"Mini non-farm" suppresses US stocks and the US dollar, Nasdaq rises by over 1% before sharply narrowing, NIO surges by over 14%, RMB hits a 16-month high

非農前日,美國就業降温再添新證,經濟擔憂支持大幅降息押注,2 年/10 年期美債收益率曲線兩年來第三次短暫結束倒掛。標普三連跌,博通盤後跌超 4%,特斯拉漲近 5%,英偉達和中概股指漲近 1%。日元一個月最高,離岸人民幣漲 300 點升破 7.09 元。黃金一度漲 1%,油價漲超 2% 後收跌,美油兩日不足 70 美元創 15 個月最低。

勞動力市場數據喜憂參半。美國 8 月 “小非農” 新增就業人數意外降至 9.9 萬人創三年半最低,且 7 月份數據被下調,顯示出勞動力市場急劇放緩。不過,每週初請失業金人數 22.7 萬人較前一週有所下降,續領失業救濟人數也回落至近三個月來最低。

不過,美國 8 月 ISM 服務業指數連續兩個月温和擴張,稍早前公佈的 Markit 服務業 PMI 終值為近兩年半最高,均緩解經濟硬着陸擔憂。今年票委、美國舊金山聯儲主席戴利稱,美聯儲需要降低政策利率,因為通脹正在下降,經濟正在放緩。

兩項就業數據公佈後,美債收益率和美元指數 DXY 均短線下行並刷新日低。兩項服務業 PMI 數據公佈後,美債收益率和美元指數短線走高,隨後刷新日高。美聯儲 9 月大幅降息 50 個基點的押注從 44% 小幅回落至 41%,降息 25 個基點的可能性升至 59%。

市場聚焦週五晚關鍵的非農數據進一步驗證降息幅度。經濟學家普遍預計 8 月非農新增就業崗位將為 16 萬個,高於 7 月的 11.4 萬個。失業率或小幅降至 4.2%。

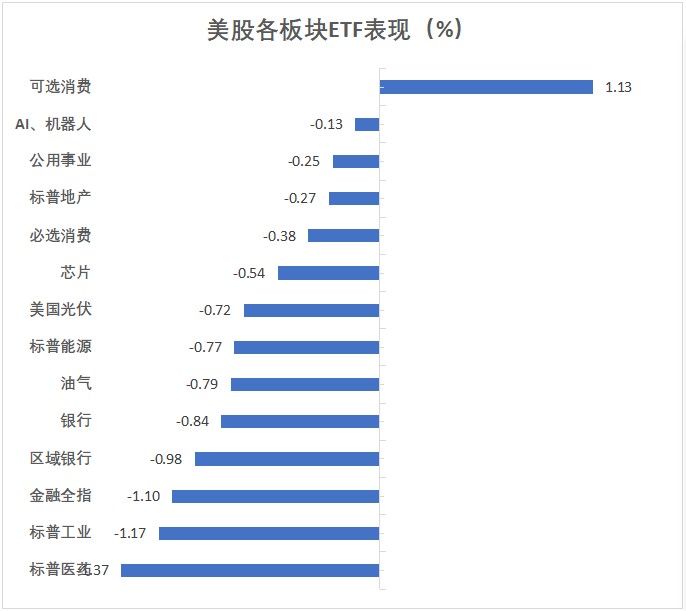

美股主要股指早盤衝高後回落,午盤時全線轉跌,後僅納指成功轉漲,但仍顯著低於早盤時的漲超 1%,尾盤時多數股指收於日低,標普大盤和羅素小盤股指連跌三日,但中概指數逆市走高近 1%。板塊方面,可選消費股漲幅居前,如特斯拉收漲 4.9%:

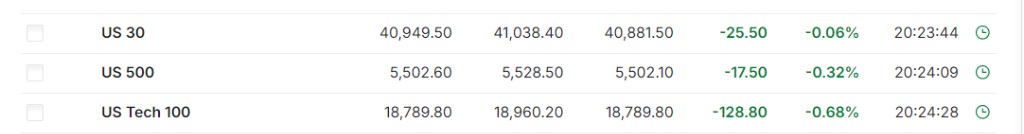

- 美股三大指數僅納指漲:標普 500 大盤收跌 0.3% 至 5503.41 點。與經濟週期密切相關的道指收跌 0.54% 或 219 點至 40755.75 點。科技股居多的納指收漲 0.25% 至 17127.66 點。納指 100 收漲 0.05%。衡量納指 100 科技業成份股表現的納斯達克科技市值加權指數(NDXTMC)幾近持平。對經濟週期更敏感的羅素 2000 指數收跌 0.61%。恐慌指數 VIX 收跌 6.66%,報 19.90。

