直板手機很多功能被消費者閒置,使用率不高。那麼廠商到底要以何種差異化功能,才能説服更多終端消費者為摺疊屏手機的高價買單呢?

當眾多縣城消費者做出和胡強類似選擇時,也讓摺疊屏手機在我們走訪十幾個縣城中銷量極其慘淡,在縣城大街、公園、大型超市和沿街門店顧客付款時,我們幾乎看不到有消費者使用摺疊屏手機。

圖源:DoNews

在很多鄉鎮運營商門店中,當我們詢問門店是否有摺疊屏手機時,得到的答案均是沒有人購買,門店沒有現貨,需要從縣城或外地調貨。

摺疊屏在縣城遇冷,衍生出的相關產業鏈生意也相對慘淡。河南省周口市鹿邑縣某手機維修店老闆趙麗表示,從 2015 年從事手機維修至今,這幾年來門店維修摺疊屏手機的顧客,加起來不超過 20 人。且這些消費者聽到維修摺疊屏手機動輒兩三千的價格後,不少都選擇放棄維修,繼續購買大直板手機。

趙麗的話在安徽省阜南縣手機貼膜店老闆朱明這裏同樣得到印證,朱明告訴我們,縣城手機門店銷售説摺疊屏在我們縣城賣得有多好我不知道,但我只知道摺疊屏手機在縣城根本賣不動。

從 2021 下半年自己就在當地人流量較大的步行街擺攤貼膜、賣手機殼至今,這三年時間賣出去的手機殼、給顧客貼膜的手機加起來有幾萬個。但印象中帶着摺疊屏手機來貼膜或買手機殼的顧客,加起來絕對不超過十個人。

圖源:DoNews

或許隨着 UTG、鉸鏈、面板等關鍵部件標準化後實現大規模生產,以及隨着摺疊屏手機出貨量增加,進而帶動廠商研發邊際成本下降和麪板廠商生產下降,最終有望實現摺疊屏手機成本下探。但即使成本下探,縣城特有的社會運行規則,讓縣城能否為摺疊屏手機貢獻更多增量,仍有待商榷。

二、縣城缺乏 “種子用户”

賈樟柯在《賈想》中寫道,“縣城裏的生活,今天和明天沒有區別,一年前和一年後同樣沒有區別。……生命對他們來説到這個地方就不會再有奇蹟出現,不會再有可能性,剩下的就是在和時間作鬥爭的一種庸常人生。”

縣城生活 “安逸” 的背後,一方面,國內很多中西部縣城仍以傳統產業為主,中老年佔比較高,年輕人外流嚴重導致新興產業不足。就業機會有限,縣城人更愛考編。

縣城消費者思維更加保守,讓縣城消費者更青睞原有認知中的事物,對新興事物接受不足。基於此,縣城新能源汽車市場更多是被奇瑞、五菱宏光、比亞迪等傳統車企瓜分,新勢力滲透不足。

圖源:DoNews

另一方面,年輕人回流、縣城多地開通高鐵、以抖音、快手為代表的短視頻加速滲透打破了縣城和高線城市的信息差,但購買類似汽車、房子、摺疊屏手機等高價產品時,縣城消費者更喜歡詢問身邊親朋好友的真實使用感受或聽取他們的意見,而非是互聯網平台上的測評博主。

且縣城很多新興事物的發展基本呈現出:廠商收割第一批縣城種子用户→種子用户在自我關係網中擴大→種子用户親朋好關係網中繼續擴大→從縣城複製到鄉鎮和農村→最終形成穩定銷量和品牌知名度。

大直板手機、微信支付、抖音團購、九號電動車在縣城的滲透過程,均符合該發展過程,這既是當前摺疊屏手機在縣城滲透率不足的原因,也是未來摺疊屏手機提高縣城滲透的重要阻力。

更進一步來看,展開後更大的摺疊屏能夠方便辦公。但一方面,縣城很多消費者主要從事傳統體力勞動,且縣城很多企業管理制度、實際辦公並不像高線城市那樣完善,摺疊屏手機缺乏現實尋求。

另一方面,縣城體制人羣使其更青睞華為摺疊屏手機。不僅僅是體制內人羣,來自安徽省太和縣某手機店的銷售李娜表示,當地四十多歲的老闆們來門店購買摺疊屏時,即使店員會推薦 OV、榮耀相關摺疊屏手機,且這些機型也有現貨,但這些老闆往往還是會選購華為摺疊屏系列。

除這些老闆們更信賴華為技術外,華為摺疊屏某種意義是他們圈子內的 “身份證”。換言之,華為摺疊屏的社交屬性遠高於實際使用屬性。但因縣城這些老闆們處在縣城尖子塔上人羣相對較少,整體出貨量有限。

