Exclusive from Zhitong | Yu Minhong and Dong Yuhui "amicably part ways", who wins, who loses?

东方甄选宣布董宇辉离职,导致股价大跌 27%。董宇辉是千里马,但与俞敏洪关系裂痕根源在于俞敏洪非伯乐。董宇辉的离职引发了抖音号粉丝数量的上涨。此外,公司还将以 7658.55 万元的价格出售给董宇辉的公司,并向其提供免费的信息系统,以维持其正常运营。

昨日东方甄选 (01797) 官宣董宇辉离职之后,晚上 7 点钟左右,与辉同行的抖音号粉丝数 2149.5 万;到了晚上 11:50,与辉同行粉丝数量已经达到 2159.6 万,涨粉超过 10 万。同时间段内,东方甄选的粉丝数量下跌约 1 万。

美股新东方 (EDU.US) 昨夜盘前大跌,正式开盘后稍有抵抗,后一路走低,最终收报 70.33 美元,跌幅 5.46%。

今日港股开盘,东方甄选大跌 27%。

不少明智的朋友早就预料到了董宇辉与俞敏洪的分道扬镳。

关系裂痕的根源,在于董宇辉是千里马,而俞敏洪非伯乐。在那一群看起来都差不多的奔跑的 “马” 中,董宇辉的特别,并不是由俞敏洪慧眼识别的,而是直播间前的消费者们慧眼识别的。

无论他们的关系,最终更接近于哪种类比(似董卓与曹操?还是孔子与子贡?),大概率都不可能是巴菲特与芒格了。

一,转让的制度安排猜想?

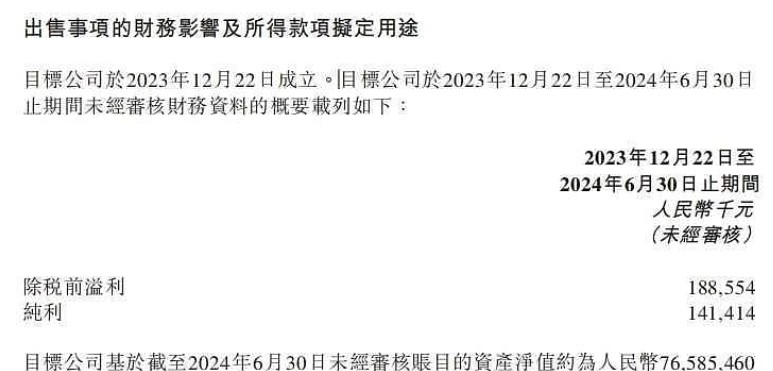

根据公告,7 月 25 日,董宇辉(买方)、北京新东方迅程网络科技有限公司(卖方)及与辉同行(北京)科技有限公司(目标公司)订立出售协议,据此,卖方同意出售,而买方同意收购目标公司的 100% 股权,代价为人民币 7658.55 万元。

除向董宇辉悉数支付所承诺的福利及补偿外,董事会主席俞敏洪已寻求董事会及董事会薪酬委员会批准将与辉同行的所有余下未分配溢利分派予董宇辉。此外,根据上市规则及本公司组织章程细则,俞敏洪已就董宇辉收购与辉同行的结算代价作出安排。为维持与辉同行的正常运营,公司将向与辉同行免费提供自主研发的信息系统。东方甄选称一年期间不时在公开市场购回价值不超过 5 亿元的公司股份。

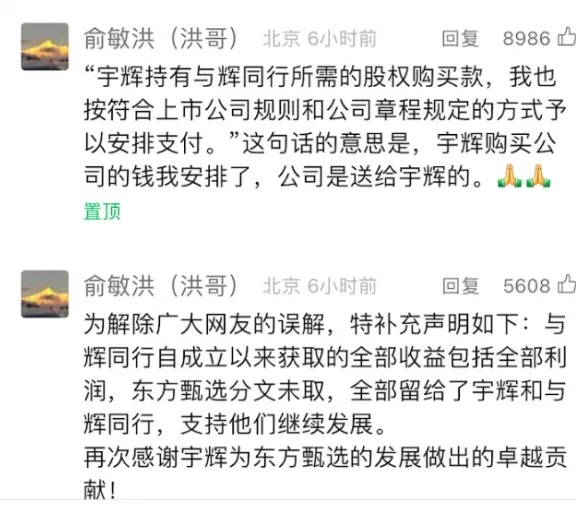

在《致东方甄选股东朋友的一封公开信》文章后面,俞敏洪的微信号推了两条置顶的留言,作为对这个安排的解释:

