Insight into WEIMOB INC's 2024 interim report: Cost reduction and efficiency improvement "combination punch" showing significant results, with adjusted net loss significantly narrowed

微盟发布 2024 年上半年业绩公告,收入为 8.67 亿元,调整后净亏损缩窄 81.4% 至-0.46 亿元。公司通过降本增效措施,预计很快实现经调整净利润转正,结束自 2021 年起的亏损周期,推动盈利能力和业务模式的改善,逐步进入可持续增长阶段。

微盟 (02013) 距离全面盈利正越来越近,这在公司的最新财报中得以佐证。

8 月 21 日,微盟发布了 2024 年的上半年业绩公告。据公告显示,微盟报告期内的收入为 8.67 亿元 (人民币,下同);毛利为 5.76 亿元;经调整净亏损为-0.46 亿元,同比缩窄 81.4%,经营性现金流已连续两个半年度为正。

能在行业低迷期交出利润端大幅减亏的成绩,实属不易,这是微盟主动推进降本增效战略转型的结果。如果长期跟踪微盟会发现,为尽早实现盈亏平衡,今年上半年,微盟采取了一系列降本增效的措施,包括聚焦主业、收缩低利润业务;提高高毛利业务、成熟业务的利润空间;严控人头、节约人力成本;谨慎对外投资和开拓新业务,强调新业务与核心业务的融合和赋能等。正是在这套降本增效 “组合拳” 之下,微盟大幅减亏,距全面盈利只有一步之遥。

更重要的是,“瘦身增肌” 后的微盟,业务结构、收入模式、利润质量稳定提升,逐渐步入高质量、可持续的内生增长阶段,未来以此良性健康的模式不断深耕,业绩也将持续好转。

按照当前的减亏幅度计算,微盟很快便能实现全年经调整净利润转正。届时微盟自 2021 年开始的亏损周期将结束,与之相应的,微盟自 2021 年开始的股价回调或也将随之结束,甚至迎来大周期级别的反转。

降本增效成效显著,驱动亏损大幅缩窄

微盟力推降本增效背后,是行业面临的现实困境。近两年宏观经济在多维因素的作用下持续低迷,社会消费品零售总额增速放缓,下游客户的软件需求和 IT 预算有所收紧,导致 SaaS 企业的扩张难度增大,行业进入发展低谷期。

作为国内零售及电商行业的 SaaS 龙头,微盟率先察觉到了战略转型的必要性,主动求变,不盲目追求营收规模和增速,而是强调利润和收入质量,深入落实降本增效的发展策略。

微盟最先做的,就是主动砍掉低利润的非核心业务,集中资源投入高质量、高产出的业务。

微盟旗下订阅解决方案 (SaaS)、商家解决方案 (营销) 业务均有调整。订阅解决方案方面,去年 5 月,微盟剥离了智慧餐饮业务,不再并入该业务的收入,2024 年上半年,微盟进一步降低了微商城业务和其他小微业务的的投入,减少了直销城市,降低低利润的客户群体的比例,更加聚焦于零售等核心大客业务。在商家解决方案方面,微盟减少了低利润的 TSO 和金融等业务,更加聚焦于服务广告主的投放业务。

这一系列调整后,微盟业务结构得到优化,收入质量也有提高。以营销业务来说,2024 年上半年,微盟商家解决方案的毛利率从 2023 年同期的 69.4% 上升至 74.5%,每付费商户平均开支增长 24.9% 至人民币 215516 元,盈利能力持续提升。

