Unicorn BLACK SESAME Intelligence initiates IPO, aiming to lead the golden track of autonomous driving

独角兽黑芝麻智能已开启招股,并将成为国内首家上市的自动驾驶芯片企业。该公司以领先的技术实力和高性能产品在智能汽车领域占据领先地位,为自动驾驶和智能化产品提供关键能力。黑芝麻智能成功跻身行业前三,并成为全球第三大车规级高算力 SoC 供应商。其自动驾驶应用生态链包括车规级图像处理 ISP、一体化数据通路和深度神经网络加速器,能够全面赋能智能汽车。该公司依赖强大的研发团队,是国内唯一一家拥有 20 年以上汽车和芯片领域从业经验的企业。

近日,百度旗下自动驾驶服务平台 “萝卜快跑” 频上热搜,引发人们对自动驾驶未来的种种畅想。

新能源汽车发展下半场聚焦 “智能化”。在汽车智能化浪潮下,作为自动驾驶汽车的 “中枢大脑”——自动驾驶 SoC(系统级芯片) 的重要性不言而喻。

国内智能驾驶芯片行业先驱——黑芝麻智能,在智能化时代以领先的技术实力证明了自身价值。上月通过港交所聆讯后,黑芝麻智能已于 7 月 31 日开启了招股,将成为国内 “自动驾驶芯片第一股”。公司股票代码为 “2533.HK”,本次拟公开发售 3700 万股,最高发售价 30.30 港元,发售时间为 7 月 31 日至 8 月 5 日中午,预计将于 8 月 8 日在港交所主板挂牌上市。

将科技刻入基因的智驾先驱

黑芝麻智能为国内最早一批研发自动驾驶 SoC 的企业。一路深耕自动驾驶赛道,黑芝麻智能发展成为国内乃至全球领先的车规级智能汽车计算芯片及基于芯片的解决方案供应商,引领我国车规级芯片本土替代的浪潮。

仅用 6 年时间,黑芝麻智能成功跻身行业前三。按 2023 年车规级高算力 SoC 的出货量计,黑芝麻智能是全球第三大供应商。

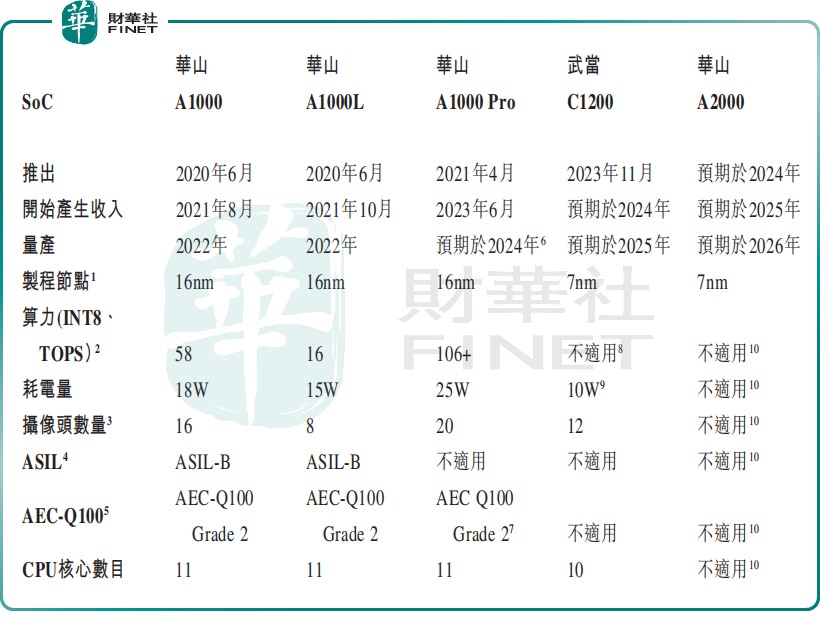

通过自行研发的 IP 核、算法和支持软件驱动的 SoC 和基于 SoC 的解决方案,黑芝麻智能的超高性能车规级产品 (包括华山系列及武当系列) 及技术为智能汽车配备关键任务的能力,包括自动驾驶、智能座舱、先进成像及互联等,全面覆盖 L2-L4 级自动驾驶以及跨域计算解决方案,可满足客户不同智能化产品的广泛需求。

黑芝麻智能打造出了自动驾驶应用的完善生态:车规级图像处理 ISP 让汽车看得清、一体化数据通路的互联下汽车看得远、深度神经网络加速器让汽车看得懂,这些生态链能够全面赋能智能汽车。

黑芝麻智能成为国内造 “芯” 领航者,依赖其强大的研发团队。

黑芝麻智能是国内唯一一家完整地集结了拥有 20 年以上汽车领域从业经验的团队和 20 年以上芯片领域从业经验的团队,核心团队均来自博世、豪威科技、高通、华为、中兴等业内顶尖公司。此外,黑芝麻智能持续加大研发投入,抢占智驾科技领域高地,2021 年至 2023 年研发投入分别达 5.95 亿元(单位人民币,下同)、7.64 亿元及 13.63 亿元。

资历丰富且知识渊博的研发团队,以及对研发的重视,构成了黑芝麻智能的独特优势,即:比汽车行业更懂芯片,比芯片行业更懂汽车。

在自动驾驶等级不断提升的背景下,SoC 的算力也需要持续增强。基于雄厚的研发实力,黑芝麻智能产品迭代迅速,车规级高算力 SoC 的 “含金量” 持续增加。

继去年 4 月发布行业内首个集成自动驾驶、智能座舱、车身控制及其他计算域的武当系列跨域 SoC 后,针对 L3 及以上,公司正在开发设计算力达 250+TOPS 的华山 A2000,这是世界上性能最高的车规级 SoC 之一,预计于今年推向市场,公司产品矩阵愈发丰富。