但是单靠这些文字,解除不了 “广大网友的误解”。至少还有三个层面上的质疑声音:

一是:俞敏洪简直是鸡贼中的战斗机。赵云和阿斗长坂坡杀个七进七出,董宇辉是赵云,与辉同行是阿斗,你让阿斗自己去杀个七进七出试试?现在所有人都在说俞敏洪把东方甄选核心资产送给董宇辉了,但是核心资产本来就是董宇辉这个人,所谓的与辉同行刨去董宇辉一文不值,董宇辉可以裸辞直接出去自己成立公司,那么与辉同行还有任何价值么?俞敏洪现在来这么一出,以后董宇辉就永远打上东方甄选核心资产的标签了,甭管干多成功都会有人在后面说这是俞敏洪送的。董宇辉与其接收与辉同行,还不如把这个直播间留给俞敏洪,也别要他的钱和什么信息系统,带着兄弟们裸辞,市场上有的是钱和供应商,从零开始做不会比接受所谓的核心资产差,但是以后不会被人戳脊梁骨了。

二是:董宇辉买股份不够的钱是俞敏洪 “安排” 的,信息系统是无偿提供的,最后 “与辉同行” 真的是董宇辉的个人私产,还是本质上成为了俞敏洪的体外资产,谁说得清楚呢?

三是:与辉同行可以免费用东方甄选的信息系统,系统是免费用,但是作为供应链提供的商品可以不是免费的。之后是否会演变成为:东方甄选作为供应链给与辉同行供货,赚取供货商的利润,与辉同行赚取销售端的利润,二者从母、子公司的关系,变成了上下游的关系呢?

二,被 “背刺” 的小股东

关于董宇辉离职,这两人之间 “温情脉脉” 的小作文保留了 “体面” 与 “周全”,但东方甄选小股东的利益,谁来 “体面” 与 “周全” 呢?

有人评论称:“一个上市公司的最核心的资产,被以 7600 万元远低于市场公允价值的方式,100% 剥离出去。对超头主播过度依赖的 MCN 公司很多,这样 100% 裸退还送盘缠的,东方甄选是第一个。这也是马云背刺股东会把支付宝从阿里巴巴剥离出去以后,这么多年我看到过最骚的操作了。俞敏洪竟然还想靠这把操作博一个慷慨大义的好名声,资本家割韭菜现在的都可以这么不要脸的吗?”

还有人评论称:“老俞这么做对小股东非常不地道,以前开高工资、发无限制期权、低价转移教育业务就不先说了,现在凭什么违背承诺,把宇辉同行全部利润分配给董宇辉,从而实现把公司业绩半壁江山的业务免费送?如果老俞还有点良知的话,就把公司账上至少一半的资金拿来回购吧,或者分红也行,不要为了自己的人设就这么欺负小股东。”

三,东方甄选股价后续怎么走?

“如果董旭辉不走,东方甄选的估值永远起不来了,哪个敢投个人 IP 的上市公司?走了是好事,如果东方甄选证明他有再造血能力,那股价新高指日可待。” 这种说法有道理,但 “走了是好事” 的前提是 “证明有再造血能力”,目前的东方甄选,有没有再造血能力呢?

网络上广泛传播的未经证实的第三方数据显示,截止 15 号,7 月上半月抖音直播间 GMV 55582 万,其中 “甄选” 直播间累计 15690 万(占比 28%),“与辉同行” 直播间累计 39892 万(占比 72%),去年同期 GMV 40854 万,抖音直播间业绩同比 136%,抖音商城,app,淘宝和其他渠道 GMV 未计入以上数据统计。

7 月东方甄选抖音直播间的业绩增长仍然维持在一个较高的水平,但增长 100% 来自于 “与辉同行” 直播间,“与辉同行” 日均 GMV 2659 万,对比 3 月日均 GMV +32%;“甄选” 直播间日均 GMV 1046 万,贵州行之后出现加速下滑的趋势,对比 3 月日均 GMV -53%,“甄选” 直播间业绩占比也从 3 月的 53% 下降到这个月的 28%。

美股新东方昨夜已经先跌为敬,港股东方甄选的跳水表演即将开始。东方甄选既然公告安排了 5 亿的回购资金,今天的下探幅度就看护盘决心了。

对于好未来 (TAL.US)、高途 (GOTU.US)、交个朋友 (01450) 等同行业公司,虽然没有上次小作文期间的 “泼天富贵” 可接,也保不齐能捡些奇怪的市场情绪利好。