AI boom boosts Arista's Q2 revenue and guidance to exceed expectations with double-digit growth, V-shaped rebound after hours | Financial Report Insights

二季度 Arista 營收增近 16%,三季度營收指引增長高達 16%,繼續保持前兩季 10% 以上增速。財報公佈後,Arista 盤後先跌超 5%,後轉漲,一度漲近 4%。

受益於雲計算公司和人工智能(AI)應用對其設備的需求強勁,高速以太網交換機龍頭、英偉達佈局 AI 網絡的勁敵 Arista Networks 的收入保持兩位數強勁增長,二季度業績和三季度指引均強於華爾街預期。

美東時間 7 月 30 日週二美股盤後,總部位於美國加州的 Arista 公佈截至今年 6 月 30 日的第二季度財報。

1)主要財務數據

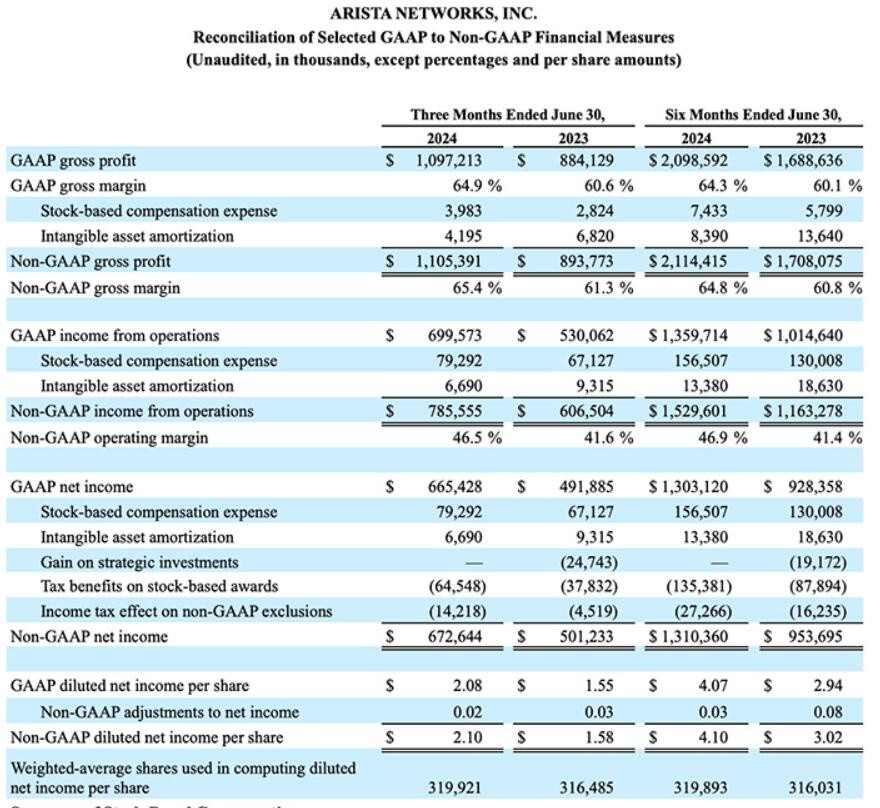

營業收入:二季度營收 16.9 億美元,同比增長 15.9%,分析師預期 16.5 億美元,一季度同比增長 16.3%。

EPS:二季度調整後每股收益(EPS)為 2.10 美元,同比增長 32.9%,分析師預期 1.94 美元,一季度同比增長 39.2%。

淨利潤:二季度淨利潤 6.726 億美元,同比增長 34.2%,一季度同比增長 46%。

毛利率:二季度調整後毛利率 65.4%,一季度為 64.2%,去年二季度為 61.3%。

營業利潤率:二季度調整後營業利潤為 46.5%,一季度為 47.4%,去年二季度為 41.6%。

2)業績指引

營收:三季度營收預計為 17.2 億至 17.5 億美元,分析師預期 17.2 億美元。

毛利率:三季度調整後毛利率為 63% 至 64%,去年三季度為 63.1%。

營業利潤率:三季度調整後營業利潤率約為 44%,分析師預期 43.1%,去年三季度為 46.1%。

財報公佈後,收跌近 2.9% 的 Arista 股價在美股盤後上演 V 形大反彈,先加速下跌,盤後一度跌超 5%,後掉頭上行,抹平盤後跌幅轉漲,盤後曾漲近 4%。評論稱,盤後 AMD 將今年數據中心芯片的銷售預期上調,體現 AI 芯片需求增長勢頭,AMD 股價盤後大漲,帶動了英偉達等一些科技股走高。

三季度營收指引增長高達 16% 保持前兩季 10% 以上增速

發佈財報時,Arista 的首席財務官 Chantelle Breithaupt 強調,二季度公司的 EPS 盈利同比猛增約 33%,得益於強勁的營收和毛利率表現。

以三季度指引範圍計算,Arista 預計,三季度營收將增長約 14% 至 16%,繼續保持今年前兩季度 10% 以上的增速。

上週 Arista 的同行 Juniper Networks 公佈的二季度營收和利潤均低於分析師預期,受累於雲計算公司對該司的網絡網絡設備支出疲軟。不過,Juniper 當時指出,該司的許多客户已經消化庫存,並正在為加強 AI 基礎設施而投資。

作為一家 to B 的網絡交換器和路由器製造商,Arista 主要服務於包括微軟、Meta 等在內的雲服務商。公佈一季度財報時,Arista 罕見地上調了今年全年的營收指引,並指出,訓練 AI 大模型對性能的高要求提振了雲服務廠商對該公司硬件產品的需求。

上月花旗報告稱,以太網滲透加快給英偉達和 Arista 帶來機會,兩者在以太網技術方面的發展接近同步,都有望在不久的將來推出高速以太網解決方案。英偉達和 Arista Networks 都將在 2024 年底或 2025 年初擁有端到端的 800G 解決方案。英偉達和 Arista 在 1.6T 產品(基於 102.4T 芯片)的路線圖上可能也是一致的。

花旗強調,對於 Arista 而言,英偉達是一個比預期更強大的以太網競爭對手。英偉達稱其預計 Spectrum-X 平台將在一年內成為數十億美元產品線,突顯了眾多客户願意在以太網領域也採用英偉達的捆綁方法。