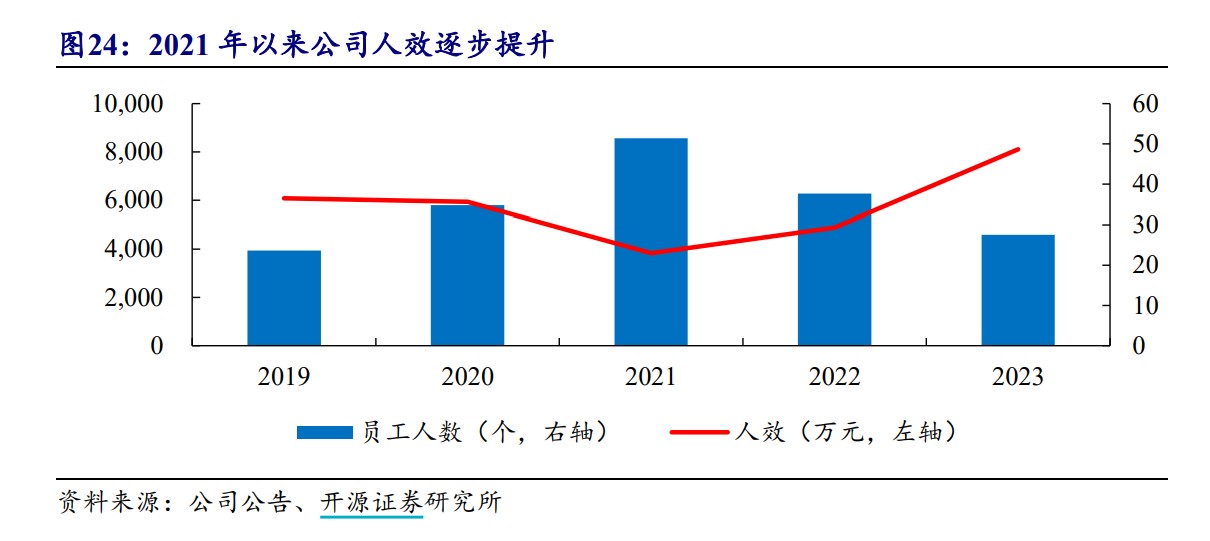

业务结构调整之外,微盟持续提升人效和优化组织结构,使费用支出得到了有效控制。事实上,造成微盟自 2021 年以来经调整净利润持续亏损的关键原因便是人效的降低以及渠道建设增加了费用支出。2021 年起,微盟为研发 WOS 招聘大量技术人员,人效有所下滑,2022 年 WOS 顺利发布后,2023 年人员压力逐步释放,在趋于稳定后人效逐步回升。

开源证券表示,由于 SaaS 行业的本质是边际成本递减,质地优秀的 SaaS 公司在后期运营成本占比会显著降低,因此人效是衡量运营能力的核心指标。随着研发/营销人员控制叠加收入放量,预计微盟的人效将进入稳步增长期,对控制费用支出将起到明显作用。

此外,微盟加速推进 AI 技术赋能 SaaS 业务及营销业务,进一步降低运营成本。在过往的经营中,不管是私域运营中的内容输出,还是大促运营中的创意内容、策略咨询,微盟都需要投入大量人力面向客户提供服务,但随着旗下 AI 应用型产品 WAI 融入并赋能相关业务后,微盟的生产力明显得到解放,投入成本亦相应减少。

在 SaaS 场景下,微盟 WAI 已拓展 58 个真实商业应用场景,覆盖了包括服饰饰品、美妆护肤、食品酒水、生鲜水果、日用百货等诸多行业,已为数万商家智慧经营提效。2024 年上半年,WAI 活跃客户数环比 2023 年下半年增长了 360%。

在营销场景下,微盟基于 AIGC 的智能创作能力已覆盖全域营销场景,尤其文生文、文生图等能力已较为成熟。报告期内,WAI 日均图片生成量达 1000+,内容采纳率达到 40%。

AI 对 SaaS 业务和营销业务的赋能,不仅可提高微盟产品体系的市场竞争力,加速商业化的持续突破,亦对微盟提升运营效率,降低运营成本有重要作用。随着 AI 技术渗透的加速,有望带动微盟运营成本进一步下降。

