The automotive industry is weak, NXP Semiconductors' third-quarter revenue guidance is not good, and it fell more than 8% after hours | Financial Report

二季度恩智浦營收同比降超 5% 符合預期,汽車業務收入降超 7%。三季度恩智浦營收指引中值低於預期,營收可能最大降超 8%,較二季度加速下滑。

荷蘭半導體芯片設計與生產商恩智浦上季度的營收符合預期,但本季度營收下滑程度超預期,凸顯了公司主打業務受到汽車行業需求放緩以及地緣政治風險增加的影響。

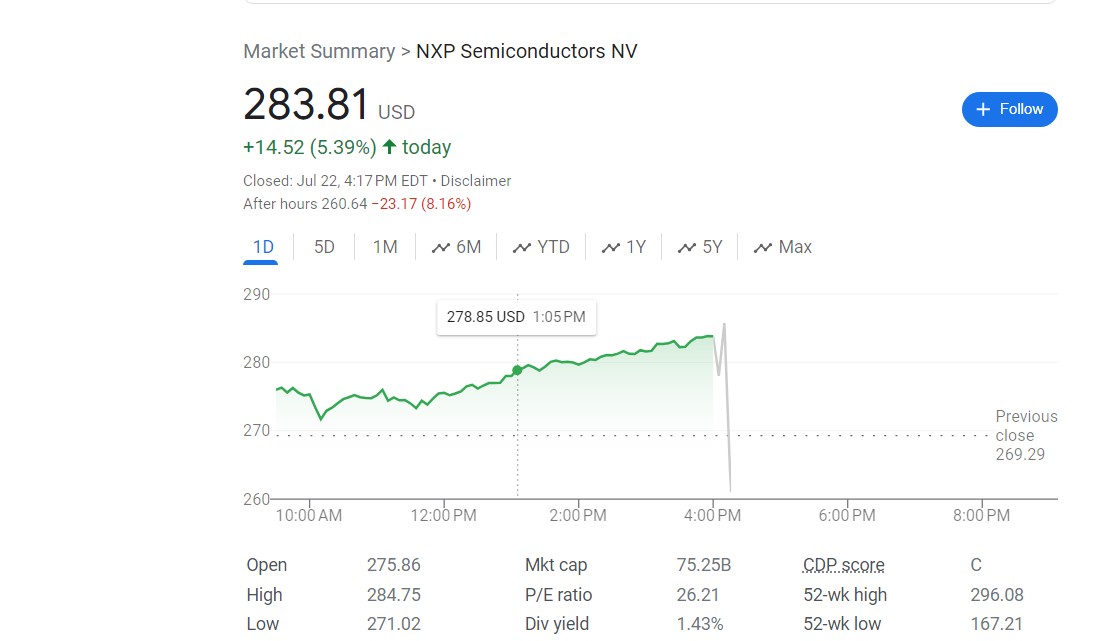

