Warner Bros. Discovery (NASDAQ:WBD) Plunges After Venu Gets Priced

華納兄弟探索(NASDAQ:WBD)股價在 Venu 體育流媒體套餐定價公佈後下跌了近 4%。華納與迪士尼的 ESPN 和福克斯的福克斯體育之間的合資企業將在今年秋季正式推出,每月收費為 42.99 美元。華納還試圖通過訴訟重新獲得在 Venu 中的股份,特別是 NBA 的股份。分析師對 WBD 股票持有 “中等買入” 共識評級,目標股價為每股 12.50 美元

長期以來一直期待的一則體育流媒體消息出現了,對於在該安排中扮演重要角色的華納兄弟探索(WBD)來説,情況並不樂觀。事實上,當 Venu 體育流媒體套餐的定價公佈時,華納股價在週四下午的交易中下跌了近 4%,顯然投資者並不滿意。

Venu 是華納、迪士尼(DIS)的 ESPN 和福克斯(FOXA)的福克斯體育共同合資的項目,旨在將大量體育賽事集中在一個平台上。而且,當這個項目於今年秋季上線時,他們計劃收費非常高,首月定價為 42.99 美元。有興趣的人將被允許進行僅有七天的免費試用,儘管事實證明,整個項目仍然可能會被政府監管機構擱置。

儘管這實際上是相對於先前的報道而言的一次降價:此前,Venu 被預計每月售價在 45 至 50 美元之間,因此,這個價格相對來説算是個便宜貨,儘管僅僅如此。報道指出,這個價格故意定得很高,以避免與傳統廣播公司的攜帶問題,如果該集團只是要推出一個廉價的流媒體平台,傳統廣播公司可能會對支付自己的攜帶費感到猶豫。

鉅額損失,經典迴歸

與此同時,華納仍在積極爭取收回 Venu 中的一部分股權,即 NBA。目前在紐約州法院提起的訴訟指責 NBA 拒絕接受亞馬遜(AMZN)提出的匹配報價,以保持 NBA 在其控制之下。華納有權提出匹配報價並要求接受,但 NBA 似乎無論如何都猶豫不決。

此外,華納還在利用其最經典的作品進行復興,推出了華納檔案館收藏系列。報道指出,儘管最近進行了重新品牌定位為華納經典,但華納檔案館收藏系列實際上仍然是華納檔案館收藏系列。這一舉措本質上是一種營銷策略,旨在將其所有經典作品集中在一個更方便的品牌下。可能,這甚至是我們最近聽到的那些削減成本的舉措的一部分。

華納兄弟探索股票值得購買嗎?

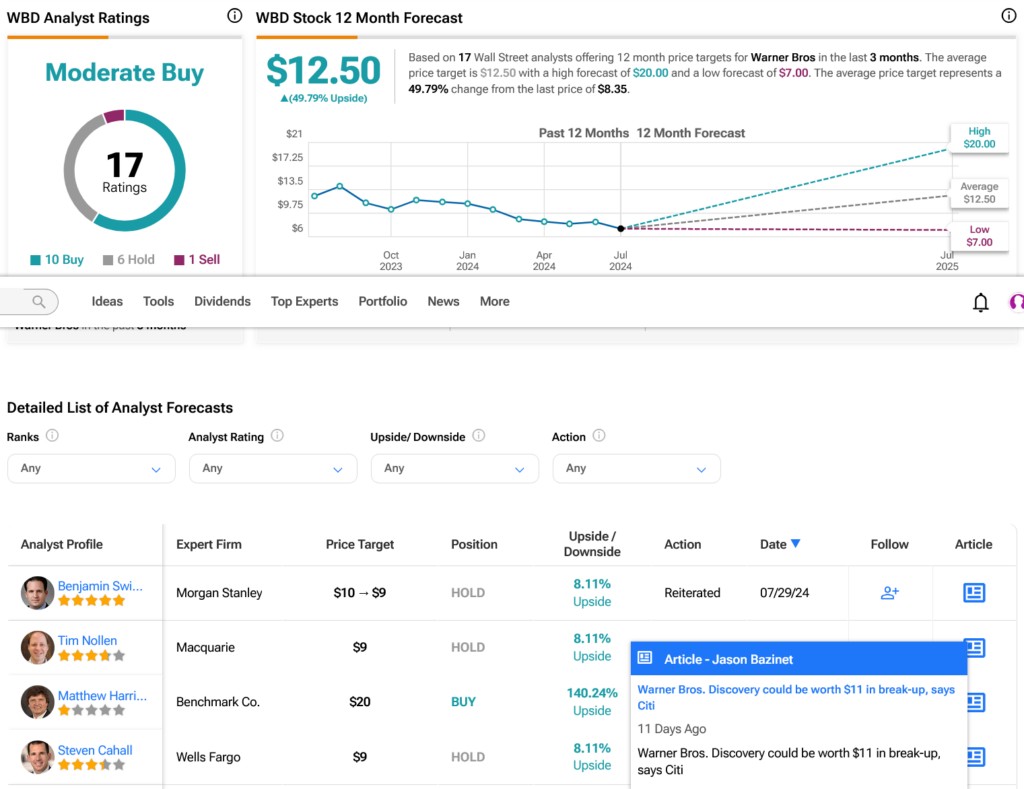

轉向華爾街,根據下圖顯示,過去三個月裏,分析師對 WBD 股票持有中等買入共識評級,其中包括 10 個買入、6 個持有和 1 個賣出。在過去一年中,WBD 股價下跌了 33.67%,而平均的 WBD 股價目標為每股 12.50 美元,暗示着 35.95%的上漲潛力。

查看更多 DIS 分析師評級

披露