从财报来看,基于上述多维举措的落实,微盟的费用率已得到明显优化。报告期内,微盟销售成本 2.92 亿元,同期收窄 25.9%;销售及分销开支 5.65 亿元,同期收窄 33.0%;一般及行政开支 2.87 亿元,同比收窄 24.5%。可以说,费用支出的有效控制,成为了微盟此次经调整净利润大幅减亏的关键。

而对于微盟未来费用支出的发展趋势,开源证券做过详细测算,其表示,在未来两年中微盟的费用率将持续改善,其预测微盟 2024-2026 年的销售费用率为 53.9%/49.1%/45.7%,研发费用率分别为 15.0%/13.6%/12.5% ,管理费用率分别为 12.0%/11.0%/10.0%。三费成稳定的下降趋势,在提高微盟盈利能力的同时,将加速利润的释放。

多维度挖掘收入增量,提高收入质量

通过战略性收缩,以及各项控费率的措施,微盟保持了业务结构的精简和高效。与此同时,微盟也在深挖核心业务,寻求增量收入和利润,这既体现在订阅解决方案、商家解决方案两大核心业务的开拓深耕,也体现在 AI 等新业务的审慎布局。

1、SaaS 业务加速向中腰部客群渗透

自提出 “大客化” 战略以来,微盟持续深耕零售业务,在大客领域的领先优势也不断加强。2024 年上半年,微盟在中国时尚零售百强中占比 47%,商业地产百强占比 43%,连锁便利店百强占比 40%。同期,微盟在服饰、快消、建材行业持续渗透并保持领先,合作百强商户数占比分别为 43%、21%、19%,分别同比增长 19%、163%、111%。

为挖掘 SaaS 业务的新增长空间,微盟加速向行业中腰部渗透,灵活调整产品线和定价策略,推出更高性价比的解决方案,进而提高在中腰部市场的渗透率。

开源证券指出,微盟已实现 “超级大客-KA 客户 - 腰部客户” 零售 SaaS 增长飞轮。具体来说,基于具备竞争力的产品矩阵,微盟一方面借助与腾讯智慧零售的密切合作,承接超级大客,打开知名度;另一方面具备较为完善的直销团队,每年稳定获取优势行业及新兴行业的 KA 客户,树立标杆案例,沉淀行业 Know-How,推出满足行业个性化的产品,加速腰部客户对接速度。

与此同时,微盟聚焦更多细分场景开发解决方案,挖掘潜力客户。报告期内,微盟围绕批发、本地生活、门店线上引流等场景,开发了对应的场景解决方案,更契合企业在经营过程中出现的场景痛点问题,从而进一步拓宽了客户类型。

得益于大客化战略的持续推进以及向行业中腰部市场的加速渗透,微盟 SaaS 业务的成长空间进一步打开,尤其零售作为 SaaS 业务 “压舱石”,增长稳定可观。报告期内,微盟零售收入 3.04 亿元,同比内生增长 3.1%;微盟零售的商户数量 8011 家,其中品牌商户 1307 家,持续稳定增长;零售收入占订阅解决方案收入比例也由去年同期的 44% 提升至 62.4%。

值得一提的是,上半年,微盟面向商家调整了订单云服务费、接口调用和消息推送服务费,生态内商家享受一定免收额度,集团对超额部分收取费用。可预见的是,此举将产生长期稳定的现金流,对公司财务情况也有正面影响。

2、营销业务深入布局多元渠道

在 SaaS 服务稳健发展的同时,微盟的营销业务则展现出了更强的增长势能。2024 上半年,微盟商家解决方案精准投放毛收入约为人民币 83.42 亿元,同比增长 19.4%。这主要得益于微盟持续深耕视频号等腾讯生态,并深入布局快手、小红书等平台挖掘新增量。

在腾讯生态,2024 年上半年,微盟的腾讯广告大盘消耗同比增长 19%。尤其在视频号领域,微盟作为微信视频号官方运营服务商,可为品牌提供一站式解决方案,已为超过 70% 的视频号年度达人提供服务,单场 GMV 超过 2000 万的视频号达人直播背后,约 60% 的场次有微盟营销的参与。