如李娜所言,縣城夠小,小到人與人之間總有千絲萬縷的關係,縣城也夠大,這裏有一個社會體系必備的所有要素。

在 “小” 和 “大” 之間卻是縣城熟人體系下有着清晰的運行規則,縣城消費者遠比高線城市消費者更追求面子,更喜歡通過高端商品來彰顯社會地位和社會認同。這正是新勢力豪華品牌難以下沉,縣城消費者更青睞 BBA 的深層次原因。

《走走停停》電影結尾主角父親曾説,我們這一代人,很多人都沒有成為自己想成為的那類人。生活就是那樣,沒有那麼好也沒有那麼糟糕,習慣了就好。

當華為摺疊屏成為縣城真正核心高端人羣的社交名片時,其他安卓品牌想要真正教育、改變這部分人羣的心智,面臨的挑戰可想而知。這既是帶動未來華為摺疊屏銷量繼續增長的關鍵因素,也是其他廠商想要提高縣城摺疊屏出貨量的難題。

三、年輕人多被蘋果收割

當其他廠商品牌力無法融入縣城四十歲以上高端人羣時,發力 “有錢有閒” 的小鎮青年人羣和 “縣城貴婦” 人羣,似乎成為其他廠商的明智之舉。

中國社會科學院社會學研究所副所長王春光曾指出,縣城還保留富有本地特色的社會形態和生活方式,即使是蘇南地區那些富裕的縣級市,房屋馬路都和城市相似,但他們內部的生活方式,比如社交方式、飲食習慣、居住方式、對婚姻和子女問題的處理,都依然保持着自己的特色。

對於縣城父母而言,子女結婚是他們人生中的大事。在父母給到的催婚壓力下,留在縣城中的女性往往會過早地結婚生子。家庭帶來的壓力,讓她們更關注手機綜合性價比,更青睞大直板手機。

廠商圍繞小摺疊屏手機或主打顏值,或推出如 AI 人臉檢測、萌寵等功能,或能打動部分 “縣城貴婦” 的心。但正如上文所述,“縣城貴婦” 父母在縣城佔比本就極低,這也影響到小摺疊屏手機在縣城的出貨量。

除縣城年輕女性外,縣城年輕男性對摺疊屏青睞程度也有限。來自河南省周口市項城市的消費者胡楊告訴我們,今年 7 月份看過不少廠商的摺疊屏手機發現,一方面,縣城很多消費者對 OV、榮耀、小米的品牌心智仍停留在性價比而非高端,這就意味着購買高價摺疊屏手機無法帶出去裝 X。

另一方面,當品牌力無法支撐起高端定位時,廠商需要有現象級功能。但輕薄、影像、展開後屏幕更大,似乎很難讓身邊人為之驚歎。如影像技術,在被小紅書精修照片、AI 生成照片和視頻衝擊下,拍照和個人技術、審美有關,購買接近萬元摺疊屏手機拍照發朋友圈,不一定有人會認為照片有多麼驚豔。基於此,同樣的價格最終還是購買 iPhone 15 相關機型。

胡楊最終選擇 iPhone 15 系列的背後,正是蘋果高端定位在縣城消費者心智中的強滲透,以及蘋果系統流暢性、無廣告帶來的強復購。且正如上文所述,縣城的封閉和保守、熟人社交網絡對消費者購機決策的影響,讓蘋果正瘋狂收割 “10 後” 少年。

來自安徽省阜陽市某縣蘋果門店銷售人員周毅告訴我們,今年 6 月 8 日高考結束當天,門店內湧來大批高考考生,當天他們直接加班到晚上 10 點。6 月 24 日安徽省高考出分當天以及後來的幾天,店內同樣不缺顧客,更有豪橫的家長直接給孩子購買蘋果三件套,用以獎勵孩子。

但蘋果高端機型收割的不僅僅只有 “05 後”,在智能手機成長爆發起來的 “10 後”,同樣被蘋果收割。來自河南省沈丘縣初三學生張子涵告訴我們,中考結束第二天就要求父母給其購買蘋果手機。父母以蘋果手機太貴、後面讀高中玩手機耽誤學習婉拒。

無奈之下,自己直接拿出自己 1800 元的壓歲錢去購買 iPhone 13 二手機。對於為何非要買蘋果?張子涵表示自己同學都在用蘋果,自己不買的話,顯得不合羣。

結語:

故事感、真實感、煙火氣、鄉愁、落葉歸根等一系列文藝和誘人的詞語的背後,卻是國內縣城有着獨有的生存法則。這套法則下,摺疊屏如何針對縣域市場推出更多有針對性的打法和營銷策略,如何和縣域經銷商和渠道商聯動,進而加速摺疊屏在縣域市場的滲透,均是廠商技術之外的長期課題。

注:應被訪者要求,文中均為化名。