"Rate Cut Trade" & "Trump Trade" Lead the Way as Small-cap Stocks Rise Strongly, While Commodities Fall Across the Board | Overseas Major Asset Weekly Report

I'm PortAI, I can summarize articles.

美股市場行情 “大切換” 持續上演,投資者加速逃離大型科技股。“特朗普交易” 令市場擔憂通脹重燃,美國長債收益率承壓並推高美元,大宗商品多數下行。

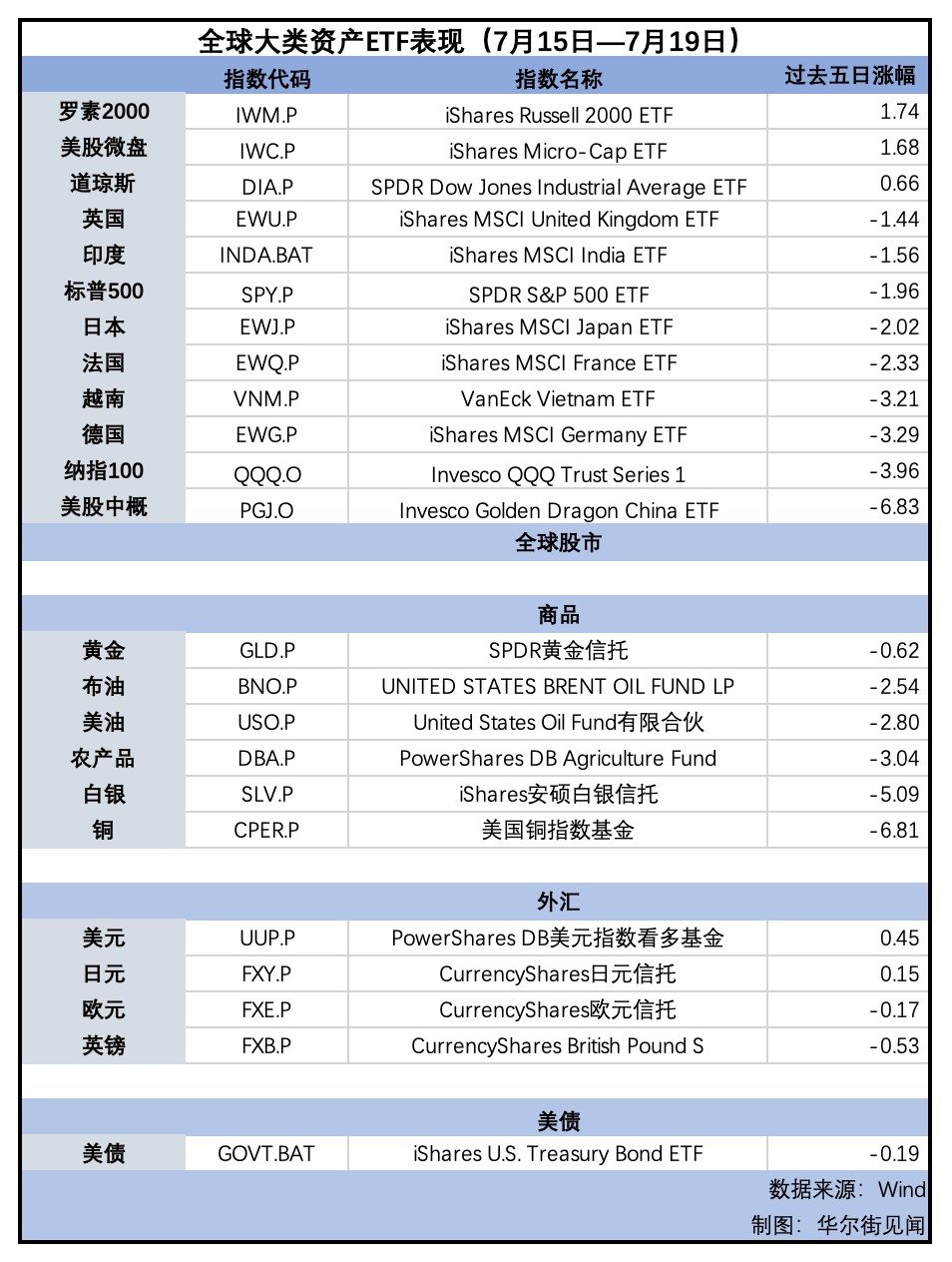

7月15日—7月19日當週,受“降息交易” 和 “特朗普交易” 影響,美股市場行情“大切換” 持續上演。投資者加速逃離大型科技股,小盤股成全場焦點。

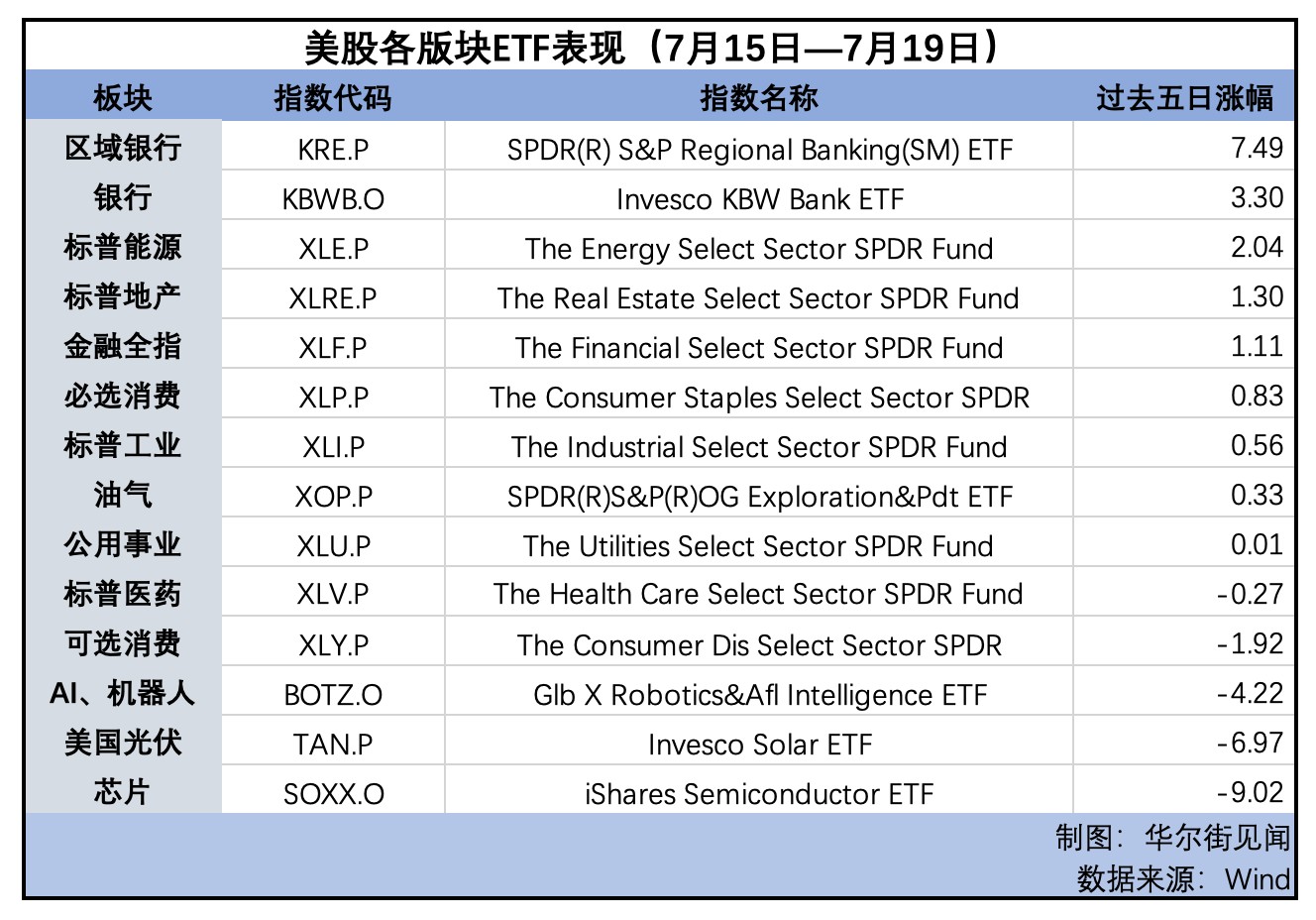

本週標普500大盤和納指分別跌約2%和3.7%,創三個月最差單週表現。納指止步六週連漲,其中芯片股成“重災區”全周跌近9%。相比之下,道指和小盤股指羅素2000則分別累漲0.7%和1.7%。有市場分析稱,在降息預期提振和盈利逐漸回升的背景下,小盤股有望持續受到提振。

在商品方面,由於“特朗普交易” 令市場擔憂通脹重燃,美國長債收益率承壓並推高美元,疊加巴以停火協議有望達成,油價全周跌超2.5%,美油一度失守80美元創一個月新低。

倫銅全周跌5.7%為2022年以來最差。美元及美債收益率攜手走高壓低貴金屬價格,黃金無緣四周連漲。

美元三週來首次周漲,非美貨幣普跌。歐元兑美元本週累跌 0.23%,英鎊兑美元本週累跌 0.57%。但日元兑美元周內曾觸及六週高點。根據日本央行公佈的每日操作數據,日本政府上週可能進行了總額接近 6 萬億日元的干預。

美債收益率本週全線上行,2 年和 10 年期美債收益率本週累漲約 6 個基點。

芯片板塊本週領跌美股,區域銀行指數連漲數個交易日創一年多最高。