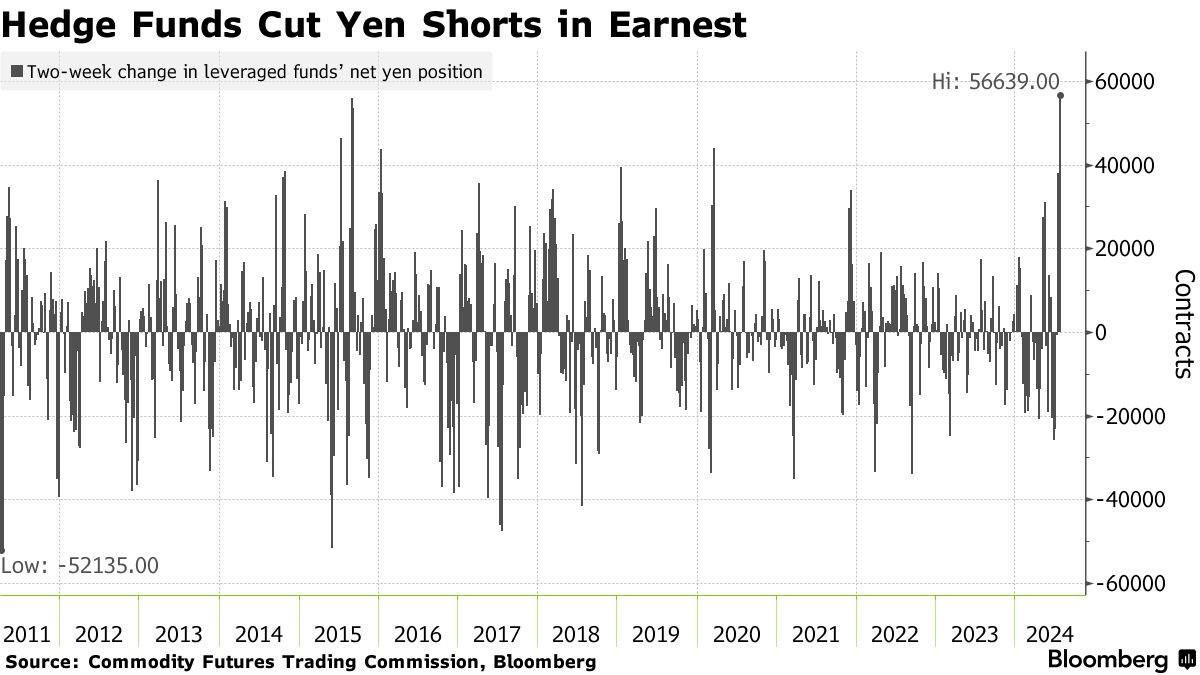

Hedge funds significantly reduce short interest in the Japanese Yen, with the Bank of Japan's decision this week being a key factor in the Yen's movement

對沖基金大舉削減日元空頭頭寸,成為日本央行本週決議的關鍵因素。根據美國商品期貨交易委員會的數據,對沖基金在過去兩週減少了 56,639 份日元空頭頭寸,這是自 2011 年以來最大規模的拋售。儘管對沖基金仍持有日元空頭頭寸,但目前的看空程度是 2 月以來最低的。市場預期利率將有利於日元。日本央行和美聯儲將在本週公佈利率決議,投資者對日元走勢的信念將接受考驗。日本央行面臨平衡貨幣政策和經濟穩定的挑戰。

智通財經 APP 獲悉,隨着一度備受投資者追捧的套利交易崩盤,對沖基金匆忙撤出日元空頭頭寸。美國商品期貨交易委員會 (CFTC) 的數據顯示,在截至 7 月 23 日的兩週內,對沖基金淨減少了 56,639 份日元空頭頭寸,這是自 2011 年初以來最大規模的一次拋售。

儘管對沖基金仍持有日元空頭頭寸,但它們目前的看空程度是 2 月以來最低的。這標誌着市場人氣出現了驚人的轉變,因為市場預期利率最終將朝着有利於日元的方向傾斜。

Brown Brothers Harriman & Co.全球外匯策略主管 Win Thin 表示:“日元近期走強是受日本央行本週將做出鷹派決議的預期推動的。如果日本央行的決議令人失望,那麼日元反彈的大部分將很快逆轉。”

日本央行和美聯儲將先後於本週公佈利率決議。投資者對日元日益看漲的信念屆時將接受考驗。掉期交易暗示,日本央行週三加息的可能性約為 50%。日本央行官員們的任何鴿派言論都有可能破壞日元近期的漲勢。

在本月早些時候日本當局疑似採取雙重干預措施提振日元之後,日元已升值約 5%。不過,瑞穗證券首席策略師 Shoki Omori 表示:“正在平倉 (日元空頭頭寸) 的是期貨投資基金。在日本央行和美聯儲本週做出政策決定後,平倉將停止,並轉向另一個方向。”

加息疑雲籠罩,日本央行面臨艱難抉擇

隨着日本央行政策會議的臨近,所有的目光都集中在日本央行如何平衡其貨幣政策,以應對疲軟的消費者支出和持續的通脹壓力。日本央行官員們必須在維持經濟穩定和支持日元之間找到微妙的平衡點。他們的決策不僅將影響日本的經濟前景,也可能對全球金融市場產生深遠的影響。

據知情人士此前透露,日本央行官員認為,由於消費者支出疲軟,他們在本週的政策會議上決定是否加息變得複雜。一些官員傾向於 7 月不加息,以便有更多時間檢查即將公佈的數據,以確認消費者支出是否會回升。但也有官員願意在 7 月會議上加息,他們認為日本央行 0% 至 0.1% 的政策利率區間非常低,鑑於未來存在很多不確定性,可能會錯過加息機會。

上週的一項媒體調查顯示,只有約 30% 的日本央行觀察人士預計日本央行將在本月底加息,但超過 90% 的受訪者認為存在加息的風險。

值得一提的是,日本央行本週的政策會議上的另一個關鍵點是日本央行將在多大程度上減少每月的債券購買量。調查顯示,分析師預計日本央行將從 8 月份開始每月削減 1 萬億日元的購債規模,降至每月 5 萬億日元 (合 320 億美元);從長期來看,根據預估中值,日本央行將在兩年內把每月購買量削減至 3 萬億日元。

在預計日本央行本月不會採取任何加息行動的分析師中,許多人表示,將加息與發佈量化緊縮路徑結合起來會造成太大沖擊,而且市場對 “雙重行動” 的反應也存在太多不確定性。三菱日聯摩根士丹利證券公司首席固定收益策略師 Naomi Muguruma 表示:“同時進行加息和宣佈削減債券計劃的可能性很小。很難想象日本央行在花了 1.5 個月時間敲定債券計劃以傳達其非常謹慎的立場後,會突然採取大膽行動。”