"Globalization Wave", see how TCL Electronics builds a model for going global

TCL Electronics has achieved remarkable results in the wave of globalization, with its adjusted net profit attributable to shareholders increasing by 147.3% in the first half of 2024, reaching HKD 45.494 billion in operating income, a year-on-year increase of 30.3%. Since 1999, TCL has actively expanded its international market. After 25 years of effort, its overseas business has gradually taken a larger share, and its brand influence has significantly increased, thanks to its implementation of a mid-to-high-end strategy and effective global operations

"Going global" or "not going global" seems to no longer be a multiple-choice question for companies in today's era of globalization. According to data from iMedia Research, the proportion of large enterprises that have implemented or have plans to go global has reached 29.5% and 19.9% respectively; among enterprises that have implemented global strategies, the proportions for medium, small, and micro enterprises are 39.4%, 17.5%, and 13.6% respectively. In terms of trends, large enterprises with strong overall capabilities have ventured into global markets earlier, but medium, small, and micro enterprises, as a large and highly flexible group in China, are accelerating their global expansion under policy and market support.

In the "going global" wave, technology, apparel, footwear, bags, and automobiles remain the main players. According to CBNData's 2023 list of the top 100 Chinese brands going global, the categories of 3C (electronics), apparel, footwear, bags, and automotive travel rank top three in terms of social media visibility, accounting for over 60% collectively, with the 3C category showing a more prominent advantage, accounting for over 30%.

As one of the earliest technology companies to go global, TCL Electronics (01070) has set a benchmark for globalization strategies. With the recent release of its interim financial results, we can catch a glimpse of its successful global expansion through the financial report.

Successful Globalization, Adjusted Net Profit Soars by 147.3%

According to the Securities Times app, TCL Electronics' history of "going global" can be traced back to 1999. It is reported that in 1999, TCL Group acquired the Leshi Vietnam Ton Nai factory, using Vietnam as a starting point to expand globally. With 25 years of experience in globalization, TCL Electronics products have achieved high channel coverage, increasing market share year by year, highlighting brand value, and steadily increasing the proportion of overseas business revenue, leading to continuous high growth in the company's performance.

In the first half of 2024, TCL Electronics achieved operating income of HKD 45.494 billion, a year-on-year growth of 30.3%, gross profit of HKD 7.748 billion, a year-on-year growth of 19.2%, and adjusted net profit attributable to owners of the parent company of HKD 654 million, a significant increase of 147.3% year-on-year.

The significant growth in performance is mainly attributed to the advancement of the mid-to-high-end strategy and global operations, demonstrating improvements in business and innovation performance, as well as cost reduction and efficiency enhancement.

Looking at the business segments, in the first half of 2024, TCL Electronics achieved comprehensive growth in all business sectors. Among them, the company's display business revenue increased significantly by 21.3% year-on-year to HKD 30.135 billion; internet business revenue was HKD 1.212 billion, an 8.9% increase year-on-year, with a high gross profit margin maintained at 54.0%; emerging businesses achieved operating income of HKD 13.953 billion, a significant increase of 60.6% year-on-year, while gross profit also increased significantly by 64.1% year-on-year to HKD 2.009 billion. In particular, the revenue and gross profit of the photovoltaic business increased significantly by 212.7% and 322.5% year-on-year to HKD 5.269 billion and HKD 543 million respectively, with the gross profit margin increasing by 2.7 percentage points year-on-year to 10.3%; The revenue from the full-category marketing business increased by 27.7% year-on-year to HKD 7.753 billion, with a gross profit margin increasing by 1.1 percentage points to 10.3%.

Delving into the internal factors driving TCL Electronics' growth, the first growth driver comes from the core competitive advantage built by the fundamental TV business.

Looking at the development history of the television industry, since the 1980s, the global color TV industry chain advantage has mainly shifted between Japan, South Korea, and China. In the 2000s, South Korea's counter-cyclical investment in panels led to the transfer of the color TV industry chain advantage from Japan to South Korea, with Samsung and LG's color TV global market share consistently ranking top two in the industry. In the 2010s, China's counter-cyclical investment in panels enabled it to surpass South Korea in the panel industry, and brand share began to rise rapidly.

