Highly anticipated "Super Central Bank Week": Fed rate cut finally landed, with exciting moves from the central banks of China and Japan

重點關注美日央行利率決議、中國 9 月 LPR 報價和 MLF 續作,英國、巴西、挪威、印尼等多國央行也將陸續公佈最新利率決議,歐洲央行行長拉加德及多位委員將在周內發表講話。

9 月 16 日至 9 月 22 日當週重磅財經事件一覽,以下均為北京時間:

下週為 “超級央行周”,重點關注美日央行利率決議、中國 9 月 LPR 報價和 MLF 續作,英國、巴西、挪威、印尼等多國央行也將陸續公佈最新利率決議,歐洲央行行長拉加德及多位委員將在周內發表講話。

此外關注:美國 8 月零售銷售、日本 8 月 CPI、歐元區 9 月消費者信心初值,以及中秋節假期期間亞太交易所休市安排。

9 月 LPR 會 “降息” 嗎?

週五(9 月 20 日),中國央行將公佈 9 月 LPR 報價。

繼 7 月 1 年期、5 年期 LPR 下調 10 基點後,8 月 LPR 維持不變,目前 1 年期 LPR 報價為 3.35%,5 年期以上 LPR 報價為 3.85%。

13 日週五國家統計局公佈 8 月金融數據,針對居民貸款需求不振,中國民生銀行首席經濟學家温彬表示,現階段市場對再度下調存量房貸利率呼聲較高,降低存量房貸利率一定程度上有利於緩解按揭早償現象、增強居民債務可持續性、促進居民消費需求修復以及形成更加公平的融資環境。

温彬表示,後續看,存量房貸利率有很大概率下調,並向新發生按揭定價逐步靠攏,總體有助於穩定居民端信用。但同時,在銀行息差日益承壓環境下,也需進一步調降存款利率、降低負債成本,進而增強金融支持實體的可持續性。

央行有關部門負責人在解讀 8 月金融統計數據時提到,貨幣政策將更加靈活適度、精準有效,加大調控力度,加快已出台金融政策措施落地見效,着手推出一些增量政策舉措,進一步降低企業融資和居民信貸成本,保持流動性合理充裕。國盛證券首席經濟學家熊園預計,年內我國央行可能還會降準降息,也很可能會調降存量房貸利率。

華泰證券在點評 8 月經濟數據時指出,往前看,我國製造業競爭力的提升仍有望支撐出口增長,然而內需偏弱的局面或加劇逆週期政策調整的緊迫性和必要性,預計 9—10 月可能迎來政策寬鬆的 “窗口期”。

針對降準降息等政策調整的時點,人民銀行貨幣政策司司長鄒瀾在國新辦發佈會也有所回應,他的表述是 “還需要觀察經濟走勢”。鄒瀾還稱,綜合運用法定存款準備金率、7 天逆回購、中期借貸便利還有買賣國債這些工具,目標是保持銀行體系流動性合理充裕。至於降息,則仍然受到 “存款搬家” 和銀行淨息差壓力的雙重製約。

週三(9 月 18 日),央行有 5910 億元 1 年期中期借貸便利(MLF)到期,關注央行到期續作情況。

上月 15 日到期的 MLF 於 8 月 26 日續做。温彬表示,央行公告於 26 日月內 MLF 續做,進一步釋放了 MLF 操作常規性後延至 25 日的信號。東方金誠首席宏觀分析師王青同樣認為,隨着 MLF 政策利率色彩淡化,已經沒有必要在每月 15 號開展 MLF 操作,來為當月 LPR 報價提供定價基礎。

MLF 利率與 LPR 之間的 “脱鈎性” 也正逐漸顯現。在此前發佈的二季度貨幣政策報告中,央行表示,LPR 報價轉向更多參考央行短期政策利率,由短及長的利率傳導關係在逐步理順。

萬眾矚目美聯儲利率決議:50 基點還是 25 基點?

