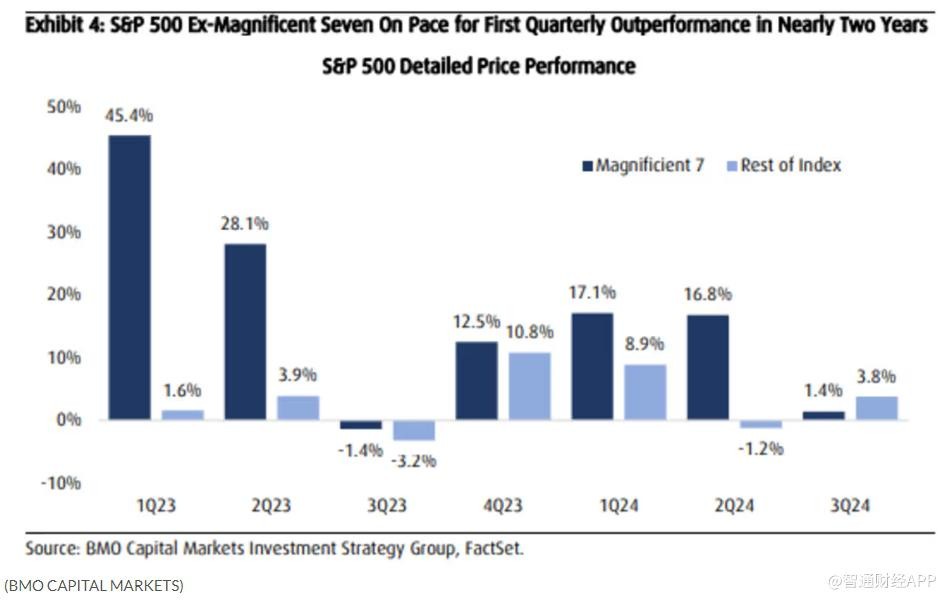

The "Seven Giants" lose momentum as other companies catch up in the S&P 500 Index

在美股反彈的背景下,“七巨頭” 的市場表現出現下滑,落後於標普 500 指數中的其他公司。BMO 首席投資策略師指出,這可能意味着巨頭股票將在近兩年內首次出現季度表現不佳。許多分析師建議投資者關注價值股、週期股和小盤股,而許多行業則超越了標普 500。儘管如此,科技股在市場復甦中仍有可能重新迴歸領先地位。

智通財經 APP 獲悉,美國股市在經歷了夏季的低迷後強勁反彈,但在過去一個月的動盪中,“七巨頭” 似乎失去了市場的領頭羊地位。

自第三季度開始以來,這些超大型公司的股價表現落後於標普 500 指數中的其他 493 家公司。據 BMO 首席投資策略師 Brian Belski 稱,這意味着這些巨頭股票可能會在近兩年內首次在一個季度內表現不如標普 500 指數的其他股票。

Belski 表示,標普 500 指數能夠在沒有科技股或超大型公司引領的情況下,接近歷史最高點的 1% 之內,這應該會增強投資者對這一反彈持續性的信心。

過去一年多以來,市場懷疑論者一直擔心股市過於集中在少數幾個估值膨脹的超大型股票上。隨着市場贏家與輸家的差距最近變得更加極端,許多華爾街策略師建議投資者將資金轉移到市場中較便宜的板塊,如價值股、週期股和小盤股。

然而,這並不意味着 “七巨頭” 不能在本季度結束前的六週內重新奪回領先地位。

事實上,隨着過去兩週股市復甦加速,科技股的漲幅有所擴大。本週,科技股為主的納斯達克綜合指數以創紀錄的速度退出了回調區間。

根據 FactSet 的數據,自 8 月 7 日市場開始反彈以來,人工智能寵兒英偉達 (NVDA.US) 的股價領漲該指數,迄今為止上漲了近 30%。

科技股仍需一段時間才能重新回到 7 月的高點。在納斯達克綜合指數於 7 月 10 日創下歷史最高收盤價後不久,投資者突然拋售超大型科技股,轉向小盤股和市場中其他此前不受歡迎的板塊。截至週三,納斯達克指數距離歷史高點還有大約四個百分點的差距。

即使 “七巨頭” 能夠重新崛起,越來越多的行業已經在最近的表現中超過了標普 500 指數,因為投資者越來越多地押注那些預計將受益於美聯儲降息的股票。

根據 FactSet 的數據,防禦性股票如公用事業、醫療保健和消費必需品,已經與金融等週期性行業一起在 8 月份展開了廣泛的反彈。BMO 發現,自第三季度開始以來,標普 500 指數中近 300 只股票的表現超過了該指數,這是近兩年來最多的一次。

包括 Carson Group 的 Ryan Detrick 在內的多頭們長期以來堅信,如果標普 500 指數想要繼續創出新高,推動其上漲的股票數量需要擴大。Detrick 週二在接受採訪時指出,現在,這種情況似乎終於發生了。“現在股市不再全靠科技股了,看到這些更具週期性的領域表現出領導力對投資者來説是個好兆頭。”