As Samsung and other South Korean manufacturers exited the panel competition, the advantages of the domestic color TV industry chain in integration, economies of scale, cost efficiency, and R&D innovation became more prominent. Leading brands continued to increase their global market shipment share—TCL Electronics' global TV shipments reached 12.52 million units in the first half of this year, a year-on-year increase of 9.2%; revenue increased by 23.2% year-on-year to HKD 25.914 billion, both volume and value significantly outperforming the industry average. In the second quarter, shipments reached 6.68 million units, a year-on-year increase of 12.9% and a quarter-on-quarter increase of 14.3%. The company's TV market share also increased by 0.9 percentage points to 13.3%, ranking second globally in brand TV shipments. The market share further concentrated, demonstrating a strong "siphon effect" in the global market.

In recent years, the capital market has not paid much attention to the black screen sector, as color TV companies are easily affected by cost and intensified competition. For example, in 2013 and 2017, LeTV and Xiaomi entered the color TV market, leading to a significant drop in the average online retail price and intensified competition.

However, since 2021, TCL's retail market share has continued to increase, driven by TCL's accelerated implementation of the "large screen + dual-brand" strategy, achieving outstanding results in the global market.

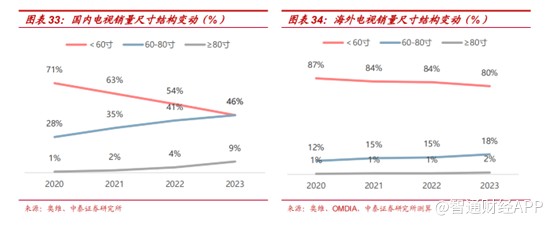

In recent years, the trend of large-screen TV consumption has become apparent, with the proportion of 75-inch and larger TVs increasing significantly. In the first half of 2024, the global industry shipment volume of 75-inch and larger TVs increased by 37.8% year-on-year, and the average TV shipment size globally increased from 49.9 inches to 51.7 inches, up by 1.8 inches year-on-year.

The larger the screen, the higher the demand for picture quality and the higher the technological threshold. With its technology and positioning in the mid-to-high-end market, TCL has a say in the large-screen color TV market. In the first half of the year, TCL's brand color TV shipments of 75 inches and above globally increased by 34.5% year-on-year, with the shipment volume share increasing by 2.3 percentage points to 11.8%.

It is worth mentioning that in the first half of the year, favorable policies such as "trade-in for new" were introduced domestically. However, according to Omdia data, the domestic TV industry's shipment volume decreased by 6.1% year-on-year, while TCL Electronics' TV shipments grew against the market trend by 5.4%, indicating its brand's strong market competitiveness In addition, from January to April 2024, Lebird successively released the Crane 7, Crane 6 PRO, and Peng 7 series products, accelerating the layout of 65/75/85-inch Mini LED and large-screen TVs for different consumer groups. The cost-effective advantages gradually emerged, and the Lebird brand also fully enjoyed the dividend of the rapid increase in Mini LED penetration rate. In the first half of the year, the shipment volume of Lebird brand TVs increased by 66.4% year-on-year, fully demonstrating the accumulated achievements in the large-screen TV and Mini LED display fields by TCL Electronics through meticulous work and innovation in products.

In terms of overseas markets, TCL Electronics has achieved stable retail volume rankings in the top five in nearly 30 countries overseas according to GfK and Circana data, through precise investment in brand marketing and increased focus on key channel coverage in North America, Europe, emerging markets, and other regions. The growth of TCL brand TVs in the European market was particularly significant in the first half of this year. It is reported that TCL Electronics increased its investment in the top channels in Europe, with 48 out of the top 50 channels already covered. In addition, TCL Electronics also used precise marketing, targeting sports events such as the European Cup, Copa America, and the Olympics to accurately promote sales by betting on championship teams, successfully driving further sales growth. With these effective strategies, the shipment volume of TCL brand TVs in the European market increased by over 40%.

It can be seen that under the strategic layout of "large screen + dual brand", TCL Electronics has built core market competitiveness in terms of economies of scale, cost efficiency, R&D innovation, and brand effects in the TV business, achieving steady growth of its foundation.

