Expectations of Fed rate cuts boost the euro, but the rally may reverse due to Powell's speech

美聯儲降息預期提升了歐元的走勢,歐元兑美元已升至一年來的高點。然而,市場分析師擔心鮑威爾在傑克遜霍爾年會的講話可能會扭轉這一漲勢,因其可能限制降息幅度。儘管歐元受到短期利好,但歐洲經濟仍顯乏力,導致歐元的增長前景並不明朗。

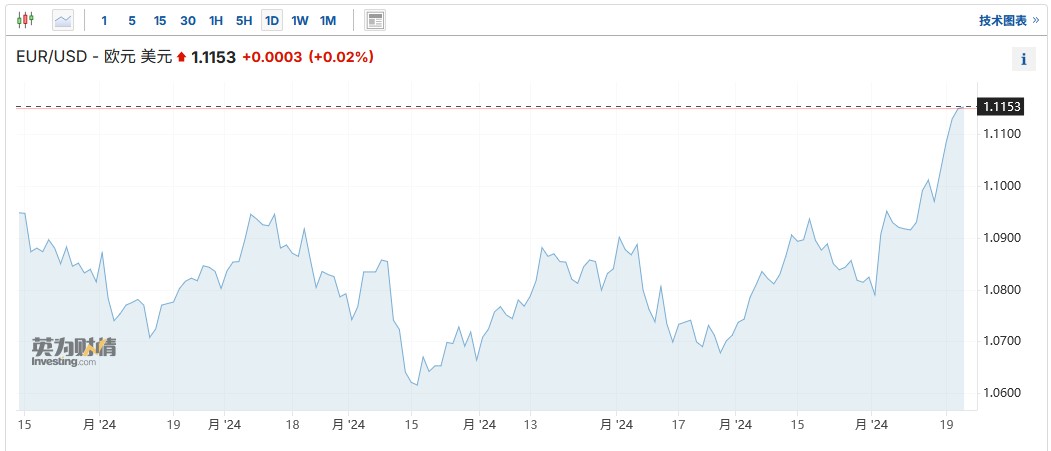

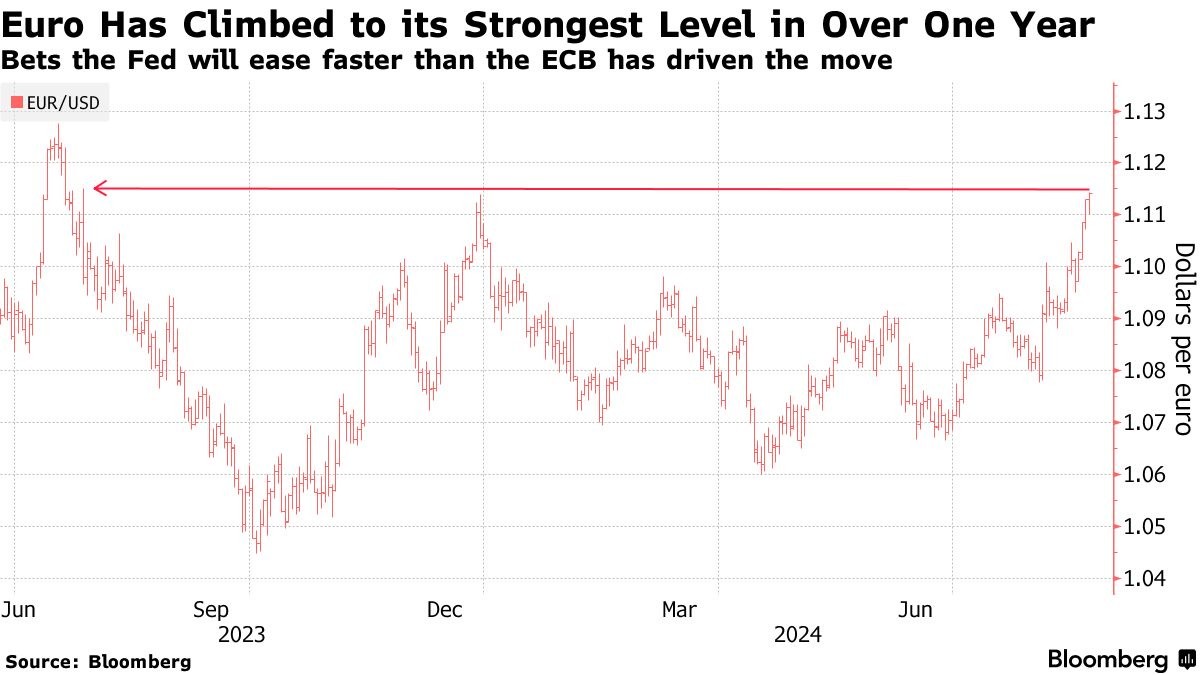

智通財經 APP 獲悉,歐元在 8 月以來維持漲勢,兑美元匯率在週三升至一年來高位。不過,美聯儲主席鮑威爾週五在傑克遜霍爾全球央行年會上可能發表的謹慎言論或許將扭轉歐元的漲勢。

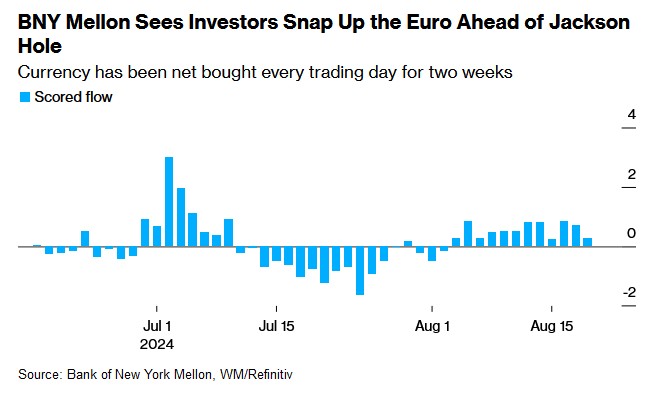

根據紐約梅隆銀行的數據,過去兩週,押注美聯儲即將開啓降息週期的基金經理每天都在搶購歐元,因為他們預計歐元將受益於美聯儲降息。與此同時,利用計算機算法追蹤最新市場趨勢的基金經理本月迄今已拋售了 700 億至 800 億美元。這推動了歐元兑美元匯率本月以來累計上漲 3%,並在週三升至 1 歐元兑 1.1143 美元,為去年 7 月以來的最高水平。