而在快手、小红书等平台上,微盟的增长速度也很可观。2024 年上半年,微盟营销服务商家在快手赛道内的年度消耗同比增长 78%;微盟营销服务服饰、美妆、快消等行业的品牌客户在小红书平台完成高效种草,广告消耗同比增长 152%。

此外,微盟营销与微盟旗下拌饭科技布局的商业短剧赛道亦有明显进展,618 大促期间,拌饭科技携手快手短剧,为京东打造的定制商业短剧《重生之我在 AI 世界当特工》,自 6 月 1 日上线后总播放量已超 4 亿次。

由此可见,多元渠道的布局以及商业短剧的成功打开了微盟营销业务的成长空间,微盟于营销市场中挖掘增量的策略取得明显成效,随着布局的不断深入,营销业务有望持续高成长。

3、紧抓 AI 机遇,审慎开辟新市场

在 SaaS 服务、营销业务两大成熟板块中挖掘新增长空间的同时,微盟亦抓住 AI 的产业机遇开辟新市场。6 月 25 日,微盟推出面向企业客户的 AI 应用产品 “WAI Pro”,该产品目前主要面向品牌商家、4A 广告公司、营销代运营团队和内容创作团队在内的企业级客户,可为其提供围绕 “营销洞察、内容创作和商业咨询” 三大类业务需求对应的 AI 应用技术服务。

值得注意的是,WAI Pro 并不是一款 “全新” 的产品,它是基于 WAI 在微盟 SaaS、营销业务上沉淀已久的产品技术和专业服务能力而推出的独立 AI 应用。简言之,WAI Pro 的产品和功能均已在微盟 SaaS 和营销业务上得到了验证,在帮助业务实现提效之后才被产品化。这意味着 WAI Pro 的市场反馈和商业化前景可靠,是一次投入风险较低的尝试。

而且 WAI Pro 所在的企业级 AI 市场广阔。据 InfoQ 研究中心数据显示,2030 年 AGI 应用市场规模将达 4543.6 亿元,其中企业市场规模占比达 67%,企业市场将主导 AGI 应用的发展。WAI Pro 的推出,将有利于微盟加速抢占企业级 AI 应用蓝海市场。

中国 SaaS 进入新阶段:从扩张到收缩,从收入至上到经营效益至上

一个行业共识是:中国 SaaS 行业发展多年,目前已从高速扩张阶段步入紧缩式增长阶段,这既有宏观经济的原因,也是行业发展周期使然。在此背景下,SaaS 企业的经营理念也逐渐由收入规模至上,转变为经营效益、收入质量至上。微盟这次半年报,就是行业发展趋势的最佳投射。

透视此份财报,作为行业龙头,微盟在战略转型上的定力和耐心得到了业绩的验证,距离全面盈利也越来越近。可以预见,在行业低迷阶段苦练内功之后,微盟将在行业修复期、上行期拥有更夯实的发展动力,且一旦跨过盈亏平衡点后,利润增长也将迎来更快释放。

开源证券预计,微盟 2024-2026 年的收入分别为 25.1/29.5/33.9 亿元,对应的增速分别为 12.8%/17.2%/15.0%,同期调整后的净利润分别为 0.5/2.0/3.6 亿元。

从资本市场的层面来看,微盟股价目前仍处于自 2021 年调整以来的绝对低位,且估值也被压缩至 PB 1.48 倍的较低水平,未能反映出微盟未来两年净利润增长的预期。一旦微盟的业绩如期释放,便是经典的困境反转,由净利润转亏而引起的股价回调,也将由净利润转盈而终结,其股价或将出现 “戴维斯双击”,即由利润释放 + 估值扩张双轮驱动微盟股价走出一波大周期级别的反转行情。

由此,当下或许是长期布局微盟的好时机,在净利润增长带动基本面向上的前提下,仍处于底部的股价下调空间有限,而上涨空间则是数倍之多,值博率较大,值得投资者重点关注。