Consumer spending remains sluggish under high interest rates, with South Korea's Q2 economy unexpectedly contracting by 0.2%

韓國第二季度經濟意外萎縮 0.2%,消費者支出持續低迷。這加大了政策制定者面臨的挑戰,可能促使韓國央行降息。儘管韓國政府和央行對 2024 年的增長預測仍然積極,但該報告顯示國內需求疲弱,私人消費下降,政府支出增長。長期增長潛力惡化,投資萎縮。韓國經濟依賴於全球人工智能發展和半導體制造商的出口增長,特別是存儲芯片。投資計劃可能會進一步推遲,韓國央行指出機械設備和建築投資導致投資減少。

智通財經 APP 獲悉,上季度,韓國經濟在年初超預期增長後再次出現逆轉,這加大了政策制定者在努力刺激投資和消費之際面臨的挑戰。

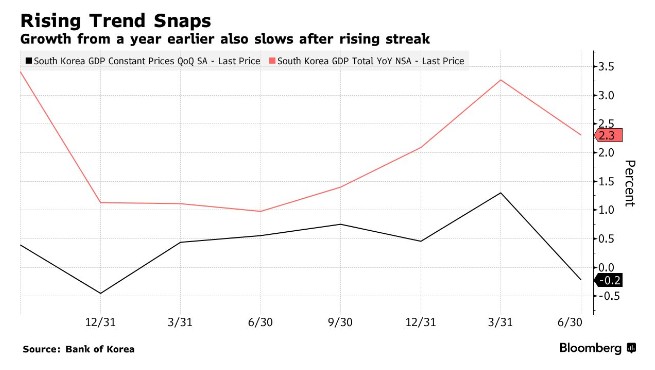

韓國央行週四表示,截至 6 月份的三個月內,韓國國內生產總值 (GDP) 較上一季度萎縮 0.2%,這一數據低於經濟學家普遍預期的增長 0.1%。

這一意外萎縮可能會增加要求韓國央行降息的呼聲,但不太可能立即採取行動。在此之前的 1-3 月季度,經濟的快速增長加劇了這種疲軟,目前,韓國央行的重點是確保不會發出短期政策寬鬆的信號,從而在無意中刺激家庭債務的進一步增加。

韓國政府和央行已經上調了對 2024 年的增長預測,這表明他們認為第二季度的結果更多地是邁向持續擴張道路上的一個減速帶,而不是趨勢正在轉變的警告信號。

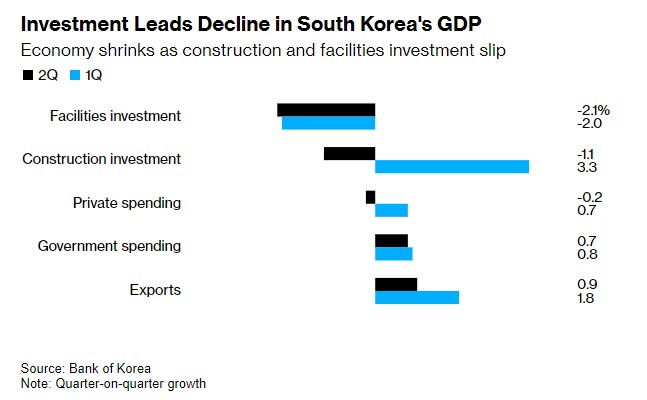

儘管如此,該報告仍突顯了國內需求的疲弱。與上一季度相比,私人消費下降了 0.2%,而政府支出增長了 0.7%。實際出口增長 0.9%,設施投資下降 2.1%。

Woori Finance Research Institute 首席經濟學家 Kwon Young-Sun 表示:“真正令人擔憂的是投資萎縮,這預示着長期增長潛力的惡化。” 他指出,如果企業等到 11 月美國大選之後,投資計劃可能會進一步推遲。

韓國央行在聲明中表示,包括芯片製造設備在內的機械設備導致了投資的減少。建築投資在上一季度意外增長 3.3% 後收縮 1.1%。

消費者支出的持續低迷表明,強勁的外部需求並沒有推動經濟整體走強。

全球人工智能發展的熱潮推動了韓國的發展,韓國擁有三星電子 (SSNLF.US) 和 SK 海力士這兩家全球最大的半導體制造商。尤其是存儲芯片引領了韓國出口的增長,推動韓國第一季度經濟增長 1.3%,是經濟學家預測的兩倍多。

貿易數據顯示,在 4 月至 6 月期間,由技術引領的出口反彈持續,並可能持續到本季度。7 月前 20 天半導體出貨量同比增長 50% 以上,支持了央行的預期,即芯片反彈可能會持續到明年上半年。

Bloomberg Economics 的一個模型顯示,韓國現在需要在下半年比前六個月增長約 0.8%,才能實現 2024 年 2.5% 左右的中期目標。

消費是今年下半年經濟的關鍵,因為在利率上升和消費者通脹持續的情況下,私人支出仍然低迷。

對於韓國央行可能在 8 月還是 10 月降息,經濟學家大多意見不一。當局將政策利率維持在 3.5% 的限制性水平已達一年半。韓元兑美元的疲軟是央行對過早降息持謹慎態度的一個因素,因為進一步的貨幣疲軟將增加食品和能源進口的成本。

今年年初的經濟勢頭強於預期,這給了韓國央行另一個在調整政策方面保持謹慎態度的理由,因為當局從半導體繁榮中獲得了信心,韓國越來越依賴半導體來度過包括新冠疫情在內的經濟挑戰。

Pantheon Economics 研究員 Kelvin Lam 在 GDP 發佈前的一份報告中表示:“與此同時,由人工智能驅動的強勁出口增長應該會支撐經濟增長,並讓央行有更多空間在政策轉向上採取更慎重的方法。”

隨着韓國生育率繼續刷新世界最低紀錄,該國還發現自身正處於另一個長期經濟活力面臨風險之中。由於預計每名婦女平均生育孩子 0.72 個,韓國面臨着勞動人口以世界上最快的速度萎縮的前景,因此該國正更積極地轉向自動化和人工智能,以緩衝人口老齡化的影響。

包括 Benson Wu 在內的美國銀行經濟學家在一份報告中表示:“我們認為,人工智能可以在不損害現有勞動力市場的情況下繼續推動韓國的長期增長。人工智能發展帶來的整體生產力增長可能是未來幾年韓國經濟增長的潛在驅動力。”

在短期內,韓國需要解決對信貸風險的持續擔憂,因為信貸風險給建築業蒙上了陰影。建築業是韓國 GDP 的關鍵組成部分。除了原材料成本不斷上漲外,由於利率居高不下,開發商難以償還債務。

在暖冬幫助鼓勵了投資之後,該行業第一季度的產出出現了意外增長。渣打銀行韓國有限公司經濟學家 Chong Hoon Park 表示,未來幾個季度情況可能不再如此,他預測第二季度將出現環比收縮。

Bloomberg Economics 經濟學家 Hyosung Kwon 表示:“GDP 數據清楚地表明,國內外都潛藏着增長風險。在陷入困境的房地產市場,重組將如何發揮作用存在很大的不確定性。與此同時,美國經濟降温可能會減緩對計算機芯片的需求,而我們曾將其視為韓國今年的主要增長動力。”