標普 500 大盤連續三日反彈失敗

美股行業 ETF 收盤多數下跌。可選消費 ETF 與全球航空業 ETF 漲逾 1%。而醫療業 ETF 與金融業 ETF 跌超 1%,區域銀行 ETF、銀行業 ETF 及能源業 ETF 跌幅接近 1%,生物科技指數 ETF 與日常消費 ETF 則各跌不到 0.5%。

- 標普 500 指數的 11 個板塊跌多漲少。保健板塊收跌 1.39%,工業與金融板塊至多跌 1.18%,原材料、能源板塊至多跌 0.8%,信息技術/科技板塊則收漲 0.05% 表現第三,電信板塊漲 0.52%,可選消費板塊漲 1.41%。

- “科技七姐妹” 僅微軟跌。特斯拉收漲 4.9%,公司預計 2025 年一季度在中國和歐洲提供全自動駕駛 (FSD),有待監管批准。英偉達收漲 0.94%,“元宇宙” Meta 收漲 0.8%,亞馬遜收漲 2.63%,谷歌 A 收漲 0.5%,蘋果收漲 0.69%,美國銀行預計即將到來的 iPhone 發佈會有望推動蘋果股價上漲,而微軟收跌 0.12%。

- 芯片股多數下跌。費城半導體指數收跌 0.6%;行業 ETF SOXX 收跌 0.54%;英偉達兩倍做多 ETF 收漲 1.71%。英特爾收跌 0.15%,英特爾正考慮出售自動駕駛軟件公司 Mobileye 部分股權,安森美半導體收跌 0.6%,阿斯麥 ADR 收跌 1.96%,應用材料收跌 1.17%,高通收跌 0.47%,科磊收跌 2.29%,AMD 收跌 1.02%,博通收跌 0.84%,而 Arm 控股收漲 1.77%,台積電 ADR 收漲 1.76%,美光科技收漲 0.11%。

- AI 概念股跌多漲少。C3.ai 收跌 8.21%,盤中一度下跌 18%,創下自 2023 年 9 月以來最大跌幅,公司上財季訂閲收入遜於預期,何時盈利仍未知。超微電腦收跌 2.09%,BigBear.ai 收跌 2.88%,戴爾收跌 1.74%,CrowdStrike 收跌 1.11%,英偉達持股的 AI 語音公司 SoundHound AI 收跌 0.22%,Palantir 收跌 1.41%,Serve Robotics 收跌 7.61%,而 BullFrog AI 收漲 5.96%,甲骨文收漲 1.32%。

中概股指逆市跑贏美股大盤。納斯達克金龍中國指數收漲 0.88%。ETF 中,中國科技指數 ETF(CQQQ)收漲 0.63%。中概互聯網指數 ETF(KWEB)收跌 0.04%。

- 熱門中概股中,蔚來收漲 14.39%,Q2 營收同比增長 99%,Q3 交付指引超過市場預期,摩根大通將小鵬汽車 ADR 評級從中性上調至超配,目標價從 8 美元上調至 11.5 美元。極氪收漲 8.71%,小鵬汽車收漲 4.74%,理想汽車收漲 0.48%,花旗下調理想汽車評級至中性,稱明年業績有不及預期風險。嗶哩嗶哩收漲 2.26%,新東方收漲 1.98%,攜程網收漲 0.74%,百度收漲 0.52%,而阿里巴巴收跌 0.05%,拼多多收跌 0.08%,騰訊控股 ADR 收跌 0.08%,美團 ADR 收跌 0.13%,唯品會收跌 0.16%,網易收跌 1.24%,京東收跌 1.68%。

