Powell leads the market, will the US stock market return to an upward trend? | Overseas Major Asset Weekly Report

I'm PortAI, I can summarize articles.

美聯儲主席鮑威爾在傑克遜霍爾全球央行年會上發出迄今為止最明確的信號,暗示美聯儲將於 9 月開始降息。他還認為美國經濟正在以 “穩健的速度” 增長,緩解了經濟衰退的擔憂。

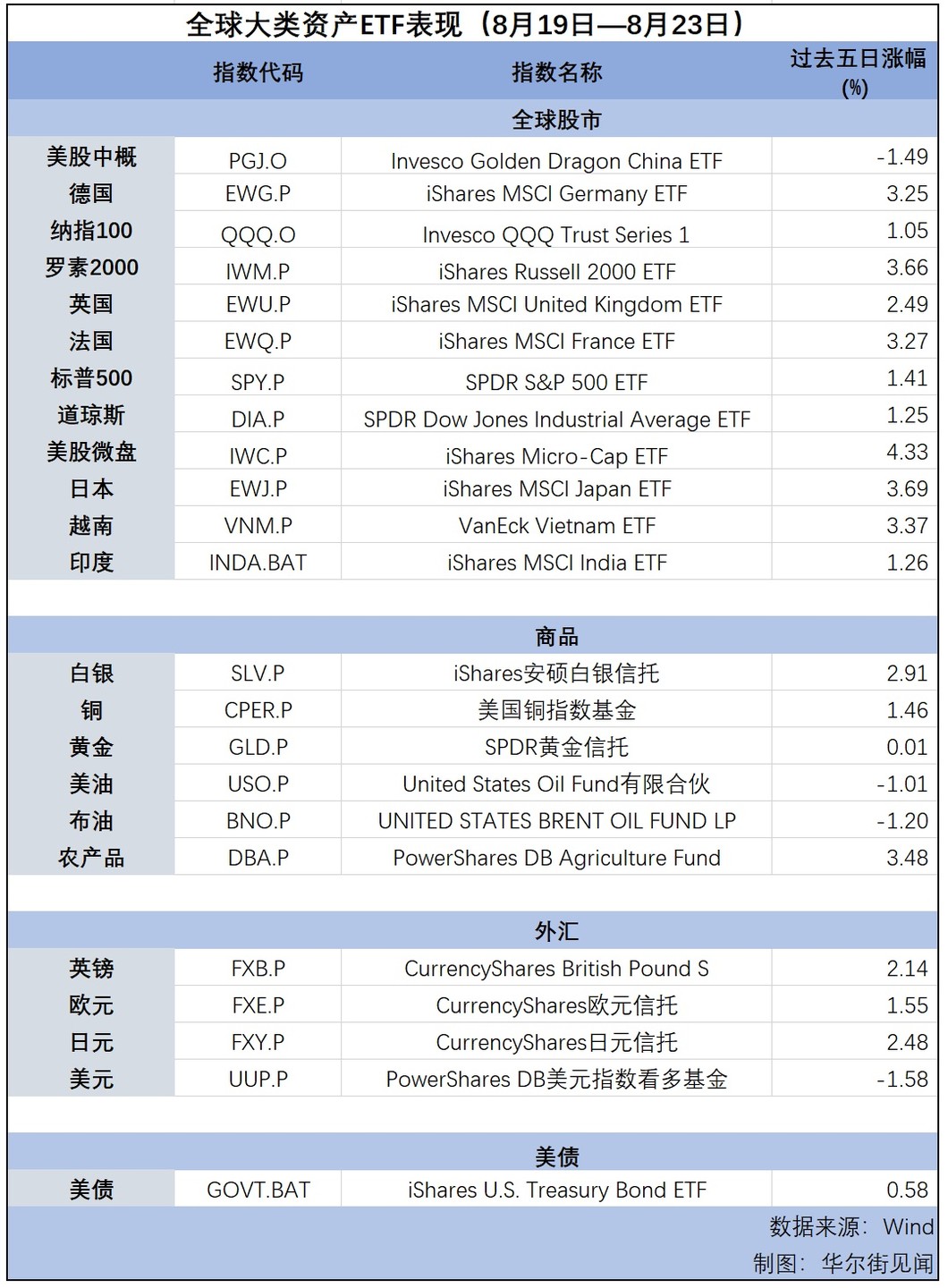

本週 (8.19-8.23)美聯儲降息預期主導市場。美聯儲主席鮑威爾在傑克遜霍爾全球央行年會上發出迄今為止最明確的信號,暗示美聯儲將於 9 月開始降息。他還認為美國經濟正在以 “穩健的速度” 增長,緩解了經濟衰退的擔憂。

鮑威爾講稿出爐後,風險偏好上行,道指一度升破 4.1 萬點,標普大盤逼近歷史最高。全周道指累漲近 1.3%,標普大盤漲 1.5%,納指漲 1.4%,小盤股指漲 3.6%,芯片股指漲 1.1%。

歐股追隨美股連續反彈,本週累漲 1.3%,創 3 月底以來最長連漲週數。

在鮑威爾 “轉向” 之際,美股銀行股全線上漲,地區銀行指數表現亮眼,創八個月最大盤中漲幅。AI、機器人,光伏、地產板塊領跑,油氣能源板塊墊底。

“鮑威爾轉向日” 美債收益率大幅下挫。短端美債收益率跌幅突出,歐債收益率追隨美債顯著下挫。

美元指數創 13 個月新低,非美貨幣在 “鮑威爾轉向” 後普遍走強,英鎊近兩年半最高。

美元及美債收益率走軟支撐貴金屬走高,倫敦工業基本金屬集體上漲。

分析稱,美聯儲主席鮑威爾的轉向政策已經完成,鮑威爾在講話中表現出了全面的鴿派。

但美銀著名策略師 Michael Hartnett 警告,目前美聯儲的降息出於經濟衰退而非 “軟着陸” 前景,而歷史上這種情況往往會帶來股市崩盤。

根據 Hartnett 的統計,鮑威爾在傑克遜霍爾年會共舉行了 6 次演講,其中有 5 次標普在未來 3 個月內下跌,平均下跌 7.5%。