週四(9 月 19 日)凌晨,美聯儲公佈 9 月利率決議,美聯儲主席鮑威爾將在 2:30 發表講話。

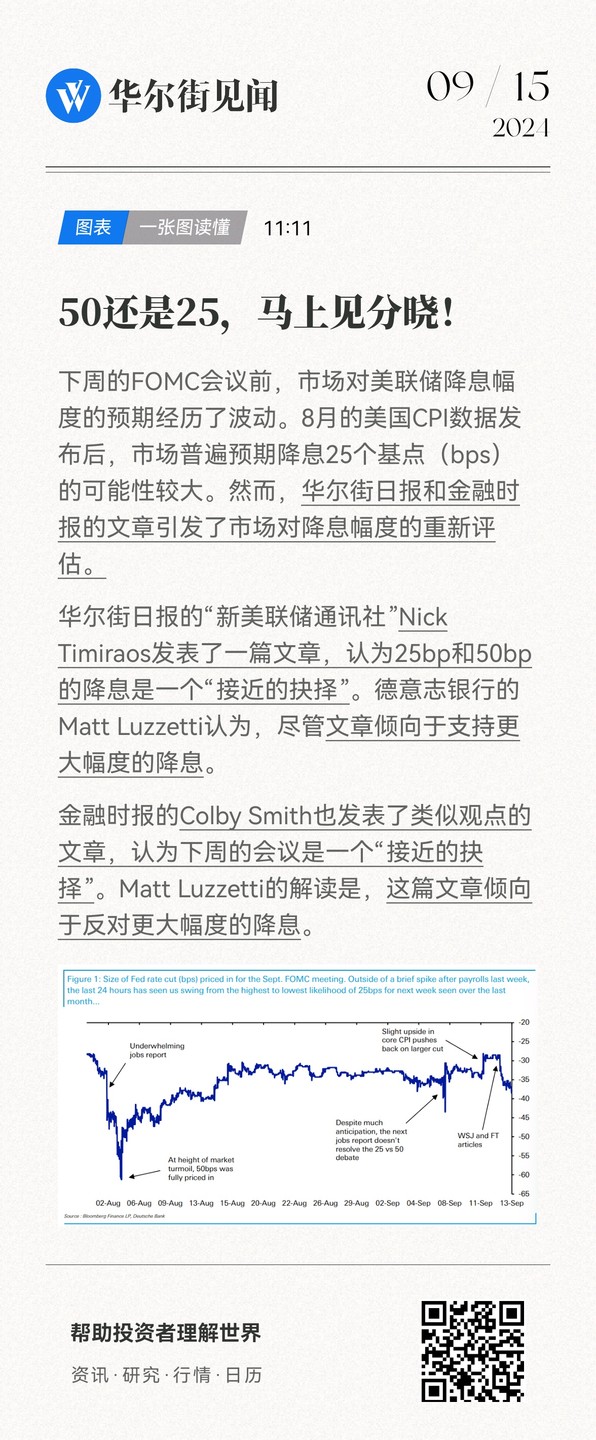

目前,美聯儲降息幾乎已經 “板上釘釘”,但降息幅度仍具不確定性。

最近公佈的數據 “好壞參半”,無論是通脹還是就業數據,都沒能 “拍板” 降息幅度。週三的 CPI 數據顯示通脹仍具黏性,拉高了降息 25 個基點的概率,週四的 PPI 數據同比顯著降温,又提升了降息 50 個基點的可能性。

當地時間週四,有"美聯儲通訊社” 之稱的華爾街日報記者 Nick Timiraos撰文稱,從 25 個基點開始降息是阻力最小的途徑,可以避免大幅降息引發市場恐慌,以及在大選前解釋大幅度降息的挑戰;但從 50 個基點降息開始,可以減少市場對後續降息幅度的爭論。

Timiraos 文章發佈後,市場對 9 月份降息幾率顯著轉漲,抹去了週三 CPI 數據後的下跌。

前美聯儲 “三把手”、前任紐約聯儲主席杜德利(Bill Dudley)本週五在新加坡某論壇上的講話也助長了大幅降息的預期。

“我認為,無論他們(美聯儲)是否降息,降息 50 個基點都是有充分理由的。”

