Walgreens stock has fallen apart: is CVS Health any better?

沃爾格林聯合博姿(WBA)股票今年已經暴跌超過 68%,原因包括零售盜竊、過時門店和失敗的收購,面臨來自沃爾瑪和亞馬遜等大公司的激烈競爭。與此同時,西維斯(CVS Health)在進行更多多元化收購(如 Aetna)的同時,由於運營成本上升、與阿片類相關的指控以及競爭加劇,股價也下跌了超過 44%。兩家公司都面臨困境,而 CVS 現在的市值已經小於其對 Aetna 的收購成本

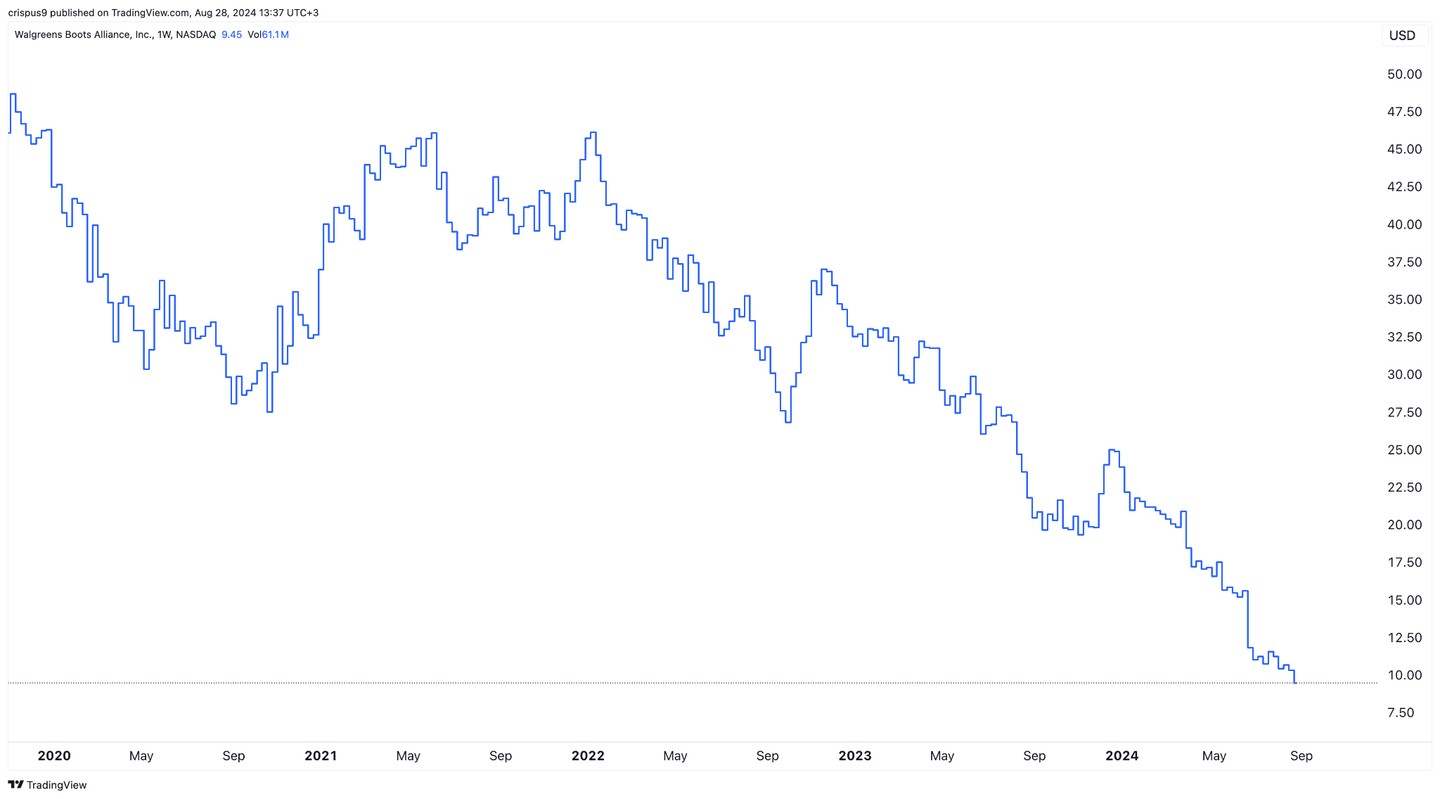

在美國正在上演一則最令人悲傷的金融故事,沃爾格林聯合博姿(WBA)正在崩潰,成為一隻墮落的天使。該股票今年已經暴跌超過 68%,過去五年更是下跌了 80%。股價跌至 9.45 美元,處於 1997 年以來的最低點。