- 其他重點個股中:(1)博通 Q3 AI 產品相關收入不及預期,Q4 營收指引遜色,盤後一度跌超 5%。(2)電子簽名解決方案供應商 Docusign 二季度訂閲營收超預期,上調全年收入指引,股價盤後跌超 5%。(3)機器人流程自動化軟件公司 Uipath 二季報和全年業績指引好於預期,股價盤後一度漲超 8%。(4)獲得英偉達 1.6 億美元融資的 Applied Digital 收漲約 66%,創 2023 年 5 月份以來最大單日漲幅。

美國經濟衰退預期加劇,歐洲股市第四日下跌:

泛歐 Stoxx 600 指數收跌 0.54% 至 512.05 點。各大板塊漲跌不一,公用事業股上漲 1.66%,而醫療保健股下跌 1.4%。成分股中,LVMH 集團旗下蒂芙尼將於 2025 年在中國新開三家門店。

德國股指收跌 0.08%。法國股指收跌 0.92%,意大利股指收漲 0.01%,西班牙股指收漲 0.53%,英國股指收跌 0.34%。

“小非農”發佈日,10年期美債收益率跌2.45個基點,盤中2/10年期收益率曲線最近一個月盤中第三次短暫結束倒掛,兩年期收益率刷新一年多新低:

- 美債:尾盤時,對貨幣政策更敏感的兩年期美債收益率跌 0.62 個基點,報 3.7476%,ADP“小非農” 發佈後跳水並刷新日低至 3.7106%,ISM 非製造業數據發佈後反抽,刷新日高至 3.7910%。

- 美國 10 年期基準國債收益率跌 2.45 個基點,報 3.7307%,北京時間 20:15 發佈美國 ADP 就業數據後顯著跳水,21:55 臨近發佈美國 ISM 非製造業指數時刷新日低至 3.7194%,ISM 非製造業數據發佈後反抽,逼近 17:09 刷新的日高 3.7722%,美股午盤再度轉跌。

歐債普遍跌約 2 個基點:歐元區基準的 10 年期德債收益率跌 1.6 個基點,美國 ADP“小非農” 就業數據公佈後顯著走低,並在 ISM 非製造業數據發佈前刷新日低。兩年期德債收益率跌 2.7 個基點。法國 10 年期國債收益率跌 2.1 個基點,意大利 10 年期國債收益率跌 2.0 個基點,西班牙 10 年期國債收益率跌 2.1 個基點,希臘 10 年期國債收益率跌 1.5 個基點。兩年期英債收益率跌 2.5 個基點,英國 10 年期國債收益率跌 2.0 個基點。

- 據央視新聞報道,當地時間 9 月 5 日,德國伊弗經濟研究所指出,繼去年經濟萎縮 0.3% 後,今年德國經濟增長將陷入停滯,本年度的增長預期下調 0.4 個百分點,2025 年德國經濟增長預期下調 0.6 個百分點。

美債收益率連續第三日下跌,10 年期美債收益率跌 2 個基點至 3.73%,除 8 月 5 日的暴跌(隨後迅速恢復)外,收益率現已回到 2024 年的低點

“小非農”令美元指數DXY跌至一週盤中低點,美國ISM非製造業數據又令美元指數一度轉漲,最終尾盤跌0.3%。非美貨幣普漲,日元盤中升破143 至一個月最高且連漲三日,離岸人民幣尾盤漲235點至近16 個月高位,升破 7.09 元:

- 美元:衡量兑六種主要貨幣的一籃子美元指數 DXY 下跌 0.29%,報 101.064 點,北京時間 20:15 發佈美國 ADP 就業數據後跳水並刷新日低至 100.964 點,22:00 發佈美國 ISM 非製造業指數後回升並一度轉漲,全天絕大部分時間處於下跌狀態,撇開 ISM 數據帶來的波動外,整體呈現出震盪下行走勢。8 月 27 日曾跌至 100.514 點。

- 彭博美元指數跌 0.19%,報 1230.74 點,亞太午盤曾刷新日高至 1233.12 點,全天剩餘時間處於震盪下行狀態,美股午盤後刷新日低至 1230.20 點,也逼近 8 月 26 日底部 1221.94 點。

- 非美貨幣普漲。歐元兑美元漲 0.26%,英鎊兑美元漲 0.24%,美元兑瑞郎跌 0.27%;商品貨幣對中,澳元兑美元漲 0.23%,紐元兑美元漲 0.39%,美元兑加元跌 0.02%。