而修正後的美國非農就業數據和美聯儲會議紀要支撐了市場對美聯儲降息的押注,這進一步提振了歐元。截至發稿,歐元兑美元匯率為 1.1153。

然而,有策略師表示,在市場對美聯儲降息預期升温之際,鮑威爾在傑克遜霍爾全球央行年會上的講話可能會抵制市場暗示的降息幅度。這將意味着,美國利率相對於歐洲利率仍將保持較高水平,而歐洲已經開始降息,這將增強美元的吸引力。再加上歐洲經濟增長依然乏力,歐元的上漲勢頭可能即將逆轉。

紐約梅隆銀行高級策略師 Geoff Yu 表示,歐元是 “美國利率預期持續回落和風險偏好改善的主要受益者”。他補充稱:“這不是一個完全利好歐元的故事,目前歐洲的宏觀經濟形勢仍然非常疲弱。” Eurizon SLJ Capital 首席執行官 Stephen Jen 則表示:“這更像是美元走軟,而不是歐元走強,因為歐元的基本面沒有太大變化。”

歐元區經濟增長前景並不明朗,市場對歐元區第一大經濟體德國的信心大幅下滑。歐洲央行管委會成員 Olli Rehn 表示,經濟增長風險強化了歐洲央行下月開會時恢復寬鬆政策的理由。

Brown Brothers Harriman 高級市場策略師 Elias Haddad 預計,由於美聯儲的寬鬆力度不及歐洲央行,歐元幾乎肯定會縮減漲幅。他表示:“我們仍然認為,這種分歧依然存在,這應該會繼續支撐美元。此外,市場對美國經濟過於悲觀了。”