Bank of America: If US July CPI falls below expectations, it may reignite concerns about stagflation

美國銀行全球研究部表示,本週將公佈的美國 7 月消費者價格指數(CPI)可能重新引發股市的滯漲擔憂。預計 7 月 CPI 將同比上漲 3.0%,環比上漲 0.25%;剔除食品和能源價格的核心 CPI 將同比上漲 3.3%,環比上漲 0.22%。疲軟的 CPI 數據可能引發股市反彈,但過熱的 CPI 數據將是重大的下行事件,可能導致市場重新陷入滯漲擔憂。預計美聯儲將在 9 月和 12 月的會議上各降息 25 個基點。

智通財經 APP 獲悉,美國銀行全球研究部表示,本週將公佈的美國 7 月消費者價格指數 (CPI) 將是股市面臨的又一大挑戰,市場剛剛從對經濟衰退的擔憂引發的大幅下跌中走出來,而令人失望的 CPI 數據可能會導致股市的進一步下跌。

自美國 7 月非農就業報告引發對經濟衰退的擔憂以來,標普 500 指數持續走低。美國勞工部將於週三公佈美國 7 月 CPI 數據。美銀預計,7 月 CPI 將同比上漲 3.0%,環比上漲 0.25%;剔除食品和能源價格的核心 CPI 將同比上漲 3.3%,環比上漲 0.22%。

美國銀行分析師 Ohsung Kwon 表示:“疲軟的 CPI 數據可能會給股市帶來緩解性反彈,但過熱的 CPI 數據將是一個重大的下行事件,可能會使市場重新陷入滯漲擔憂。”“對市場來説,更熱的 CPI 將比更疲軟的 CPI 更令人驚訝。”

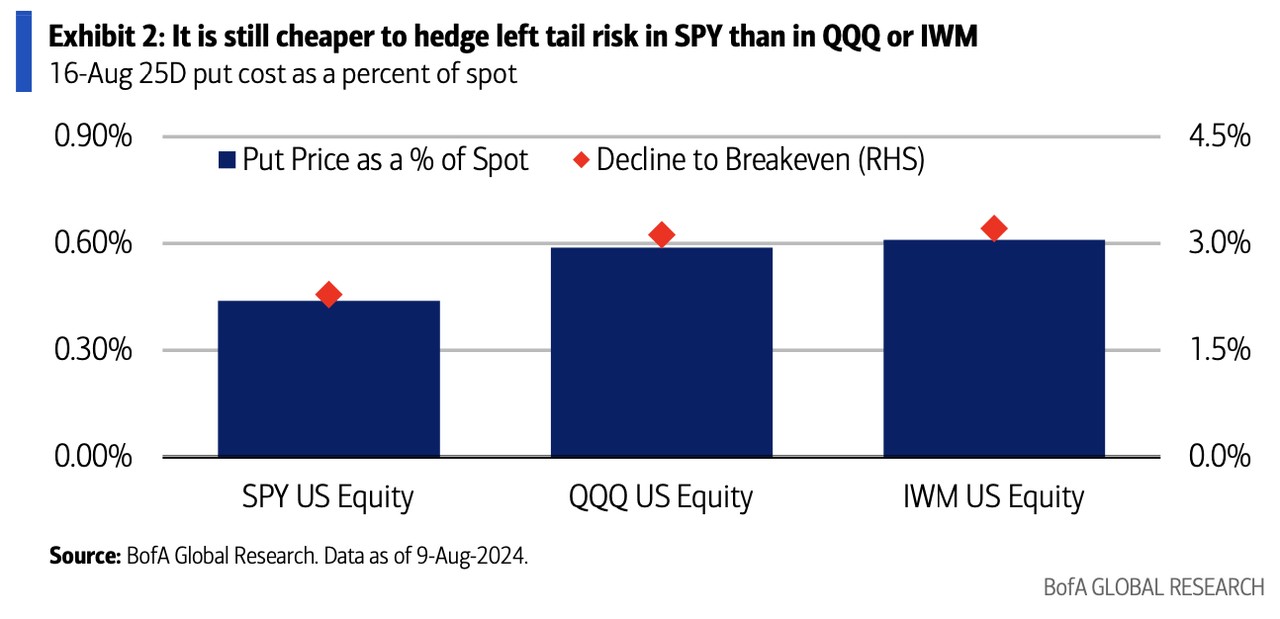

他補充稱,預計 7 月 CPI 數據將引發股市拋售的投資者可以購買標普 500 指數看跌期權,這比購買羅素 2000 指數或納斯達克 100 指數的下行保護 “仍然便宜”。

Ohsung Kwon 表示,對經濟硬着陸的擔憂被誇大了,美聯儲大幅降息或在政策會議間隙降息的可能性很低。不過,他表示:“股市至少需要美聯儲的支持,直到下一個強勁的宏觀數據出爐。現在缺少的是美聯儲的認可,恢復人們對經濟增長最終將得到支持的信心。” 美銀預計,美聯儲將在 9 月和 12 月的會議上各降息 25 個基點。