7 月 22 日週一美股盤後,在納斯達克上市的恩智浦美股在公司財報公佈後跳水。原本週一股價收漲約 5.4%,盤後一度跌超 8%。

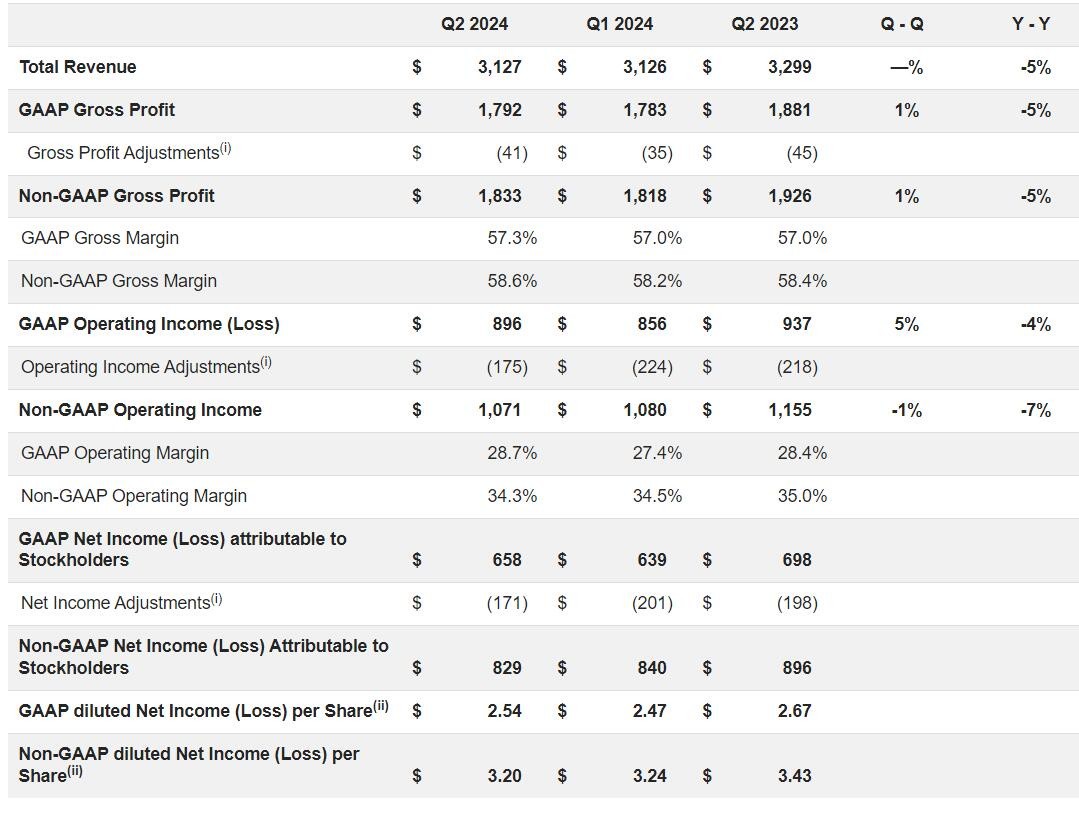

恩智浦公佈財報顯示,截至 6 月末的今年第二季度,公司營收 31.3 億美元,同比下降 5.2%,大致符合分析師預期,一季度同比略為增長近 0.2%;當季非 GAAP 口徑下稀釋後每股淨利潤為 3.20 美元,同比下降 6.7%,環比下降 1.2%,也符合預期。

非 GAAP 口徑下,恩智浦二季度的毛利為 18.33 億美元,同比下降 5%,毛利率為 58.6%,略高於去年同期的 58.4%;非 GAAP 口徑下,營業利潤為 10.71 億美元,同比下降 7.3%,營業利潤率為 34.3%,低於去年二季度的 35.0%。

