Is Japan's monetary policy more important than the Federal Reserve's? "Wall Street's oldest trade" still poses significant risks to the global market

日本貨幣政策的動向對全球市場產生巨大風險,特別是套息交易的解除引發了投資者的擔憂。8 月初,美國股市因這一因素下跌,日經指數也因投資者急於退出套息交易而暴跌。預計日本央行可能進一步加息,加大市場的不確定性。分析指出,套息交易的解除威脅到風險資產的前景。

八月初美國股市的恐慌背後有一個很大的因素,這個因素一直沒有消失,而且與美國經濟放緩關係不大。當時市場動盪的原因是因為套息交易的解除。

智通財經 APP 獲悉,一個月前,日本日經指數下跌 12.4% 的部分原因是由於投資者急於退出套息交易,並引發了全球股市的拋售潮。8 月 5 日,道瓊斯工業平均指數和標普 500 指數創下自 2022 年 9 月 13 日以來的最差表現,前者下跌 1033.99 點,跌幅達 2.6%。

投資者的擔憂在於,美國股市近年的上漲很大程度上得益於套息交易的便利借貸。套息交易是一種通過低息借款購買高收益貨幣或資產的策略。由於日本央行多年來維持超低利率,投資者通過以日元為資金的交易大量買入其他國家的股票和資產。

最近的數據表明,新的套息交易已經重新活躍起來。據 Fed Watch Advisors 首席投資官兼創始人 Ben Emons 表示,槓桿型對沖基金增加了日元期貨的空頭頭寸。

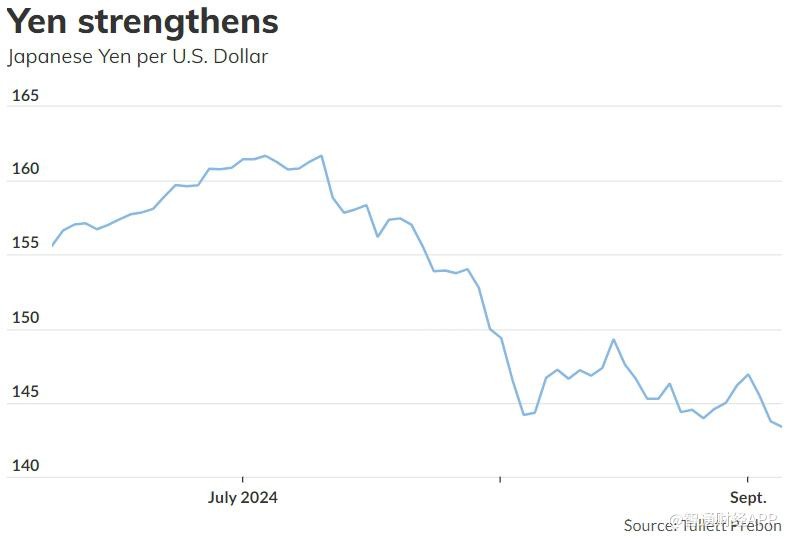

與此同時,日元的升值表明套息交易可能再次解除。日元通常作為低收益貨幣被用來投資高收益的替代品,而在週三,日元兑美元上漲了超過 1%,週四交易價約為 143.42 美元兑 1 日元,是今年以來的最強水平之一。

此外,人們預計日本央行在 7 月將借貸成本從接近零的水平上調後,可能會進一步加息,這一舉動可能會對全球市場產生影響。貨幣波動往往很大程度上由所謂的利率差異驅動,即全球不同國家之間的利率政策差異。隨着日本加息的進行,美聯儲預計將於 9 月 18 日進行首次降息,自 6 月和 7 月以來,隨着美債收益率和美元下跌,這一趨勢可能持續。

Standard Bank G-10 策略負責人 Steve Barrow 表示:“套息交易的解除確實對風險資產的樂觀前景構成了嚴重威脅。” Barrow 在週四的一份報告中寫道,幾十年來,日本通過貿易和經常賬户盈餘投資海外的資金可能會 “逆轉”,因為日本利率和日元的上升。

Barrow 還補充道,日本央行,可能比美聯儲更為關鍵,8 月日元飆升和股市下跌帶來的 “混亂” 可能只是未來更大變化的前兆。

AGF Investments 貨幣策略師兼固定收益聯席主管 Tom Nakamura 指出,類似的外匯發展對美國股市產生更廣泛影響並不常見,回顧 1997 年的亞洲金融危機,或許可以找到類似的案例。儘管 2022 年英國主權債務危機對英鎊和歐洲債市產生了影響,其程度並沒有像套息交易解除那麼劇烈。

他表示,日元套息交易的進一步解除仍然是一個巨大的跨市場風險,投資者對日本央行未來一兩年的行動感到擔憂。無論是美國經濟放緩還是其他央行的政策決定,市場的波動性仍然很高,甚至比 8 月初還要大。

Emons 將套息交易描述為 “華爾街最古老的交易”,其形式多樣。例如,套息交易不僅限於日元,也可以使用美元借款進行新興市場的投資,或者反映在加元與日元之間的交易上。

儘管 8 月日元的升值已經對市場情緒造成了影響,Nakamura 認為,套息交易作為一種整體策略依然具有吸引力。他指出,市場已經意識到這一風險,這有助於減輕其影響;最糟糕的情況通常是意料之外的。

他將日元兑美元的 140 視為一個關鍵水平。如果日元逐漸升值至 130 至 135 之間,這種情況是可控的。但如果這種升值在一兩個月內發生,可能會帶來麻煩。