Big Lots on the Brink of Bankruptcy as Headwinds Persist

American off-price retailer Big Lots is facing potential bankruptcy under Chapter 11 due to ongoing macroeconomic challenges and declining sales, which have seen a 10% drop year-over-year in Q1 FY24. The company is seeking investors for a financial lifeline as it deals with a liquidity crisis and plans to shut down 315 stores—about 25% of its total operations. In after-hours trading, Big Lots stock fell 15%, and it has lost 88% of its value this year amid poor traffic and consumer spending shifts.

American off-price retailer, Big Lots (BIG) is on the brink of filing for bankruptcy under Chapter 11 as macroeconomic headwinds persist, Bloomberg reported. BIG stock slumped 15% in after-hours trading yesterday in reaction to the news. BIG’s retail outlets offer home goods, furnishings, electronics, and seasonal goods. A shift in consumer spending habits, with a reduction in the purchase of discretionary items has led to years of declining sales for the retailer.

Big Lots has also been facing a liquidity crunch. The company took a loan last April to stave off the pressure, but its situation has not improved. Big Lots is seeking investors to avert bankruptcy protection. However, all talks remain in the early stages and no decision has been made yet. A Chapter 11 Bankruptcy could reportedly be filed within weeks.

Big Lots’ Woes Continue to Grow Bigger

During its Q1 FY24 results declared in June, Big Lots stated that it would shut down roughly 40 non-performing stores and also cautioned investors about its viability in the foreseeable future. Q1 sales fell by 10% year-over-year, while net loss came in wider-than-expected. Big Lots even said it could default on a 2022 loan obligation.

The store closure target quickly climbed to 315 in August, which is roughly one-fourth of the total stores Big Lots operates in the U.S., reflecting the sheer pressure on the retailer.

The continued high-interest rate environment has marred consumers’ inclination to buy big-ticket items such as home furnishings. Plus, increased shipping and delivery expenses have impacted retailers’ bottom lines. Big Lots is not the only retailer getting affected by the headwinds. Recently, specialty flooring retailer LL Floorings (LLFLQ) filed for bankruptcy under Chapter 11, as sales continued to decline and debt obligations mounted.