Technological innovation builds technological barriers, and global supply chain capabilities become a solid backing for scale development

It is worth noting that as a leading global intelligent terminal enterprise, building a solid foundation is just the basic requirement. It is important to understand that the global TV market competition remains fierce, so technological strength, product innovation, and channel layout are still crucial to maintaining a leading position.

In terms of technological strength, TCL Electronics and the panel leader CSOT belong to the TCL system. CSOT independently develops technologies such as HVA and HFS to provide technical support for Mini LED, giving it a first-mover advantage in industrial research and development.

In terms of product innovation, TCL Electronics has launched innovative products in multiple fields such as TV, photovoltaics, and smart home. In the field of display technology, in 2019, TCL Electronics was the first to launch the 8K Mini LED X10 smart TV, becoming the world's first enterprise to achieve mass production of Mini LED TVs. Since then, TCL Electronics has successively launched many globally stunning products, including the 115-inch QD-Mini LED TV, which have been well received by consumers.

According to TCL Electronics' announcement data, the global shipment volume of TCL's mid-to-high-end products Quantum Dot TV and Mini LED TV increased by 64.4% and 122.4% year-on-year respectively, maintaining a leading global position in the scale of Mini LED TVs.

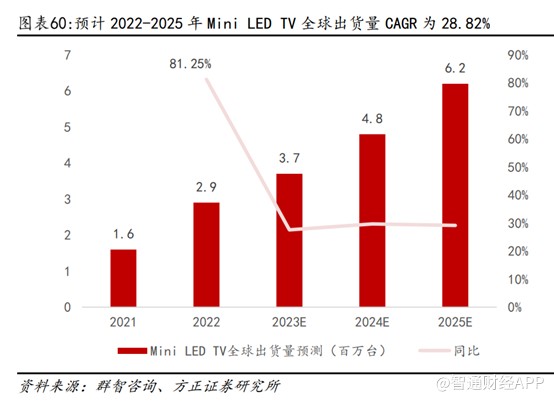

Technological development is driving the acceleration of the trend towards high-end products. According to data from Qunzhi Consulting, the global shipment volume of the Mini LED TV industry in the first half of 2024 increased by 74.3% year-on-year, and is expected to reach 6.2 million units in 2025, with a CAGR of 28.82% from 2022 to 2025 With the steady advancement of Mini LED technology, the mass production of Mini LED TVs is expected to further drive the industry's development. As a global leader in Mini LED, TCL Electronics will also fully enjoy the dividends brought by the development of the global mid-to-high-end market.

If technology strength and product innovation build technological barriers, then channel layout shapes the brand power of the enterprise. In terms of channel layout, TCL Electronics' market channel layout presents a diversified and globalized characteristic. In the international market, TCL Electronics has successfully covered over 90% of the top channels globally. In the North American market, TCL Electronics has entered the six major sales channels including BestBuy, Walmart, Costco, Target, Amazon, and Sam's Club; in Europe, TCL Electronics has implemented a localized marketing strategy, covering 48 of the top 50 channels; in emerging markets such as Latin America, TCL Electronics has established a Brazilian subsidiary and strategic cooperation with channels like Magazine Luiza S/A, extensively covering offline supermarkets and chain stores.

The extensive coverage of market channels has also enabled TCL Electronics to expand its full-category marketing business, promoting intelligent products such as TCL brand air conditioners, refrigerators, and washing machines to enter the international market. Utilizing its global marketing network, TCL Electronics achieved year-on-year growth in full-category marketing revenue, bringing more new growth points to the company.

Moreover, leveraging the previously expanded market channels, TCL Electronics started operating household photovoltaic business in 2022, and also achieved rapid growth in the first half of the year. According to the financial report, as of the end of June 2024, the photovoltaic business has covered 23 key provinces and cities in China, with over 150 signed projects, over 1200 distributor channels, and over 70,000 signed households. The company also plans to expand its overseas business in the future.

Conclusion

TCL Electronics' ability to become a "model for going global" is not achieved overnight, but is the result of forward-looking development strategies, efficient and correct operational layout, and other factors working together. This capability not only drives the company's performance to continuously flourish with growing vitality but also makes TCL Electronics' valuation worthy of being highly regarded by the market