- 日元:日元兑美元漲 0.21%,報 143.44 日元。美股盤前,日元最高觸及 142.852,美國 ISM 服務業 PMI 數據曾令日元短線下挫,並刷新日低至 144.23 日元。

- 離岸人民幣:離岸人民幣(CNH)兑美元尾盤漲 235 點,報 7.0899 元,為 2023 年 5 月以來最高,盤中整體交投於 7.1144-7.0871 元區間。在岸人民幣/美元上漲 0.3%,收於 7.0888,也是去年 5 月以來最高。

- 加密貨幣跌多漲少。市值最大的龍頭比特幣尾盤跌 3.51%,報 56305.00 美元。第二大的以太坊尾盤跌 3.51%,報 2380.00 美元,兩者均至一個月低位。

全球經濟衰退擔憂飆升,掩蓋了OPEC+決定至少推遲兩個月增產,以及美油庫存下降至一年新低的好消息,油價衝高回落至逾14個月低點,美油漲超2.3%後收跌0.07%,布油漲超2%後收跌0.01%:

- 美油:WTI 10 月原油期貨收跌 0.05 美元,跌幅 0.07%,報 69.15 美元/桶,創 2023 年 6 月份以來收盤新低。

- 布油:布倫特 11 月原油期貨收跌 0.01 美元,跌超 0.01%,報 72.69 美元/桶。

- 盤中表現:有消息稱 OPEC+ 已經達成共識,將把石油供應增加的計劃推後兩個月實施。加之 EIA 政府版原油庫存週報顯示,美國上週 EIA 原油庫存下降約 690 萬桶,至去年 9 月以來新低。受兩者影響,美油和布油價格持續拉昇,美股早盤時美油最高漲超 2.3% 上逼 71 美元整數位,布油最高漲超 2% 升破 74 美元整數位。但經濟衰退恐慌引發避險情緒升温,兩油急劇下挫,美股午盤後刷新日低時,美油最低跌近 0.7% 跌穿 69 美元整數位,布油最低跌近 0.5% 下逼 72 美元整數位。

- 天然氣:美國 10 月天然氣期貨漲超 5.08%,報 2.2540 美元/百萬英熱單位。美國上週天然氣庫存增幅低於市場預期

由於對經濟衰退的恐懼,油價不僅跌至 2024 年的新低,而且還即將突破 2023 年的低點

雖然盤中 ISM 服務業 PMI 數據曾令金價漲幅收窄,由於 ADP 數據疊加週三的 7 月 JOLTS 職位空缺數大幅下降,暗示勞動力市場大幅放緩,美元和美債收益率攜手走軟提振貴金屬價格,黃金價格漲至近一週高點:

- 黃金:COMEX 12 月黃金期貨尾盤漲 0.84%,報 2547.20 美元/盎司。現貨金黃金天維持漲勢,美股盤前 “小非農” 及首申數據公佈後,刷新日高漲逾 1.1% 升破 2520 美元整數位,尾盤時現貨金漲 0.86%,報 2516.76 美元/盎司。

- 白銀:COMEX 12 月白銀期貨尾盤漲 2.14%,報 29.168 美元/盎司。現貨白銀全天維持漲勢,美股早盤最高漲近 3.2% 升破 29.10 美元整數位,尾盤時現貨白銀漲 1.94%,報 28.8229 美元/盎司。

- 分析指出,如果 8 月份週五公佈的非農報告顯示失業率達到 7 月份的 4.3%,即 2021 年以來的最高水平,那麼隨着市場加大對大幅降息的押注,金價將重回歷史高位,年底有望衝擊 2700 美元。

- 倫敦工業基本金屬漲跌不一。經濟風向標 “銅博士” 漲超 1.47%,報 9092 美元/噸,倫錫收漲 272 美元,而倫鋅跌超 2.07%,倫鋁收跌 18 美元,倫鉛收跌 25 美元,倫鎳收跌 136 美元。

- COMEX 銅期貨漲 1.50%,報 4.1402 美元/磅。

避險需求支撐金價徘徊歷史高位附近

以下為北京時間 9 月 5 日 23:00 以前更新內容

勞動力市場數據喜憂參半。美國 8 月 “小非農” 新增就業人數創三年半最低,進一步佐證勞動力市場放緩,美債收益率和美元攜手走低。不過,每週初請失業金人數較前一週有所下降且低於預期,續領失業救濟人數降至近三個月來最低,美元跌幅收窄。市場將關注明晚非農數據進一步驗證。