沃爾格林聯合博姿股票

為什麼沃爾格林崩潰了

沃爾格林的市值已經跌至 89.6 億美元,遠低於 2019 年的 500 億美元。要了解公司跌至何種程度,可以考慮一下,2019 年股價達到頂峯時投資 1000 美元,如今僅值 150 美元,不包括股息。

該公司面臨着諸多挑戰。關鍵城市的零售盜竊一直是一個讓人頭疼的問題,已經給公司造成了數百萬美元的損失。為了解決這個問題,公司被迫關閉了美國數百家門店並鎖定產品。雖然鎖定產品可以防止盜竊,但也會讓顧客望而卻步。

沃爾格林還因其過時的門店和在 2022 年失敗的收購 VillageMD 而備受困擾,當時它試圖打造一個完整的服務生態系統。這次收購結果很糟糕,公司大部分資產被減記,大部分員工被解僱。因此,公司報告了 60 億美元的季度鉅額虧損。

最重要的是,沃爾格林聯合博姿正面臨來自沃爾瑪、Target 和亞馬遜等公司的激烈競爭。其他數字藥房也紛紛湧現。例如,Hims & Hers(HIMS)的市值已經超過 34.8 億美元,這對於一家 2017 年創立的公司來説是一個不錯的成就。

沃爾格林還在努力剝離其 Boots 股份。其試圖將其公開上市的努力失敗,公司現在正在與潛在的私募股權公司進行討論。

沃爾格林的困境讓人想起了 RiteAid,這家公司在美國擁有第三大市場份額,但由於高債務負擔而申請破產。

閲讀更多:克萊默建議購買沃爾格林股票,儘管最近有員工大規模離職

西維斯健康也不樂觀

從表面上看,西維斯健康和沃爾格林聯合博姿是類似的公司,因為它們在美國都擁有數千家藥店。

然而,這兩家公司在很大程度上是不同的,因為西維斯經營着更多樣化的業務模式。除了藥店,西維斯健康還擁有 CVS Caremark,這是美國最大的藥房福利管理公司(PBM)。Caremark 與 Express Scripts、OptumRx 和 Humana Pharmacy Solutions 等公司競爭。

西維斯健康還擁有 Aetna,這是它在 2018 年以 780 億美元收購的公司。通過擁有 Aetna,公司能夠為客户提供更多解決方案。此外,它在 2023 年以 100 億美元收購了 Oak Street Health。這次收購使公司在初級保健業務中獲得了更多機會。

然而,現實是西維斯健康也並不好,因為其藥店業務也面臨着與沃爾格林類似的挑戰。

競爭加劇,而消費者現在更傾向於選擇像亞馬遜和沃爾瑪這樣提供免費運輸服務的公司。這兩項服務擁有數億客户。它還花費數十億美元改善其門店。

西維斯的規模比收購 Aetna 的金額還小

此外,經營成本上升,導致利潤率降低。此外,公司同意支付 50 億美元用於與阿片有關的指控。

因此,西維斯健康股價從 2022 年最高點暴跌超過 44%,目前處於 2020 年以來的最低點。因此,其市值已從 2020 年的超過 1,360 億美元降至 730 億美元。

換句話説,西維斯現在比收購 Aetna 的金額還要小。它的債務總額也增加,長期債務總額已上升至 610 億美元以上。

最近的業績顯示,西維斯健康上季度收入增長了 2.6%,達到 912 億美元,而半年自由現金流為 80 億美元。

然而,公司還降低了其未來指引。它預計其自由現金流約為 90 億美元,低於 105 億美元,而其 GAAP 攤薄每股收益將在 4.95 美元至 5.20 美元之間,低於之前的 5.64 美元。

因此,有風險西維斯健康股價在短期內保持不穩定,因為交易員將關注其扭轉局面。因此,雖然最終會反彈,但恢復可能需要時間。

西維斯健康股票分析

西維斯健康股票

周線圖顯示,西維斯股價在過去幾周內保持穩定。在此過程中,它形成了一個看跌的旗形圖表模式,這是一個流行的跡象,表明它將有一個看跌的突破。

股價一直低於 50 周和 100 周移動平均線。因此,股價可能會有一個看跌的突破,下一個關注點將是 45.58 美元,這是 2020 年 3 月的最低點,比當前水平低 21%。

文章來源:沃爾格林股價崩潰:西維斯健康如何? - Invezz