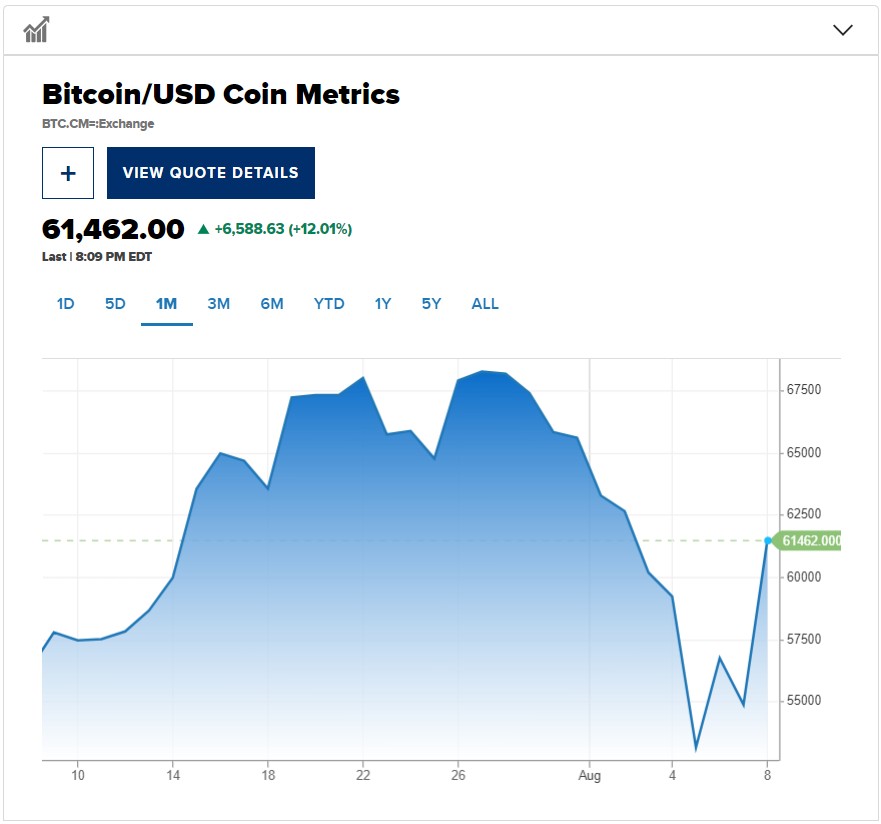

Cryptocurrencies rebound across the board, with Bitcoin briefly surpassing $62,000 USD

加密貨幣市場近期出現大幅拋售後,比特幣在本週突破 62000 美元,恢復上漲。比特幣漲幅超過 12%,一度升至 62000 美元以上,較支撐水平 55000 美元高出許多。以太坊也漲幅超過 14%,接近 2700 美元。此前,比特幣和以太坊曾引領加密貨幣市場下跌。市場正在試圖找到立足點,加密貨幣交易波動較大的 8 月被認為是關鍵時期。投資者對美聯儲是否會降息以及市場調整是否持續引起擔憂。今年以來,比特幣上漲近 44%。

智通財經 APP 獲悉,加密貨幣從本週早些時候的大幅拋售中恢復上漲,比特幣週五一舉突破 62000 美元。

數據顯示,比特幣漲逾 12%,一度升至 62000 美元上方,遠高於今年大部分時間的支撐水平 55000 美元。以太坊大漲超 14%,逼近 2700 美元。週三,比特幣和以太坊還一度引領加密貨幣市場和相關股票下跌。

截至週四收盤,Coinbase(COIN.US) 和 MicroStrategy(MSTR.US) 股價分別上漲 7.50% 和 9.07%。兩者在盤後均繼續上漲。

隨着日元套利交易平倉帶動市場去槓桿化,且美國國債收益率因擔心經濟衰退而上揚,在週一的暴跌後,市場似乎正試圖找到立足點。比特幣一度跌破 5 萬美元,此前一週交易價格接近 7 萬美元。不過,上週晚些時候,在 7 月就業報告弱於預期之後,市場擔憂開始顯現。

Bitwise 資產管理公司分析師 Ryan Rasmussen 表示:“未來一兩個月,宏觀經濟將佔據主導地位。從中東緊張局勢加劇到日元套利交易的崩潰,再到對美國經濟衰退的擔憂,每個人都在擔心下一隻靴子什麼時候會落地。”

8 月一直被認為是加密貨幣交易波動較大的一個月。Rasmussen 表示,在這些擔憂消退之前,大多數機構投資者可能會優先考慮他們的股票投資組合,而不是他們分配給加密貨幣的 1% 至 5% 資產。

“多種力量和反應正在導致加密貨幣市場出現橫向反彈,” 比特幣 IRA 聯合創始人兼首席運營官 Chris Kline 表示,“加密貨幣繼續感到萎靡不振,主要是因為投資者對美聯儲是否會降息以及這種調整是否只是曇花一現還是會引起更多擔憂持觀望態度。”

今年以來,比特幣累計上漲了近 44%。