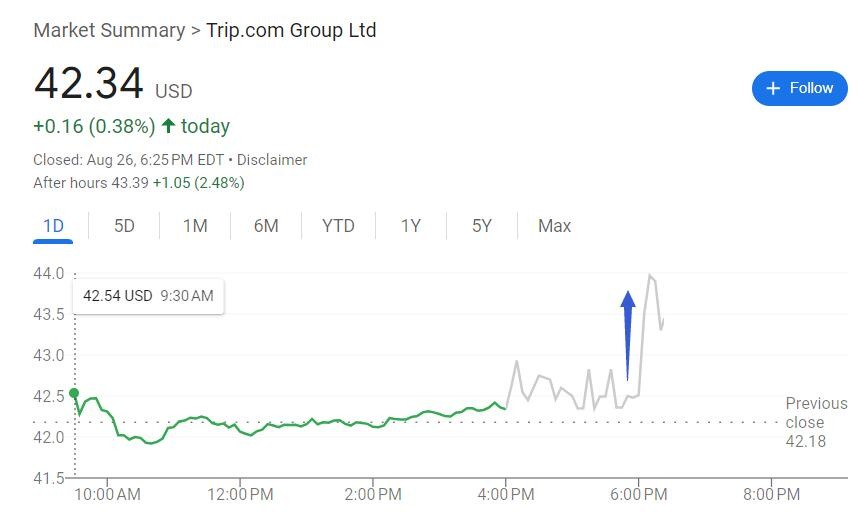

Trip.com's second-quarter profit exceeded expectations, surging by over 40%. Strong travel demand led to a nearly 4% increase in after-hours trading | Financial Report Insights

二季度携程盈利和收入均保持两位数增长,营收超预期增长 14%,EPS 增长近 42%;国内网站住宿预订增长 20%,出境酒店和机票预订全面恢复至 2019 年疫情前水平,国际平台总收入增 70%。

二季度携程继续得到强劲的旅游需求支持,保持两位数收入增长,国际业务继续增长强劲,体现旅游消费的韧性。

美东时间 8 月 26 日周一美股盘后,携程公布今年第二季度和上半年的未经审计的财务数据。

1)主要财务数据:

营业收入:上半年携程总营业收入 247.09 亿元人民币,同比增长 20.7%,其中二季度总营收 127.9 亿元人民币(约 17.6 亿美元),同比增长 14%,分析师预期 127.5 亿元。

EPS:上半年调整后每份 ADS 收益(EPS)为 13.24 元,同比增长 61.5%,其中二季度为 7.25 元,同比增长约 41.8%,分析师预期 5.22 元。

毛利:上半年毛利润为 207.21 亿元,同比增长 19.8%,其中二季度毛利润为 104.6 亿元,同比增长 13%,符合分析师预期。

2)细分数据

酒店预订:二季度酒店预订业务营收 51.4 亿元人民币(约 7.07 亿美元),同比增长 20%,分析师预期 49.5 亿元。

交通票务:二季度交通票务营收 48.71 亿元,同比增长 1.2%,分析师预期 49.7 亿元。

旅游度假:二季度旅游度假营收 10.25 亿元,同比增长 42%,分析师预期 10.2 亿元。

商旅:二季度商旅业务营收 6.33 亿元,同比增长 8.4%,分析师预期 6.345 亿元。

财报公布后,周一收涨近 0.4% 的在美上市中概股携程盘后加速上涨,盘后涨幅一度接近 4%,后涨幅收窄到 3% 以内。

国内网站住宿预订增长 20% 国际平台总收入增 70%

财报数据显示,今年前两个季度,携程每季的总收入均两位数超预期增长,二季度在历史高基数基础上同比增速较一季度有所放缓,仍实现稳健增长。

主要业务中,住宿预订一季度和二季度的营收每季至少增长逾 20%。旅游度假二季度的同比增速较一季度的 129% 明显放缓。携程称,住宿预订和旅游度假业务均主要受到旅游需求、尤其是假日期间的需求更强劲驱动。

交通票务二季度的增速不但较一季度的 20% 放缓,而且放缓程度超出分析师预期。携程称,二季度该业务主要受到机票价格波动影响。

携程称,二季度国内和国际业务均保持增长。其中,携程国内网站的住宿预订同比增长约 20%,受益于国内游和出境游均强劲增长。跨境游带动携程出境、入境及海外平台业务高速增长。

二季度,携程出境酒店和机票预订量已全面恢复至 2019 年同期疫情前水平,国际航班运力恢复率超过全行业的 70% 以上水平。

国际业务保持显著增长,携程国际 OTA 平台 Trip.com 总收入同比增长约 70%,一季度增长约 80%。

携程的联合创始人、董事局主席梁建章表示:“在旅游需求,尤其是跨境旅游需求的强劲增长下,2024 年第二季度,我们实现了持续增长。这一强劲的表现彰显了我们在动态市场中的适应能力。展望未来,我们将全力以赴,运用人工智能(AI)进行旅游业的创新,为客户创造卓越的价值体验。”

财报会议中,携程在行业首次应用 AI Agent,展现公司对于创新,以及采用新技术推动旅游业变革的坚定承诺,并介绍 AI 落地的具体成果——两款内容产品。

携程 CEO 孙洁表示:“我们很高兴看到中国旅游消费的强劲增长和韧性。这种乐观的前景激发了我们对创新和新举措的热情。通过与合作伙伴的合作,我们有能力取得更大的成功。”