Global stock markets experience "Black Monday"! European and American stock markets plummet, with the Japanese stock market plunging by 13%

全球股市遭遇黑色星期一,歐美股市大幅下跌,日股暴跌 13%。市場擔心美聯儲行動太遲緩,導致投資者拋售股市,轉向債券。歐洲股市本週初也下跌至近六個月低點。各大交易所開盤均下跌,金融板塊受創最嚴重。全球股市遭遇拋售的原因包括美國就業市場疲軟、人工智能股票漲勢高估值以及中東緊張局勢加劇避險情緒。股市可能進一步回調。

智通財經 APP 獲悉,由於市場擔心美聯儲在支持放緩的經濟方面行動太遲緩,全球股市拋售加劇,美國股指期貨大幅下跌,投資者轉向安全的債券。

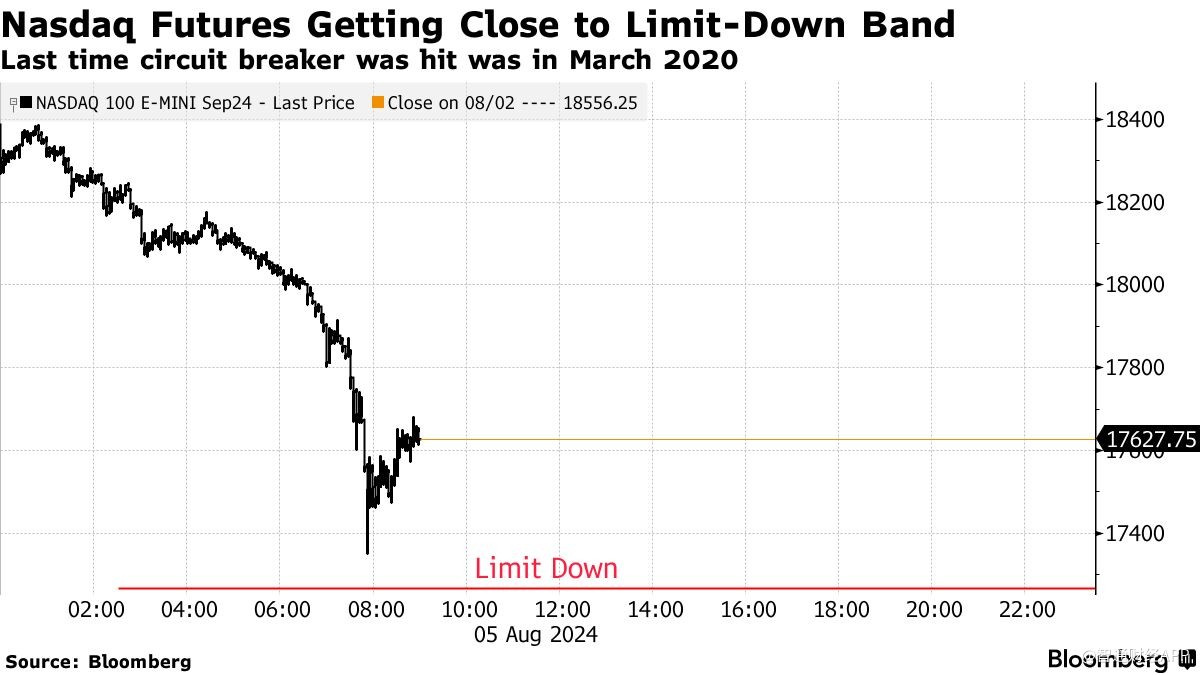

納斯達克 100 指數期貨一度暴跌 6.5%,接近觸發熔斷機制,此前該指數上週五進入技術性調整。標普 500 指數期貨下跌超過 2.5%。

納斯達克 100 指數期貨暴跌,接近觸發熔斷機制

歐洲股市本週初跌至近六個月低點。截至發稿,歐洲斯托克 600 指數下跌 3.1%,至 482.42 點,創下 2 月 13 日以來的最低水平。該指數也遭遇了兩年半以來最糟糕的一天。上週,該指數創下近 10 個月來最差單週表現,自 4 月 15 日以來首次跌破 500 點大關。

歐洲所有主要交易所週一開盤均下跌。金融板塊是當日受創最嚴重的板塊。歐洲銀行指數下跌約 4.4%,觸及 3 月份以來的最低水平。

其中,意大利聯合信貸銀行、聯合商業銀行、德意志銀行的股價均下跌約 6%。巴克萊銀行下跌 5.4%,西班牙薩瓦德爾銀行下跌 4.9%。

在日本,東證指數和日經指數雙雙下跌超過 13%。中國台灣基準股指創下有史以來最大單日跌幅,而亞洲股指則出現了四年多來的最大跌幅。日元兑美元上漲逾 2.5%。

美國衰退擔憂引發拋售潮

上週五公佈的數據顯示美國就業市場疲軟,引發投資者對美國將陷入經濟衰退的擔憂,全球股市遭遇拋售。投資者還擔心人工智能股票的漲勢會抬高估值,而中東緊張局勢也加劇了避險情緒。“股神” 巴菲特旗下伯克希爾哈撒韋公司 (BRK.A.US) 將所持蘋果 (AAPL.US) 股份大幅減持近 50% 的消息也打壓了市場情緒。

盛寶銀行外匯策略主管 Charu Chanana 表示:“這是一個相當戲劇性的轉變,表明近期的趨勢在很大程度上受到美國軟着陸預期的支持。美國軟着陸假設受到的質疑越多,股市可能進一步回調。”

全球股市下跌反映出人們對經濟前景、地緣政治風險的擔憂,以及對人工智能大肆炒作的質疑。高盛集團經濟學家將明年美國經濟衰退的可能性從 15% 提高到 25%,不過高盛補充説,有理由不必擔心經濟衰退。

與此同時,MSCI 新興市場股指下跌逾 3%,勢將創下 2022 年 3 月以來的最大單日跌幅。日元和人民幣等融資貨幣的突然升值損害了套利交易,套利交易通常涉及交易員以較低的利率借入資金以投資於收益更高的資產。

發展中國家貨幣走高,馬來西亞林吉特領漲,而墨西哥比索則繼續下跌,因為交易員繼續平倉新興市場套利交易。

在其他地方,由於中東緊張局勢加劇,更廣泛的金融市場出現拋售,石油價格延續下跌趨勢,跌至七個月低點。週一,加密貨幣也受到全球市場避險情緒的影響。

美聯儲降息預期升温,債券受青睞

美國 7 月非農數據低於預期,導致人們對美國經濟衰退的擔憂加劇,並增加了美聯儲 9 月份降息的可能性。

摩根大通和花旗銀行的分析師預測,在 2024 年底之前,美聯儲將降息三次,包括 9 月和 11 月各降息 50 個基點,隨後在 12 月降息 25 個基點。

更安全的債券受到投資者青睞。10 年期美國國債收益率下跌 5 個基點,至 3.74%,為一年多來的最低收盤水平。2 年期國債收益率暴跌 11 個基點,因交易員押注美聯儲 9 月降息幅度可能超過預期。全球債券收復了今年的失地。

日本基準的 10 年期國債收益率跌至今年 4 月以來的最低水平,週一下滑多達 17 個基點。由於債券收益率下滑可能侵蝕貸款利潤率,日本最大的銀行三菱日聯金融集團股價創下有史以來最大盤中跌幅。

安聯投資管理公司的 Charlie Ripley 表示:"從美聯儲的角度來看,這並不意味着要倉促做出政策決定,但應有助於他們在下次會議上評估政策決定時摘掉樂觀的眼鏡。"