The consumer downturn behind tech stocks

科技股背後的消費不振。近期消費數據出現下滑跡象,導致 A 股和美股消費股走低。資本開支對 AI 的投入增加,但其他領域擴張不足,導致漲價和裁員,收入下降,銷量下滑。消費公司表現突出,但餐飲公司業績不達預期,全球化公司難以取得超額成長。麥當勞和星巴克等公司受到影響。AI 股有長期增長預期,而餐飲股估值調整。麥當勞和星巴克的股價走勢不佳。消費股大部分處於市場對立面,是否抄底時刻待觀察。

現在消費是表現最差的板塊之一了。自進入 6 月以來,各地的消費數據都出現了斷崖下滑的跡象。

A 股受此牽連新低,那美股呢?情況也好不到哪裏去。在納指和道指雙雙新高的背後,是眾多食品飲料股近期的不斷新低。頭部大公司表現很差,表現突出的消費公司鶴立雞羣。

看來有 Ai 以後,飯都不用吃了。

所有公司在資本開支端繼續加大對 Ai 的投入,但同時也意味着,在其他領域的擴張投入不足,最後轉化為了各行各業的漲價,而疊加 Ai 化後的裁員,不少人收入下滑,一降一升,自然是銷量下滑,消費不振。

目前的美股消費股大部分已經處於市場的對立面,過去經常伴隨着指數一起新高的消費行業如此表現是難得的,是否到了抄底時刻呢?

一、多類別消費密集暴雷?

首先看到今年以來各類消費公司的表現。不難發現,多家大型食品飲料及餐飲公司是下跌的,比如,麥當勞、星巴克。百事、百威、億滋。而近期,達美樂和墨式燒烤兩家頭部美國快餐公司也發生了大幅度的下跌。具體原因都是業績不達預期。

幾家全球化的巨頭基本都不可避免地被全球的業務影響了,看到具體的財報,麥當勞一季度的財報顯示,收入同比增速從 10% 降到 4%,環比負增長,利潤趨勢相同。非美國地區的需求疲軟,都不及預期,造成了收入降速。

對於這種全球化已經滲透率到極致的公司,很難通過開拓新市場或者其他手段來取得超額成長。而跟 Ai 股相比,這些餐飲股也沒什麼長期增長預期和故事可説,完全就是看財報定價,在當前的利率條件,切換到低個位數增速時,自然會迎來估值大調整。一向長牛的麥當勞也因此背離了指數,回到了久違的 20PE。

自今年以來,這家全球第一大餐飲公司的走勢完全背離了大盤:

星巴克的狀態還要更差些,最新一個季度已經營收轉負,而中國市場被低價咖啡卷麻了。股價表現也更差一些。

但這些公司也不能完全歸因於全球業務的需求下降,佔比最大的美國本土業務,也沒有跟上大盤的漲勢,比如星巴克二季度的美國同店銷售也是下滑 3% 的,而全球所有同店下滑 4%。而要知道,美國 GDP 是增長 2% 的。餐飲消費目前的狀態就是不如美國其他行業繁榮。

而業績表現很優秀的個股呢,則又面臨殺估值的問題,而且是大盤漲,它大跌。比如達美樂,雖然業績增速不達預期,但是 Q2 的美國同店銷售額是增 4% 的,放在餐飲行業也算優秀了,其次利潤也還增了 30%,但市場就是放大了收入增長不足這個問題,強行殺估值,這段時間的回調幅度也有 20% 以上。