早盤公佈的美國 ISM 非製造業活動連續兩個月温和擴張,稍早前公佈的 Markit 服務業 PMI 終值態勢趨同,緩解硬着陸擔憂。

美股主要指數盤初走高後多數轉跌,僅納指漲:

- 美股三大指數衝高後回落:標普 500 大盤漲近 0.5% 後又跌超 0.3%。與經濟週期密切相關的道指盤初漲近 0.3% 後跌超 240 點或跌近 0.6%。科技股居多的納指漲超 1.2% 後回吐多數漲幅。

美股盤初,主要行業 ETF 漲跌不一,全球航空業 ETF 漲超 2%,可選消費 ETF 漲近 1%,醫療業 ETF 跌超 1%。

- “科技七姐妹” 全線上漲。英偉達漲超 3.2% 後漲幅砍半,特斯拉一度漲超 7%,公司預計 2025 年一季度在中國和歐洲提供全自動駕駛 (FSD),有待監管批准。亞馬遜一度漲超 3.7%,蘋果一度漲超 2%,“元宇宙” Meta 一度漲超 1.7%,谷歌 A 一度漲超 1.8%,微軟一度漲超 1%。

- 芯片股漲跌不一。費城半導體指數盤初跌超 1.5% 後又漲超 1%;科磊跌超 2.7% 後跌幅砍半,阿斯麥跌超 2.4% 後跌幅砍半,AMD 盤初跌超 2% 後抹平多數跌幅,而 Arm 控股一度張超 2.8%,台積電美股一度漲超 2.2%,英特爾一度漲超 2.3%,美光科技一度漲超 1.5%。

- AI 概念股漲跌不一。C3.ai 一度跌超 18%,Serve Robotics 一度跌超 8.5%,英偉達持股的 AI 語音公司 SoundHound AI 跌超 1.6% 後漲超 1.4%,現在轉跌,超微電腦盤初跌超 3.9% 後跌幅砍半,而甲骨文一度漲超 1.7%。

中概股漲多跌少。納斯達克金龍中國指數一度漲近 1.3%。熱門中概股中,蔚來和極氪一度漲超 8.6%,理想汽車曾漲超 1.4%,小鵬汽車曾漲超 6%,嗶哩嗶哩漲超 4.3% 後回吐部分漲幅,而拼多多盤初跌超 2.6% 後跌幅砍半。

- 值得注意的是,蔚來 Q2 交付量和營收雙雙創歷史新高,Q2 營收同比增長 99%,Q3 交付指引超過市場預期。

以下為 21:50 以前更新內容

昨日“美聯儲最愛就業指標”崩盤,JOLTS 職位空缺走弱至 2021 年初以來最低水平,增強降息預期並帶動美債收益率跳水,全球的避險情緒升温。

週四(9 月 5 日),美國 8 月 ADP 就業人數公佈,增長 9.9 萬人遠不及預期的 14.5 萬人。美債收益率繼續走低,2 年期國債收益率下行逾 2bp,黃金等避險資產走升。

美股開盤三大股指漲跌不一,蔚來績後漲逾 4%,特斯拉盤初漲近 2%,C3.ai 下跌 18%。

美債上漲帶動美元走弱,日元走強,澳大利亞和新西蘭債券也追隨美債走勢。今日亞太股市高開低走,日韓股市集體收跌,歐股方面小幅低開。

當前投資者密切關注週五即將發佈的非農就業數據。此外,今晚 22:00 美國 8 月 ISM 非製造業指數出爐。

- 美股開盤三大股指漲跌不一,蔚來績後漲逾 4%,特斯拉盤初漲近 2%,C3.ai 下跌 18%。

- 美國 8 月 ADP 就業報告公佈,美債收益率跳水。2 年期國債收益率下行逾 2bp、10 年期國債收益率下行逾 1bp。美元指數短線走低至盤中低點。美元兑日元跌 0.5%,報 143.01。