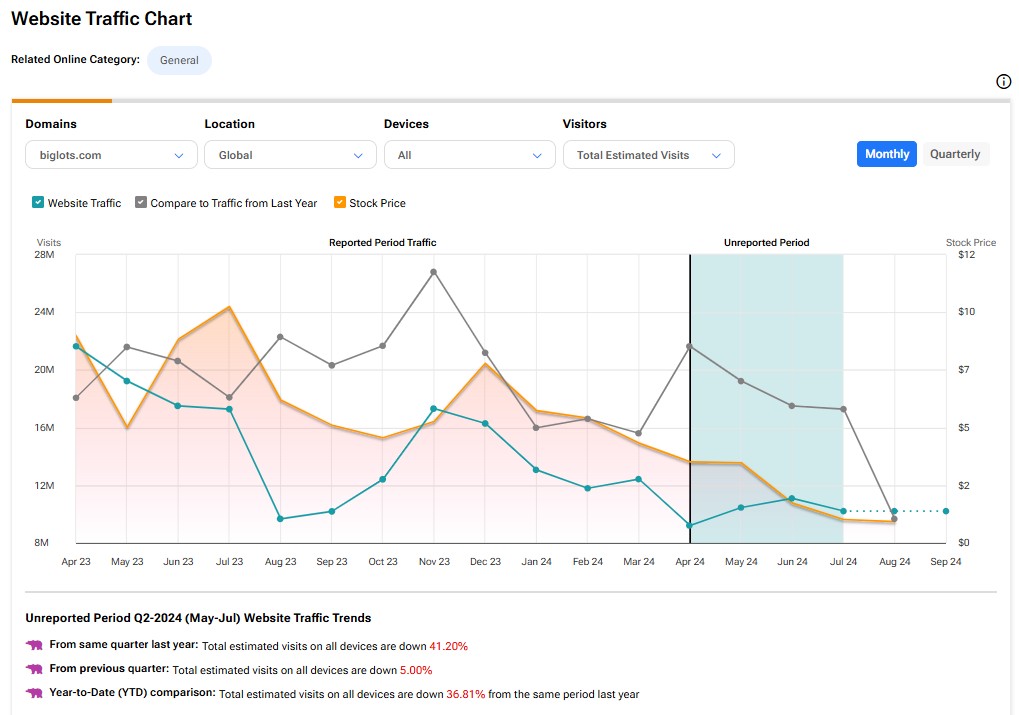

Website Traffic Hints at Big Lots’ Weak Traffic

According to TipRanks’ Website Traffic tool, the total estimated visits to all of Big Lots’ apps and websites worldwide decreased by 36.81% in the year-to-date period compared to last year. The dismal figure shows how the retailer’s sales have been declining as customers curb their discretionary spending.

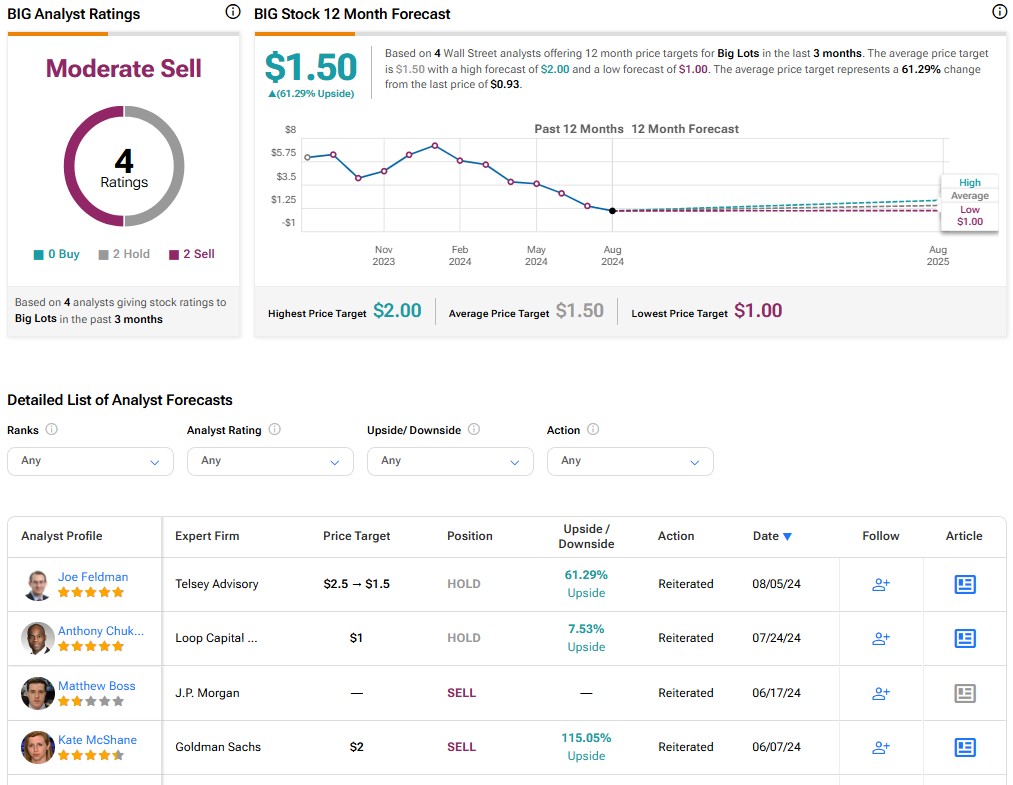

Is Big Lots Stock a Buy, Sell, or Hold?

On TipRanks, BIG stock has a Moderate Sell consensus rating based on two Hold and two Sell recommendations. Also, the average Big Lots price target of $1.50 implies 61.3% upside potential from current levels. Meanwhile, BIG shares have plunged 88% so far this year.

See more BIG analyst ratings

Disclosure