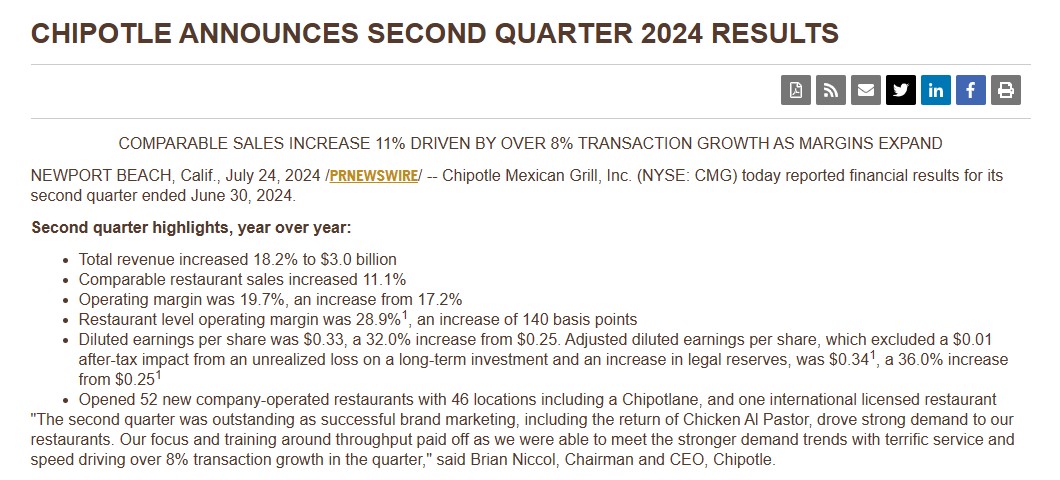

而廣受好評的墨西哥蓋澆飯 CMG 的業績更強,在整個環境不好的情況下,加速成長,Q2 收入增 18%,利潤增 33%,同店銷售額增 11%,價廉物美的特性使得其滲透率加速提升,但過往對成長性的定價不低,一直是 40 倍左右,所以也遇到了殺跌,6 月以來也是跌 20%,這個公司基本是美股餐飲成長龍頭,這樣的跌幅也是挺罕見了。這樣的 Q2 收入和利潤放在 40 倍 PE 的科技股上,能這樣跌?

由此可見,消費行業跟美股格格不入。指數漲 20%,自己跌 10%,一下被拉開 30% 的差距。

業績就算還可以又要計較估值,換言之,也就業績尚可,長期估值也不貴的消費股能跟上美股。比如説幾大食品飲料股中的可口可樂,漲價後提升了下半年的收入指引,本身估值也低,今年還能漲個 10%。但是,百事、億滋、百威就沒那麼幸運了。百事跟可樂同為雙巨頭,二季度業績增速不如可口可樂,過去漲價更兇,也導致現在漲價空間更少。下調預期,估值又比 KO 高,所以表現也差了一點。

另外,百事不但賣飲料還賣零食,從目前的消費者數據看,零食相對飲料粘性低,所以開支被削減得更厲害,也可以説,百事相比 KO,就是零食業務拖後腿了。而看到純零食公司億滋,還沒公佈 Q2 業績,但 Q1 增速驟降至 1.4%,北美收入下滑 2.1%,確實是難啊。

總體看下來,食品飲料股的表現,令人擔憂,不下館子很正常,但小零食都不吃了,這就有點出人意料了。

日用品方面,家化快消品的表現不錯,比如寶潔、高露潔、聯合利華等等。主要是估值低,長期低於食品飲料。今年以來,無論寶潔和聯合利華,業績沒有大的下滑,維持 5% 以內營收增速,10% 左右利潤增速。跟食品飲料中較優秀的公司無異,這就產生了估值修復空間。

消費控制,可以控制不去餐廳,不吃零食,刷牙洗澡這些沒什麼可省的。

但寶潔還是聯合利華,核心產品都是日用剛需的家化產品,如果是非剛需的化妝品,就麻煩了,雅詩蘭黛的表現很糟糕了,今年又跌了 30%,高端化妝品嘛,經濟影響自然是大的。即使是中低端歐萊雅股價也是跌的。

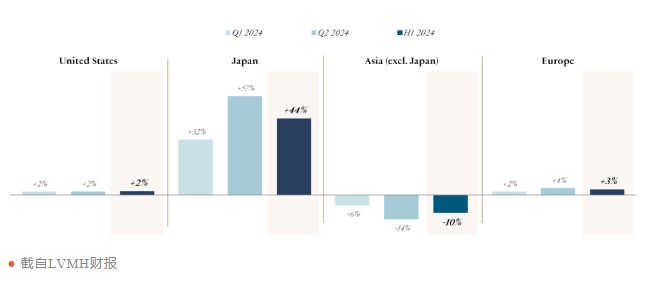

服裝方面,大公司表現不佳,耐克前不久暴雷,而近日是 LVMH 暴雷。奢侈品基本只有愛馬仕能穩住,其餘全掛。

全球服飾消費都不行,性價比路線的代表優衣庫,相對它們沒那麼差,但算上匯率,表現也不亮眼,收入幾乎 0 增長。

但美國消費行業仍有一類股票表現優異,就是零售商:沃爾瑪、cost、都有不錯的表現。業績是逐季改善中,相當難得。

結合餐廳行業的狀態,飯總是要吃的,那不吃餐廳,自然是自己動手了,百事不也説了,自己的品牌零食賣不動了,那是因為消費者去買零售商自營的白牌零食了。

這也是可以理解的,雜貨零售是貼近高頻低價消費的業態,它們的表現與餐飲股的表現並不衝突。而本來社區零售店 DG 這些也理應不錯的,只是它們被 TEMU 定向打擊了。