截至當地時間週五晚間,交易員押注美聯儲下週降息 50 基點的概率大幅躍升至 50%,而在週四,這一概率僅為 15%。

隨着降息預期有望即將兑現,本週五(9 月 13 日)金價突破歷史新高,現貨黃金價格一度達到 2586.09 美元/盎司,本週價格漲幅超過 80 美元,創下自 2020 年以來的最強單週表現。

關注日本央行下次加息時點

週五(9 月 20 日)上午,日本央行公佈 9 月利率決議,該行行長植田和男將於 14:30 召開貨幣政策新聞發佈會。

市場調查結果顯示,略超半數的觀察人士認為日本央行下次加息的時間是在 12 月,預計 9 月的會議不會採取加息行動。屆時關注植田和男在會後發言時對下次加息時點的相關表態。

不過,日本央行理事中川順子在本週三(9 月 11 日)的講話中表示,調整貨幣寬鬆水平的步伐取決於經濟、通脹和金融狀況。只要經濟表現符合預期,日央行將繼續調整貨幣政策。

目前,交易員正在評估日本央行貨幣政策與美國總統辯論對外匯市場帶來的影響。分析稱,如果日本下次加息在 12 月,預計美聯儲預期中的降息可能會引發美元/日元大幅反彈,美元多頭重返市場的最佳窗口將在下週結束前出現。

其他重要數據、會議及事件

-

美國 8 月零售銷售

週二(9 月 17 日),美國人口調查局將公佈 8 月零售銷售環比數據。上月公佈的數據顯示,美國 7 月零售銷售環比增長 1%,數據全面超過預期,整體零售環比增速創一年半來新高,但前月數據連續第八個月被下修,經濟軟着陸的觀點仍需更多數據支撐。

新近公佈的9 月消費者信心指數顯示,伴隨着美國通脹的回落,消費者的短期通脹預期降至 2020 年 12 月以來新低,美國 9 月消費者信心指數初值創四個月新高。其中,耐用品購買條件的改善,是推動消費者信心指數增長的主要因素,消費者們認為價格更為優惠。

-

第九屆華為全聯接大會

第九屆華為全聯接大會將於 9 月 19 日-9 月 21 日召開,主題為 “共贏行業智能化”,具體包括鯤鵬、昇騰算力底座、鴻蒙原生開發生態、AI 應用落地等內容。

屆時,華為還將展示其在金融、政務、製造、電力、鐵路等九大領域的智能化解決方案,包括華為星河 AI 網絡、新能源功率預測 AI 方案等,以推動其全面智能化戰略(All Intelligence)。

-

日本 8 月 CPI

週五(9 月 20 日),日本總務省將公佈 8 月 CPI 數據。上月公佈的數據顯示,剔除生鮮食品的核心 CPI 同比上升 2.7% 至 108.3,連續 35 個月同比上升,且漲幅連續 3 個月擴大,顯示通脹穩步上行。

由於日本政府取消電力燃氣費補貼,能源價格上漲成為推升 CPI 的主要原因。今年 7 月,日本電費同比上漲 22.3%,城市燃氣費上漲 10.8%,推動能源價格同比上漲 12.0%,大幅超過 6 月的 7.7%,對 CPI 漲幅的影響達到 0.9 個百分點。

-

國內成品油將開啓新一輪調價窗口

週五(9 月 20 日)24 時,國內成品油新一輪調價窗口將開啓。

9 月 5 日,國內油價迎年內 “第七降”: 92 號汽油每升下調 0.08 元,95 號汽油每升下調 0.08 元,0 號柴油每升下調 0.08 元。按照媒體估算,按一般家用汽車油箱 50 升容量估測,加滿一箱 92 號汽油少花 4 元。

今年以來,中國成品油價共歷經 18 次調價窗口,其中 7 次上調、7 次下調、4 次擱淺。

打新機會

當週(9 月 16 日-9 月 20 日)A 股有 2 只新股網上發行,美的集團將在香港主板上市,實現 “A+H” 上市。

當週共計 9 只(A 類與 C 類合併統計)新基金髮行,其中債券型基金 0 只,混合型基金 2 只,股票型 0 只,指數基金 4 只、Reits 1 只。