随着更高算力和更高性能的 SoC 产品不断落地及量产交付,黑芝麻智能有望把握智驾大风口,引领行业进入新纪元。

在自动驾驶芯片领域 “专” 和 “精”,令黑芝麻智能获得众多知名机构的青睐。成立以来,公司共获得超 10 轮融资,累计融资金额约 7 亿美元。投资方阵容星光熠熠,包括小米、吉利、上汽集团和腾讯等明星企业,以及大基金二期、武岳峰科创等一线资本。

商业化提速,收入猛增

自动驾驶赛道长坡厚雪。据弗若斯特沙利文数据,自动驾驶乘用车全球及中国渗透率预计将由 2023 年的 69.8% 与 74.7% 提升至 2028 年的 87.9% 与 93.5%。

与此同时,全球及中国车规级 SoC 市场规模亦将从 2023 年的 579 亿元与 267 亿元增长至 2028 年的 2053 亿元与 1020 亿元,复合年增速分别达 28.8% 与 30.7%。

黑芝麻智能有实力把握住这一快速增长的市场机遇。2020-2023 年,黑芝麻智能的客户数从 33 名快速增长至 85 名。目前,公司已与 49 多家汽车 OEM 及一级供货商合作,包括一汽集团、东风集团、江汽集团、合创、亿咖通科技、百度、博世、采埃孚及马瑞利等知名企业。

随着客户群体不断扩大,黑芝麻智能的产品订单量和营收规模持续迈上新台阶。

截止今年 3 月底,黑芝麻智能的 SoC 产品出货量合共超过 15.6 万片;自动驾驶产品及解决方案业务的交易量由 2021 年的 35 笔增加至 2023 年的 298 笔。

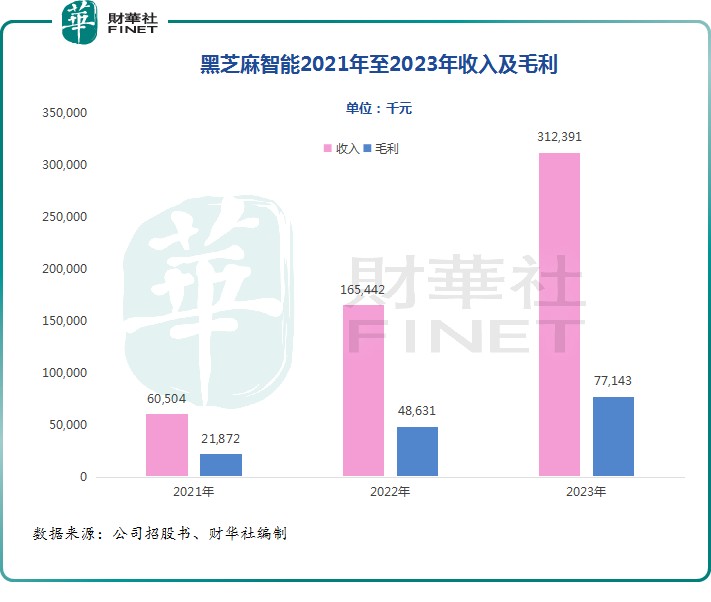

亮眼的经营数据亦推动公司收入节节攀升。2021 年至 2023 年,公司总收入由 6050 万元激增至 3.12 亿元,复合年增长率高达 127%;公司毛利也由 2187 万元增长至 7714 万元。

此外,公司毛利率在今年一季度大幅提升,由上年同期的 18.7% 上升至 60.9%,主要得益于公司自动驾驶算法集成在基于 SoC 的解决方案中,以及智能影像解决方案毛利率增加。

在国内车规级芯片市场绝对量增长的同时,在美国《芯片与科学法》等法案压力下,高端替代成为行业大势,有望助推国产芯片厂商抢占市场份额。

事实也是如此,黑芝麻智能正受益这场国产替代潮,市场占有率正快速提升。在国内高算力自动驾驶 SoC 出货量(按颗计)的排名中,公司的市场份额由 2022 年的 5.2% 提升至 2023 年的 7.2%,一年时间上升 2 个百分点。

黑芝麻智能当前从 16 家汽车 OEM 及一级供应商获得了意向订单,以就 23 款车型量产 SoC 产品。而在未来几年,公司更高阶的 A2000、下一代 SoC 等产品有望带来更多的多元化客户群和意向订单,从而推动公司规模效应的提升,从而不断增强公司造血能力。

总结:

今年是汽车智能化时代下本土自动驾驶芯片落地元年,行业成长性和爆发力确定性强,在行业具有先发优势的黑芝麻智能也已有备而来。

通过专注于自动驾驶人工智能芯片领域的创新与突破,黑芝麻智能从技术、产品、解决方案和业务模式各个方面为高性能芯片的落地做到了全方位布局。作为行业技术领先、产品力领先的龙头企业,黑芝麻智能商业化发展十分迅速,正引领本土车规级芯片迈向纵深。

自动驾驶奇点时刻将至,作为香港资本市场极为稀缺的自动驾驶芯片标的,身具 “高科技” 标签,黑芝麻智能在获得资本助力后有望迎来加速发展,获得更大的市场份额。