最後總結一下當下美股消費股的表現,越高端的表現越不好,性價比路線的才能超額收益,維持好的業績。另外,全球消費市場都差,美國小差,歐洲中差,亞洲大差。而業績好又要計較股票估值,市場對消費股相當苛刻。

近期,單殺估值的消費股比比皆是,明星成長消費股居多:CMG、CELH、DECK,都是高估值高成長的代表,從 6 月開始大跌,但也普遍有着下半年可能增速大降的預期。

那麼,現在美股消費的抄底邏輯就是,看市場殺估值的成長型消費股是否錯殺,至於業績下行帶動股價崩的,這種情況就很複雜,業績下滑中,估值就不是穩定的而是動態向上的。像雅詩蘭黛這樣越跌越貴的,是很難受的。

二、美股繁榮與消費繁榮

消費股仍然是美股表現亮眼的一大板塊,它不會像芯片、互聯網和企業服務(類 saas)板塊那樣,呈現整體超額收益。

消費指數不是一個能跑贏市場很多的指數,平庸的公司也很多。但卻又產生了不少股王,幾百倍的股票。比長期漲幅,怪物飲料、達美樂披薩都可以跟英偉達扳扳手腕,比近幾年漲幅,有 ELF、CMG 和 DECK 這類大牛股。

這裏面是它們優秀商業模式,利潤可以全部用以股東回報產生的漲幅放大效應帶來的。另一方面,美國科技改善效率,最終也會帶動普通人的收入跟着漲,然後流向消費端。而社會風氣鼓勵超前消費,最終也產生了各類優秀的消費股。

現在 Ai 的繁榮背後,是互聯網巨頭們靠商業模式優勢(易提價、易裁員)取得了業績增量,將業績增量從企業開支轉化給了芯片等硬件公司的業績,換取這些互聯網巨頭的產品升級,但硬件公司的利潤並未傳導給太多的本土企業。其次,互聯網巨頭的產品升級直至目前都沒有產生大的成果,幫助大家提升工作效率,新的工作崗位也沒有產生。

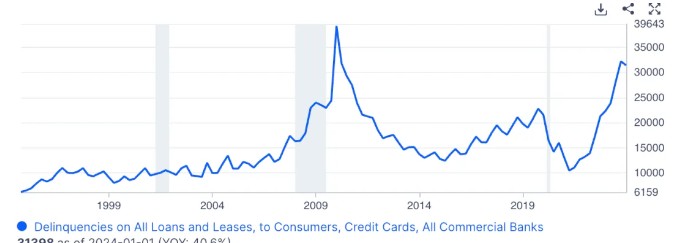

所以,牛市的紅利並沒有傳遞到美國實體經濟,也是消費股表現不佳的關鍵。目前的消費貸款逾期水平,也已經達到了非常高的位置,怪不得小零食都不吃了。

但換一個思路想,目前虛擬服務收入的互聯網公司,業績都是一片增長,如果把它們當做一種消費,那麼整體的消費水平就不算很差了,可以理解為,大家在削減實物消費,增加虛擬消費。

這説明了,短期精神享受還是高於物質享受的。消費品配方不改,口味不改,跟日新月異的 Ai 應用相比,確實沒那麼多吸引力了。但當有一天消費者發現不斷推新的 Ai 應用也沒什麼新意,還不如吃好穿好,消費股和科技股的差距將很快拉平。

三、結語

所以本質上,當下消費股的不佳,是全球性的,太多的消費公司暴雷了。而轉折點,一是看全球性的收入回升,其次則看在虛擬消費和實物消費的平衡。但並不妨礙有些消費公司更賺錢了:做性價比的、做虛擬服務的。因此當下,可以説是對不同類別消費的定價分離階段。

部分消費股的下跌,不完全是殺業績,這段時間以來,很多沒暴雷的消費股的股價被科技股擠壓了,發生了同樣增速,不同定價的事情。雖然這些公司平衡完業績和估值,也很難説現在是錯殺還是正常的估值調整。但相對來説已經是近幾年來,難得的估值低位了。跟中國一樣,現在也正是抄底美股消費的關鍵時刻。但也別忘了,優秀的消費股只是少數,消費行業不存在整體機會。