- 亞洲股市在日本下跌後抹去了大部分漲幅,日韓股市集體收跌。

- 歐股開盤主要股指小幅走低,歐洲斯托克 600 指數幾乎沒有變化。

- 國際油價走升,美、布兩油日內均漲逾 1%。

- 黃金、白銀走升。現貨黃金向上觸及 2520 美元/盎司,日內漲 1%。現貨白銀日內漲超 2%,現報 28.83 美元/盎司。

【21:35 更新】

美國就業數據喜憂參半,市場關注明晚非農數據。美股盤初三大股指漲跌不一,納指盤初跌 0.11%,標普 500 指數漲 0.04%,道指漲 0.22%。

特斯拉盤初漲近 2%,公司預計 2025 年一季度在中國和歐洲提供全自動駕駛 (FSD),有待監管批准。

蔚來盤初漲超 4%,Q2 營收同比增長 99%,Q3 交付指引超過市場預期。C3.ai 盤初跌逾 18%,公司上財季訂閲收入遜於預期,何時盈利仍未知。

黃金股上漲,科爾黛倫礦業漲逾 3%,金羅斯黃金漲近 3%,巴里克黃金漲逾 2%。

【20:20 更新】

美國 8 月 ADP 就業人數(“小非農”)數據公佈:增長 9.9 萬人,預期 14.5 萬人,前值 12.2 萬人。

美國 ADP 數據公佈後,美國國債收益率短線跳水,2 年期國債收益率下行逾 2bp,現報 3.735%;10 年期國債收益率下行逾 1bp,現報 3.744%;美元指數短線走低,日內跌 0.23%。

美元指數短線走低至盤中低點,日內跌 0.23%。美元兑日元跌 0.5%,報 143.01。

現貨黃金向上觸及 2520 美元/盎司,日內漲 1%。現貨白銀日內漲超 2%,現報 28.83 美元/盎司。

美股三大股指期貨均走低,納斯達克 100 指數期貨跌幅擴大至 0.68%,標普 500 指數期貨日內跌 0.28%。

【17:40 更新】

蔚來美股盤前漲近 5%,公司發佈 2024 年二季度財報,營收和交付量雙創新高。

公司 2024 年 Q2 營收 174.5 億元,上年同期 87.7 億元。 預計 2024 年 Q3 交付量將在 61,000 至 63,000 輛之間,市場預期為 56,770 輛。

【17:10 更新】

美、布兩油日內走高,均漲逾 1%,分別報 69.92 美元/桶、73.44 美元/桶。

特斯拉美股盤前漲逾 2.5%,公司預計 2025 年一季度在中國和歐洲提供全自動駕駛 (FSD),有待監管批准。

【16:20 更新】

美股盤前三大指數期貨微幅上漲。

主要科技股中,特斯拉漲超 2%,英偉達、台積電均漲逾 1%。

【以下為 15:00 更新】

歐洲主要股指開盤小幅走低,歐洲斯托克 50 指數跌 0.11%,德國 DAX 指數跌 0.29%,法國 CAC40 指數跌 0.50%。英國富時 100 指數跌 0.2% 後上漲 0.02%。

日韓股市集體收跌,日經 225 指數收跌 1.05% 報 36657.09 點;東證指數收跌 0.48% 報 2620.76 點。韓國首爾綜指收盤下跌 0.2%。

【以下為 8:30 更新】

日元上漲後兑美元一度升至 143,現報 143.52。

截至目前,美國 10 年期國債收益率和 2 年期國債收益率均下跌 1 個基點。

美國國債的走勢部分受到職位空缺數據(JOLTS)的影響。週三,美國勞工統計局公佈報告顯示,美國 7 月 JOLTS 職位空缺數低於市場預期,並降至 2021 年初以來的最低水平,裁員人數增加,與勞動力市場需求端放緩的其他跡象一致。

摩根士丹利的克里斯·拉金表示:

“市場可能不像一個月前那樣緊張,但他們仍在尋找經濟不會過度降温的確認。但到目前為止仍未找到。”

美聯儲將在幾周後開始降息,目前的主要問題是首次降息的幅度,而週五即將發佈的美國就業數據將有助於確定答案。

而上個月的就業報告引發了對增長的擔憂,美聯儲主席傑羅姆·鮑威爾已明確表示,美聯儲現在更關注勞動力市場的風險而非通脹。

此外,亞太市場開盤漲跌不一。其中,日經 225 指數低開 1.4%,東證指數跌 1.2%,韓國首爾綜指高開 0.7%。