分業務看,恩智浦最大收入源汽車業務二季度營收 17.28 億美元,同比下降 7.4%,降幅遠超一季度的 1.3%,體現了汽車行業疲軟的形勢。

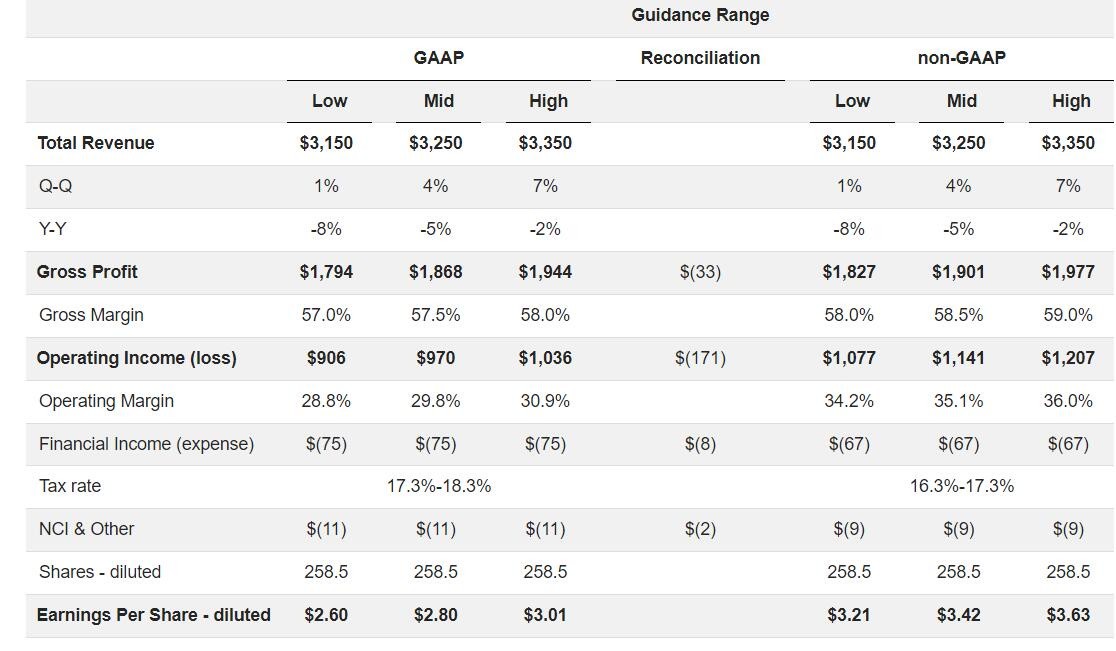

業績指引方面,恩智浦預計,非 GAAP 口徑下,三季度的營收在 31.5 億至 33.5 億美元,中值 32.5 億美元,而分析師預期位於指引區間的高端 33.5 億美元。以這一指引估算,三季度恩智浦營收可能加速下滑,最大同比降幅將近 8.2%,最小降幅超過 2.3%。

GAAP 口徑下,三季度稀釋後每股盈利(EPS)為 2.60 至 3.01 美元,同比零增長或下降 13.6%,整個區間都低於分析師預期的 3.09 美元。

非 GAAP 口徑下,恩智浦預計三季度調整後營業利潤 10.77 億至 12.77 億美元,中值 11.41 億美元,也低於分析師預期的 11.7 億美元。

非 GAAP 口徑下,恩智浦預計三季度調整後毛利潤率為 58% 至 59%,中值持平分析師預期的 58.5%。

NXP Semiconductors 的 CEO Kurt Sievers 在發佈財報後表示,憑藉公司二季度的業績和三季度的指引,恩智浦已成功渡過業務的週期性低谷,我們預計將恢復季環比增長。

有評論質疑 Sievers 的説辭,稱目前還不相信恩智浦增長的故事,Sievers 所説的這個週期性低谷的背後是什麼?他們將如何保持勢頭?

二季度恩智浦傳出繼續發力打造汽車生態的消息。5 月在中國舉行的恩智浦汽車生態技術峯會上,恩智浦透露,正在加速中國汽車生態構建,聯合各方共同推動未來汽車創新。

恩智浦已在中國建立汽車電子應用技術能力開發中心,以更主動地圍繞中國客户需求進行技術研發。此外,繼在天津設立人工智能應用創新中心之後,恩智浦還在今年 4 月啓動了人工智能創新實踐平台雲實驗室。後者為恩智浦半導體全球首個全線上實驗室。

根據規劃,恩智浦將藉助雲實驗室助力中國客户和合作夥伴,特別是中小企業客户發掘增長動能,以全球化資源、前瞻性視角和系統級思維加速他們的產品開發和創新成果落地

6 月,恩智浦宣佈與德國汽車零部件公司 ZF Friedrichshafen AG(ZF)合作,共同開發用於電動汽車 (EV) 的下一代 SiC 牽引逆變器解決方案。ZF 將採用恩智浦先進的 GD316x 高壓隔離柵極驅動器,加快讓下一代純電動汽車採用 800-V 和 SiC 功率器件。

同在 6 月,恩智浦與 Vanguard International Semiconductor Corp.宣佈,計劃成立一家合資製造企業 VisionPower Semiconductor Manufacturing Company Pte Ltd (VSMC),該公司將在新加坡建造一座 300 納米半導體晶圓生產廠。該合資工廠將支持 130 納米至 40 納米混合信號、電源管理和模擬產品,面向汽車、工業、消費和移動終端市場。恩智浦計劃,合資公司將獲得台積電授權的底層工業技術。