Mitsubishi UFJ Financial Group: BOJ may raise interest rates again as early as December, with yields reaching 1.2% to "comprehensively invest" in Japanese bonds

三菱日聯金融預計日本央行將繼續加息,表示當日本國債收益率達到 1.2% 時,將考慮將其 4880 億美元的證券投資組合更多地轉移至該資產。該行市場業務主管 Hiroyuki Seki 指出,可能重新大舉買入國內主權債券,政策利率或在 12 月或明年 1 月上調至 0.5%。截至目前,十年期日本國債收益率為 0.867%。

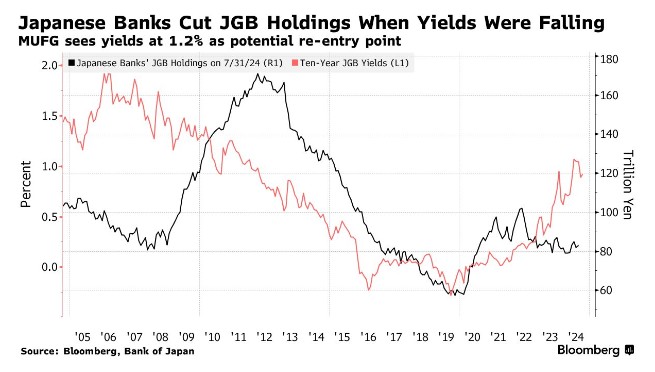

智通財經 APP 獲悉,三菱日聯金融表示,當日本國債收益率達到 1.2% 時,將考慮將其 4880 億美元的證券投資組合更多地轉移到該資產上,因為該公司預計日本央行將繼續加息。

三菱日聯金融市場業務主管 Hiroyuki Seki 表示,當 10 年期國債收益率和隔夜指數掉期達到這一水平時,這家日本最大銀行將考慮 “全面投資” 國內主權債券,Seki 表示,該銀行可能將 5 萬億至 10 萬億日元 (350 億至 700 億美元) 從央行儲備中轉移到債券中。目前,十年期日本國債收益率略低於 0.9%。

隨着日本央行開始加息和削減債券持有量,全球交易員都在密切關注日本金融機構是否會重新大舉買入日本債券的跡象。由於通脹抬頭,三菱日聯金融預計,日本央行行長植田和男將在政策正常化方面取得穩步進展,下一次加息最早可能在今年進行。

Seki 在接受採訪時表示:“隨着股市和匯市恢復穩定,我們認為最早可能在 12 月或明年 1 月將政策利率上調至 0.5%。”

據瞭解,掌管三菱日聯金融 70 萬億日元證券投資組合的 Seki 曾正確地預測了日本負利率政策將在 3 月結束,以及隨後在 7 月引發市場動盪的加息。

Seki 表示,日本央行可能會考慮將基準利率上調至 “中性” 利率,估計至少為 1%。他補充道,鑑於本世紀政策利率未超過 0.5%,市場尚未完全消化央行的走勢。

“從目前的水平來看,利率還有更大的上升空間,” Seki 稱。

截止發稿,日本十年期國債收益率為 0.867%。儘管日本央行在 7 月 31 日提高了利率,但受美國國債收益率下降的拖累,該收益率在 7 月達到了 1.1% 後一直在下降。

三菱日聯金融等日本銀行或許能夠緩解全球投資者對外國資產大規模回流的擔憂的一種方式是,這些公司利用其在日本央行持有的日元儲備為購買提供資金。如果日本金融機構開始將資金匯回國內,這可能會擾亂已經動盪的外匯市場,並對美國國債和其他外國債券造成壓力。

Seki 補充道,三菱日聯金融所持日本國債 (不包括到期債券) 的平均存續期可能從目前的 1.1 年延長至約 3 年。

能源領域交易

身兼三菱日聯金融集團銷售和交易業務主管的 Seki 還表示,該銀行將抓住日本電力交易市場的增長機會。

上個月,該公司表示將開始為日本電力期貨提供交易執行和清算服務,這使其成為首家加入被海外競爭對手所掩蓋的國內交易所的大型銀行。

Seki 表示:“為了促進清潔能源投資,電價的可預測性至關重要。但期貨市場沒有充分發揮作用,無法抑制價格波動風險。”

隨着日本不斷增長的可再生能源需求和季節性波動刺激波動性和套利機會,預計 2016 年放開的日本電力市場對價格對沖的需求將激增。

但大部分日本電力期貨交易是在歐洲能源交易所 (EEX) 進行的,從石油巨頭到金融機構,許多海外參與者都是該交易所的會員。日本國內證券交易所運營商東京工業品交易所一直難以實現交易量的增長和規模的匹配。

Seki 表示,使用東京工業品交易所可以讓日本企業將在 EEX 交易時面臨的匯率風險和較高利率降至最低。他補充道,該銀行約有 20 名員工負責電力期貨交易執行和清算服務。

Seki 表示,三菱日聯金融還打算參與現貨電力市場。該銀行已決定收購處理實物交易的初創公司 enechain 一家子公司 49% 的股份。